Understand the basic idea of Commodity Channel Index (CCI) indicator practically

.png)

Background Image Source- Canva.com/Location

Assalam-o-Alaikum Steemians !

I'm @moneyster, a professional level Cryptocurrency investor and an analyser. As usual, today I thought to share another Crypto-related experience with you. I hope this article will be considerably beneficial for all the Steemians in this community

|

|---|

Commodity Channel Index (CCI) is a very helpful indicator that we can use for identifying suitable Overbought and OverSold regions in a market with some additional details. Here we can see some measurements in the indicator dashboard panel. But these measurements are not equal to our traditional measurements which we use in the RSI or RSI based indicators

Basically, this indicator shows some extreme opportunities for entering the market or leaving the market. At the same time, we can identify exact trend pressure in the relevant market with the help of this Commodity Channel Index (CCI) indicator.

In the Traditional RSI indicators, we consider it as an Overbought zone when the indicators show above 70 levels. At the same time, we consider it as an Oversold zone when the indicators show below 30 levels. But here we consider it as an Overbought zone when the indicators show above +100 levels. Same as that we consider it as an Oversold zone when the indicators show below -100 levels.

However, we will not FOMO to buy or sell from those zones as it is only an indication of the relevant price force in the Market. It means when the indicators show above +100 levels, we consider this as a good buying pressure in the market. So, the price can still go high in such situations.

As an example, if the indicators show above +200 to +400 levels, that is the best indication of a considerable trend reversal. In such situations, we can get some confirmation to sell our accumulated assets at the right time. At the same time, if the indicators show below -200 to -400 levels, that is also the best indication of a considerable trend reversal for accumulating more assets.

With the help of this Commodity Channel Index (CCI) indicator, we can easily identify the exact trend of the relevant market in the present condition. Here we have the ability to get the basic idea of the relevant Market condition by a comparison of historical prices as an average. In addition to detecting overbought and oversold regions, here we can identify the current Market Pressure whether it is bullish or bearish. Then, we can take suitable entries when the indicator shows more than 200 as the measurements. Finally, we have a higher possibility to find proper Trend reversal points in the Market with the help of this Commodity Channel Index (CCI) indicator.

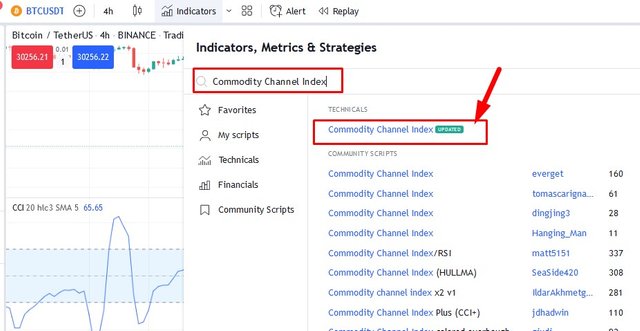

First of all, I will add this Commodity Channel Index (CCI) indicator to my Crypto Chart using the TradingView platform. Then we can go to "Indicators" thought to tool panels and search "Commodity Channel Index" in the giver search bar. Below I have included a screenshot to demonstrate adding the VuManChu Cipher B + Divergences indicator to our chart.

|

|---|

Below I have demonstrated some good zones with the help of this Commodity Channel Index (CCI) indicator. Here we can see good zones to sell our assets or take a sell entry through the Extreme Overbought Levels.

|

|---|

Below I have demonstrated again some good zones with the help of this Commodity Channel Index (CCI) indicator. Here we can see good zones to buy new assets or take a buy entry through the Extreme Oversold Levels.

|

|---|

In this way, we can easily confirm the present Market condition and take suitable entries with the help of this amazing Commodity Channel Index (CCI) indicator. The most interesting thing about this indicator is that it prepares us for the next entry.

I have studied the below-sourced articles to further study these topics and I have explained all the above facts in my own words and experience.

10% benificiary set for @tron-fan-club

.gif)

Twitter Shared

https://twitter.com/moneyster12/status/1525893000257318912?s=20&t=j-exGXGAXFiQwH6Alu5uFw

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Thank you @kouba01 for your support.