The Bitcoin ETF Just Might Destroy Bitcoin

I just had to laugh at the bleeps and boops during the intro of this video. Here is CNBC with a dedicated crypto show with pixel graphics and complete glorification of Bitcoin as some sort of gamer paradise where we can get by by sitting inside and watching the price go up.

If Bitcoin was a threat to the system, they would outlawed and destroy it. If Bitcoin was not a threat to the system, they would embrace and integrate it.

I think now that Bitcoin is not only being embraced, but it also looks like the value will be under their full control with the ETFs if those occur.

And taking a look at this, Charlie Lee is integrating Litecoin with the banks.

So what the fuck? How is this outside of the system in any way? Charlie I-Sold-At-The-Top Lee who worked at Google, makes a free an open source internet coin and is backing it up with a German bank, and that's getting covered on mainstream CNBC?

If it's not clear to you who's really in control of this crypto mess, I don't know what to tell ya.

And back to the value of a Bitcoin: The blockchain's value can't be priced in dollars, especially since it's free and open source. Sure it can be used for transactions but it's free. And the supply argument of it having 21 million can't even be used now, because if you're looking to make a profit, ETFs would effectively EXPLODE the supply just like the Futures. Why speculate on Bitcoin when we can just buy an ETF or bet on the price in Futures?

And I contemplated the use of Bitcoin as a potential unit of energy since it takes electricity to mine it, but the problem with that is that the first Bitcoins were easy to mine, and now it takes more and more to make it. Therefore, Bitcoin is not a unit of electricity, it's based on demand. If demand is up, then we'd have to be slave to electronics because we'd need Bitcoin for transactions. If demand is down (which I think it should be), it'd be a waste of electricity and precious resources we need to survive.

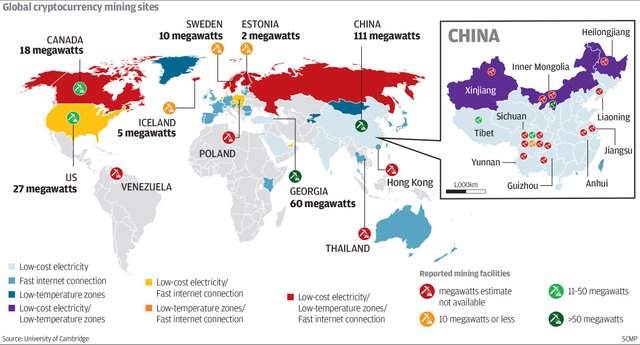

The biggest trouble that I can't get past at all with Bitcoin is the transaction fees. Every single transaction that two individual parties perform on this system, gives a tiny amount of wealth to the miners. Well, mining Bitcoin isn't exactly popular anymore since it's so expensive and energy-intensive to do, so who's really mining it other than some giant computer bases in China or a corporate headquarters?

And if I were China with a massive percentage of the total mining power, I would 51% attack the fuck out of it if needed, and control the blockchain to my will just from the hashpower.

"Link people's addresses up, and if I don't like them then we'll just deny their transactions."

So with every single transaction on the network, your money goes to China in little pieces. Where will that go over time? Not in your hands. There won't be a trickle down effect, there will just be more control by the top.

As far as I can see, ETFs are just paper manipulation. In late 2017 they had to buy in and sell the actual Bitcoins to drive up and down the price. If ETFs become a thing, they'll do the same thing that they've been doing to gold and especially silver.

And I feel, because the end of paper money is approaching. So with fiat paper ending and crypto being "regulated and integrated", what's your best choice?