Introducing PASTEL: Enabling Successful Crypto Investing

This article is originally written by PASTEL Blog

https://medium.com/pastel-blog/introducing-pastel-1d1d5f96793e

Introducing PASTEL

INTRO

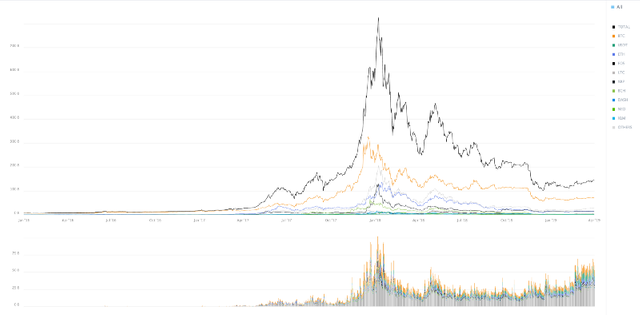

In 2008, the birth of Bitcoin signaled the start of the blockchain technology, but the time when it became popular worldwide was the cryptocurrency market boom in 2017.

There were many people who had invested carefully by recognizing the true value of each project with anticipation and confidence in the blockchain technology. However the cryptocurrency market, mainly led by individuals who have come to expect to make money by investing regardless of the value of the blockchain and cryptocurrency was immature in traditional financial view.

In terms of market size, even when the cryptocurrency market recorded the highest point in January 2018, it was below 1/100 of the existing stock market ($100 trillion). This was the limit of the retail-led market, where funds from existing financial institutions or professional investors did not inflow. This market is still not regulated and volatile, but people can still expect high returns from this market. Then, why professional investors and institutions those who are familiar with the traditional financial markets can not easily enter the cryptocurrency market?

Traditional Financial Market vs Cryptocurrency Market

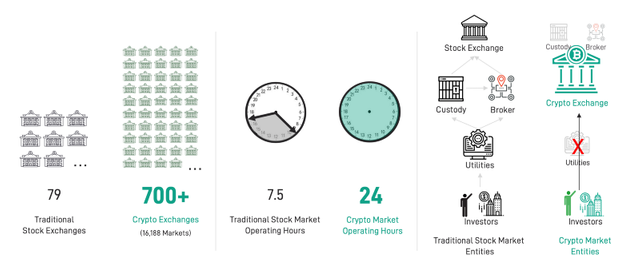

The cryptocurrency market is certainly different from the traditional financial market.

In the traditional financial market, an exchange only can be organized by obtaining a proper license for each country. However, most countries still do not have clear guidelines for the cryptocurrency exchange yet. A lack of regulations resulted in creating over 1,000 exchanges around the world and listing more than 2,000 coins at different exchanges.

Unlike the traditional financial markets, where open and closing time is set, most global cryptocurrency exchanges operate 24/7. Also, each entity like exchanges, custodians, and brokers have clear roles in traditional financial market but in cryptocurrency market, the exchange takes most of their roles.

Still Uncomfortable Market

Most cryptocurrency exchanges are easily accessible to anyone, regardless of borders, by simple authentication process. Investors can easily purchase coins through the exchanges where the coins are listed, but to manage all of their assets they should use multiple exchanges. So, investors with diverse assets have to manage them through multiple exchanges and wallets and some of them need to track their balances by manually using Excel sheets. Even at the most basic level, it is difficult to know where and how much my assets are allocated.

It is important to follow recent trends of the market from the community, news, and more but because of too many communities and exchanges, capturing the trend of market is very difficult.

In the perspectives of trading strategy, crypto market operates 24 hours a day, so people have come up with different trading strategies compared to the traditional financial market. Most of the exchanges only provide limit orders and it is very inconvenient for people who need to make orders manually overnight.

In current financial field, as long as individuals have corporate accounts, they can create as many members' accounts as they need in order to manage assets together. However, in cryptocurrency exchanges, even though it is a corporation, it cannot share assets between the member accounts which makes uncomfortable to operate large amount of assets

Some exchanges allow to create three to five corporate accounts for each corporation, but each account is managed independently. In addition, these corporate accounts are made in multiple exchange, it is difficult to identify and manage assets scattered across all exchanges at once. Institutions with enormous amount of asset, professional traders should execute the orders to minimize the damage by trading but the company can not control the authorization of access, like transfer, it may be exposed to big risks.

Cryptocurrency Investment and Management with 'PASTEL'

PASTEL resolves inconveniences in the cryptocurrency market and adds new value to the community.In order to mitigate these difficulties and inconveniences, Voost developed "PASTEL", the most seamless crypto asset management platform, which enables to trade in multiple exchanges in one interface and managing scattered cryptocurrency assets at once.

Fundamental and Sentimental Information

To establish a good investment strategy, people need to analyze their fundamental and sentiment information to understand the market and come up with their own investment insights. PASTEL provides users with high-quality information for their investment through partnerships with various media, analytic data provider and professional reporting projects. PASTEL also shows the currency with largest volatility in last 24 hours and the market capitalization information to help users making better insights.

Algorithmic Order and Technical Analysis

PASTELl's TWAP algorithm keeps tracking market prices for a specific period of time and automatically execute at a price below the maximum price when buying and execute at a price almost equal to the market price above the minimum price when selling. Users can also monitor the specific progress of TWAP execution in real time.

PASTEL pricing chart is importing Trading View library to enable users to do in-depth technical analysis in familiar environments.

In-Depth Portfolio Management

Currently, most of competitors only show balances of user assets while PASTEL analyzes user portfolios from various angles. Users can check the asset status and P&L by currency, exchange account, and fund and view portfolio trends easily in various viewpoints to obtain insight into the next investment strategy. All asset-related data can be exported to Excel, allowing for additional analysis based on users' preferences.

Agency-Level Compliance

PASTEL supports two types of accounts: "Personal" and "Group." In a group account, admin and general members can manage assets together. Admin can add new members to the group by sending invitations. Also only admin can register or remove API keys to access exchange accounts with assets to manage. Depending on admin's operating strategy, multiple funds can be defined and members can be assigned to manage the funds together. Group members can only manage funds under the granted authority.

PASTEL also provides three kinds of authorities for members: 'View', 'Trade', and 'Transfer'. Everything that happens in PASTEL, from login to logout to order, is also recorded in a separate repository. Admin can view all activity history, and group members can view all the history of funds they manage.

Conclusion

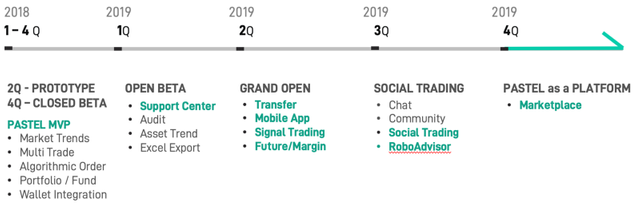

PASTEL Roadmap 2018–2019PASTEL completed all tasks planned for the first quarter of 2019 on the roadmap and launched Open Beta service on March 19. In the future, PASTEL is planning to provide the most valuable information and features so our users can experience the most efficient investment in one service.

- Detailed introduction of each features of PASTEL will be posted in order of its importance.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

The fastest news about PASTEL will be posted in PASTEL Support Center and Facebook. If you have any questions or feedback, please feel free to contact us through our support center.

PASTEL: https://pasteltrade.net/home/

PASTEL Support Center: https://support.pasteltrade.net/en/support/home

Facebook: https://www.facebook.com/pasteltrade

Voost Homepage: https://voostlab.com