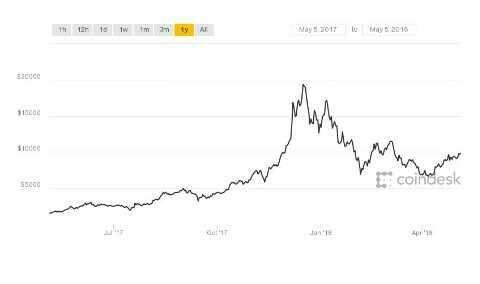

The fed paper shows a decline in the price of the bitcoin launch in 2017 and then

The decline following the peak of Bitcoin approached the $20,000 directly related to the launch of futures markets, according to new research from San Francisco Federal Reserve.

"Rising fast and the fall of the price of the next after the introduction of futures don't look as coincidental, " the four researchers said in a letter to regional Fed bank Economy recently.

The highest price cryptocurrency lined up with the Chicago Mercantile Exchange, CME, or introduce futures trading bitcoin.

A decrease in the Bitcoin after rising to almost $20,000 directly linked to the launch of the futures market, according to research from San Francisco Federal Reserve published Monday.

"Quick Rise and subsequent decline in prices after the introduction of futures don't look as coincidental, " four researchers wrote in the latest Economic Letter regional Fed bank. "This is consistent with the behavior of trade that usually accompanies the introduction of futures market for the assets."

The price of the bitcoin peaks line up with the Chicago Mercantile Exchange, CME, or introduce futures trading bitcoin on 17 December. On the same day, bitcoin reaches a height of $19,783, according to data from CoinDesk. The Chicago Board Options Exchange, or CBOE, the futures market has also opened a week earlier, but trade there is very slim, said the letter.

The 12-month performance of the Bitcoin

Till future there is very difficult, if not impossible, to bet on a decline in the price of the bitcoin, the researchers said. As investors continued bargain ptimistic, cryptocurrency rose more than 1,300 percent in 2017.

Meanwhile, pessimistic, have no financial ways to support the belief that the price of the bitcoin will collapse.

"So they were left waiting for their ' I told you so ', " said the researchers. "Launch futures bitcoin enables pessimistic to enter the market, which contribute to the reversal of price dynamics bitcoin. "

On Monday, bitcoin is trading at about half of the peak of pre-futures, approached $9365 at 3:10 pm ET, according to the researchers compare this price with a reaction-based mortgage securities, which they say depends on the strength of the same driving force of traders optimistic and pessimistic.

As for why it is the gradual downfall rather than collapse overnight, researchers say it could be a lack of concern or willingness to enter the market in the first week of trading.

Prices and demand in the future can be helped by traditional financial institutions become more willing to accept bitcoin, and official recognition and acceptance of the regulations of the bitcoin as payment, they wrote.

But cryptocurrency that are competing to become more widely used can cause bitcoin "plummeted because this market tends to be a winner-take-all, " said the researchers.

Hello! We do one thing. I followed you, I hope you will follow me. Let's develop the power of steemit together and improve your blogs.