My DeFi Series - Understanding Decentralized Finance (DeFi)

If you've been around the crypto field for a time, you probably know about or have at least heard about decentralized finance (DeFi). Perhaps you've had never heard of DeFi if you're new to cryptocurrency or haven't given it much thought. My goal is to create crypto content that is understandable to those who have never heard of it, as I've indicated in prior posts on this site. Likewise, it's never a bad idea to brush up. If I make a mistake, please correct me in the comments as I'm not an expert and simply like to explore around crypto and NFTs.

Therefore, I believe the simplest way to describe decentralized finance is to start by reviewing what people typically see when they think of financial. We employ centralized finance on a daily basis. This includes conventional banking, investment services, prepaid cards, and all other financial services under the control of an entity. In conventional finance, the authorities and regulators decide how and when you can use your funds.

Considering being able to accomplish all of that and much more without being able to be stopped. without having someone in charge of the economy or your money.

With cryptocurrency, we have control over our finances as well as what we do with it. Cryptocurrency are being designed to accomplish a variety of things since it is digital money that is not governed by a single centralized entity. Decentralized applications, sometimes known as "dapps," are protocols/platforms and applications that can be written by anybody and are accessible to anyone using a wallet.

Different dapps have been developed that enable interactive connections between our wallets and us. The best example of this are things like decentralized exchanges, or DEXs. You only need to connect your wallet to decentralized exchanges rather than creating an account, trying to remember a password, or even verifying your identity using KYC.

You can trade one cryptocurrency for another, such as TRX and USDT tokens, after your wallet is connected to a DEX. There is no middleman gathering your personal information or limiting your options. Even things like providing liquidity, farming and borrowing/lending with your assets to maximize your earnings are possible on some of these decentralized platforms.

The most common use of DeFi has always been swapping, providing liquidity, yield farming, lending and borrowing. I'll go over each one in turn, explaining how they operate and how to go about it, as well as the general advantages and disadvantages of DeFi.

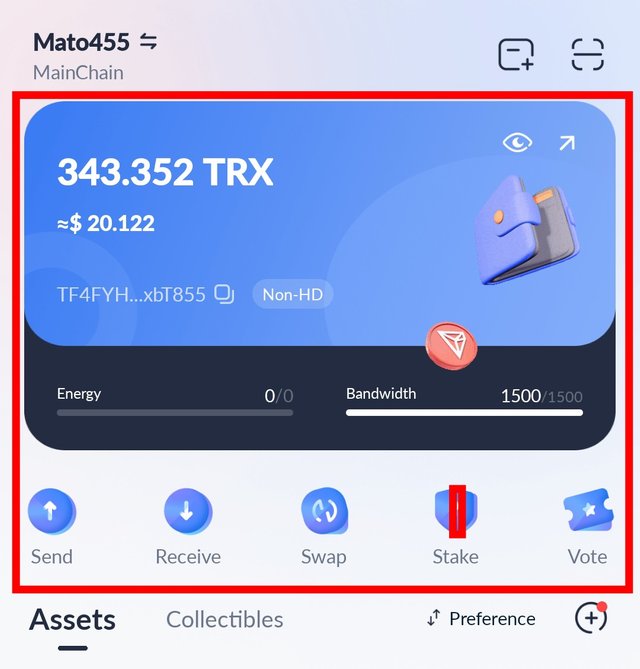

Before I start explaining them, it's important to understand that you must have a decentralized wallet in order to interact with any DeFi platform or protocol. A decentralized wallet is a digital wallet that gives users total control over their funds and enables direct interaction with Dapps. Some blockchain networks have their own decentralized wallets that let users explore and interact while paying a fee using the native token of the blockchain. For instance, the Tron blockchain makes use of the decentralized TronLink wallet, which enables users to exchange TRC-20 tokens and engage with Dapps on the Tron ecosystem while paying fee using the network native token (TRX)

Creating/Importing Account On TronLink

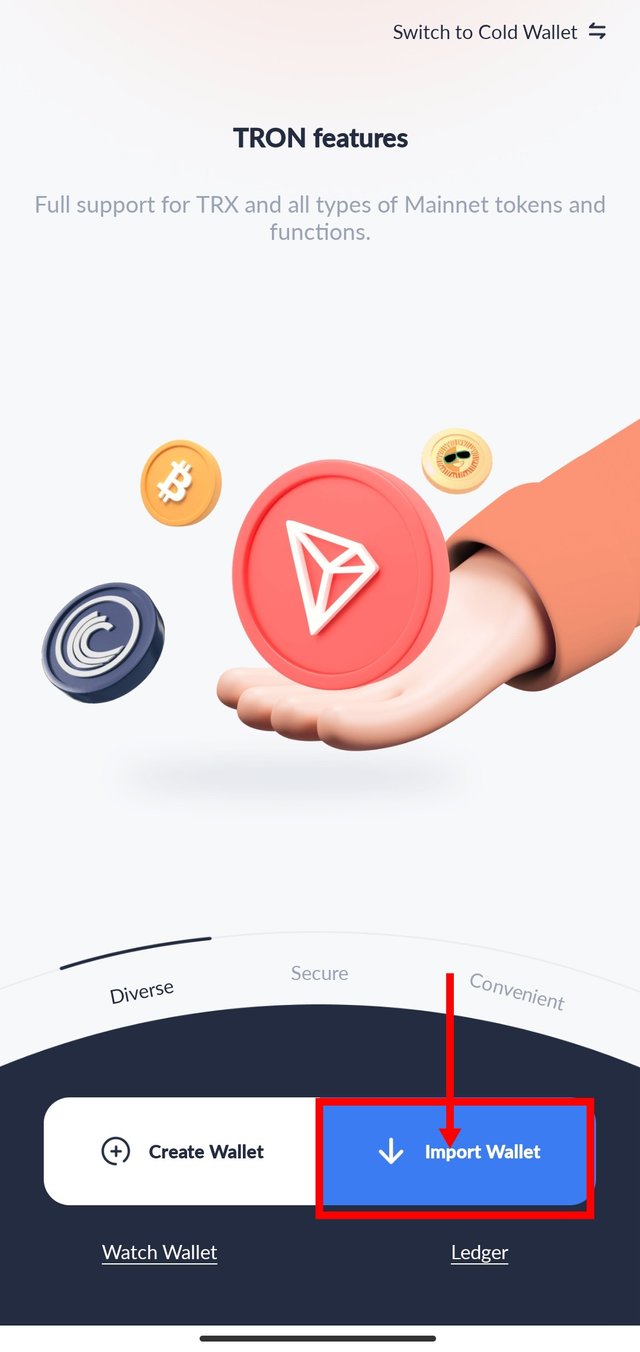

So for users that already have a Tron account, you can simply import your Tron account using your private key by following this steps;

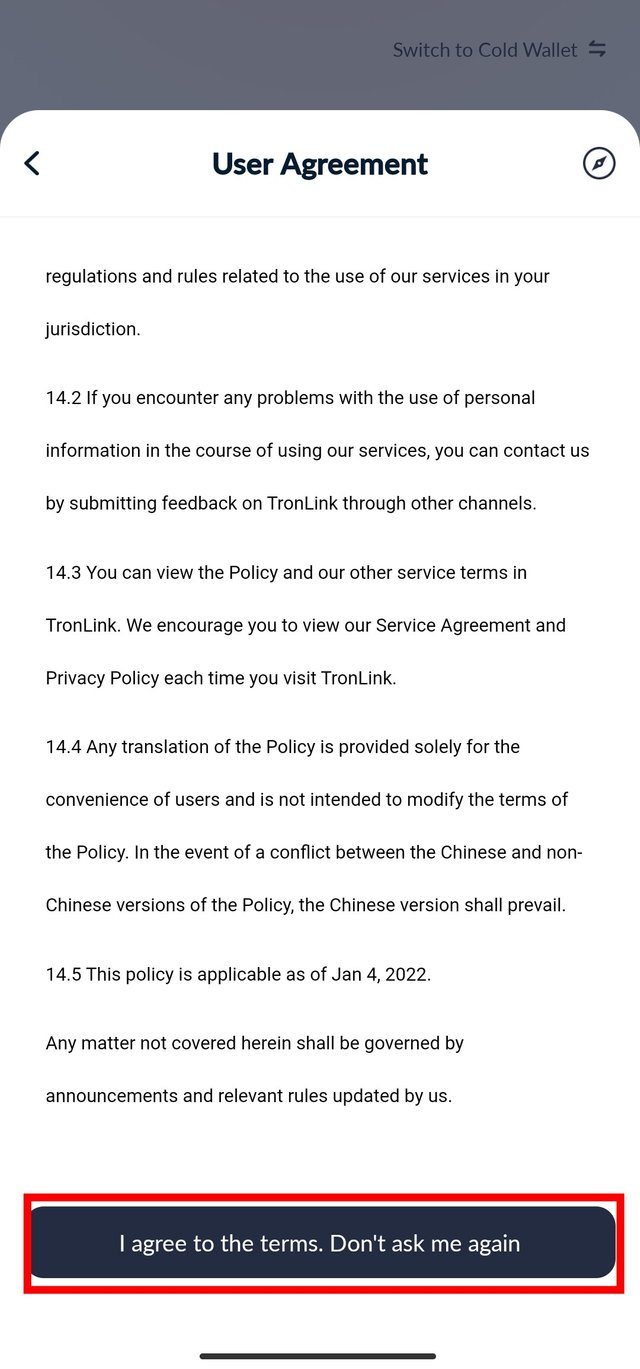

Step 1: After downloading and installing the Tron link app, launch it and select "Import wallet" before scrolling down and selecting "I agree with the terms."

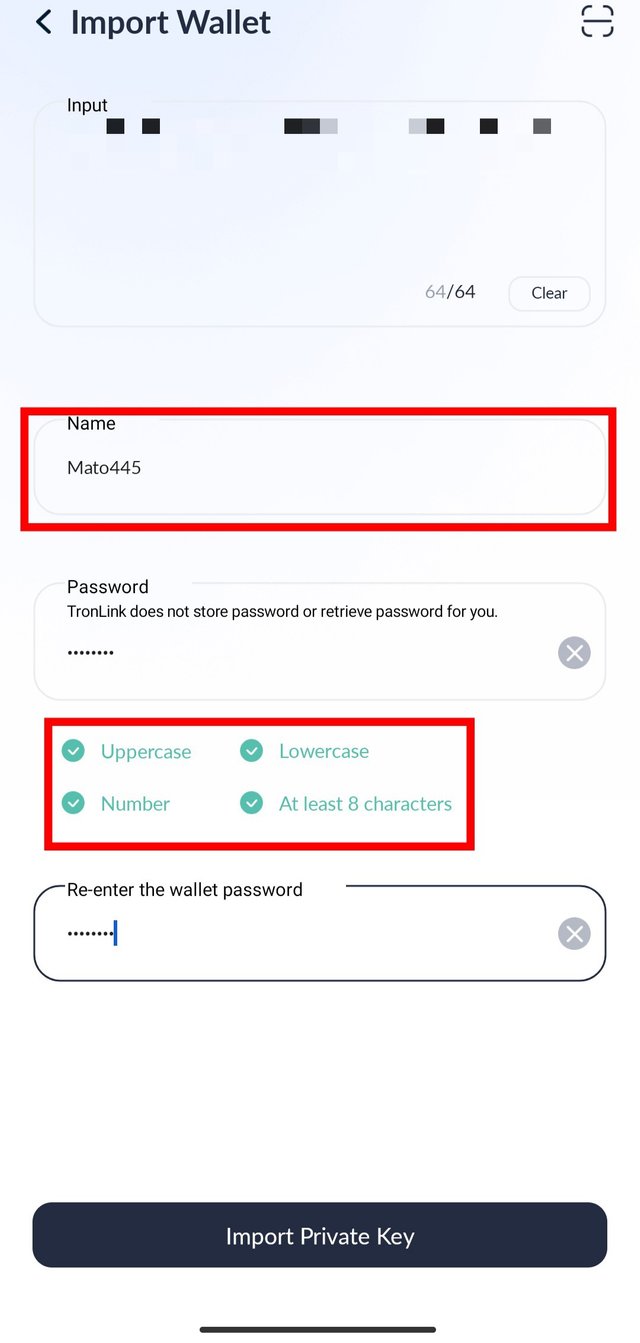

Step 2: Then click Next Step and enter your preferred password. Ensure that the password has at least eight characters and includes a number, uppercase letter, and lowercase letter. Click Import Private Key after correctly entering the password a second time.

You have successfully imported you Tron account to your Tron link mobile app, you can now interact with the Dapps on Tron system.

Creating a Tron Account

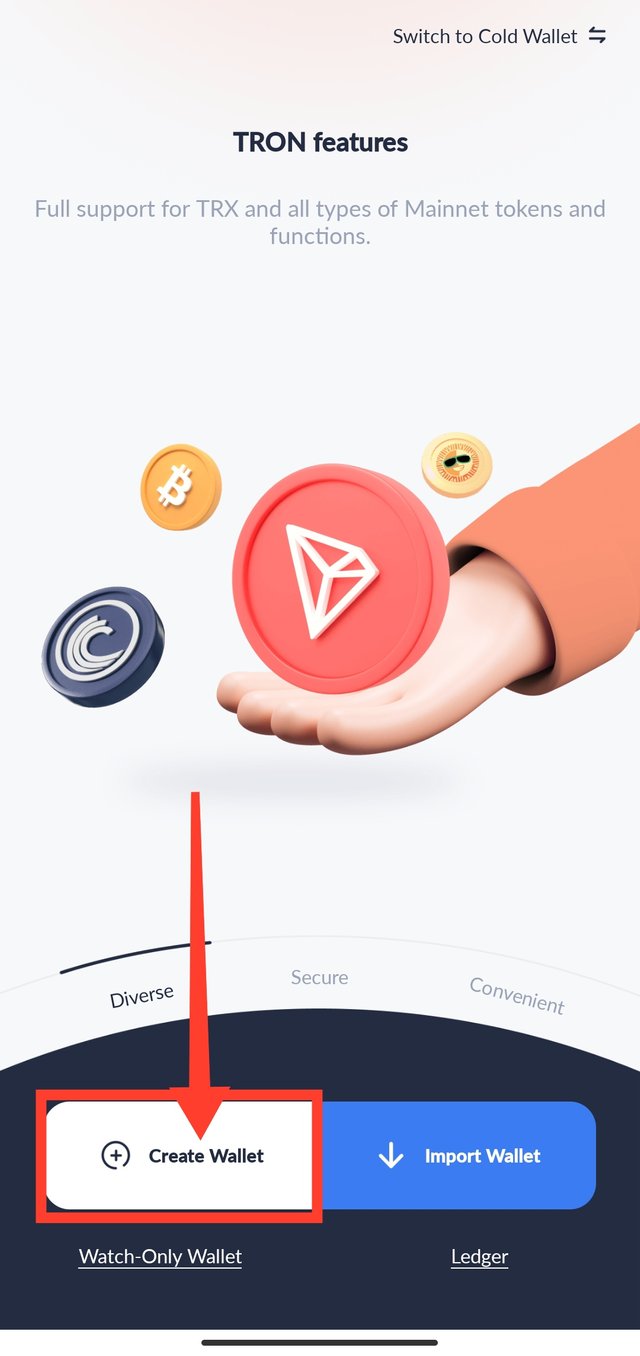

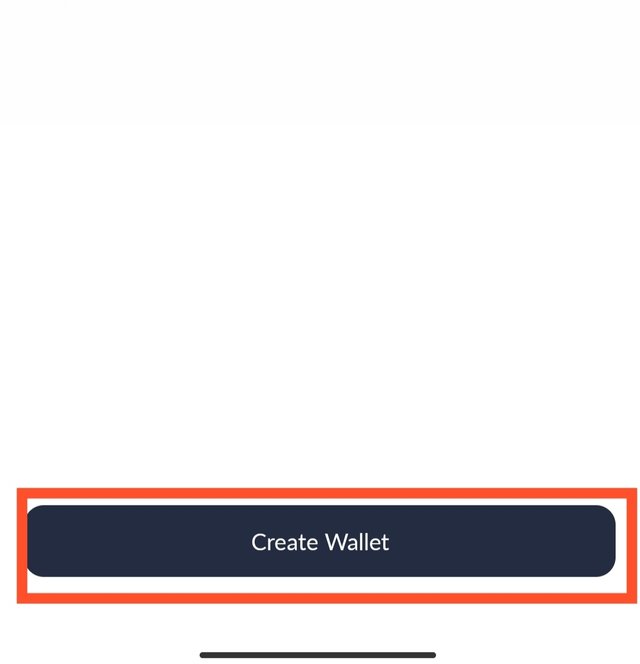

So for users that doesn't have a Tron account, you can simply create a new Tron account by following this steps;

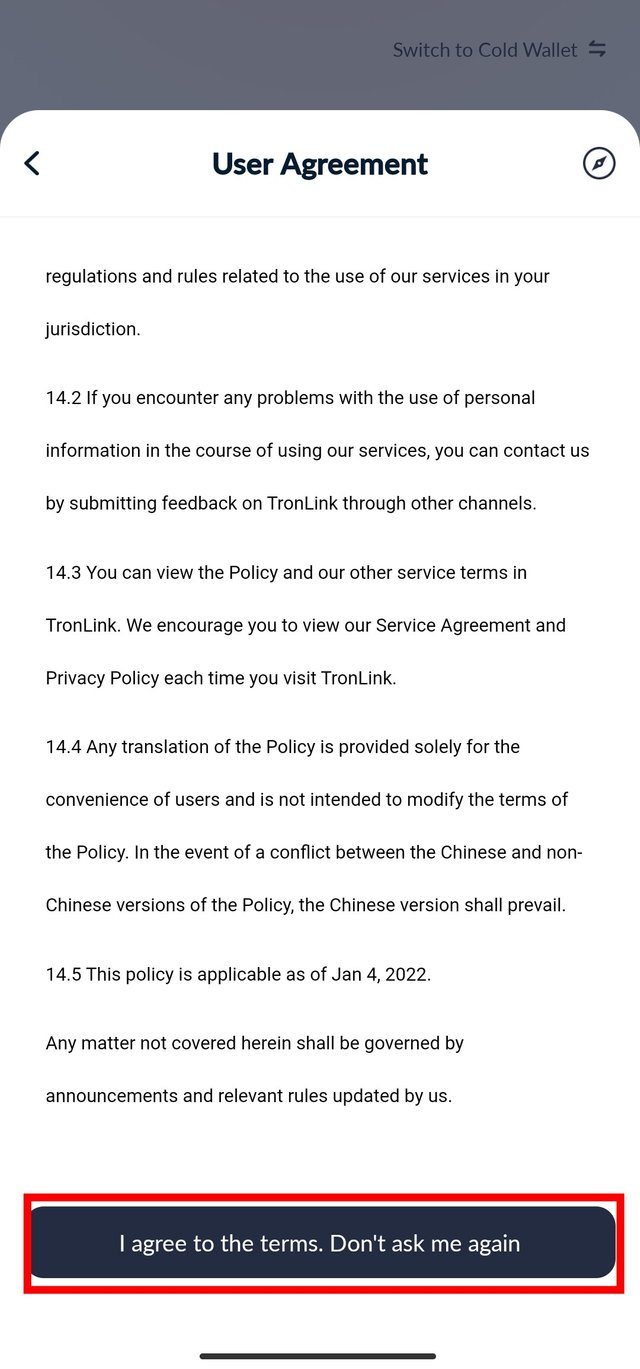

Step 1: After downloading and installing the Tron link app, launch it and select "Create wallet" before scrolling down and selecting "I agree with the terms."

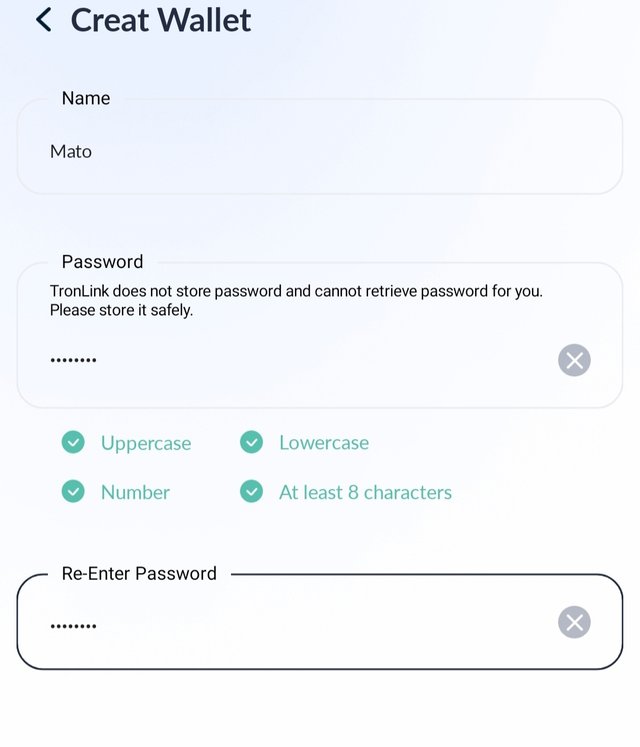

Step 2: Enter your preferred username, the password and re-enter the password again to confirm it and finally click on Create wallet

And that's it, you've successfully created a new Tron wallet account, you can now receive and send TRC-20 tokens as well as interact with the Dapps on Tron network.

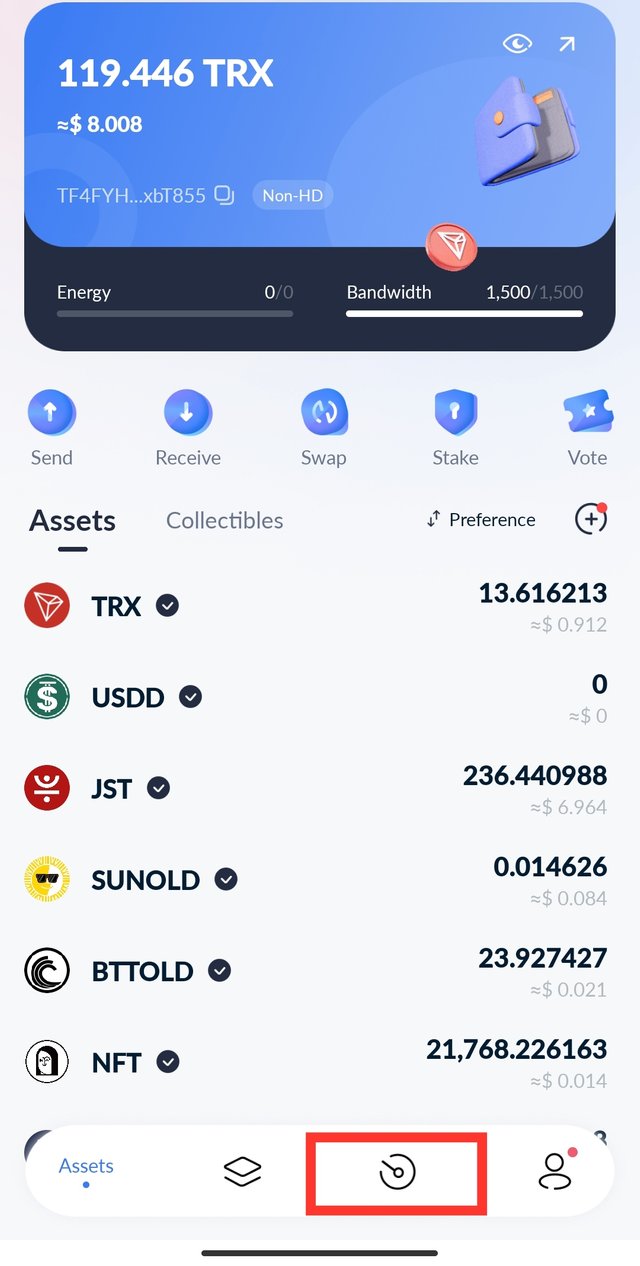

After successfully creating or importing our Tron account into the TronLink wallet, let's move on to the discussion.

Swapping

This is one of the most common use of DeFi, users can swap or exchange their tokens, this eliminate the need for middleman as well as order book as seen in centralized platform. Instead it use AMM mechanism to facilitate swapping of tokens.

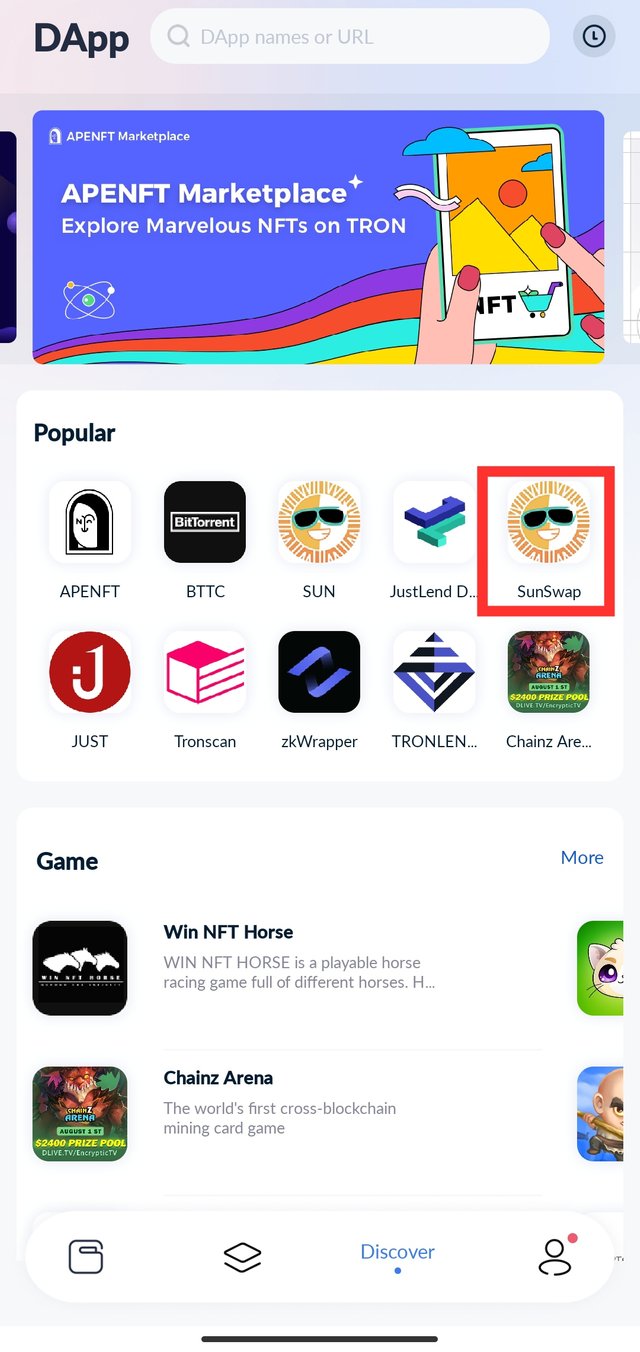

SunSwap is the most popular DeFi platform on Tron blockchain, this platform allows users to swap their TRC-20 tokens to another.

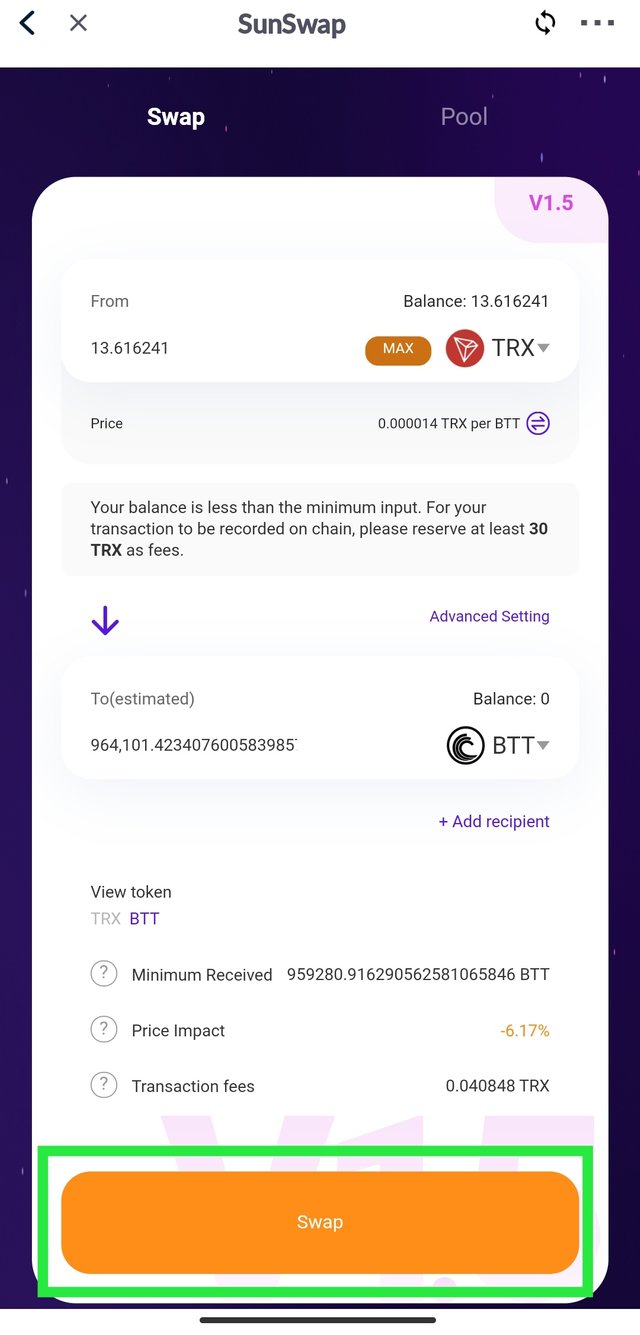

Swapping tokens requires certain amount of TRX as fee, to do this follow the steps below

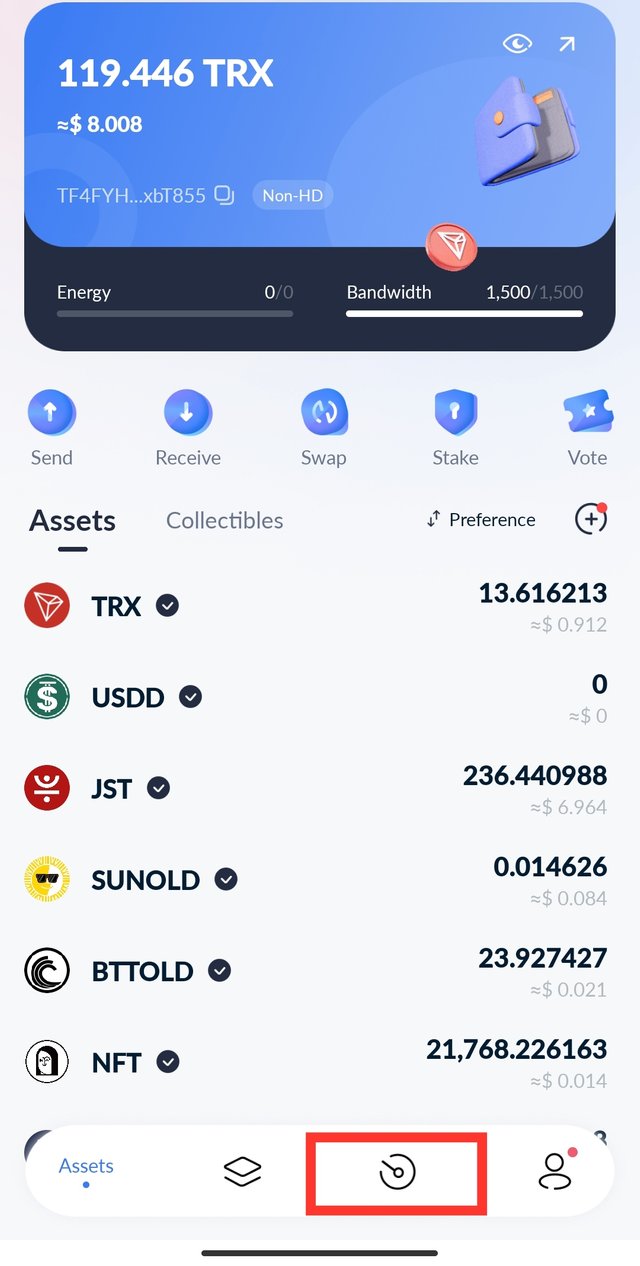

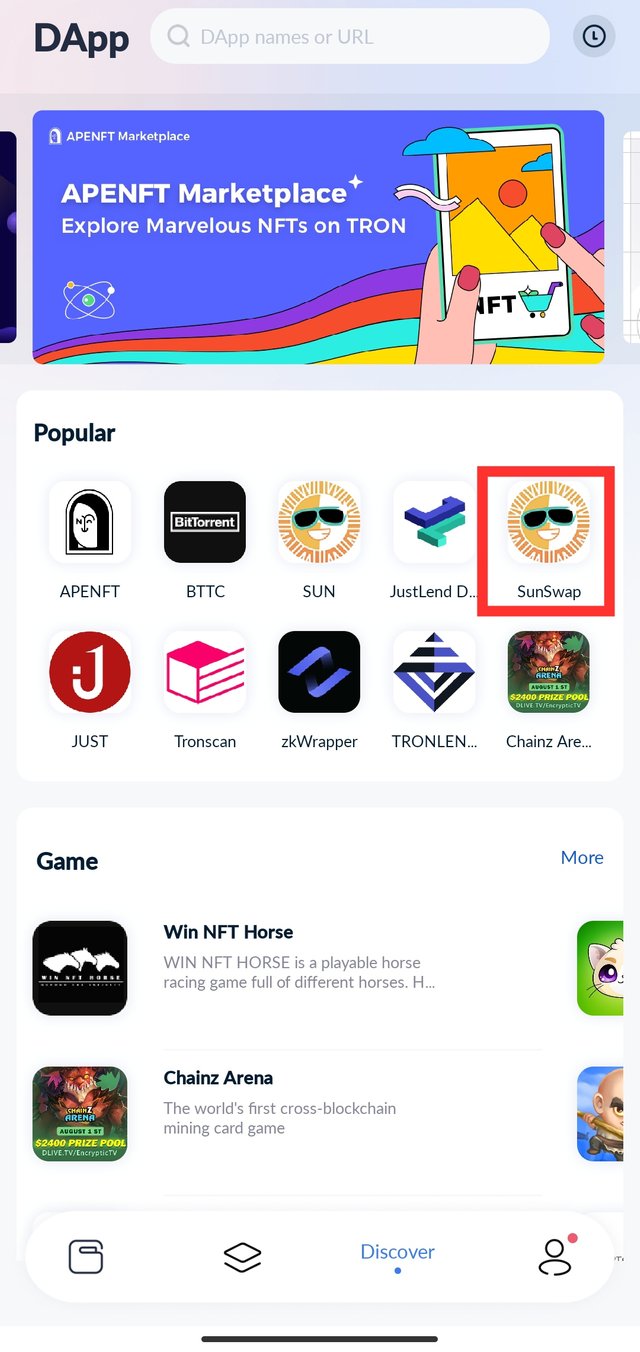

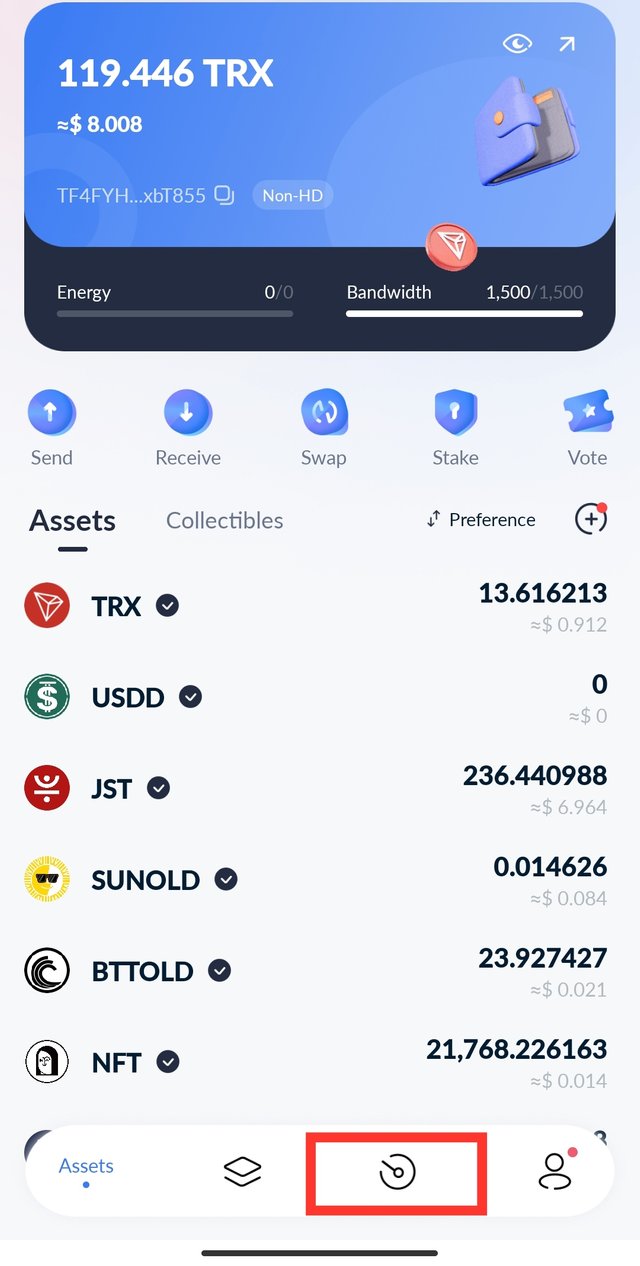

Step 1: Open the TronLink app, and click on Discover, select SunSwap from the dapps displayed

|  |

|---|

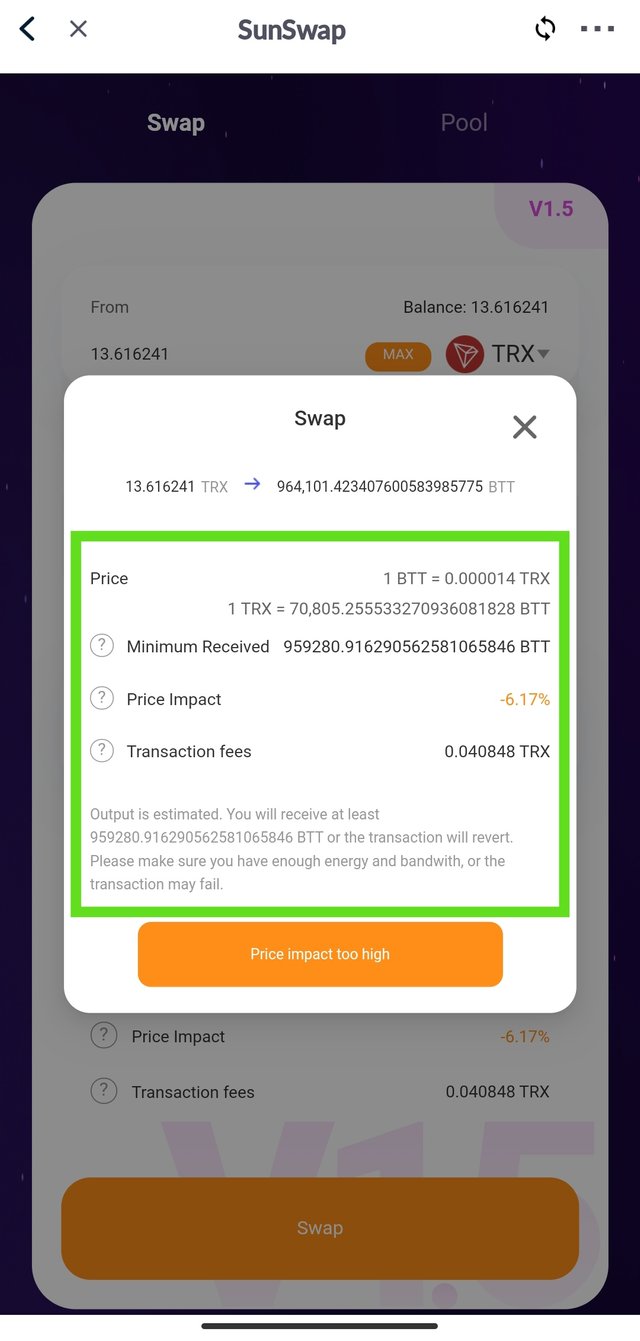

Step 2: Select the token you want to swap, and the token you want to receive/get and enter the amount then click Swap, the details of the swap will be displayed, which includes the minimum amount you will get, the fee, and the price impact.

|  |

|---|

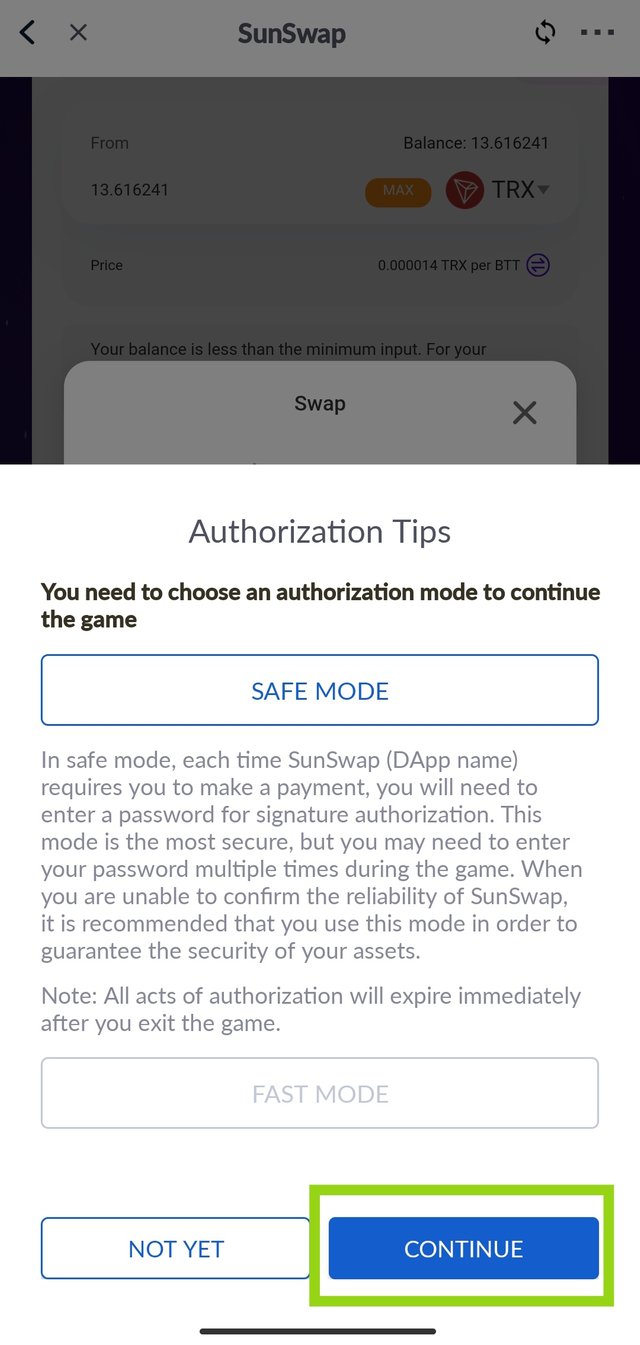

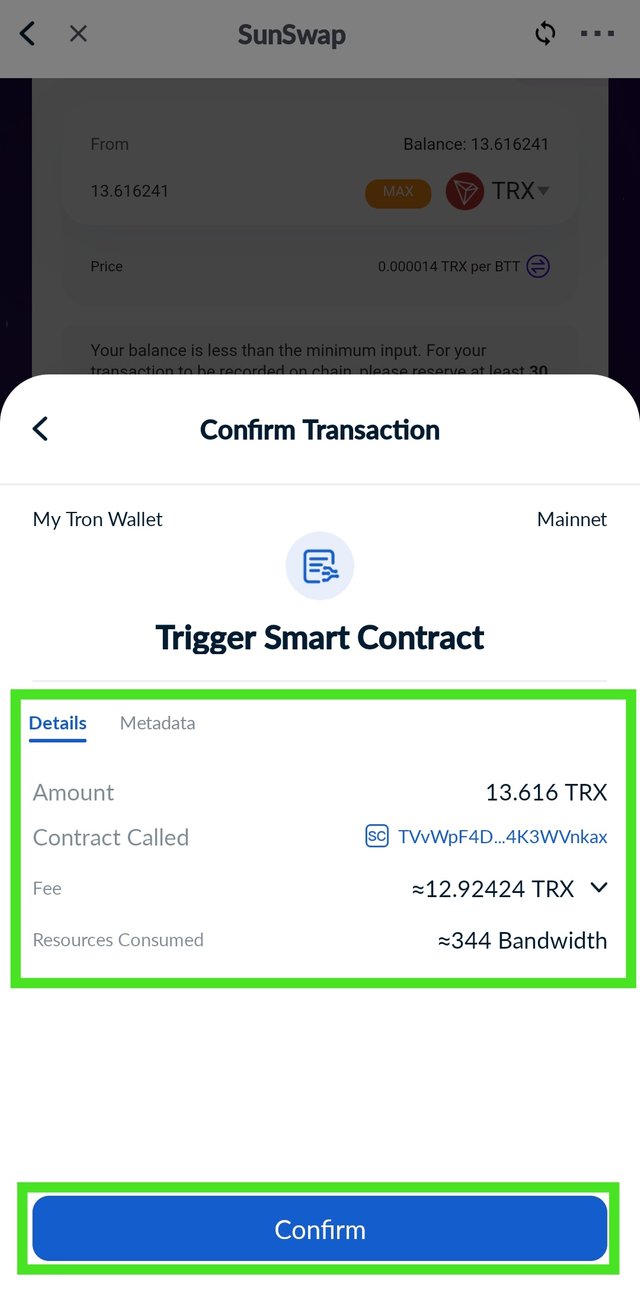

Step 3: If you're satisfied with the price impact, click it to continue. However, you must first authorize your Tron wallet to interact with the SunSwap, which has a fee associated with it. Then, you can initiate the transaction, which has a fee associated with it as well (TRX)

|  |

|---|

As I mentioned, the AMM mechanism makes swapping possible by eliminating the need for an order book. On the other hand, the AMM is a pool of money or tokens that users who are known as liquidity providers deposit. These tokens are used for swapping, and the liquidity providers then earn the swapping fees based on how much they deposited (provided)

Liquidity Pool

This is another another common activity on DeFi, and it has a great benefit since it enables users to generate passive revenue. The Liquidity Pool is a smart contract pool that contains money or tokens that users who are known as liquidity providers deposit. The pool helps to facilitate trading on decentralized exchanges, and the provider is rewarded with the trading fees.

Users who are interested in participating in or earning from the liquidity pool must deposit trading pairs of cryptocurrencies on the pool, which are frequently in an equal position, meaning the two tokens must be split 50/50. For example, if you want to provide TRX and USDT as liquidity, you must provide 50/50 TRX and USDT. If you want to use $200 worth of TRX, you must be prepared to use $200 worth of USDT as well (50-50).

SunSwap a Tron DeFi platform also allows users to provide liquidity to the pool, this liquidity providers are used to facilitate swapping or exchanging of tokens and the providers earn the fees as rewards.

Providing liquidity requires you to have two tokens at 50-50, you'll also need to have enough TRX for fee, just follow the steps below;

Step 1: Open the TronLink app, and click on Discover, select SunSwap from the dapps displayed

|  |

|---|

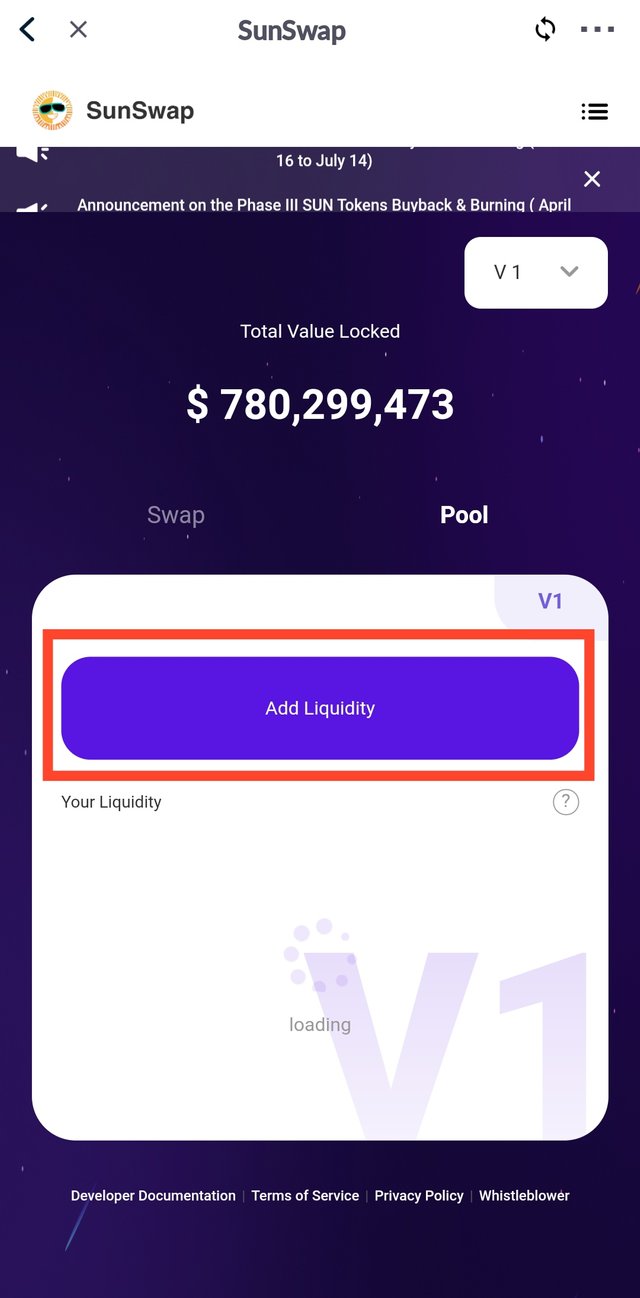

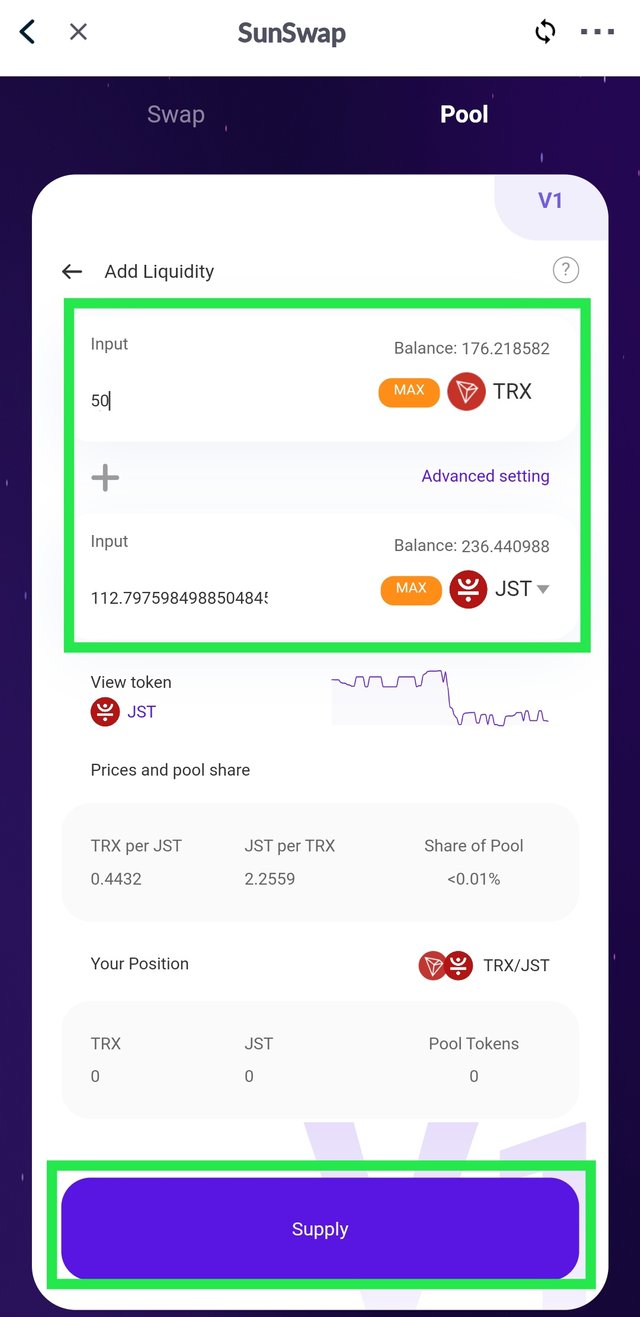

Step 2: Select Pool, and click on Add liquidity, select the token tokens and enter the amount.

|  |

|---|

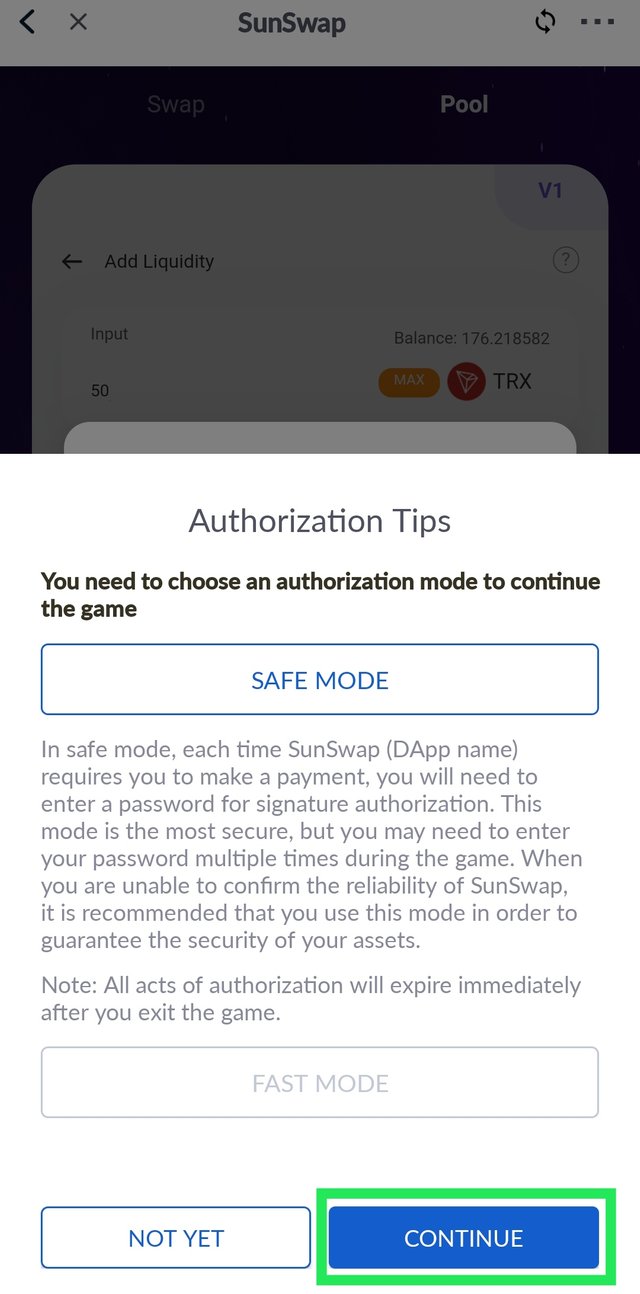

Step 3: Enter the amount of the two token, make sure they're 50-50 then click on Supply, then authorize the transaction by clicking Continue

|  |

|---|

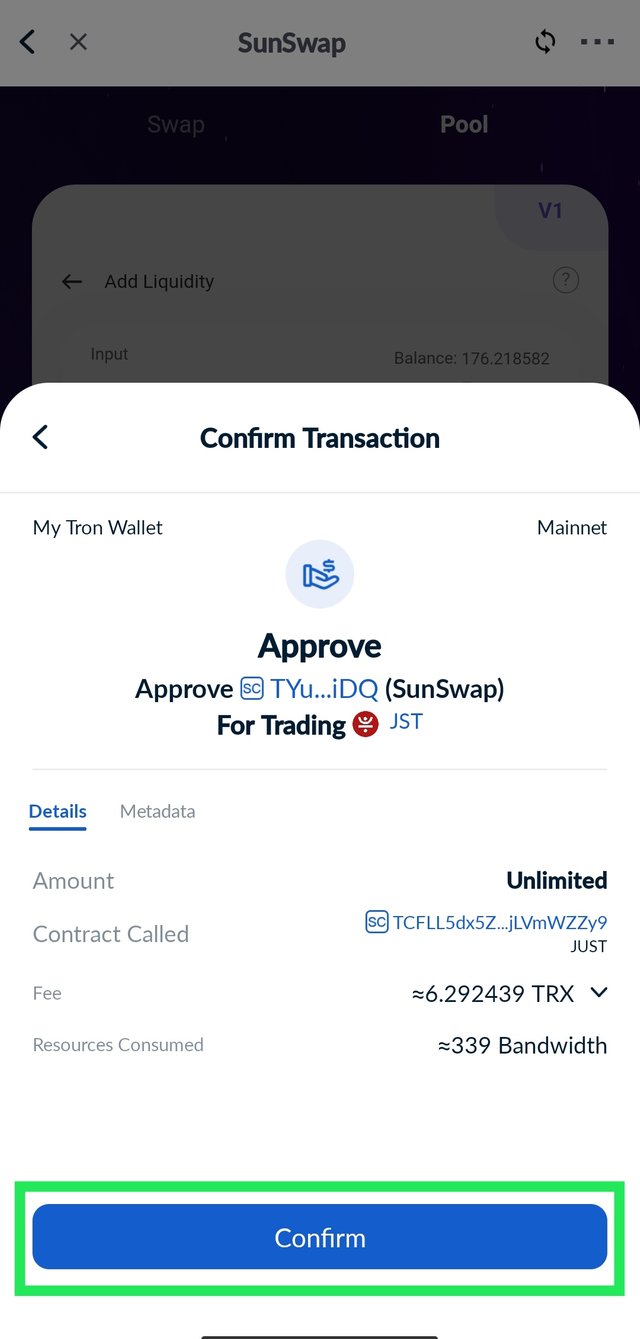

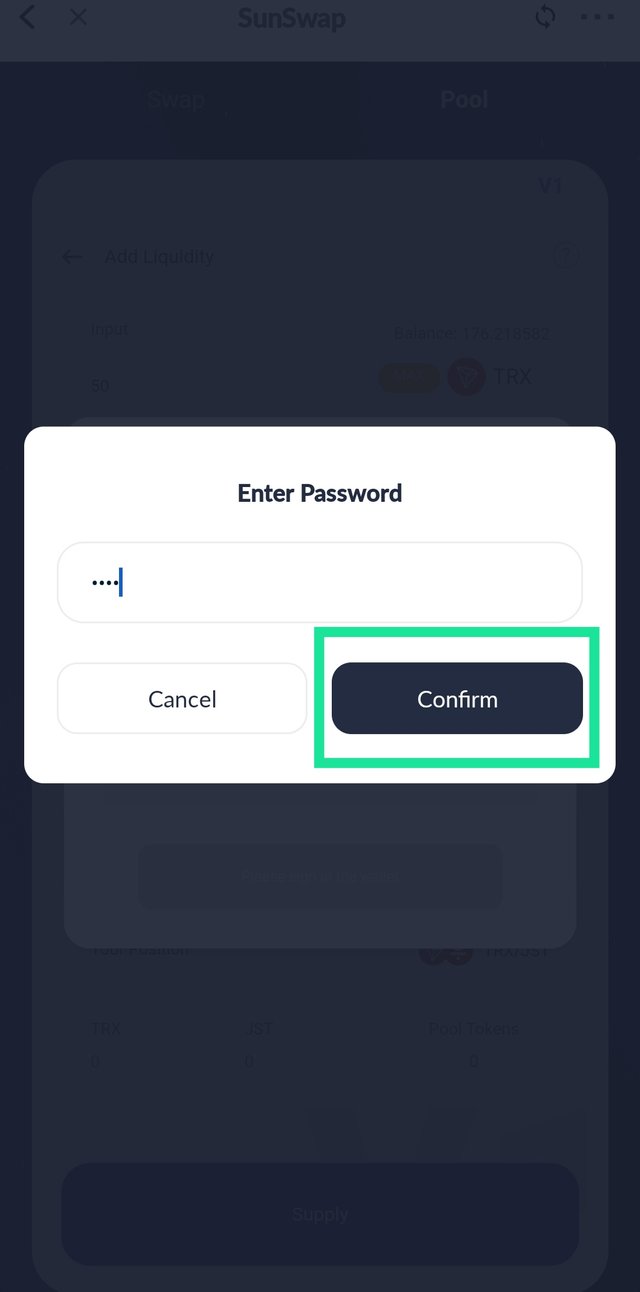

Step 4: The transaction fee both in TRX and the resources it will consumed was displayed, click on Confirm and enter your password to approve the transaction.

|  |

|---|

Yield Farming

Yield farming is another common use in DeFi, this is the most passive income generator, In essence, this enables you to combine equal amounts of two assets to generate liquidity for the platform, as I described in Liquidity pool. Depending on the platform and the assets you are pooling, this will typically offer some sort of yield. On Tron network you can farm using SUN Dapp, this is more advance than SunSwap, as it allows users to do a lot of DeFi activities like yield farming.

Users who are interested in farming needs to first provide liquidity i.e offer two equal tokens to the pool. This token will then be staked at the "Farm* section to earn passive income at a certain percentage depending on the assets or token staked.

Farming On SUN

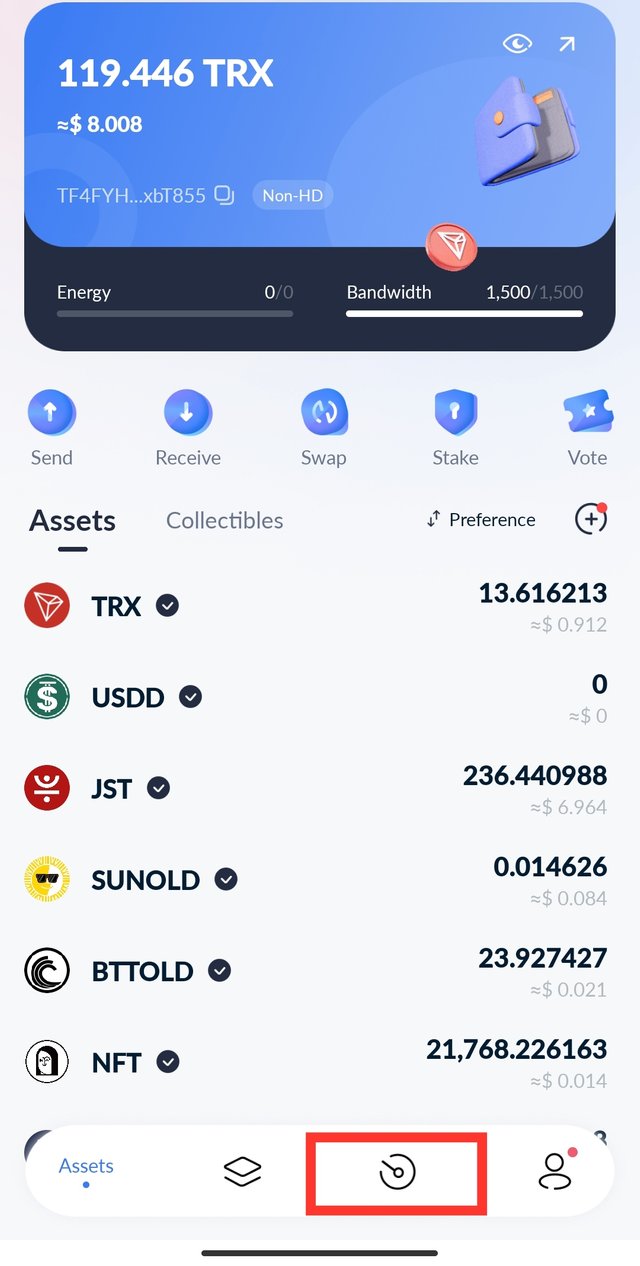

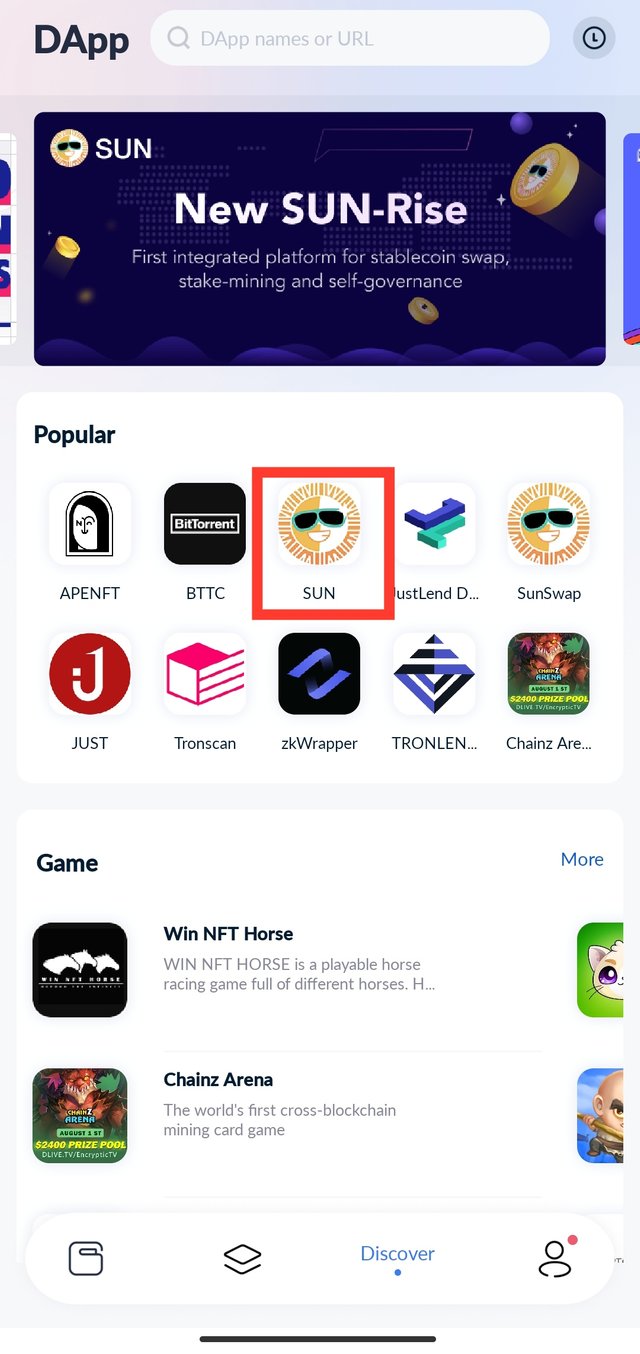

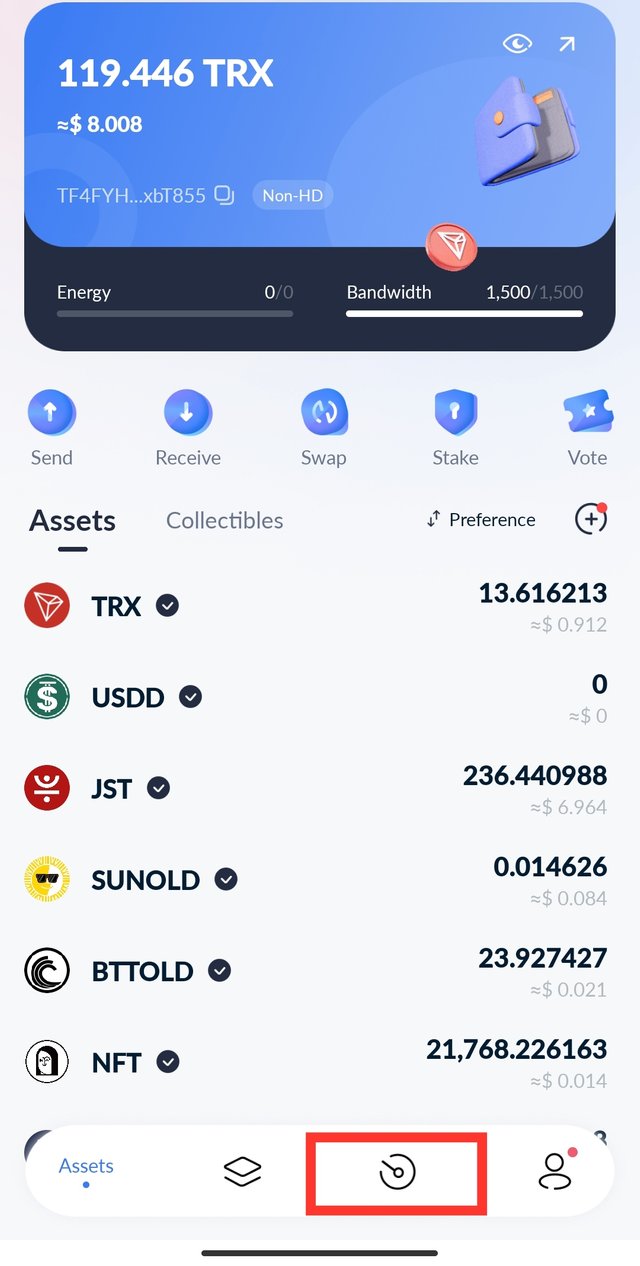

Step 1: Open the TronLink app, and click on Discover, select SUN from the dapps displayed

|  |

|---|

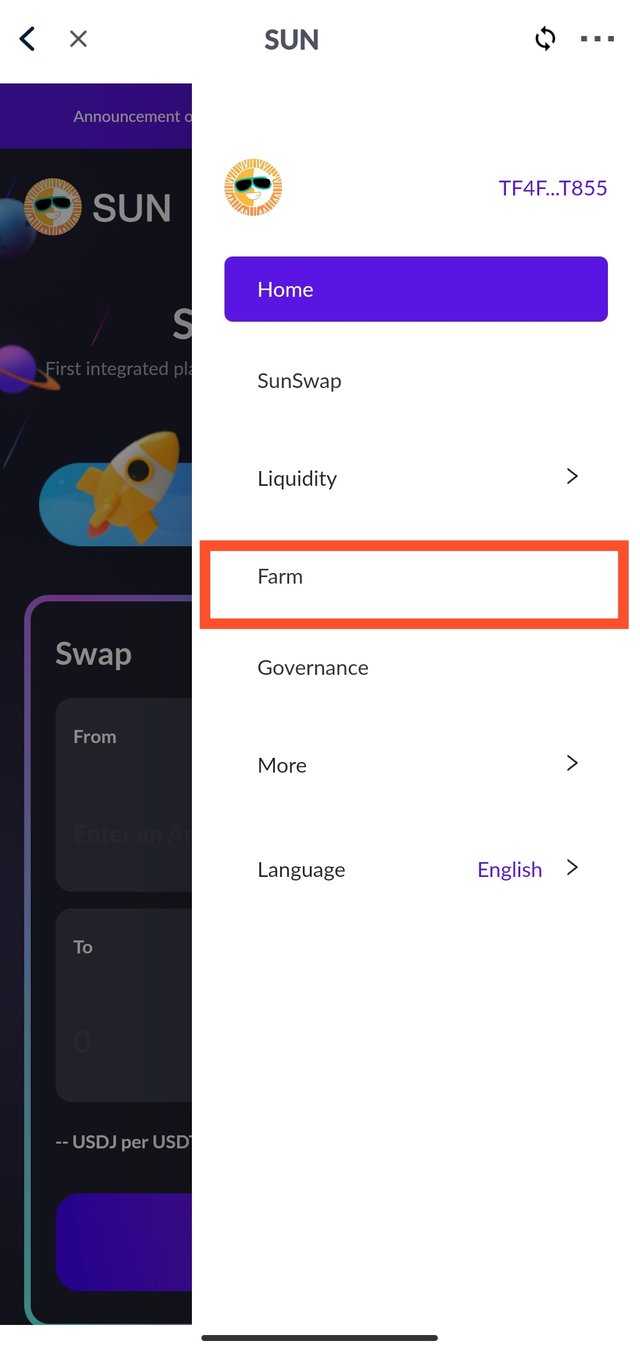

Step 2: On the homepage click on the three horizontal lines and select Farm

|  |

|---|

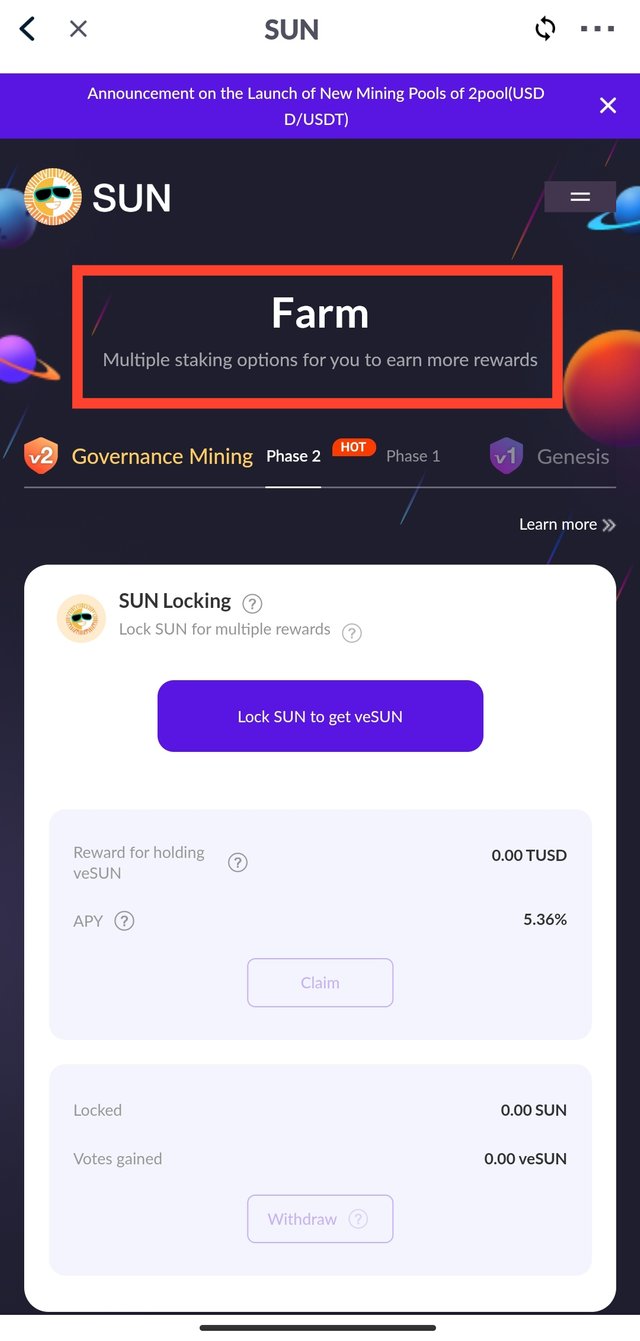

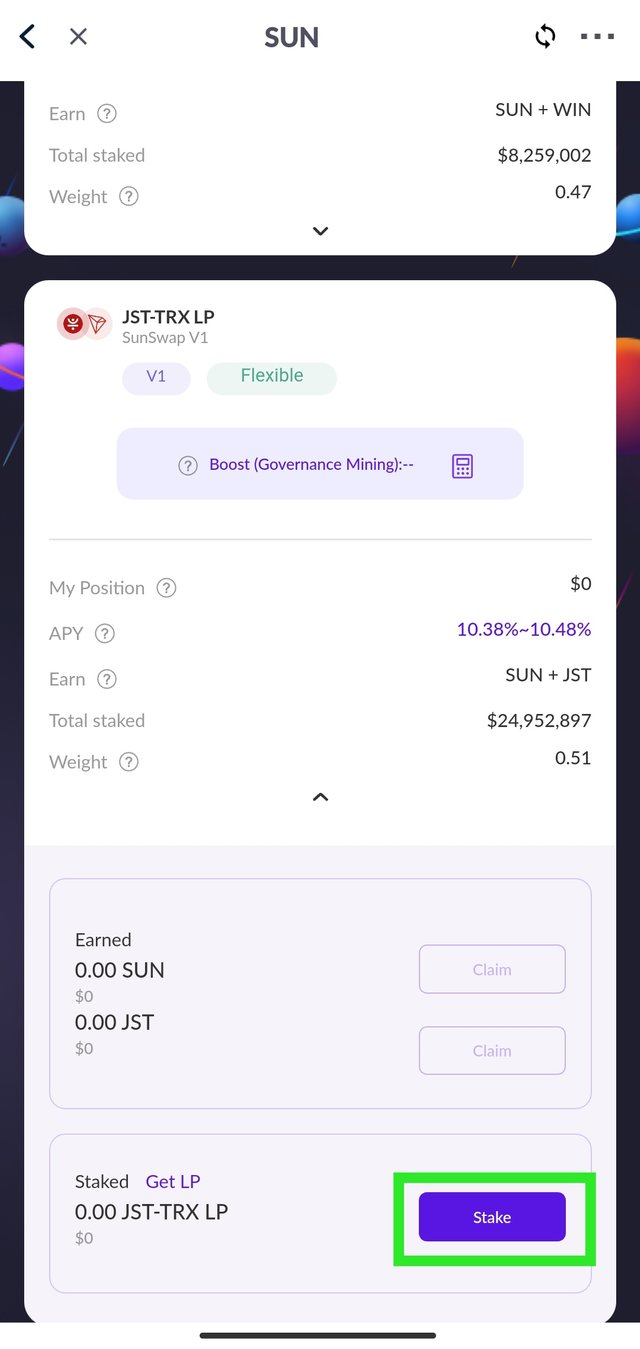

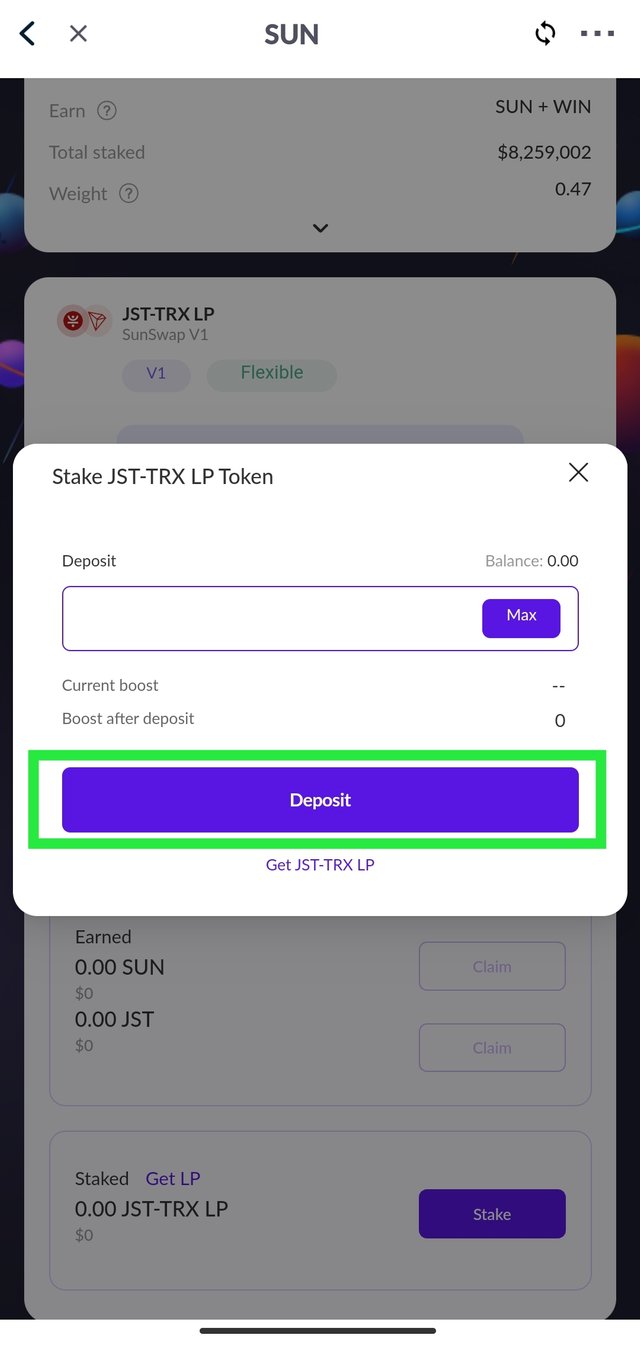

Step 3: Scroll down you will see the list available tokens for farming, this include the APY, the total staked and the weight. I select JST-TRX LP, the APY was around 10.48%, click on Stake, enter the amount of LP token you want to stake and click on Deposit

|  |

|---|

I only have jWIN-TRX liquidity token which is not available on the farming section, but the rest of the process is self explanatory

Lending & Borrowing

This another use of DeFi, this work similar with the banking system, where investors or user can supply or lend out their assets, and people can as well borrow those assets by providing collateral. The lending and borrowing comes with it own annual percentage, the lender received a certain percentage (depending on the token or asset) supplied, while the borrower pays a certain percentage (depending on the token or asset) borrowed.

Lending requires the user to stake their assets, then they receive the native token or the token supplied at a certain APY. Borrowing requires the user to borrow asset and repay at a certain APY.

JustLend is a Dapp on Tron network that allow users to lend and borrow asset, users can supply their TRC-20 tokens on JustLend, this token is then lend out to borrowers, and the supplier of the asset received the interest (APY) paid by the borrowers.

Lending On JustLend

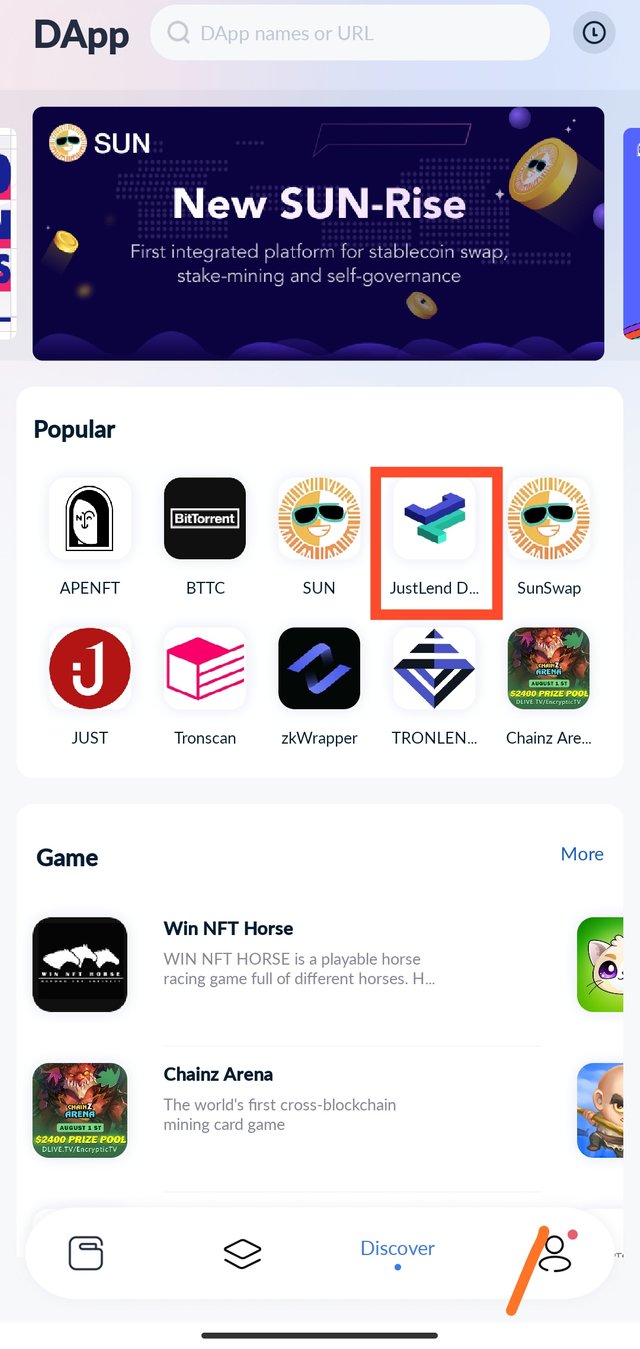

Step 1: Open the TronLink app, and click on Discover, select JustLend from the dapps displayed.

|  |

|---|

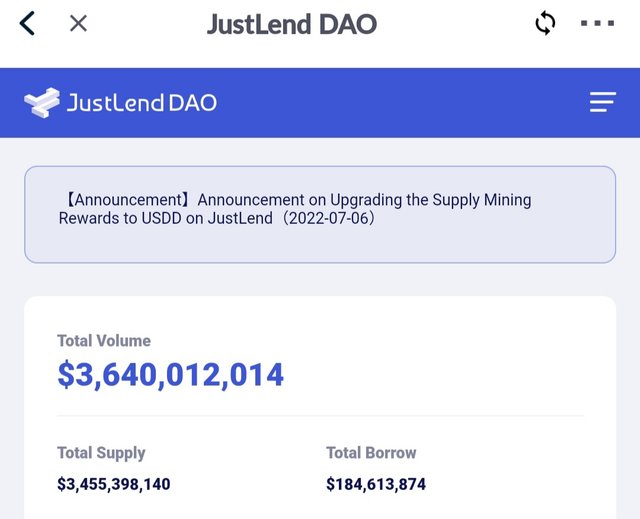

Step 2: On the homepage, the total volume, the total of supply and the total borrow are displayed.

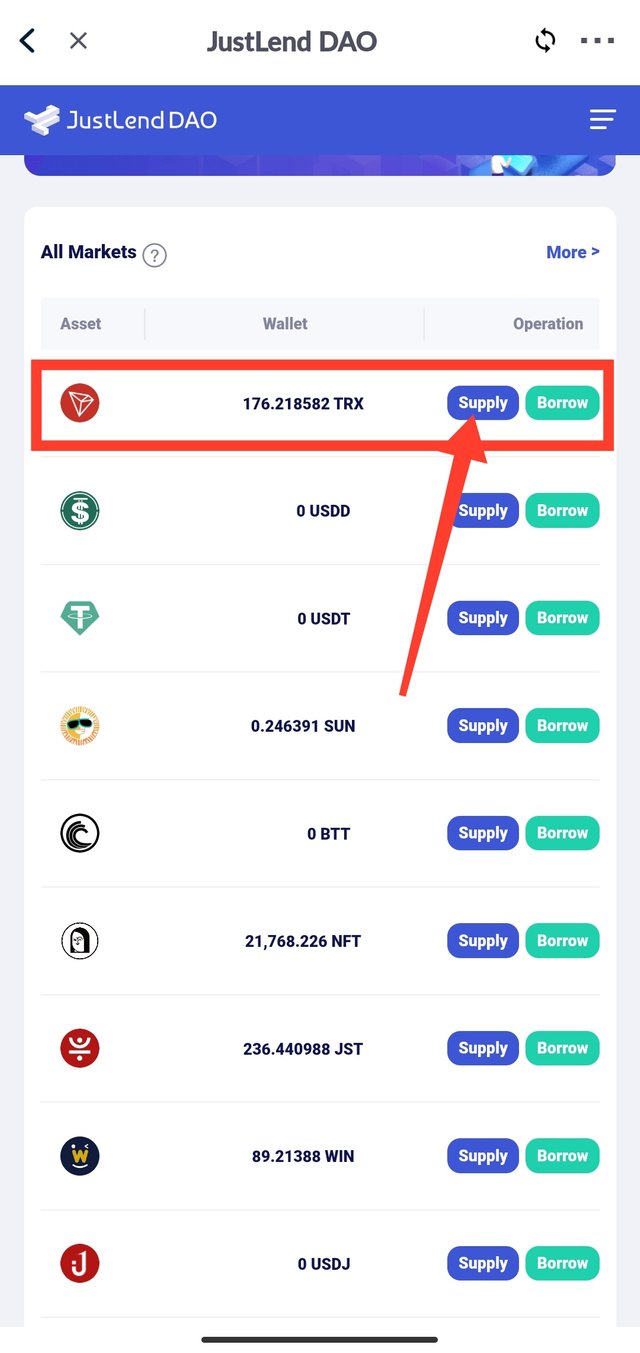

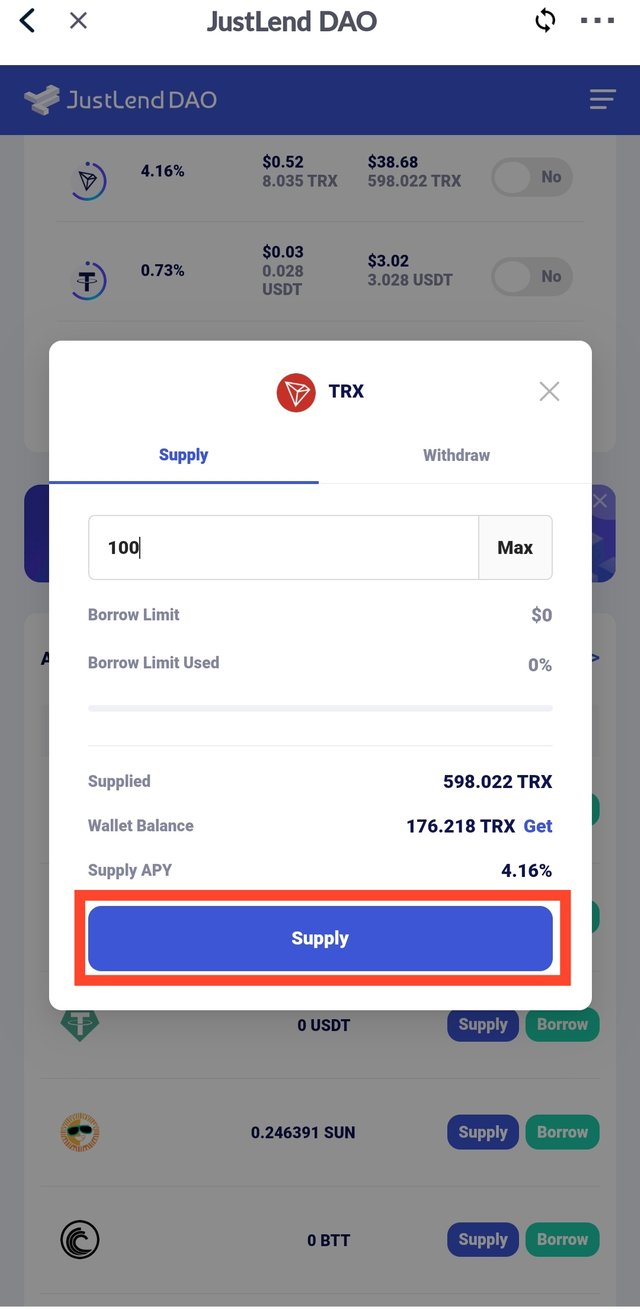

Step 3: Scroll down, the TRC-20 tokens available will be displayed, select the token you want to supply and click on Supply, enter the amount of token you want to supply, the APY will be displayed then click on Supply

|  |

|---|

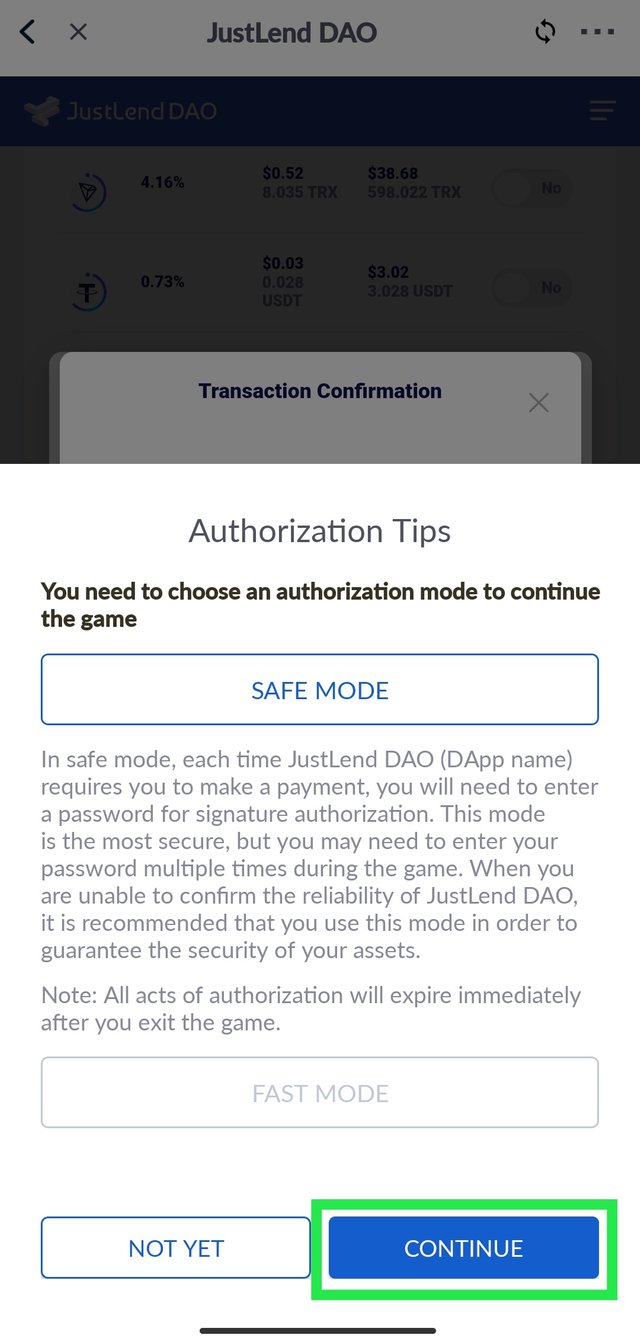

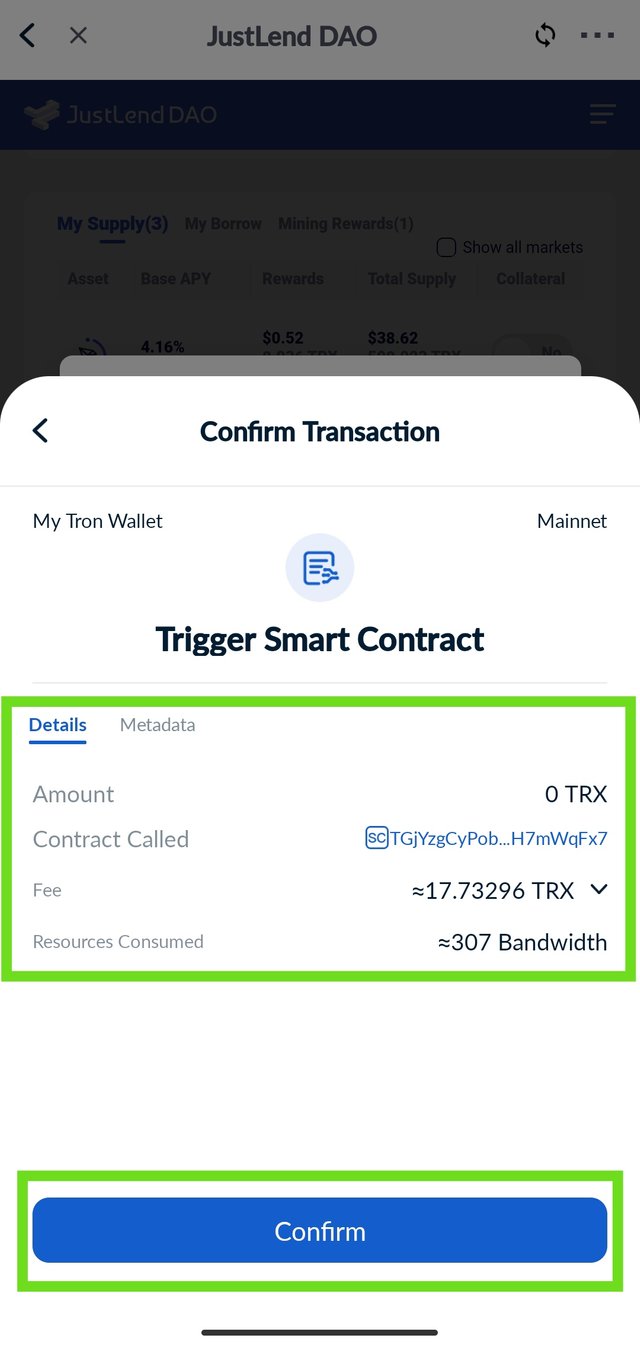

Step 4: Authorize the transaction by clicking on Continue, the transaction fee both in TRX and the resources it will consumed will be displayed, click on Confirm and enter your password to approve the transaction.

|  |

|---|

Borrowing On JustLend

Step 1: You must first supply assets on the platform in order to borrow other assets. These supplied assets are used as collateral.

Note: You are not permitted to borrow more than your assets' true net value.

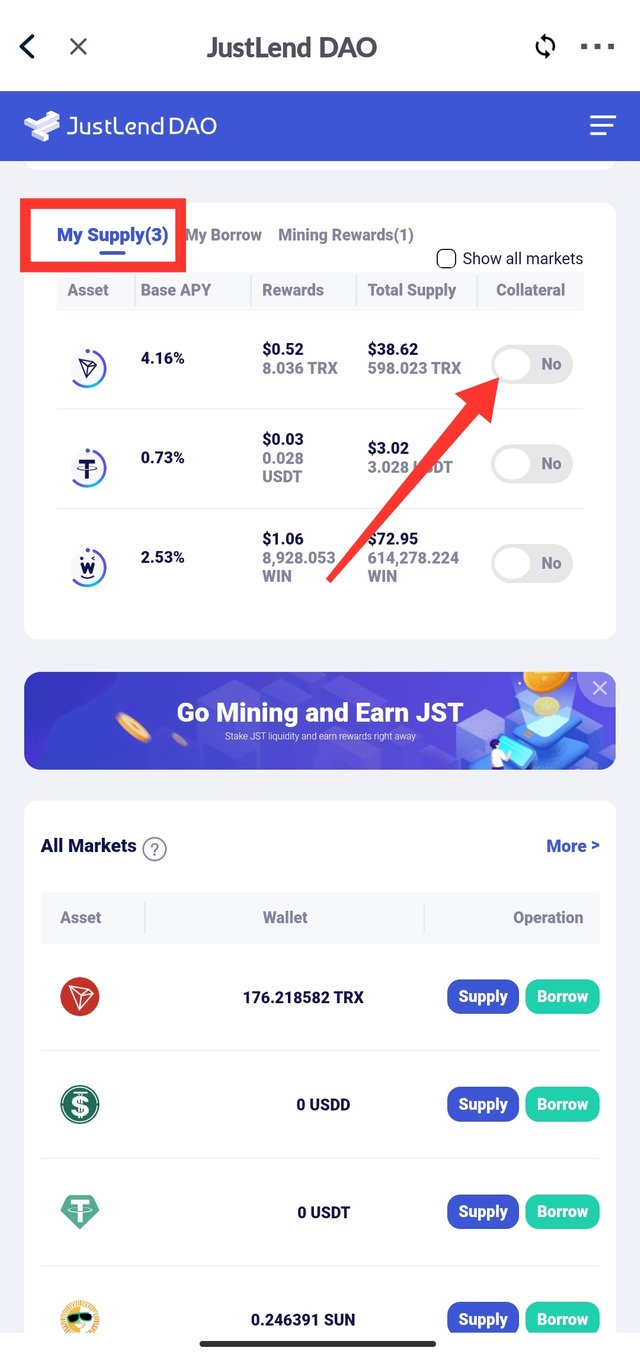

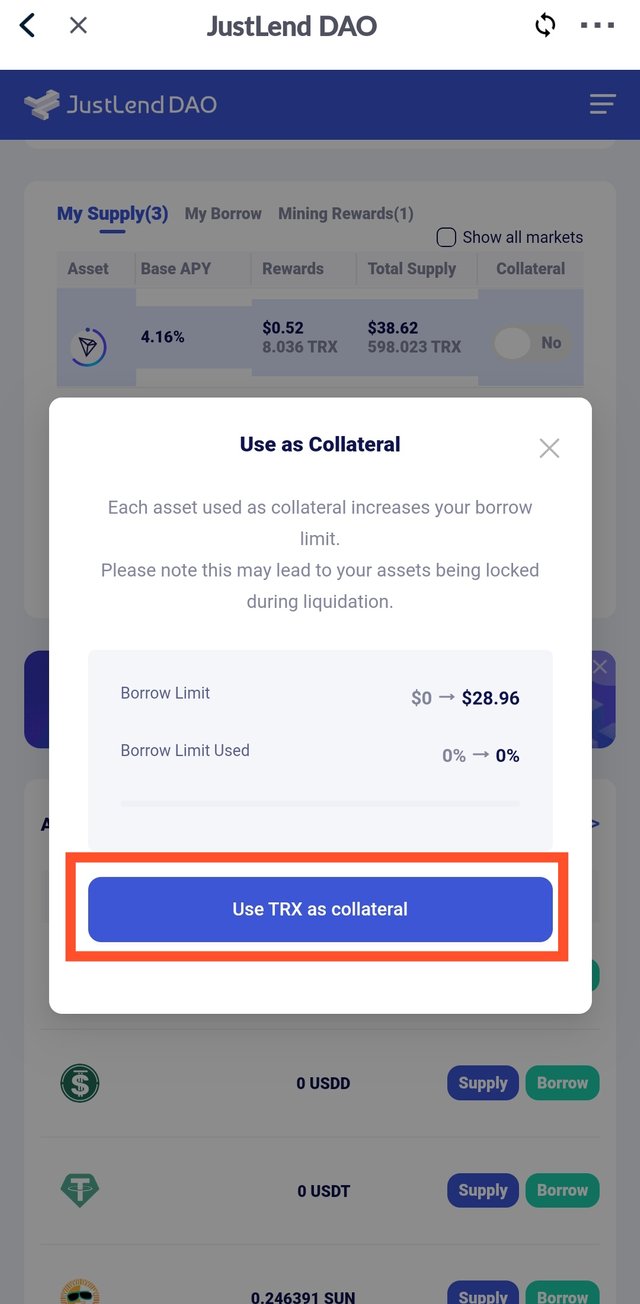

Step 2: After you've supplied your asset, navigate to My Supply, the list of all the assets you've supplied will be displayed, just navigate to the one you want to use for collateral and turn on the toggle, the value of asset you can borrow will be displayed.

|  |

|---|

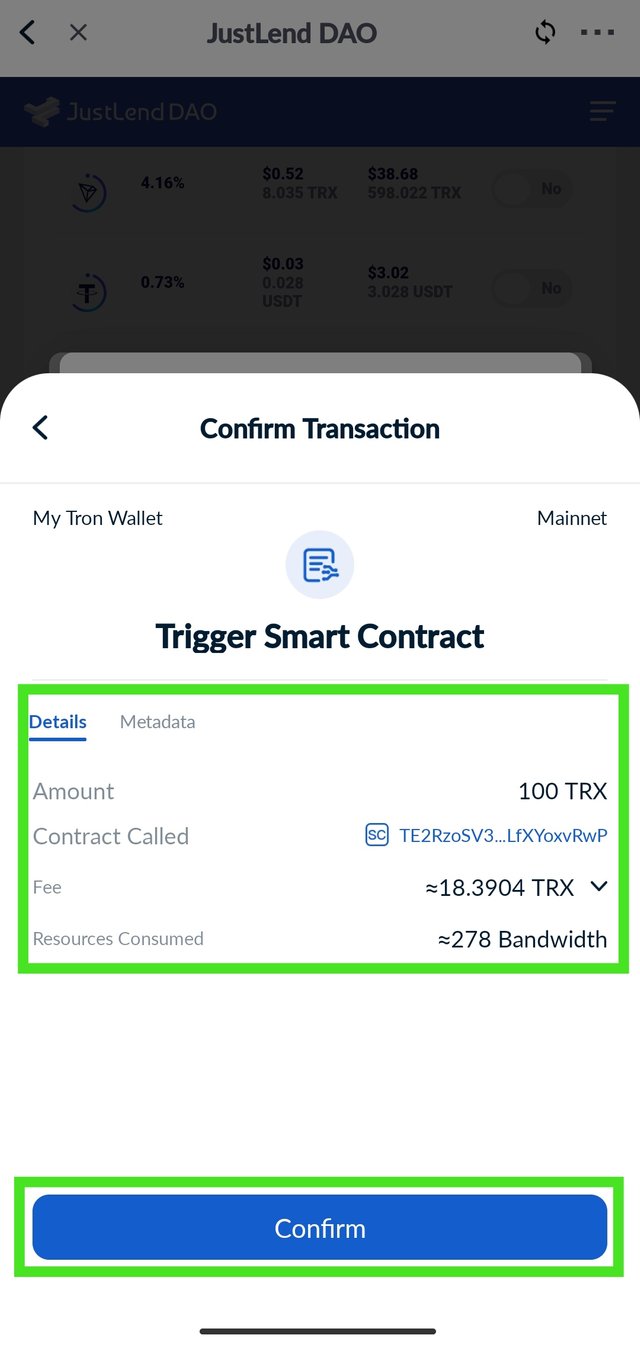

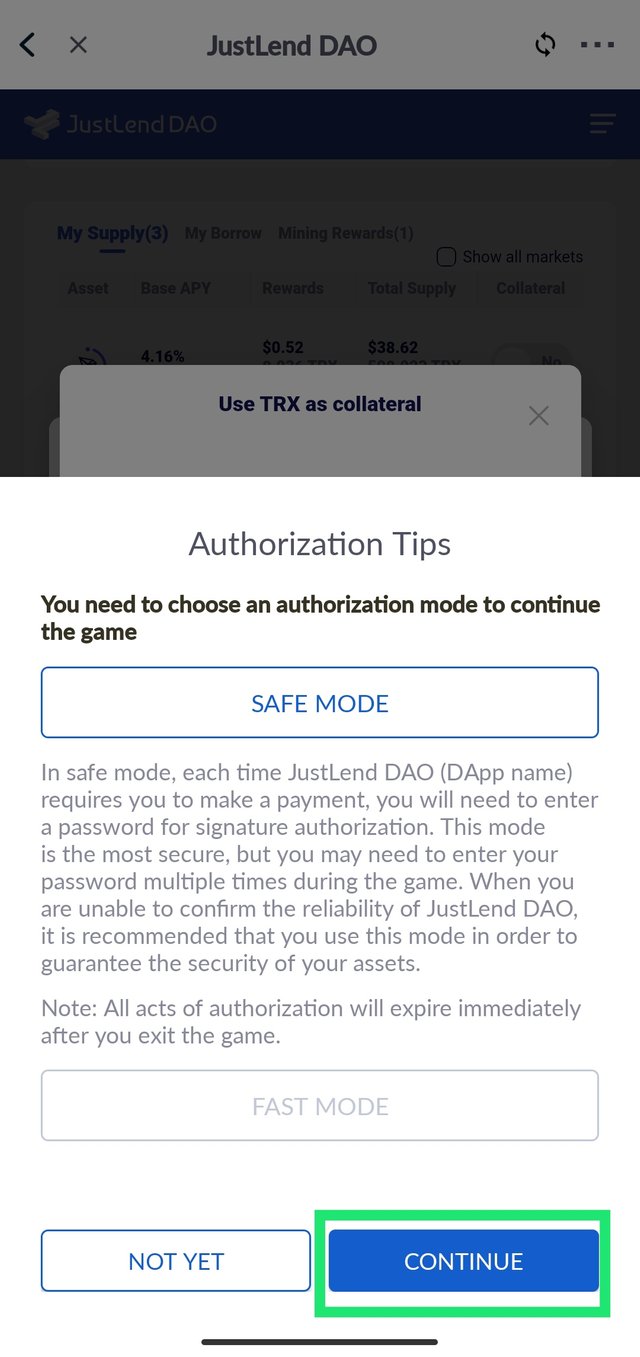

Step 3: Authorize the transaction by clicking on Continue, the transaction fee both in TRX and the resources it will consumed will be displayed, click on Confirm and enter your password to approve the transaction.

|  |

|---|

After you've successfully collaterized your asset you can then borrow another asset against it.

To borrow, just simply navigate to the asset, click on Borrow enter the amount, authorize and sign in with your password to confirm the transaction.

Important Note Each transaction will requires a significant amount of Energy and in case you don't have much energy TRX will be charged significantly

Conclusion

DeFi has established itself as one of the greatest human inventions, and it offers many significant advantages over conventional financial systems. These DeFi platforms' reliance on the verifiable and unchangeable blockchain technology is one of their benefits. By doing this, fraud, misinformation, and problems with duplicate spending are eliminated. You are free to add your Tron and Tron-based tokens to the platform in order to trade between other assets without any restrictions. Nobody can close your account or refuse to provide you with services, and you can still benefit from a lot of things, one of which is making your money work for you by either lending, farming, or providing liquidity.

The financial structure of the future is DeFi. putting the entire power of digital currency in the hands of essentially anyone with a smartphone or computer connected to the internet. It is the most open and limitless financial system that is currently in existence. Although centralized systems will always exist, I can't wait until the day when DeFi will completely take the over the whole finance system and everyone will be given full and complete access to finance and investment without any hindrance or limit.

https://twitter.com/Matthew08450011/status/1551609434358571008?s=20&t=v67_dGMCs-9KpDhHD4jzSg