Ethlend - Financial Services For Smart Societies

Financial services have always been a driving force of development in advanced societies. Many people have ideas. However, most ideas require capital to bring to fruition. This is where financial services come to play. Financial services range from accounting to credit-card services to loans to insurance and stock brokerage. All these financial instruments allows individuals, communities or corporate bodies to expand their portfolios as well as grow their businesses.

The blockchain is basically a transparent immutable ledger which stores records of transactions that can always be referred to at any time. This is a powerful tool that is set to disrupt the finance industry. Cryptocurrency allows a lot of flexibility and improves upon the security and transparency of everyday transactions.

Cryptocurrencies such as Ethereum allow owners to offer and receive peer-to-peer financial services enforced by Smart Contracts.

This brings us to Ethlend.

ETHLend is the first Ethereum-based application that Integrates Blockchain Interoperability with Bitcoin source

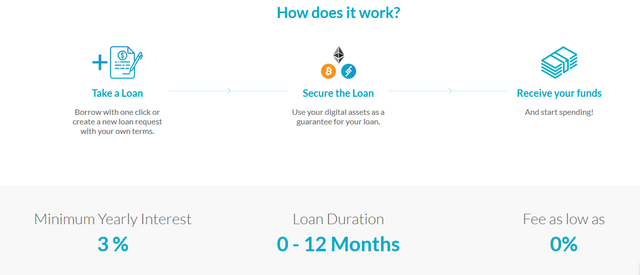

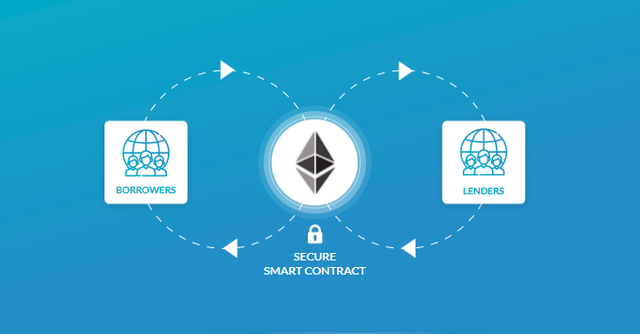

Ethlend is a crypto-lending marketplace that allows users to interact and offer/give loans to each other (peer-to-peer) within the secure confines of the blockchain. This type of environment (the blockchain) removes a Central Authority as well as physical limitations (eg borders).

As mentioned earlier, digital assets are securely held in an Ethereum smart contract. The Smart Contract makes sure that certain conditions are met, before transferring cryptocurrency from one wallet to another.

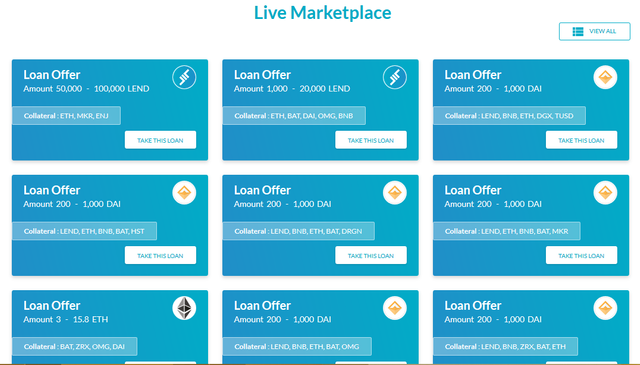

Users can also check their holdings and eligibility for loans. Ethlend offers an open live marketplace where users can indicate the loans they wish to give and other users can freely choose who to loan from.

The best part of Ethlend is that it offers Crosschain interoperability with Bitcoin. AAVE, a UK-based FinTech company, has announced that users can now leverage their bitcoin holdings as collateral for Ethlend loans. This broadens the customer base and allows more flexibility in loans as Bitcoin users don't have their leisure of Smart Contract functionality.

Ethlend is for seasoned crypto users and newcomers alike. Ethlend even provides a Learning Center where users can properly learn and be informed of how crypto works as well as the dynamic procedures of Smart Contracts.

All in all this project promises to be a new bridge between businesses and individuals around the world and will enable crypto enthusiasts' to pursue their dreams without financial restrictions.

Ethlend has launched their mainnet and users can now trade Ethereum or Bitcoin against Stablecoins voted on by the community.

In the following articles, I will discuss the different sections of Ethlend as well as their services and how to use them. You can also check out the Ethlend website yourself or read about them in the Ethlend State of The Dapps page.

DISCLAIMER

The information contained within this post is not to be taken as financial advice. I am not a financial advisor and none of your investment decisions should be carried out based on any information presented here. Please do you own research before investing in cryptocurrencies or any digital asset. You can lose all of your money by investing wrongly. The information presented in this article is for educational and entertainment purposes only.