CryptoCurrency today Balkan >> Hybrid Crypto Exchanges

To date, there are two types of exchanges in the crypto industry, centralized (Binance, Bitfinex, Coinbase, and others) and decentralized (BitShares, Waves Dex, RuDex, and others). But soon, there will be hybrid crypto exchanges. What are they for and how will the new exchanges work?

CEX + DEX = HEX

———————-

Blockchain is a decentralized system whose participants mainly use centralized exchanges (CEX = Centralized Exchange). These exchanges are the standard solution for the transfer of funds. Such exchanges have deficiencies related security since all activities are controlled by third parties. That is, it depends on the company's employees who require the private keys to be placed inside the network. This attracts scammers and hackers who constantly attack CEX platforms.

Decentralized exchanges (DEX = Decentralized Exchange) were developed to negate the vulnerabilities of the classic crypto exchanges system. It is worth recalling that all DEX operations are related to the software of the system and there is no control over the operations performed. This does not allow decentralized exchanges to offer latency or liquidity tools that could motivate large institutional investors to enter the market and provide them with guarantees.

To solve the problems of centralized and decentralized exchanges, hybrid crypto exchanges (HEX = Hybrid Exchange) are being developed, which will be based on the functionality and liquidity of CEX platforms, as well as the confidentiality and security of DEX platforms. So far, there are no specific working examples on the market. Many projects are at the final stage of development and implementation in the system. Let us consider some of them.

Future Hybrid Crypto Exchanges

———————-

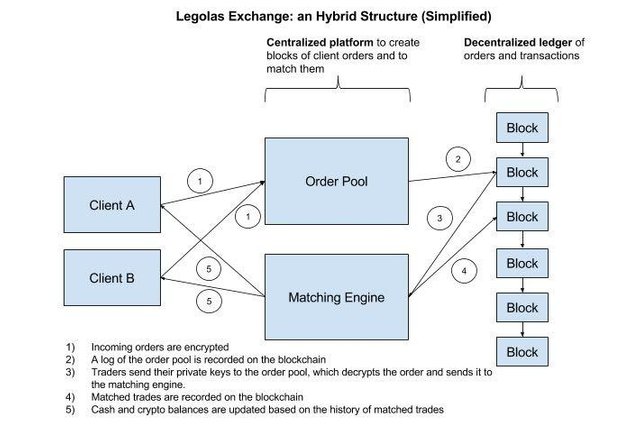

The Legolas hybrid exchange is a semi-differentiated order-matching protocol. All incoming orders and transactions are encrypted, fixed by time and stored in a chain of blocks, and order coordination is performed outside the network. The decentralized information on orders and transactions allows for transparent pricing and transaction reliability. The centralization of the order pool and their comparison allows to achieve scalability without restrictions and locks. The developers promise to provide high throughput by combining and coordinating orders.

Another hybrid crypto exchange, Qurrex, plans to enter the market in the near future and in 2020, Qurrex aims to compete with centralized exchanges. While there is active marketing promotion, the company's representatives say that thanks to its speedy instruments Qurrex will achieve a maximum transaction speed of 70,000 operations per second. They also promise that the exchange will provide its users with all the necessary information, namely, quarterly reports, results of audits conducted by one of the top 4 global auditing companies, and reports on the operation of the system from an independent commission. They also promise to provide users with detailed information on the status of their accounts, including completed and unfinished trading operations.The upcoming hybrid crypto exchange Eidoo will also adhere to the system of user verification, or KYC, as the exchange has received a license from the Association for Financial Services Standards (VQF). The exchange intends to act in accordance with the Anti-Money Laundering (AML) Directive, which means that a large amount of user data will be stored inside the network. The accounts are based on an Ethereum smart contract. The orders will be compared using software that is completely disconnected from exchange contracts. Verification of all operations is entrusted to the mechanism of centralized approval of orders. This is done to obtain lower gas costs in the chain when checking compliance. Transactions between wallets will be based on atomic swaps, trading operations will become indivisible and will be terminated only after orders are completely filled.

The developers of Stoxum promise to create the first hybrid exchange with a 100% share allocation. This is the world's first hybrid exchange for cryptocurrencies with an aggregation pool of liquidity, which combines the speed of centralized solutions and the reliability of decentralized ones. All financial indicators of the platform will be completely open. The white paper of the exchange says that it intends to introduce all the best technological components.

The Start Is Promising, but What Is Next?

———————-

Hybrid exchanges should be the golden mean that will unite the advantages of a centralized exchange, such as cooperation with large investors and the trust of many users with the advantages of a decentralized exchange, such as reliable storage and the absence of subordination to a higher authority. We will find out very soon if the developers of a new type of exchange will be able to realize their ideas and become full-fledged players of the cryptocurrency market. At least all the prerequisites for successful implementation are available.

———————-

Don’t miss out next post! Comment, ask and don’t hesitate to upvote!

Coins mentioned in post: