TRAKINVEST Fully Decentralized Ecosystem For Equity Trading

Every day there are more projects. And each with a unique offer. The financial services industry suffered heavy losses due to lack of customer trust and reduced retail participation. In today’s world, everything is virtual, which also includes a trading platform that tries to implement changes in traditional investment management models and retail brokers. One of the online platforms is TrakInvest, which for the past three years has tried to change the financial services landscape throughout Asia. Its headquarters is in Singapore. TrakInvest mainly focuses on crowdsourcing financial policy. Trakinvest is a platform for trading at the community level. At present, it offers the opportunity to share investment knowledge with its users, as well as with other network members. In addition, he provides tools to predict using intellectual contracts. It also offers digital certification programs in virtual trading. Trakinvest hopes to launch its token for tracks in the first quarter of 2018 to current users. This will allow them to receive commissions in exchange for their trade data services through their cellphones as well as the web platform. Currently, The Trakinvest company provides irreplaceable ideas, moods and trade data, creating an online trading platform. Funds that will be provided include certification and reputation systems that will be labeled. TrakInvest moves from a centralized, technically developed environment to a platform based on decentralized ecosystems. This platform uses Blockchain technology to develop a decentralized p2p ecosystem that allows community members to perform useful services. Tools, incentives and rewards for understanding assistance in continuity and full creation of a decentralized social trading platform. Thanks to the use of effective Blockchain technology, Trakinvest aims to improve the existing platform scalability by strengthening its transparency and security. This platform environment has a very strong technical base due to Ethereum’s open utility network and solid technology support. Trakinvest offers a solution that has a white mark to provide access to their basic property to get more customers, as well as for corporate marketing in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. or attract current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. or attract current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. where there are more than 18,000 shares, and clients participate in share investment practices without losing money. who have a white label to provide access to their basic property for the acquisition of more customers, as well as for marketing companies in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. as well as for corporate marketing in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money. as well as for corporate marketing in financial services. The company provides training for new users, or attracts current users to invest in securities markets. It has a strong network on 10 global exchange platforms, where there are more than 18,000 shares, and clients participate in share investment practices without losing money.

Work principle:

TrackInvest technology combines technology networks, such as artificial intelligence, digital devices, Algo trading and smart contracts. The Trade Social Tool allows individual customers to share investment advice and to receive information from the crowds in the market, technology in the field of high intelligence and data infrastructure will contribute to smarter and faster cars that are able to process large amounts of unstructured data, including developments real-time market and news on social networks. At the same time, you get a deeper understanding of specific stocks for the correlation of market movements, and not just the study of price movements of one stock.

TrakInvest Knowledge Chart (TKG) . Knowledge Graph (KG) is a multi-relational graph consisting of relationships between entities. This is because a very effective way to extract and manage knowledge from large unstructured data sets. Some of the leading search engines, such as Google, Wikipedia, and Bing, use these KGs to improve their search on the Internet. The TKG construction machine constantly scans many new sites, social networks, online discussion forums, etc. To make TKG. TKG, apparently, consists of characters such as investors, analysts, securities, institutions and crypto-conversions. The following problems are listed below: AI machines from TrakInvest decided to build TKG:

Schema induction predicate.

– Specimen population.

– Overcoming deficits with in-depth training assistance.

– Estimation of source reliability.

– natural language.

Mood machine . The feeling was read by TrakInvests mood engine from some unstructured text data, and such entities and relationships were collected at TKG. For example, when analytical recommendations for certain security that have developed over time are extracted and managed by mood engines. In the same way, an assessment of how the crowd atmosphere for certain crypto currencies has changed over time, done by the machine. Therefore, TrakInvest Knowledge Graph, combined with the atmosphere of its various components, helps in providing a holistic view of market conditions that includes the various actors and stakeholders mentioned above. Most importantly, it is very important to continue to update and expand this schedule to change the world situation.

Continuous learning. TI-STOCK qualifications, TI-ANALYST and TI-TRADER evaluations, are known for the analysis of the TKG mechanism and feeling analysis, each of which provides time-sensitive quantitative metrics, which can be estimated by stock analysts and traders to assess this continuous training performance using analysis advanced networks, in-depth training in columns and graph embedding methods. The calculation and updating of this assessment can be done using the mechanism of continuous learning. The first step is the exact definition of the indicator, the updated parameters correlate with the projected capacity of the relevant variables in relation to real market signals. Thus, because this training mechanism is possible not only to assess the overall competency of the analyst,

Project features:

– Real exchange rate quotes from 10 global exchanges in 8 different countries, including the United States, Britain, China, India, Thailand, Singapore, Australia and Hong Kong.

– 22 hours of shopping center along with a monitored portfolio. • Real-time news channels.

– peer-to-peer training.

– User vulnerability.

– Main financial ratios, stock search functions and price schedules.

– Sentiment shares for more than 18,000 global stocks.

– Interaction and interactive user interface.

– At any time, trade via TrakInvest and Facebook Messenger ChatBot mobile applications.

– Detailed personal trade reports.

– Support services.

Why blockade:

The transition from centralized technical infrastructure to distributed and ecosystem platforms lays the foundation for new business models in the area of investment analysis and technology to conduct financial transactions. Identifying these changes in the industry, the TrakInvest platform uses blocking technology to create a decentralized peer-to-peer ecosystem that is in demand by community members in providing additional services. Tools for remuneration, incentives, as well as analytical tools to help resolve the establishment and integrity of a fully secure virtual social and commercial environment that encourages the effectiveness of the results of exchanging analytical data in the investment field, as well as data on trade in real time. Effectively using blocking technology, TrakInvest aims to increase the expansion of existing platforms while simultaneously increasing the level of transparency and security. Equipped with full-featured stacking memory technology and the capacity of Ethereum’s open community network, the ecosystem has reliable technical support.

Token:

During the storage period, Trackinvest (TRACK) tokens will be issued. Trackinvest will sell compatible ERC-20 line markers based on Ethereum. The purpose of selling markers is to provide discount participation for early users of a decentralized platform. To provide markets for functional loans in such a way, early adopters are needed. Getting Tracks, early adopters get discounts on the use of decentralized credit platforms. The ICO is structured to provide the best opportunities for anyone who wants to participate from the beginning, providing maximum flexibility and control for the participants. The Trackinvest Marker (TRACK) will be used to buy products and services in the Trackinvest network. This will also be used to provide incentives for early followers.

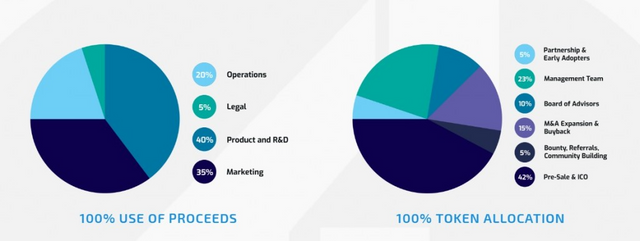

Token Distribution:

Selling tokens:

Start: 8 hours on 8 February 2018 (SST)

End: 8 nights on March 7, 2018 (SST)

Minimum Investment: 0.1 ETH

Amount collected in advance sales: US Dollar 13,928,416

Distributed and committed tokens: 32,999,597

Total TRAK tokens: 155,294,118

Tokens available for Karundfiding: 66,000,000

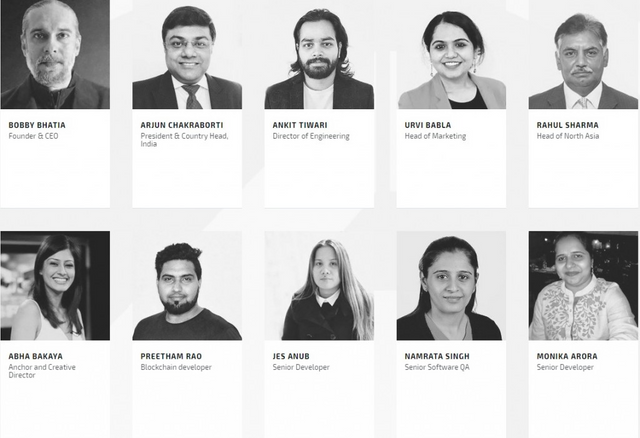

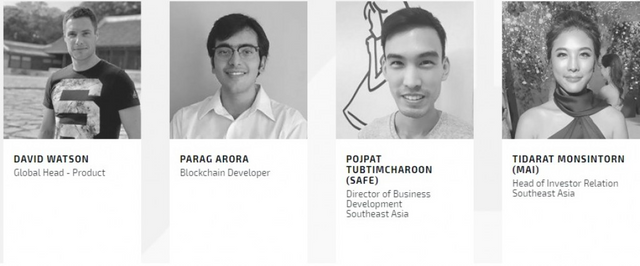

Team:

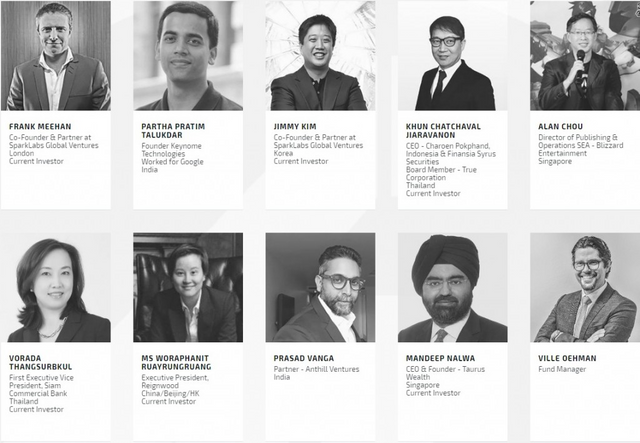

Advisor:

Roadmap:

More information here:

WEB SITE: https://trakinvest.ai/

ANN THREAD: https://bitcointalk.org/index.php?topic=2577674

WHITEPAPER: https://trakinvest.ai/files/ti-whitepaper.pdf

FACEBOOK: https://www.facebook.com/Trakinvest/

TWITTER: https://twitter.com/TrakInvest

TELEGRAM: https://t.me/joinchat/HDcljkqtXoQZOUedkKGpuw

btc name Sriningsih22

btc profil link https://bitcointalk.org/index.php?action=profile;u=2303929