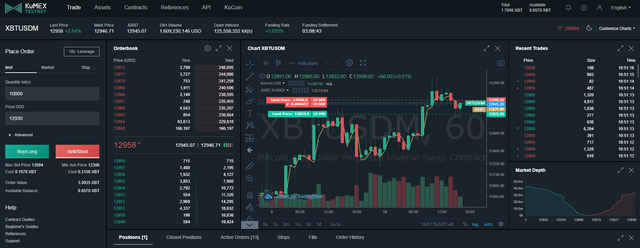

First day of KuMex simulated trading!

So far, I've had a pretty decently successful day on the leveraged derivatives trading on the KuMex TestNet. A sharp swing upwards yesterday, combined with the relative inexperience of other traders and the thin order books on the first day made for some pretty easy profits!

For a quick post on how to join the KuMex simulated trading (10,000 KCS for ranked traders at the end of the first week) or a chance for a share of 100,000 EUR from the Binance Europe on-ramp read my earlier post here!

Not into reading and stopped listening at the prospect of "FREE" tokens/cash, here are the relevant links!

Kucoin account required for KuMex.

Complete KYC at Binance Jersey

... reading is better!

Anyway, I noticed that many of the other traders that were on KuMex on the first day seemed to not really understand the concept of leveraging (you are in debt to the exchange, with a possibility for forced liquidation) or the concept of derivatives (you are better on the direction of the indexed price against the position that you are taking (up or down, long or short).

Leveraging magnifies the potential profit that you can make from making a successful bet... however, it also magnifies the losses (and even worse if you are liquidated). Thus, discipline to not get greedy and the ability to cut losses are paramount skills here.

I saw many people placing orders that were way too large and way too far away from the actual indexed price (.BXBT)... instead relying on the Mark Price (which was the going price for contracts on KuMex, not the price of the actual asset!). This led me to believe that people were thinking that they were buying the actual asset and not the derivative product. This meant that when swings happened, they would be wiped out as they were way too far away from the actual price of the Bitcoin.

... and yesterday, there were decent swings....

This meant that I could easily set stop-limit orders that would skim off the over-reachers and immediately rake in a profit. Of course, discipline rules supreme... so I didn't do it too often as it is still risky, and I limited the size of the grabs to no more than 50,000 simulated USD.

Another thing that I noticed was that there were relatively thin order books, especially when the price was moving fast... which meant that people putting in market long/shorts were suddenly wiping out the order book in one direction or another... so I got in the habit of placing some pretty orders that would be sitting a fair bit further away from the market price to try and catch these events... and I got them pretty well! Quite possibily, some of these orders would have been liquidation calls from people who didn't understand the consequences of leveraging (PS: It's NOT your money, you are borrowing...).

This was combined with a seeming reluctance for people to short... so there were far fewer shorts than longs. Making the order books even more unbalanced, and thinner still on the shorting side!

So all in all... a simulated 70% profit in a few hours of trading... putting me well in the leaderboard... however, the trick is to stay there! All of it can go as easily as it came... especially if more seasoned traders come into it!

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones

.gif)

KuMEX team even made a deal with Michael Gan about adding more languages on their platform. They just added Korean and looks like they will be completing it. Have you seen it?

https://www.kucoin.com/news/en-kumex-is-now-available-in-korean/?utm_source=tftj