African infrastructure development: Where does the money tree that pays for African infrastructure grow? Part 6 in a series

By the end of last week's series of five posts on African infrastructure development (you can find a list of the full series at the end of this post), a number of you had started to ask more pointed questions about how African infrastructure is funded and who funds it. In other words, since we know money doesn't grow on trees, where does it come from?

Today's post, delivered to you from Lusaka, Zambia, where the jacaranda trees are in full bloom, will be about who has been funding infrastructure - how is a much more complex question we might not get to in this series.

A snapshot of infrastructure funding in Africa in 2015

The graphs I'll show you today all come from the Infrastructure Consortium for Africa's 2014 and 2015 annual reports.

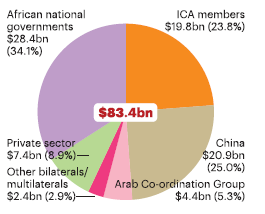

This first graph breaks down the total US$83.4bn financing in 2015 by source of finance.

What is strikingly welcome about this is that the greatest contributor to financing Africa's infrastructure in 2015 was African governments themselves. A few other notable observations: China is the next biggest financier of African infrastructure (and we see this particularly in transport and logistics linkages such as railways and ports, connecting resource-rich areas to global markets), the traditional financiers in the ICA are coming in third and there is a welcome contribution from the private sector at US$7.4bn.

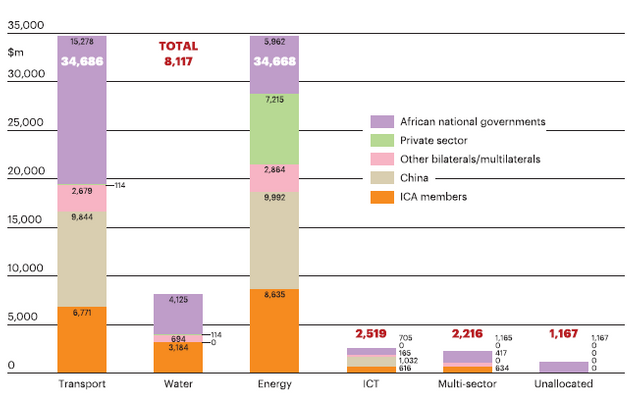

This next graph breaks down the contributions by source into sectors and source. That US$7.2bn private sector investment? It went into energy projects.

The transport and energy sectors attracted the lion's share of financing in 2015, and it is perhaps interesting to note that while transport and energy attracted similar levels of financing, African governments covered the entirety of transport finance in that year while the private sector stood in for about 55% of finance for energy sector investments.

A quick comparison with 2014

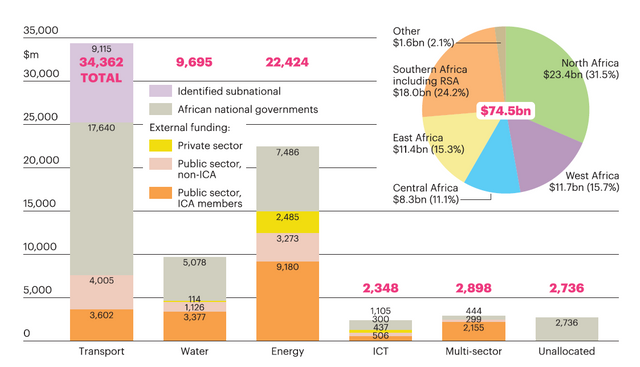

Now, compare this with 2014 finance, which totalled US$74.5bn:

It's worth noting the jump in funding for energy infrastructure in particular from 2014 to 2015, much of that increase taken up by the private sector.

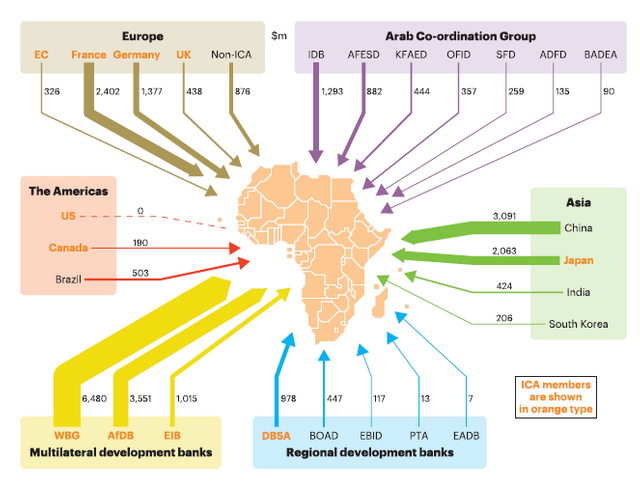

Here's a breakdown of the external (non-African, also excluding private sector) sources of funding, which by my calculator's count comes to US$28.0bn. This is characterised in the annual report as "reported and identified financing flows into Africa's infrastructure".

The multilateral development banks (the World Bank Group, African Development Bank and European Investment Bank) played then, and continue to play, a leading role in infrastructure finance.

Our basic conclusion is that more finance is flowing to African infrastructure, and we're looking forward to the 2016 ICA Annual Report to see whether the trends we've picked up are continuing or not.

Have I answered your questions about who is funding African infrastructure?

Enough graphs for today! I hope this has piqued your interest to start a deeper dive into who finances African infrastructure.

First image from Pixabay, all others from Infrastructure Consortium for Africa

Team South Africa banner designed by @bearone

Hi Kiligirl, I am wondering what is in it for China? Rights to exactly what? Call me a skeptic , but there is always an agenda. 🐓🐓

Hits the nail on the head! Zinggggg!

Excellent question, @mother2chicks. There are many speculative answers to that question, and none of them is "benign altruism - they just want to help the people of Africa". As always, a question like that is more complex than it seems because the information is presented in a simplified way. In reality, it's far more than "China" investing in African infrastructure. It's their national government, state-owned entities and private sector, such as construction companies and equipment manufacturers (I've probably missed a really obvious grouping), and each has its own interests, which include securing mineral resources for the long term at low prices and securing the infrastructure to deliver it to China so they effectively create a vertically integrated system - from mine to delivery in China. African governments often say that China is really good at government to government engagement, where Western governments and multilateral institutions tend to throw in "too many conditionalities", like health, safety and environmental safeguards. We also hear about dodgy deals where governance is questionable and kickbacks are likely, but we never see forensic audit reports, so can't say for sure. I hasten to say there are certainly Chinese companies doing business honestly and with integrity in Africa, so we shouldn't tar all with the same brush. I'm going to do a slightly deeper dive into the "who funds what" question today, and will touch some more on China which may or may not go some way to more fully answering your question.😊😊

..good post, txs ... comment, big bucks (yens) coming in from China...!!

https://steemit.com/china/@indepthstory/this-is-how-china-slowly-but-surely-is-gobbling-up-africa

@indepthstory

Indeed, @indepthstory! When we look closely at Chinese funding of projects, we see interesting patterns.

It's interesting to see how energy and transport sectors are attracting attention and getting development funds. How is the fair execution of these funds carried out?

Very good post brainy and factual @kiligirl. I'm turning into your fan after reading your posts every time. What happens when you start writing 2 posts a day?

Keep sharing, caring, informing and inspiring the world. Stay awesome.

Steem On!

Oh, @ugetfunded, you really know how to reach me. Btw, I'm not trying to be brainy, I'm trying to reach people, especially Africans, who might not know there's a deep good news story here but it takes time to get to because of all the noise of the regular players.

I'm writing from Lusaka this week so I'm thinking of sharing a few street scenes from this city I love so much. Its not a very photogenic city, but it's a survivor. What do you think?

I know how to reach the statistical @kiligirl because I myself have got some magic powers but please don't tell others about it.

Regarding doing a photo post, I don't know about this city but I'm dead sure readers will like it if you post them the way they are. Try some black & white photos and check which ones look better. Can't wait to see this next post.

Good luck!

You are so funny, @ugetfunded :-). Thanks for your advice. This non-photographer will take it seriously. I spent half my day today walking between an office park and 2 malls. A more urban experience I could not have hoped for or dreaded (go with the last one). I'm going to find some streets lined with gorgeous hardwood trees and contrast them with the proliferation of malls.

Thank you for sharing dear it is amazing and information for every one.really helpful post for us.

Amazing post dear........

keep it up.

and please friends follow me.

@mahmoodhassan

And please upvote my post i also upwote your all post friends.

very nice

my link https://steemit.com/@rkanwal

upvote and comment

keep supporting each other.

Very good

😊😊

Friends.

Sory friends. Help mehttps://steemit.com/writing/@safrijals/reading-pantun-membaca-pantun-20171010t01923448z

Congratulations @kiligirl, this post is the fifth most rewarded post (based on pending payouts) in the last 12 hours written by a Hero account holder (accounts that hold between 10 and 100 Mega Vests). The total number of posts by Hero account holders during this period was 211 and the total pending payments to posts in this category was $3240.86. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

This is very interesting, the governments that fund these infrastructure projects do you suppose it is money they lent from the IMF or Brics Bank or does their tax payers pick up the bill? Great post !

Excellent question!

Great question, @louiscpt, and thank you for the compliment.

I answer under correction, but I think there are very few African countries currently borrowing from the IMF. There are discussions this week in Washington between countries in dire financial straits and the IMF; one of the countries in serious discussions is Zambia, led by its excellent Minister of Finance, who recognises the serious implications of an IMF bailout. He and his team also recognise that a deal with the IMF has to be based on a plan that the country comes up with itself for its financial recovery, in collaboration with the IMF. As you probably know, our own country of South Africa is contemplating similar discussions, but I'm not convinced the penny has dropped with our Finance Minister that breaking Trevor Manuel's treasured covenant of NOT borrowing from the IMF will have drastic implications on all levels of our economy - and the government would have to come up with the plan on which the bailout is based. I don't know enough about the BRICS Bank's lending policies to comment, but I suppose like other development finance institutions a lot of their lending is project-based. Regardless, the taxpayers (including those who may not pay income tax, but will pay VAT and other consumption-based taxes) will pick up the bill at some stage. Grant money is scarce and a very small portion of the national fiscus. The good news, I suppose, is that development finance to lower income countries is usually "concessional" - provided on more favourable terms - than commercial funding.

Thank you for this reply , The problem I have and I might be wrong with borrowing from the IMF or for that matter a country like China nothing is for free . My first guess is that they would need some sort of security in case we cant pay , and that will be state owned assets that makes a profit like Eskom ,Telkom and SAA :) for instance . And we are talking most probably Billion's of Dollars . If they cant pay they will take those profit making companies increase the cost of services to get there money back and the government will never be able to recover and that means we will be taxed to oblivion as we are now.I am not a profit of doom but I think this money printing since the last crash in 2008 is going to come to a bad end and many people is going to be hurt in this process of experimenting the global dept can not go on like this countries are starting to fall as they cant even service the interest on that debt. Thank heavens for Crypto...

Nice post

Hello kiligirl..finally I got my answer in part 6.. series. Nice to read about the funding of intrastructure in Africa..

Resteemed..

Thank you, @momi5. I was so glad you asked that question, and I appreciate your patience! I'm going to go a little bit deeper into the "who funds what" question today. Appreciate the support as always :-)