BQT - Introducing Revolutionary Hedge Trades System

Hello everyone,

We Believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto Asset Holdings and negotiated directly by Trader Peers.

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency. The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees. 2017 Global Crypto Currency Benchmarking Study, Cambridge Center of Alternative Finance

While many Blockchain experts are trying to find more ways to marry CRYPTO with FIAT, BQT Team believes in reducing dependency on FIAT altogether. Every Crypto Asset has its value and can be used as negotiating tool to acquire another Crypto Asset. We believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto asset holdings and negotiated directly by trader peers.

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

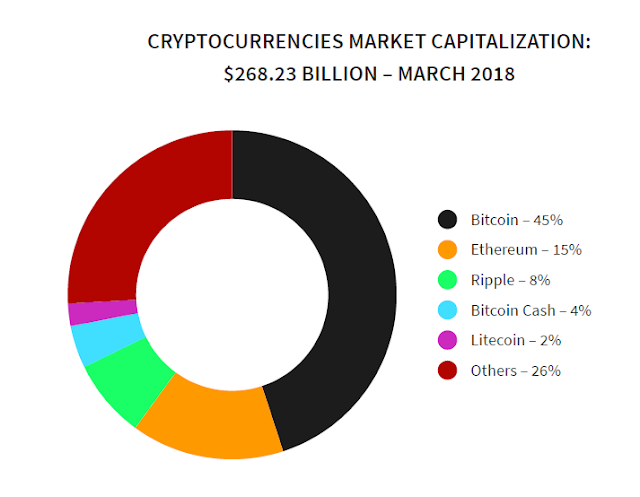

CRYPTOCURRENCY MARKET

The cryptocurrency market is evolving, and its market capitalization was estimated to US$268.23 billion on March 31st, 2018.

Since the introduction of Bitcoin in January 2009, thousands of cryptocurrencies have existed at some point and today, there are hundreds of cryptocurrencies with a market value that are being traded. Still, Bitcoin is the undoubtful leader representing approx. 45% of the total market capitalization.

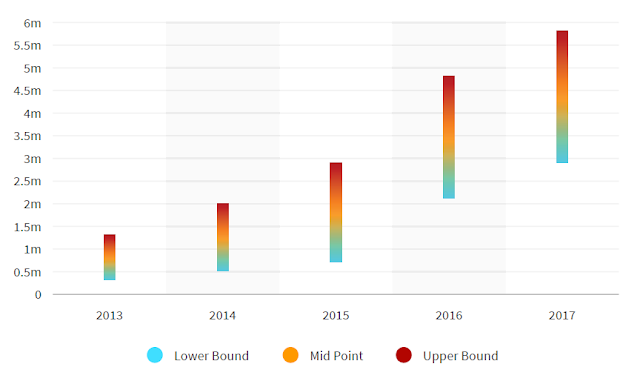

The current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million, according to the latest report by Cambridge Centre for Alternative Finance.

Although it is almost impossible to know precisely how many people use cryptocurrency, using data obtained from study participants and assuming that an individual holds on average two wallets, Cambridge Centre for Alternative Finance estimated that there were between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet in 2017.

A multitude of projects and companies have emerged to provide products and services that facilitate the use of cryptocurrency for mainstream users and build the infrastructure for applications running on top of public blockchains.

While the cryptocurrency industry is composed of many important actors and groups, there are four key cryptocurrency industry sectors today:

- Exchanges

- Wallets

- Payments Companies

- Mining

BLOCKCHAIN TECHNOLOGY: STABLE AND EXPANDING

The blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without the need of a central certifying authority. Potential applications include fund transfers, selling trades, voting, and many other uses. Alan Morrison and Subhankar Sinha, PWC, "A primer on blockchain

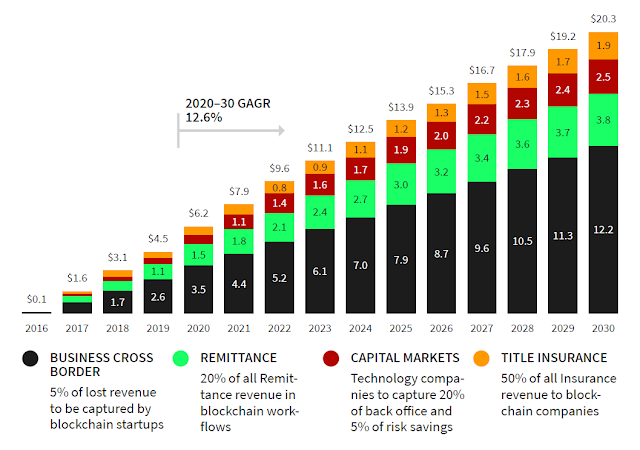

Blockchain technology is conquering the world and it completely transforms the way many markets operate. It is estimated that blockchain companies could experience a revenue pool of $6 billion by 2020 and $20 billion by 2030.

These figures are based on the impact of digital ledger technology on payments:

(1) Business Cross Border,

(2) Remittance, as well as the impact on

(3) Capital Markets and

(4) Title Insurance.

BLOCKCHAIN TECHNOLOGY REVENUE POOL ($ BILLIONS)

The increasing adoption of digital currency will put downward pressure on remittance payments shifting 20% of revenue to Blockchain companies. This is projected to account for $1.5 billion (24%) of Blockchain revenue in 2020 and $3.8 billion (19%) in 2030.

Remaining revenue is captured by the reduction of infrastructure and counterparty risk for capital markets, as well as savings in Title Insurance commissions and maintenance cost. In the period 2020-2030, a Compound Annual Growth Rate (CAGR) of 12.6% is estimated for the Blockchain technology market.

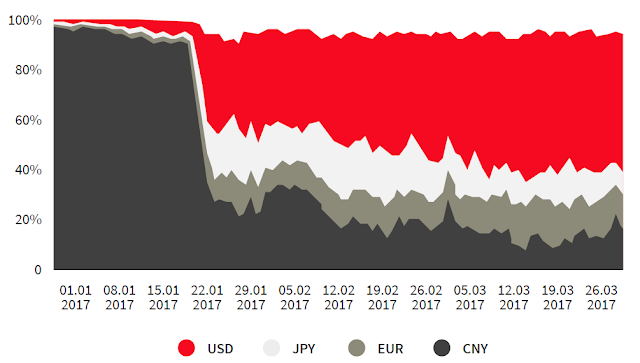

BTC EXCHANGE TRADING VOLUME SHARE BY NATIONAL CURRENCY

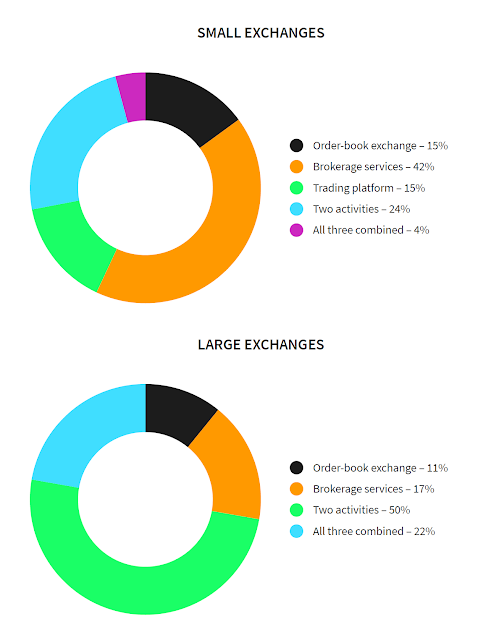

Small Exchanges are specializing mostly in one trading activity while most Large Exchanges active with multiple exchange features.

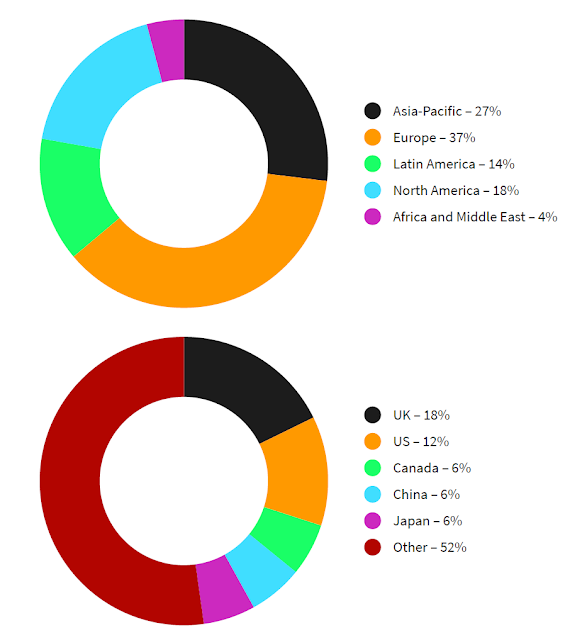

Europe is dominating the market and with China restrictions many exchanges, including a leading Asia exchange – Binance – is planning to relocate to Europe.

BQT INITIAL COIN OFFERING (ICO)

BQT is launching its Initial Coin Offering (ICO) campaign in July, 2018 issuing 200,000,000 ERC20 tokens (BQTX), minted at the end of an ICO.

BQT would charge 1% transaction fee for the instant trades and 3% escrow fee for Hedge Trades. All fees are payable ONLY with BQTX tokens to ensure the liquidity and utilization for the tokens. In addition, the BQTX tokens can be used as escrow collateral for some trades or added as additional collateral.

50% of the Fees would be shared quarterly during the first 3 years of Exchange operations as follows:

- 20% to ICO Initial Token Holders

- 15% to Top Traders

- 15% to Referral Affiliate Partners

BQTX-TOKEN STRUCTURE

200,000,000 BQTX TOKENS WILL BE ISSUED DURING ICO *

800 BQTX TOKENS = 1 ETH

- Total 800,000,000 Tokens Authorized, 200,000,000 Tokens Issued during ICO, 600,000,000 tokens will be frozen and would only be released as needed for company expansion, marketing and loyalty programs to maintain token liquidity (up to 10% per year).

FOR MEMBERS

Using the potential of the BQT community, its users will get quick access to tools and cryptocurrency to assist with their daily needs. They will have the ability to borrow, lend, save and pay for goods and services protected by Blockchain security.

In addition, access to the marketplace will let its members purchase products and services posted by its affiliates and other members.

During the pre-boarding/pre-ICO period, every crowd investor will be granted BQTX tokens for sharing this opportunity with their friends on social media.

FOR PARTNERS/BQTX-COIN HOLDERS

BQT ICO will be traded on the Ethereum Blockchain Platform and will bring dedicated partners sharing distributed digital assets via its cryptocurrency instead of the burden of an expensive traditional IPO. BQT APIs will be available for its community of entrepreneurs, startups and other businesses to sell their products and services using its technology to stimulate the growing crypto-economy even further.

The Ethereum Blockchain API makes it effortless for anyone to quickly adapt their services and to reach a tremendous untapped audience of the BQT community and beyond.

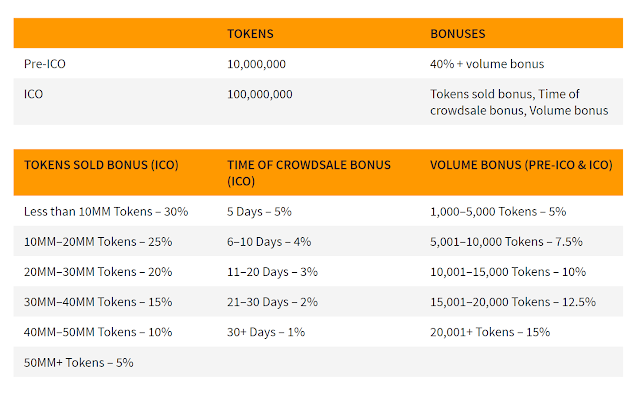

BONUSES

BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will start after the private institutional sale.

PRE-ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The pre-ICO whitelisting process will take 2 weeks after which Tokens will be offered for sale during 1 Day of Pre-ICO sale to registered individuals/entities which were approved during the whitelisting process.

ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will take 6-8 weeks after which Tokens will be offered for sale during 1-3 Days of ICO sale to registered individuals/entities which were approved during the whitelisting process.

Bonuses will be awarded based on the day of the whitelisting registration, total tokens sold and amount of investment. Here are the terms of the ICO bonus structure:

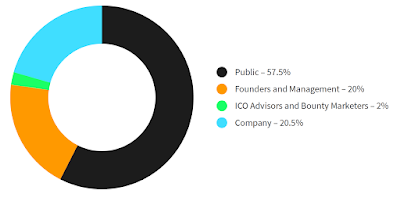

TOKEN DISTRIBUTION

Due to the high utilization expectations and the need for expansion capital, the Company will freeze the majority of the tokens (600,000,000) and only release up to 10% per year if necessary for company expansion, Marketing and Loyalty Programs to maintain token liquidity.

BQTX TOKEN DISTRIBUTION POST-ICO (EXCLUDING FROZEN TOKENS)

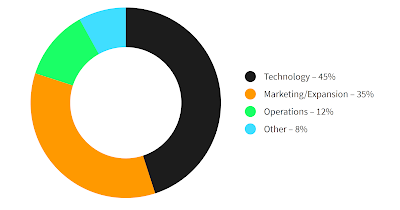

FUNDS ALLOCATION

Most proceeds from the sale will be allocated for Marketing and Expansion purposes and 20% of proceeds will be allocated to complete the testing and release of Beta and future versions of BQT technology. All ICO Crowdsale investors will receive first invitations to the Closed Beta release prior to the Beta market release.

Roadmap

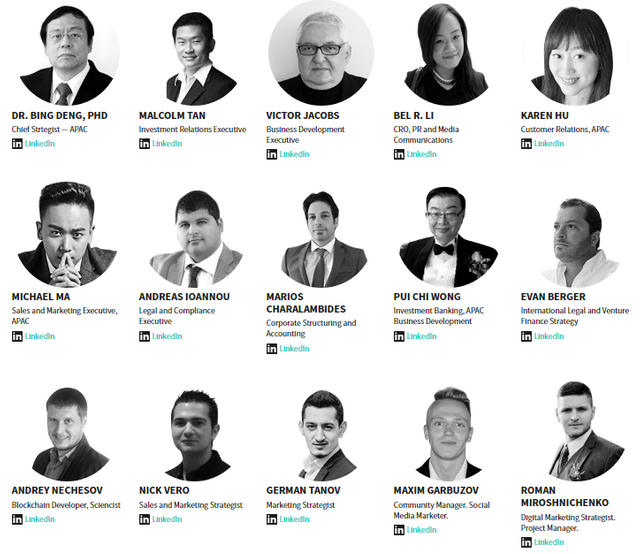

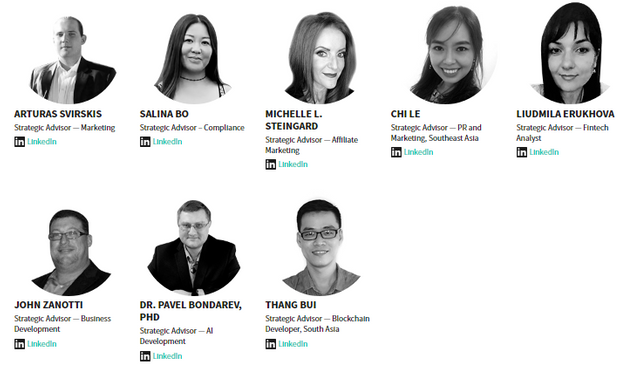

TEAM AND STRATEGIC ADVISORS

To find more relevant details from the BQT project, please follow a number of sources for the following references:

- Website : https://bqt.io/

- Whitepaper : https://bqt.io/assets/pdf/whitepaper.pdf

- Facebook : https://www.facebook.com/BQTPROJECT/

- Twitter : https://twitter.com/bqt_ico

- Telegram : https://t.me/BQTCommunity

- ANN Thread : https://bitcointalk.org/index.php?topic=4855053.msg44205944#msg44205944

bitcointalk : samuraijin

ETH Address : 0x3f9bb3679f1B71F22d823992078244C87EF4D455

I upvoted your post.

Thank you.

@Yehey

Posted using https://Steeming.com condenser site.