ICO!! It's all the rage but what the hell is it? (ICO Analysis: Understanding ICOs intuitively)

Most of us here have heard the term "ICOs" being thrown around a lot lately and MANY of us have already participated in them and traded our cryptos for ICOs (or fiat in some cases) in hopes of high return. Most of us have read covers, stories and articles from reputed media houses like WSJ, Reuters and Bloomberg. (It is worth noting that two of these three news agencies also provide financial advice to corporate firms, Banks and Wall Street, and they all are watching this space closely)

These articles don't analyze ICOs. ICOs they're good? Are they bad? It's all the rage! BUT WHAT THE HELL IS IT?

At this point, after reading the recent media coverage about ICOs, some of us decide:

- that's it's too risky of an investment

- or they decide "I'm gonna get in this ICO thing"

And this analysis is for the people who want to get into this and get a piece of this new cake (that isn't fully baked yet?) AND people who think this is all too risky ALIKE.

So, for some revelation on ICOs what most of us naturally do is look up ICO on Wikipedia and come across this:

Now, this isn't very helpful. It's just reinforces us to what we have already decided about ICO's. People who like ICOs look at the numbers and are sold by the growth potential on their investment, and the people who see this as a risk/bet read about the regulations and bans hence reinforcing their outlook on ICOs and they steer WAAYY clear and solemnly resolve to never buy "RISKY" ICOs again.

This post is all about an intuitive analysis of ICOs, this post will tell you what ICO's are and what ICO's are NOT. What are the risks associated with ICOs in general. I will not call out ICOs to be good or bad, rather look into what they mean. This is the post I wish I found to read when I was learning about ICOs initially. The analysis that I'm going to post took a lot of time and experience to gather. This post will analyse and contain the following :

- Understanding ICOs

- Econometric background of ICOs and Market Analysis

- Risks and Rewards involved

This is NOT a technical analysis of blockchain or the underlying technology. (maybe in the future)

Before getting started, let me introduce myself briefly as I am still new to this platform. I'm a full stack developer since high school. I have a good experience with Data Analysis using Deep Learning (colloquially known as A.I.). I have been Crypto-Trading for about 2 years now and still am. I have invested some in ICOs. I have mined BTC when I was at uni, I mined using ASICs from 2013 through early 2016. And recently started GPU mining again.

Understanding ICOs

Let's start with something we are all familiar with "IPOs." Taking YouTube as an example.

Think of YouTube, we ALL have seen YouTube, used YouTube or been on YouTube for some reason at some point in time, some of us also have channels that make money!

- YouTube is a business that is centralized. For such business to come into existence. Someone codes a website (or creates a product), licenses it, then provides it as a service (or sells the product) in exchange of "value" (money or data/information)

- For YouTube to get started, they first launched a website. It became popular among users because it made their lives easy (or interesting) in some way.

- When YouTube got a large audience (or sales, in case of other businesses), they wanted to expand, get better servers and get more audience.

- To do this YouTube goes public with an IPO.

- This is called an IPO or Initial Public Offering.

This is how businesses used to be born.

Going public with an IPO is when a company offers a percentage of "stock ownership" (or shares) of their business to the public in exchange of money. This value is decided by the company itself basing it on how much they speculate their company is going to be worth these decisions (or calculations) are backed by sales, sales predictions, revenues, revenue models etc. For example, YouTube asks $1m for 10% of equity of their company, hence evaluating their business at $10m.

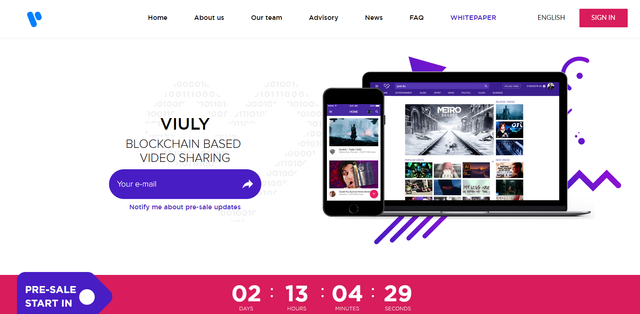

Now let's think about something unfamiliar "ICOs". Taking Viewly as an example.

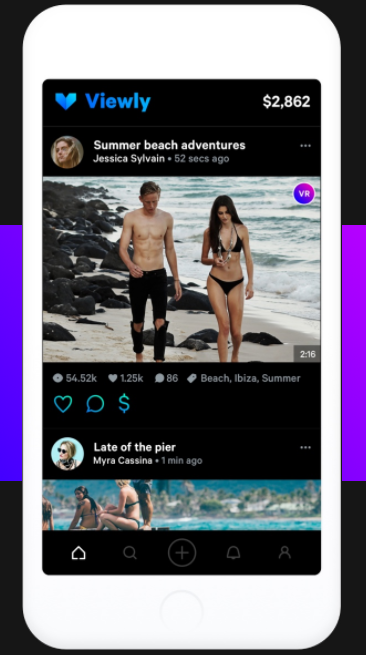

Think of Viewly, most of us know that they just launched their ICO, some of us even invested money in it.

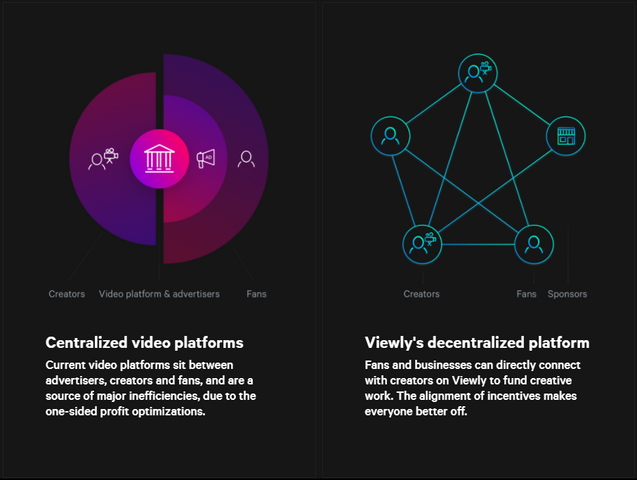

- Viewly is a business that is decentralized. Decentralized in essence means that no one in particular owns most of it's equity (or shares). For such an organisation/business to come into existence someone or a group of individuals codes a website (or creates a product), open sources it, then provides it as a service along with it's ownership to run the economy among it's users. [buyers and sellers within Viewly, ie Content creators (sellers), content curators/promoters(sellers), viewers (free), advertisers (buyers)]

- For Viewly to get started they have launched a prototype website. Which is popular among users. But currently has it's limitations as it's still a "prototype" (also known as alpha stage in development).

- Viewly wants funds for research and development to move from alpha stage to a working service that people can start using Viewly.

- To do this Viewly goes public with an ICO.

- This is the highly enigmatic ICO or Initial Coin Offering.

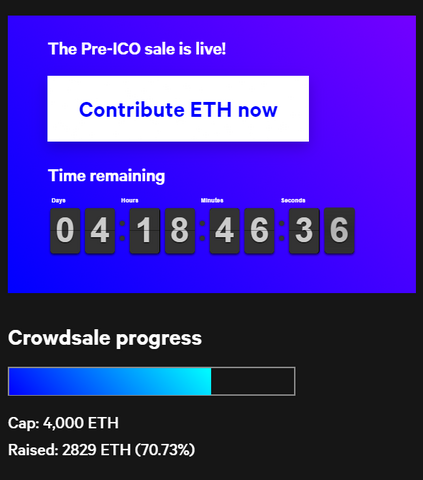

Going public with an ICO is when an organisation offers a percentage of "stock ownership" (or shares) of their business to the public in exchange of crypto-coins that their economy will use. This value is decided by the organisation itself basing it on how much they speculate their organisation is going to be worth these decisions (or calculations) are backed by whitepapers, proof of concepts, proof of work, prototypes etc. For example, Viewly asks 4000 ETH for 10% of equity of their organisation, hence evaluating their business at 40,000 ETH.

Now, we all know what an ICO is, where it comes from, and what it represents. With that out of the way we can now proceed to understanding the market and the economics that drives it.

Econometric background and Market Analysis

Now you might be wondering, what brings value to economy or a currency. The answer is simple, it is trust that gives value to a dollar or Bitcoin. With a dollar, the trust is guaranteed by the Federal Reserve and the government. With BTC (or ICO coins) the value comes with the computational trust and the agreement of all users (will go in-depth about the technicality of Blockchain in a future post). In a nutshell, all users agree that a Bitcoin can be traded for about $4000 worth of real world goods. (these are traders who trade BTC on Forex against various fiat currencies, giving it a universally accepted $ value.

It is worth mentioning that, BTC will still have monetary value, even if dollar ceased to exist

This is not some sort of non-existent value. People's trust gives it a value (just like Gov's trusts gives a piece of paper value). And exchange of goods and services with cryptos adds to the cryptos value.

Just like cryptos, ICOs have value too, because of the people's trust (and computational trust). They represent REAL goods and services in an economy and hence have value.

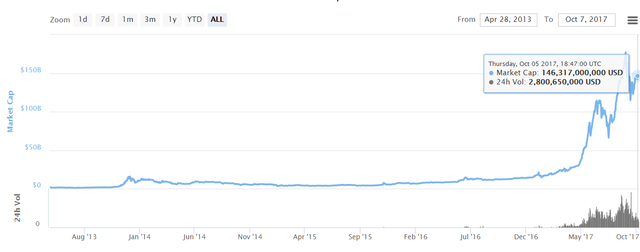

The market is GROWING. Faster than an algae bloom in a swamp!

The total market capitalization for all the cryptos was at $12 billion. The same market is worth over $146b TODAY. This is over 10x increase. Please note that this 10x increase is not equal to a 10% increase. This increase denotes an approximately 1200% growth in one year.

Market Cap of all cryptos combined on Oct 2 2016 (circa 1 year ago)

This is obvious that this market is no bubble, it has been growing and absorbing various other economies. Now, we can safely assume that the crypto market is not a bubble. This is like calling "internet market" a bubble just because Yahoo! shares dropped down after rallying up real high on the NASDAQ charts. The reality is the overall "internet market" is booming. And it has made many people a lot of money. (Zuck, Bezos, Google Bros)

Market cap of all cryptos combined today

Now, the very argument I made collapses on itself. If we cannot blame Yahoo! for internet economy being a bubble, how can we know that we are not buying a "Yahoo" equivalent for the crypto market. Which looks good now, but will be obsolete in the future. This is known as, RISK. It's nothing to fear about. It's a part of the game.

Now for me personally, I would speculate that this market will hit a $1 Trillion capitalization same time next year, this argument can be backed by the imperial evidence of the market history. I do not see this failing anytime soon. However, I'm extra cautious about the market and pay close attention to trade volumes and new technology that will eventually replace the previous tech. This is called SPECULATION, understanding the market and the risks, understanding market movements and trends. Then calling your shots, buying and selling at just the RIGHT time.

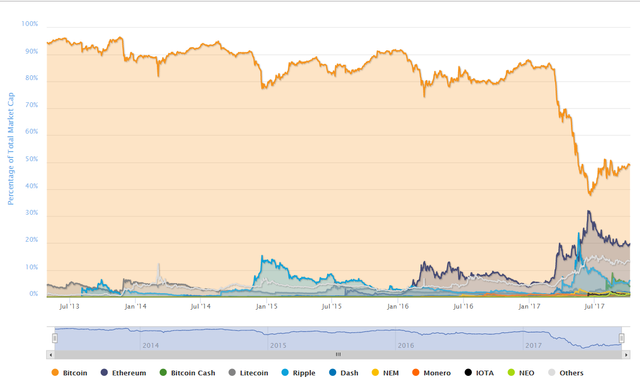

A vague look at the market distribution shows that BTC is being absorbed by the ETH market. This might be a false alarm, but the trend so far looks like it. This doesn't mean that BTC will fail completely, but it hints at the trend that BTC might eventually end up cheaper than ETH if the market continues this movement

With that out of the way, understanding the market and the general trends. Let's proceed to understanding the risks involved with ICOs

Risks and Rewards involved

This is what every YouTuber/News agency/Media House says:

Investing in ICO's is a very speculative job. One must be careful and very well versed about the coin they are investing in. You should always read the technical whitepaper and check for yourself if the ICO actually has a proof of concept and isn't just a plain scam site. Make sure you read about the team, and that they have a good history of projects and Git repositories.

What NO ONE will tell you is this:

- You can never be sure that the ICO that you invested in, will ever actually become a REAL CRYPTO COIN, that people will trade in exchange for other goods, services and products.

- With so many different organisations pitching for the same idea (decentralizing the same business/service) we can never know which one of those will eventually take over the market. For example: Viuly is a service that claims to decentralize YouTube too, just like Viewly. (we all know Viuly is the scammer in this case, but you get my point)

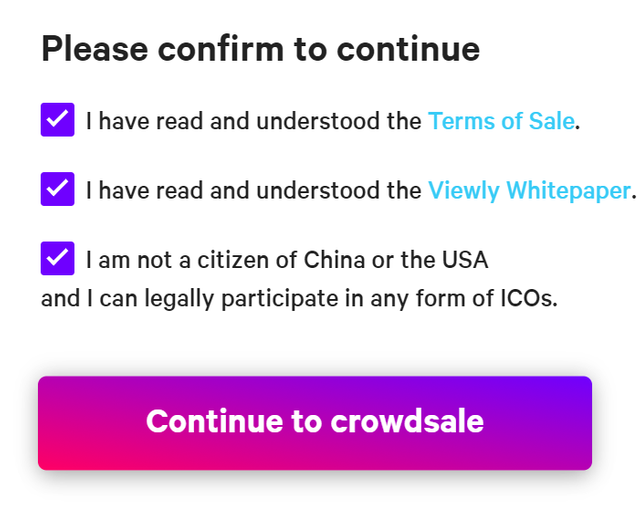

- Governments will lose a lot of control over the decentralized economy. Resulting in lots of revenue lost (in taxes) and will try to come up with many ways to regulate/tax/control this new economy. Hence we keep hearing about Countries banning cryptos and ICOs every other day. And are required to digitally sign agreements like these

The rewards with ICOs come when the coins that you bet in during the Coin Offering turn into an actual service/product. The organization actually succeeds in decentralizing the industry they set out to decentralize, hence absorbing that industries market capitalization, increasing the value of your coins exponentially.

Epilogue

With all this being said, I want to end this post with a nice little speculation that gives us all hope. Humanity's earliest endeavor was agriculture, it was very centralized and the world saw kings and empires. Then we changed our ways, built communities, societies and eventually civilization. Then came the real estate business couple of centuries ago, it gave the world a few millionaires and fewer billionaires. Then came the golden Industrial age, more people made more money. Now is the time for crypto industry, this is decentralized and will make many more millionaires and billionaires in the coming couple of years.

There is a lot of money to be made and lost here.

Stay very aware and alert of the market. Buy and sell at the right time. Don't hold for long.

The untold secret of business is not unfathomable intelligence or a genius IQ or some superpowers. Its simple...

What's new? What's next? How am I gonna get in there first?

Hope you all learnt something from this post. Would love to discuss more in the comments.

PS: My next posts will be technical analysis of blockchain. And what decentralization actually means and implies for the economy.

Cheers,

I'm new here and put in a lot of time to write this. Please resteem and share this around if you found it to be worth your time. Any help and criticism from veterans would be appreciated.

Thanking everyone in anticipation.

Cheers,

Amratech

help others, great post really, effort shows, I was going to resteem this, you will learn the ropes :)

unfortunately my vote is not enough to boost a post :|

good luck with the analysis keep me posted leave a link when it's out :)

Thanks much for giving me your time and reading this. I will reply to this comment when I make a new post or I will comment on one of your posts that I like.

Thanks again :)

Great stuff mahh man!

Def a WINNER of the #bellyrubchallenge!:)

Got my follow-up:) Stay Awesome!

Im glad you like it @kid4life. I made a new post today. Don't forget to check it out. And let me know how you're making money in this fork.

Okay bossman I am on it now:))

This wonderful post has received a bellyrub 0.66 % upvote from @bellyrub thanks to this cool cat: @kid4life. My pops @zeartul is one of your top steemit witness, if you like my bellyrubs please go vote for him, if you love what he is doing vote for this comment as well.

Congratulations @amratesh! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat write up. Thanks for mentioning it in a comment. Be patient here. I've been producing content for over a year and it takes a while to get noticed. Just keep doing your thing and adding value to others in comments and you'll get there over time. You need to build followers or else it's like tweeting to no one.

Thanks for the suggestion. Any advice is much appreciated. Yes, I should gather an audience before performing.

But the way I see it is, why bother about the audience if you enjoy performing anyway ;)

No, you misunderstood. Perform away, every day and all the time! It's the expectations that need to be adjusted until the audience is there to meet them.

This post may help a bit. Maybe this one too. Good luck!

I've been searching for a lot of resources to get started efficiently here. I get what you mean. Thanks much.

It's amazing to see so many intellectuals on here. Love the community. Will play as much as I like. ;)

Cheers

Congratulations @amratesh, this post is the ninth most rewarded post (based on pending payouts) in the last 12 hours written by a Dust account holder (accounts that hold between 0 and 0.01 Mega Vests). The total number of posts by Dust account holders during this period was 2267 and the total pending payments to posts in this category was $482.62. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

!originalworks

The @OriginalWorks bot has determined this post by @amratesh to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here! || Click here to participate in the @OriginalWorks sponsored writing contest(125 SBD in prizes)!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Congratulations @amratesh! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPICO's are great unless they are Initial Con Offerings. Always be prudent before buying. I got lucky back in 2012, but some have been scammed out of thousands so buyer beware.

I agree. But let's not forget that the risks don't end there. Even if it's not a Con, there's still a very high chance of it not becoming a real coin ever.

That's what this post is about.

Well done your posts are going great !