DAY TRADING v SWING TRADING? LEARN WHICH TRADING STYLE IS BEST FOR YOU!

Hello Traders,

The largest financial market in the world, foreign exchange, attracts traders of all kinds. With more and more people having access to the Internet, online trading grew exponentially. As such, different trading styles grew in popularity, like swing trading, for instance.

Based on a trader’s capital, trading strategy, and personality traits, we can define different trading styles. Swing trading, as mentioned above, is just one of them.

Day trading, investing, scalping, are other examples. While a swing trader uses intermediate timeframes to analyze and trade the currency market, a scalper and an intraday trader use lower timeframes.

In this article, we want to make a clear distinction between day trading and swing trading. More importantly, we bring a comparison between the two, so that every trader knows what trading style fits his/her strategy.

Furthermore, we present some of the most relevant Forex swing trading strategies used today as well as day trading strategies too.

.png)

Day trading, as well as swing trading, has pros and cons. Depending on the time horizon for a trade, the adjacent trading costs vary wildly.

Thus, the trading style affects the bottom line. Or, the net profit at the end of a trading day or period.

Defining the Intraday Trader and Day Trading’s Characteristics

The basic definition of the intraday trader is that all positions are closed before the end of the trading day. Also called day trading, this trading style has multiple advantages over swing trading.

For instance, it avoids the weekend’s uncertainty. Because the currency market closes over the weekend, many times, it opens with a gap on Monday.

Events over the weekend affect the opening prices. Elections, referendums, natural phenomena, Chinese economic data (released on Sundays), etc., influence the currency market. However, the intraday trader has no concern regarding the opening levels on Monday because there’s no open position. Everything gets closed by the end of the previous Friday (the last trading day).

As such, the weekend’s uncertainty doesn’t exist in this case. Moreover, the intraday trader doesn’t pay negative swaps.

Before going into more details, we must define the concept. A swap is the interest rate differential between the two currencies that form a currency pair.

It reflects the differences between the two monetary policy, and the broker charges it at the end of the trading day. In other words, it adds or deducts an amount corresponding to the open position and its volume.

Positive or negative, the swap affects the bottom line too. It represents an income or a cost.

Because negative interest rates exist in many jurisdictions and low-interest rate levels across the world, many currency pairs have a negative swap for positions held overnight. The intraday trader, thus, avoids the possible negative swaps related to swing trading.

Perhaps the most significant advantage of day trading vs. swing trading is that it avoids consolidations. Despite the general belief, the currency market spends a lot of time consolidating.

The intraday trader, as such, has quick entries based on lower timeframes, like the five-minute chart.

Day Trading Strategies – News Trading vs. Technical Trading

News trading is one of the most famous day trading for beginners’ strategies. Why for beginners? Well, news trading is the retail traders’ favourite way of how to start day trading.

Well, retail traders watch the economic calendar and buy and sell a currency pair after the economic release. Few know that the intraday trader that uses such day trading strategies has little chances to survive in the long run.

The problem is that competition is fierce and made by robots.

Trading algorithms buy and sell in a blink of an eye when the news comes out. Hence, robots will always outpace the intraday trader at news trading. Speed is its advantage.

Because the intraday trader is a scalper (uses quick entries for fast profits), technical trading works best. As such, most intraday traders use a strategy based on technical analysis.

They use trend indicators or oscillators, as well as other various trend-riding strategies. But again, all these strategies apply on lower timeframes.

After all, riding a trend one the five-minutes chart is similar to doing the same on the daily chart. Only the time horizon differs.

The intraday trader uses algorithmic trading too. Expert advisors are a popular way of taking advantage of small market moves.

Thus, the role of the intraday trader switches from time to time to supervising the expert advisors and adjusting the trading strategy, rather than actual trading.

Swing Trading’s Generalities

As a swing trader, you bypass all the advantages of an intraday trader mentioned earlier. However, swing trading has some other benefits.

To start with, the possible positive swaps. A swing trader keeps positions open from a few hours to a few weeks and even a couple of months.

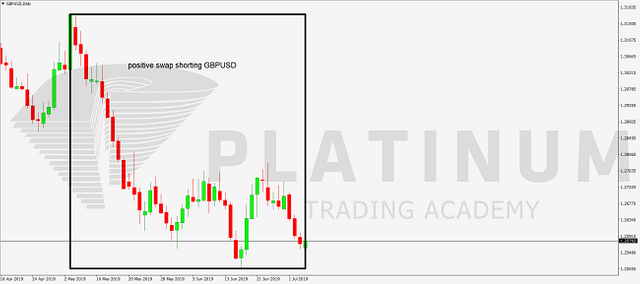

A trade that takes a long time and pays a positive swap (e.g., shorting GBPUSD for the months of May and June 2019) ads to the bottom line. The profit represents the difference between the entry and exit prices.

In the case of shorting the GBPUSD, the exit price is smaller than the entry one. That’s the profit marked by the distance the price travelled.

However, staying short GBPUSD for the two months paid a positive swap. Because the interest rate in the United States exceeds the level in the United Kingdom, being long the dollar benefited the swing trader.

In fact, accounting for positive swaps is one of the most popular Forex swing trading strategies. Many swing traders simply ignore or refuse to enter positions that have no time limit and pay a negative swap.

Thus, the swap may act like a pro for both the intraday trader (avoiding the negative swap) and the swing trader (taking advantage of the positive one). However, we can say that the intraday trader has an opportunity cost given by the potential positive swap missed.

Swing trading has a different perspective than day trading. Traders use bigger timeframes (hourly, four-hours, daily) and have a more complete market image.

The savvy swing trader uses a top/down analysis to arrive at the perfect swing trade. He/she uses the yearly, monthly, and weekly charts to come down to a timeframe like the daily where a trade makes sense.

Interpreting Economic News as a Swing Trading Strategy

The name of this paragraph is relevant enough. Swing traders interpret economic news, not just trade them.

For the intraday trader that scalps on the market’s reaction to the news, the direction doesn’t matter. The trader just goes with the flow.

But the swing trader always looks at the bigger picture. Not only that considers the economic release but also prepares for upcoming events.

Take the NFP (Non-Farm Payrolls) as an example. NFP is a volatile economic release when trading financial markets.

Both the intraday trader and the swing trader pay attention to it. The intraday trader profits from the ranging conditions present during the NFP week.

On the other hand, the swing trader waits for the NFP to pass. If the swing trader opens a position ahead of the NFP release, he/she always considers the economic events coming next week.

For instance, it could be that the week following the NFP release, the Fed publishes the monetary policy statement. Thus, the swing trader having a longer time horizon for the trades may position for the Fed’s release rather than the NFP.

It is clear by now the difference between trading the news and interpreting the news. It offers a simple way of comparing the day trading and swing trading styles.

Major Swing Trading Strategies Used by Forex Traders

Technical swing trading strategies exist too. As mentioned earlier, day trading strategies mostly use technical indicators.

Such strategies work on the long term too, providing traders to use bigger timeframes. But besides technical indicators, other strategies exist that work exclusively on swing trading.

Elliott Waves

The Elliott Waves Theory is the first step to learn swing trading. A trading theory extremely popular among retail traders, it bases its principles on market psychology.

Ralph Elliott noticed that the stock market during the 1930s moves in cycles. Each cycle made specific waves that correspond to crowds’ behaviour.

He documented the patterns and put everything together in what became the most famous swing trading strategies of all time. The Elliott Waves Theory counts impulsive and corrective waves to forecast future prices.

According to Elliott, an impulsive wave has five segments. Labelled with numbers (1-2-3-4-5), they show a major market decline or advance.

A corrective wave, on the other hand, is a three-wave structure. Labelled with letters (a-b-c), it corrects a previous wave.

Together, impulsive and corrective waves form cycles of various degrees. For the swing trader, the key to interpreting the market is to combine cycles of various degrees.

Known as a top/down analysis, such market interpretation is the bread and butter for the swing trader.

Point and Figure

Point and figure charting as a swing trading strategy perfectly illustrate the longer time commitment of swing traders. Simply put, it accounts only for relevant market moves.

The theory uses a series of Xs and Os to mark rising and falling prices. For one X or O to appear on a chart, the price must travel more than a certain distance.

Typically, the distance is calculated using the ATR (Average True Range) for the past fourteen days. If the market closes beyond the ATR(14), an X is added to a chart or an O, depending on if the move was bullish or bearish. If the market travels a smaller distance, the chart remains unchanged.

A simple approach, like the point and figure theory account only for the market move that matters. It eliminates consolidation times, precisely what a swing trader wants.

Pitchfork

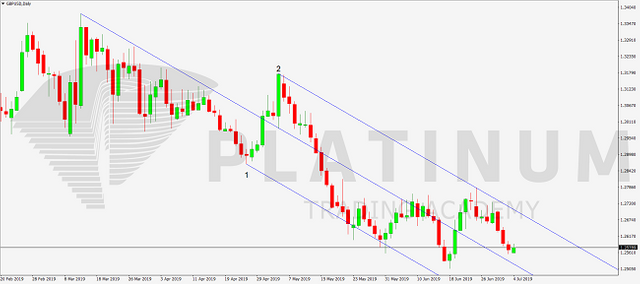

Also known as Andrews’ Pitchfork and presented as a trading tool on all trading platforms, a Pitchfork has three pivot points.

The three points represent the start of three parallel lines. The two channels that result guide the swing trader in rising and falling markets.

Some swing trading strategies combine the Pitchfork with the Elliott Waves Theory. They project the extended wave in an impulsive move using the end of wave 1 and 2 as pivot points.

The major advantage is that the trend becomes evident as the swing trader combines the two theories.

Conclusion

Day trading and swing trading have advantages and disadvantages. In the end, it is up to the trader’s choice to become an intraday trader or a swing trader.

One aspect we didn’t mention so far in this article is the time dedicated to trading. The intraday trader spends a lot of time in front of the screens.

However, the swing trader does the analysis first. This task can be accomplished over the weekend too, for instance, when the markets are closed.

Next, he places the trade, either using pending orders or entering a market when they are open. Finally, sets the stop-loss and take-profit orders, and that’s it, let the market do its job.

From this point of view, swing trading leaves room for other things in life. A day job, for instance. Working out, reading a book, or whatever the swing trader likes to do.

The intraday trader doesn’t have this luxury. During the trading hours, only after banking the pips free time awaits. If not, work continues. However, the intraday trader enjoys a risk-free weekend, as there are no open positions.

To sum up, the two trading styles presented here appeal to traders based on their availability to trade. One may wish to be an intraday trader, but that’s impossible having a day job, for instance.

As time plays a vital role in trading, we can see its influence here too. The intraday trader uses short-term targets and trades larger volumes. However, the swing trader uses longer-term targets with smaller volumes.

In the end, what matters is for the trading account to grow, and not the trading style used. What type of trader are you: intraday or swing trader?

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.