Market Maker And Market Taker - How They Facilitate Crypto Transactions

Hello friends,

I count it all joy to be before this great community to relate with you on another very interesting and educative topic.

Today, we shall be examining extensively on the concept of market maker and market taker, this concept is very useful in the cryptoworld.

And before we begin, we need to learn some basics before diving into market making and market taking, stay tuned.

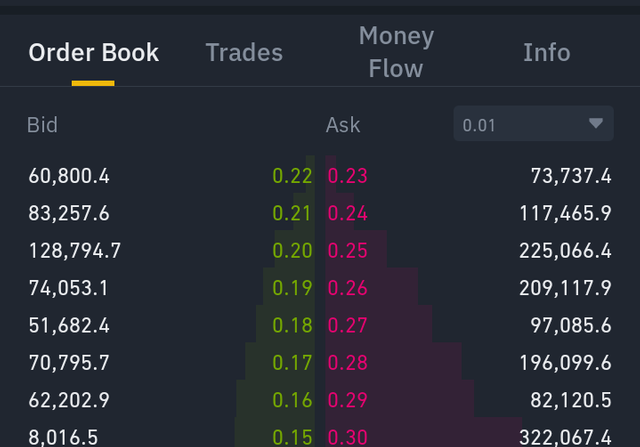

ORDER BOOK

SCREENSHOT FROM BINANCE

Order book can be explained to be a digital book which contains a list of sell and buy orders of a specific commodity, usually organized by price levels.

An order book helps to outline the number commodities being asked or bid on at different prices in the market.

It also helps in the identification of market participants behind the sell and buy order, although some remain unrevealed.

The valuable information revealed by the order book helps traders and also helps to increase market transparency.

The order book is used by many exchanges to outline the orders for different currencies and at different prices, and this orders can either be manual or digital.

The information of the buyers and sellers usually appear on the left and right hand side of the screen.

The order book helps to show how liquid an asset is , as it shows the interaction between buyers and sellers and the ease with which the asset is bought and sold.

A trader can also make use of an order book to make wise trading decisions as the order book shows if the market is being driven by institutions or retail investors, and also the order book is used to determine support and resistance of a commodity.

Whenever there are large amount of buy order at a specific price, a trader will denote a support level and when there is a large amount of sell order at a particular price, it denotes a resistance level.

The order book also helps to show order imbalances in the market which in turn helps in predicting the direction/trend of the market.

For example when there's a massive imbalance of buy order versus sell order, this may indicate a rise in price of the commodity as the buying pressure is higher than the selling pressure

COMPONENTS OF AN ORDER

There are few features that an order book must posses for it to be an order book and some of these features are:

- BID SIDE:

SCREENSHOT FROM BINANCE

The bid side of an order book is a portion of an order book that is usually written in green.

This side is usually filled with all the buy orders and Important information related to buyers.

The bid side usually contains the bid price, bid quantity and bid total(amount × price) of the market.

The bid price refers to the highest price that a buyer is willing and able to pay for a particular quantity of a commodity at a given period of time.

And the bid prices is arranged in descending order from the highest bid price to the lowest, down the book.

The bid quantity refers to the amount of a commodity that a buyer is willing to buy at a given price

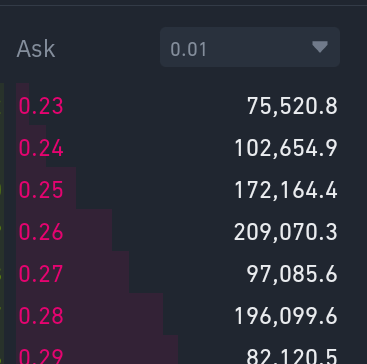

- ASK SIDE:

SCREENSHOT FROM BINANCE

The ask side is the very opposite of the bid side, it is usually written in red, as it contains all sell orders and information related to sales of a particular commodity.

The ask side usually contains the ask price, ask quantity and ask total(amount × price) of the market.

The ask price refers to the highest price that a seller is willing to accept for a particular quantity of a commodity at a given period of time.

And the ask prices is arranged in ascending order from the lowest bid price to the highest, down the group.

The ask quantity refers to the amount of a commodity that a buyer is willing to buy at a given price

MARKET MAKERS AND LIMIT ORDERS

Market Maker can be explained to be a person or group of individuals (firms) who actively quotes two sided market of a commodity, supplying asks and bids of a commodity in the market.

A market maker helps to provide liquidity to a market and at the same time earn passively from the difference between the bidask spread

A market maker displays buy and sell prices for a considerable number of goods and he only sells off when he receives a buy order from the buyer.

Through market making, the market maker helps to facilitate a smooth financial operation, as without the operation of a market maker, there will be insufficient financial transactions and lesser investment activities.

In a nutshell, a market maker can be explained to be a person that makes his own quote of prices in the market.

These individuals do not have their order filled immediately at the market price, instead they wait for the market to sell at their preferred price.

They mostly make use of a limit order.

LIMIT ORDER

When you look carefully at the order book, you will notice that there are numerous orders on the order book and they are at different prices.

And this orders are yet to be executed, such an order is known as a limit order.

A limit order can be explained to be an order that is placed for a commodity to be sold/bought at a specific price different from the market price.

A limit order is one that is not executed immediately, it remains unfilled until it's price demands are met

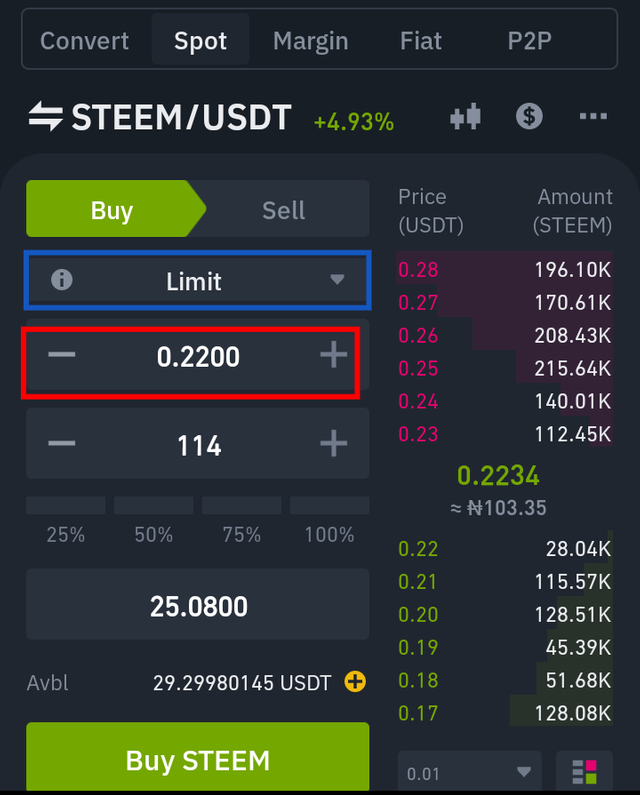

ACTING AS A MARKET MAKER USING LIMIT ORDER

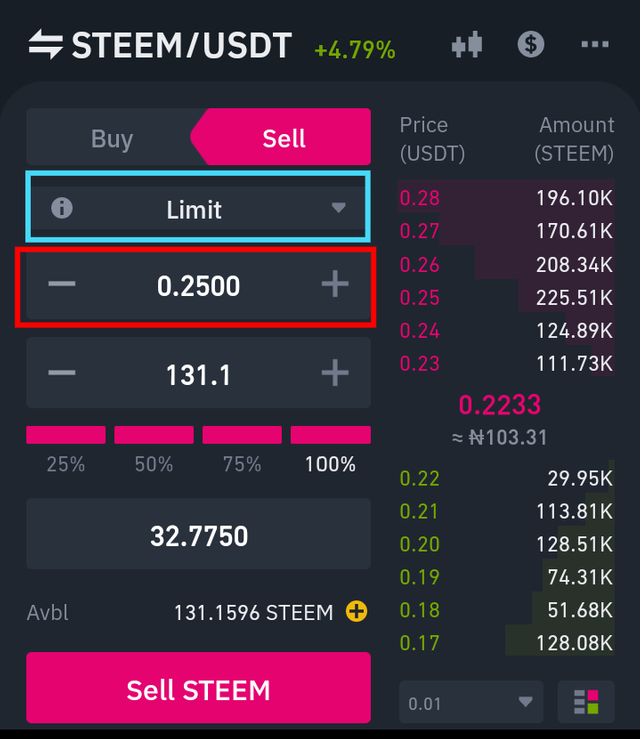

To act as a market maker, I had to visit binance exchange and place both a buy and sell limit order.

SCREENSHOT FROM BINANCE

The screenshot above is from my binance app, and as seen above, I am placing a buy limit order on the pair STEEM/USDT, which was not fulfilled immediately.

As seen above, I inputed the price at which I want my order to be filled, and it can only be filled when the market gets to my desired price

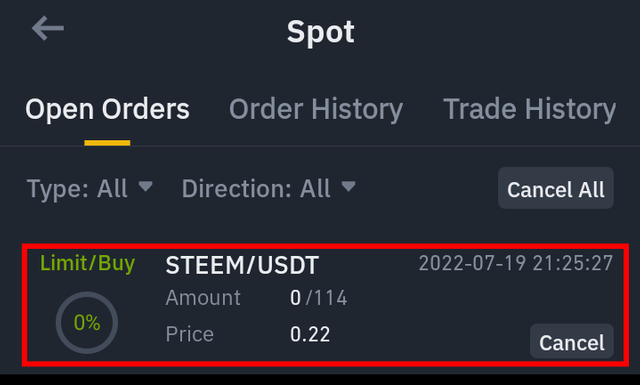

SCREENSHOT FROM BINANCE

The screenshot above shows my open buy order on the pair STEEM/USDT.

Being a limit order, it is not expected to fulfill immediately but to fulfill at my desired price.

I also decided to place a sell limit order on my binance app.

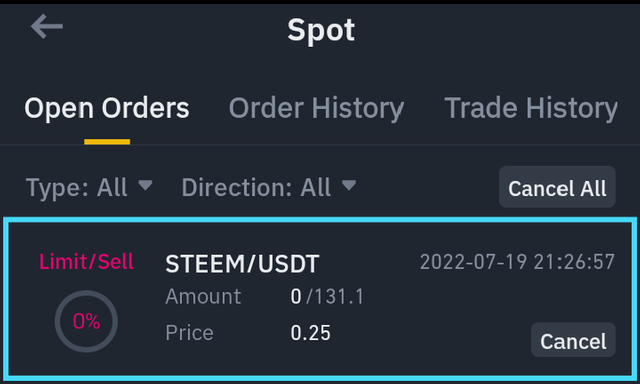

SCREENSHOT FROM BINANCE

As seen above, I placed a sell limit order on the pair STEEM/USDT, and as shown above I decided to sell steems at a higher price than it's current price

SCREENSHOT FROM BINANCE

As shown above is an open order of the sell limit order I placed on Steem/usdt.

MARKET TAKERS AND MARKET ORDER

A market taker can be explained to be someone who completes a market order by accepting it.

In other words, market takers are individuals that initiate trade at the current price of the market, they help to fill the market order of market takers.

Market takers places an order with the expectation that it is filled immediately and for this reason, they make use of market order, when performing transactions.

MARKET ORDER

A market order can be explained to be an order placed t the market's Current best price.

It is an order that is easily executed, unlike the limit order which doesn't guarantee execution.

The market order is usually taken by market takers as they don't care about buying the commodity at a given price, they are willing to buy it at the best available current price.

Although the market order doesn't guarantee that the market will be executed at the initiated price ( which is due to slippage) but it does guarantee market execution.

ACTING AS A MARKET TAKER USING MARKET ORDER

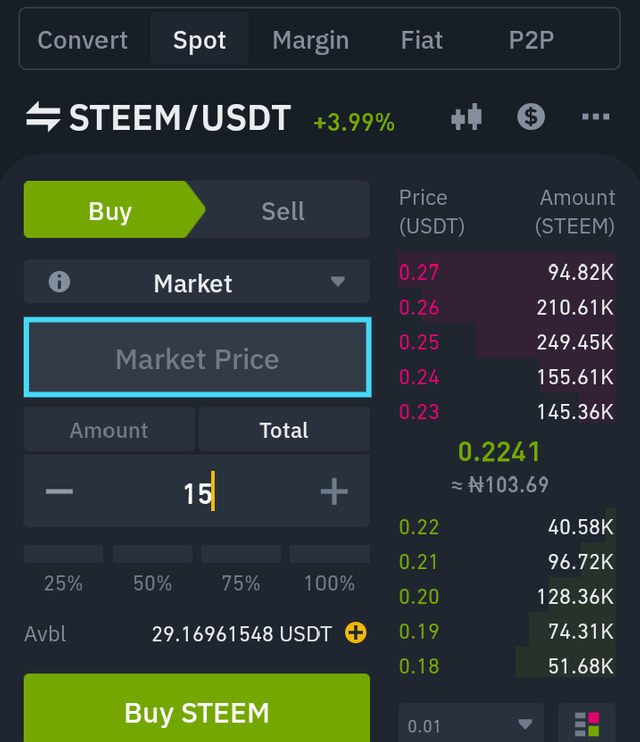

I am going to illustrate how to act as a market taker placing a market order on binance.

SCREENSHOT FROM BINANCE

As seen above, I placed a buy market order of 15USDT on the pair STEEM/USDT, and this order is expected to be executed immediately.

SCREENSHOT FROM BINANCE

Shown above is a screenshot showing the complete execution of my market order.

It was executed immediately.

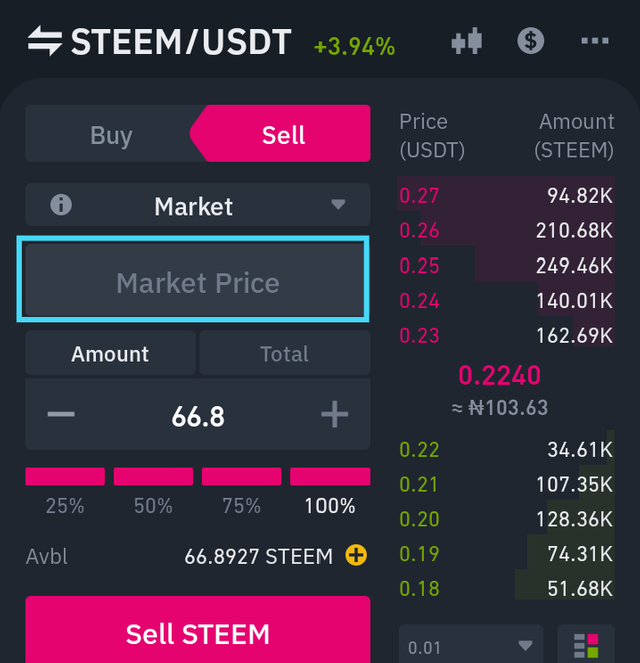

I also went ahead to place a sell market order on the pair STEEM/USDT on binance.

SCREENSHOT FROM BINANCE

As shown above is a screenshot of the sell market order I initiated on binance.

And below is a screenshot showing its complete execution

SCREENSHOT FROM BINANCE

RELATIONSHIP BETWEEN MARKET MAKER AND MARKET TAKER

As it is known, market makers helps to provide liquidity by initiating a limit orders.

And a lot of limit orders of a commodity will mean there are a lot of pending orders at different prices for that commodity.

When such happens, there will be readily available orders for the market takers to fill, thus making trading easy and fast.

In a nutshell, we can say market makers provide liquidity by creating the orders while market takers takes liquidity by accepting the created order.

DIFFERENCES BETWEEN MARKET MAKER AND MARKET TAKER

| MARKET MAKER | MARKET TAKER |

|---|---|

| They choose the price at which their order should be executed | They accept the available market price |

| They mostly work with limit orders | They work with market orders. |

| They provide liquidity | They take liquidity |

| The execution of its order is not guaranteed | it has a guaranteed order execution. |

STEEM MARKET PLACE

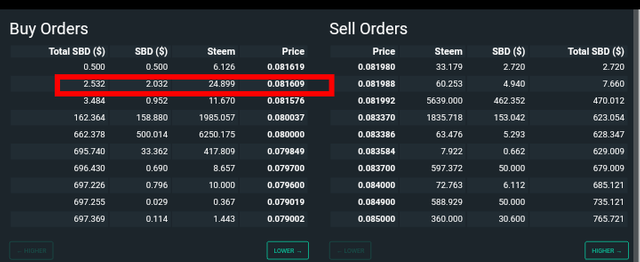

For those of us that have been enjoying the steemit platform before the lack of sbd printing, we should know the steem market place.

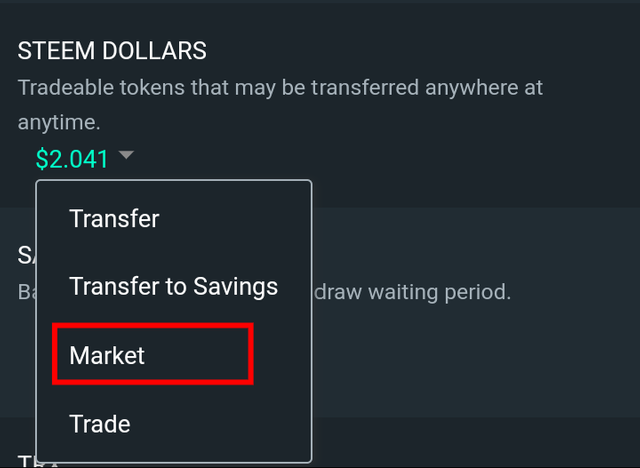

Steem market place is where we swap SBD for STEEM, when we still had sbd, and it can be accessed through the following steps below.

To access steem market place, visit your wallet, click on the drop down under the steem dollar feature, then click on market, and the steem market place will appear.

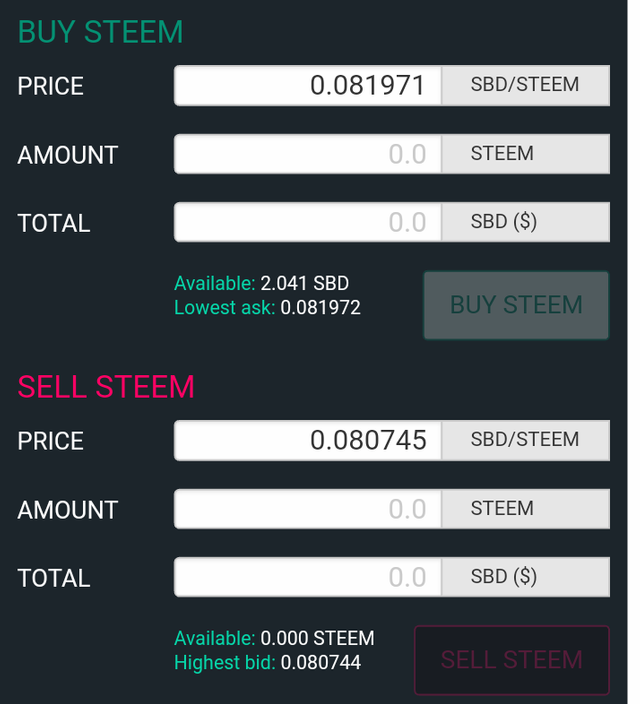

The steem market place is very easy to use, there are areas to buy and sell steem for sbd and vice versa.

Unlike in an exchange, steem marketplace doesn't have the limit order and market order, but we can choose to either accept or change the lowest ask or the highest bid.

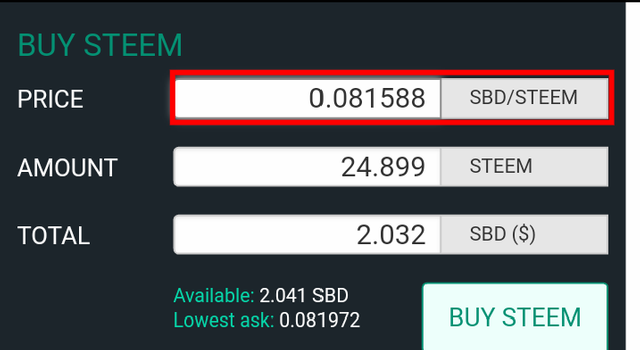

SETTING MY LOWEST ASK

By changing my ask price, it is as if I am placing a limit order and the order will be executed at my desired price.

As shown above, I changed the lowest ask and set my lowest ask, and then I proceeded to place the order.

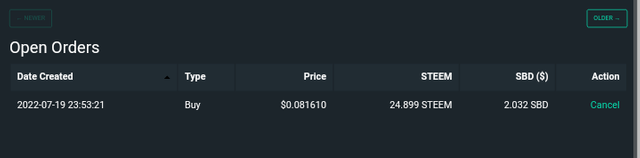

Since that was the current market price, the order was initiated but wasn't executed, instead it was added to the order book.

And below is the order book

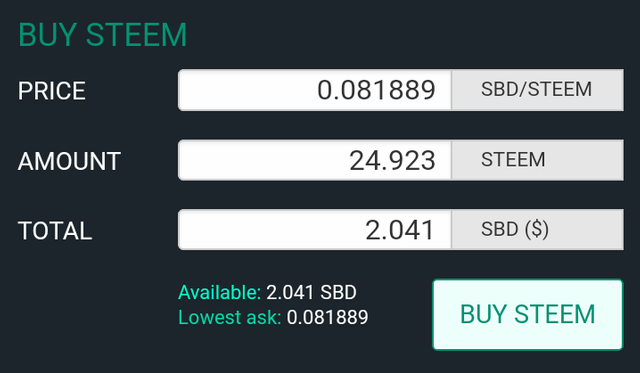

ACCEPTING THE LOWEST ASK

Accepting the lowest ask is more or less placing a market order, let's see how it goes.

Visiting my wallet, I decided to accept the lowest ask and placed an order with it.

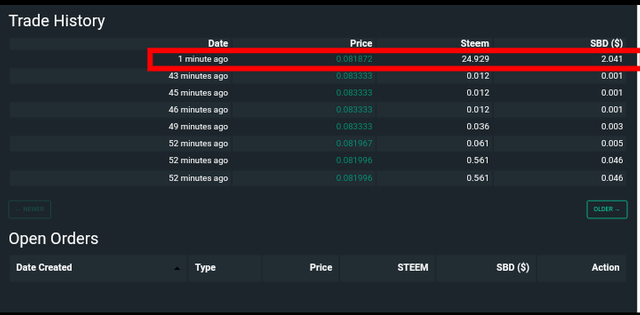

By doing so, I noticed that my order was initiated and executed immediately, just as shown below.

As shown above, the order was executed immediately and added to the trade history.

CONCLUSION

As crypto enthusiast, it is very important that we understand the concept of market making and market taking.

We have discussed their differences and we have also seen that they help to facilitate smooth trading activities.

One of the discussions that is certainly very good for many people to learn here. Thank you for sharing

Wow, that’s is a great tutorial from you bro. Thanks for sharing

Wao! So detailed and explanatory. Welldone dear friend. You did a good job.

Thank you for stopping by

Order book is very basic and important topic to know for any new trader. So, its very informative and well explained tutorial. I hope anyone can make their ideas like order book, bid ask price, limit order etc clear from this nice tutorial.

This is a comprehensive tutorial. I love it.

Learning is inevitable

Thanks for impacting more knowledge in us