FINAL GUIDE 2018 - ¿What are ALTCOINS? (or cryptocurrencies alternatives to Bitcoin)? - ¡DEFINITION!

Most cryptocurrency investors have followed an identical path. First they heard about Bitcoin and decided to buy their first satoshis.

Then they quickly discovered that there were hundreds of "ALTCOINS"

These altcoins are also based on the blockchain technology, but they point to other objectives and come with other features, other validation protocols ...

But, what are these altcoins really? What do these different cryptocurrencies provide for Bitcoin? How to obtain information about these and how to buy them?

What are altcoins ... and what are they for?

The term "altcoin" is the abbreviation of "alternative bitcoin". So all cryptocurrencies are affected, with the exception of Bitcoin.

These are alternatives to Bitcoin insofar as they are also digital assets, which are based on blockchain technology.

Now there are several hundred altcoins (there were 1469 in the writing of this guide).

You can imagine: most of them do not have much interest. MacronCoin, LePenCoin, FAILCoin, FraudCoin, ... Hundreds of digital currencies do not offer new features, and were designed with the aim of attracting enough investors to allow their developers to generate revenue.

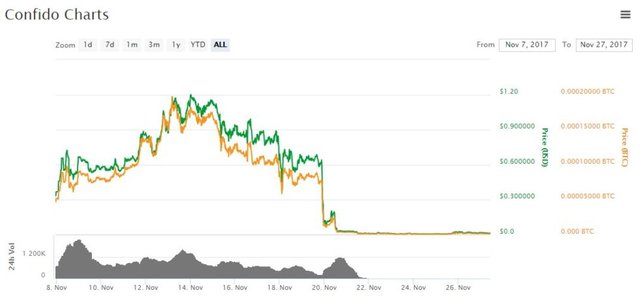

Some fall apart in another place during the night This was the case a few weeks ago, the digital asset Confido ("I trust" in Italian), whose leader flew in the nature with the sums collected during an ICO (fund raising in cryptocurrency), causing a sharp fall in the price of assets.

Since everyone can decide to start their own cryptocurrency, new assets are created every week, and most of them will end up being forgotten.

At the same time, some altcoins offer extremely interesting innovations, which allow your network to be valued in billions of dollars.

Some try to replace Bitcoin by proposing an "improved" version of the protocol that was designed in 2008. The literary Charlie Lee is probably the best example: it is a modified version of Bitcoin (with hash algorithm and a different "block time", which aims to provide reduced rates and transaction terms.

Others do not intend to limit themselves to a payment system. This is the case of networks such as Ethereum or NEO, which offer real ecosystems to raise funds, implement decentralized applications, develop smart contracts, etc.

We can also mention the anonymous cryptocurrency. Some of them, like Monero, depend on a chain of non-transparent blocks and, therefore, allow transactions to be carried out confidentially, a confidentiality that is not offered by Bitcoin, which is a pseudonymous network.

Finally, others like Nano can make payments almost instantaneously, without any transaction fees.

Altcoins vs Bitcoin: the match

For the "Bitcoin maximalists", there is only one currency worthy of interest: Bitcoin.

They consider that this is the first fully decentralized currency and indicate that it is the only one that can count on a considerable transaction volume and hashing rate. They also evoke network effects to explain why they swear by Bitcoin.

However, even if he is extremely enthusiastic about Bitcoin and believes that it should remain the most valuable asset in the ecosystem for at least several years, we can consider that altcoins also have a role to play.

Especially since Bitcoin was designed to offer a decentralized alternative to the financial system, and altcoins participates in said decentralization. In addition, if it is difficult to modify Bitcoin (as we saw during the "war of the forks"), the altcoins offer a formidable "laboratory", which allows to go far beyond what it allows to do the "testnet" (the chain of blocks). alternative) of Bitcoin.

We can also think that Bitcoin benefits from the appearance of these altcoins. It remains the reference asset used by traders to obtain these alternative digital currencies. And every time one of them is mentioned in the conventional press, the author invariably evokes Bitcoin, which is the basis of this ecosystem.

Finally, the presence of these altcoins offers options to users: Bitcoin and altcoins are not antinomian. If they feel that the BTC is not fulfilling its function, in particular due to the higher transaction rates and deadlines (problems that are being solved, in particular thanks to the "escalation" solutions known as "second layer") OR A lack of anonymity, they can perfectly decide to resort to other alternative currencies.

What was the first altcoin?

Created in April 2011, Namecoin was the first altcoin.

Although it can be used as a means of exchange, it was developed primarily to decentralize the domain name reservation process.

Although it was no longer ranked 229 when this article was written, the asset was still marketed on multiple platforms.

Moving to alternative cryptocurrencies, a good idea?

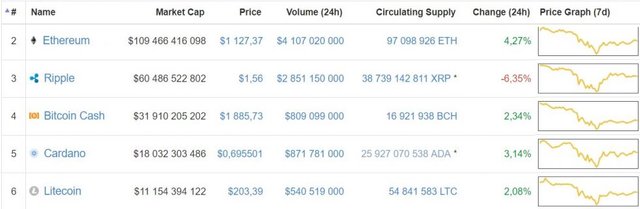

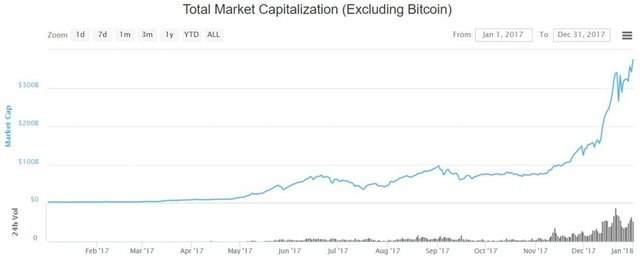

In 2017, the valuation of these altcoins increased considerably from less than $ 2.3 billion to $ 373 billion:

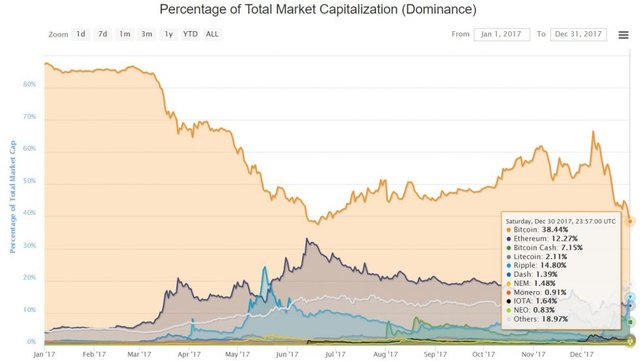

At the same time, despite the fact that the price of Bitcoin grew by 1500% during the year, its dominance in the cryptocurrency market fell drastically, from 87% to 38%:

Should we sulk Bitcoin and resort exclusively to these alternative cryptocurrencies? Probably not.

First, some alternative cryptocurrencies, which have not yet offered truly functional products, are already valued in billions of dollars. Therefore, one can wonder if their teams can justify, in the coming months, such assessments.

So, although Bitcoin is already considered volatile, many altcoins are already at a much higher level. As a result, although earnings opportunities are significant, capital losses are also significant.

It is also likely that these assets are subject to price manipulation, while their trading volumes are low and the markets in which they operate are barely regulated.

In addition, a rich merchant (nicknamed "whale") can afford a significant portion of the available corners, which will increase its price. It will attract investors, who will want to take advantage of this increase, and who expect it to continue. Once the course has grown sufficiently with your arrival, the merchant may suddenly resell all these corners and make a profit.

This is the mechanism used by bomb and dump groups to attract as many investors as possible to earn money at their expense.

Therefore, it is better to avoid rushing into assets that are shooting up, and to favor those with promising technology, which seem to be undervalued in relation to other competing networks. It is important to be aware of the "Market Cap" shown by CoinMarketCap, which allows you to get an idea of the valuation of an asset: the price of a corner, alone, that does not provide such an indication.

Among the factors that should be considered are:

- Active developers, with some < background >

- A large community of investors and "supporters" who seem to want to make a long-term commitment

- Relatively high trading volumes

- Cases of real use, which will probably attract many users in the coming months / years

You can also visit CoinGecko, which offers scores (developer, community and public interest). Even if they are calculated from an algorithm (and you should refine these results with your research), it can be a valuable tool for finding promising assets.

Our advice:

Take the time to conduct a thorough investigation before investing in an asset. And remember, just because one or two people are excited about Twitter or Reddit does not mean it's the last time they buy, it's a good buy.

You should also understand that these are extremely risky assets. Some observers believe that it would not be reasonable to invest more than 1 or 2% of their assets in these alternative digital currencies. Whatever your choice, it is better to only put the sums you can afford to lose.

Finally, even if applications such as Blockfolio can track the evolution of your cryptocurrency portfolios in real time, it may not be relevant if you aim for a long-term objective. It may be better to buy some securities and forget about them for several months, so you do not have to worry about them.

How to buy Altcoins?

Most altcoins can be obtained, for European investors, through two platforms: Binance and Bittrex.

Keep in mind that these do not allow, unlike Coinbase, directly exchange euros for digital assets. First you will have to buy Bitcoins (or Ethers) with Coinbase (or another service) and then send them to these platforms, and then you can get, in return, altcoins.

To know which markets are exchanged each of these altcoins, the procedure to follow is relatively simple.

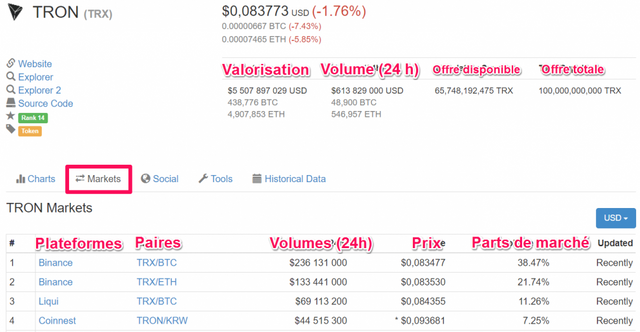

You can go to CoinMarketCap and click on the asset you want to obtain. For example, when looking at the TRON (TRX) alternative cryptocurrency, simply click on "Markets" to find out which platforms you can turn to:

As a European, the platform that will allow you to obtain the greatest amount of assets, with significant trading volumes, is Binance.

You can find most of the main altcoins listed in CoinMarketCap. Feel free to access our Binance tutorial: you will discover how to create and protect your account, but also how you can proceed with your first exchanges.

To find other assets, you can also choose other platforms such as Kucoin, Bittrex, Mercatox or Cryptopia.

Keep in mind that it is highly recommended:

To configure, as soon as it is registered, a two-factor authentication method. An attacker who manages to steal your username and password will not have the possibility to access your account and steal your cryptocurrency.

Do not use these platforms to "store" your altcoins in the long term. We invite you to use, for each digital currency, software portfolios (each altcoin is associated with a different portfolio, which must be referenced in its official website). For greater security, you can afford a Ledger Nano S, which stores many altcoins.

DO YOU HAVE DOUBTS?

If you have any comments or questions about these alternative cryptocurrencies, do not hesitate to use the comments section below.

Congratulations @all.crypto.whale! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP