What is cryptocurrency mining? Everything you need to know to begin with

While you were learning about getting started series here on Bitfolio, you must have come across the term “mining” a lot of times. Sure, we have explained this process in brief and you must have a gist of what exactly mining is.

And if you know what is mining, you also should know why is it that everyone is talking about mining. It is a source of income for some and many juice out some extra money out of it. So this post is dedicated to all those who were curious to know the process of cryptocurrency mining, learn it and the best, get into it.

This post is part of learning series and in case you are not following, here’s what we have covered so far:

As part of this guide, you will learn the following:

- What is cryptocurrency mining? How to mining works?

- Profitability in mining cryptocurrencies

- Frequently asked questions

- Final thoughts

That being said, let’s dive in to the main chunk right away.

Let us save some data and time of your and explain or refresh a few common terms that we will be using throughout this guide, so let’s see it.

Read Also: Bitcoin Community goes gaga over this Bitcoin hash. What’s so special about it?

What is Cryptocurrency?

Cryptocurrency is the money of the future that runs on the internet and just like the internet, it doesn’t have any owner. Just a community of developers, investors, and enthusiasts who maintain the network.

Cryptocurrency is digital money that doesn’t exist but has monetary value just like fiat currency that we use in our daily lives. To sound technical, Cryptocurrency is peer to peer electronic cash system that is completely anonymous, decentralized and secure. Cryptocurrency is not legal everywhere as it has limitations and flaws.

There are over 1600 cryptocurrencies and tokens and there are three ways you can use any of those cryptocurrency or tokens. One, use exchange platform and buy the desired cryptocurrency for fiat currency. Two, exchange it for already purchased cryptocurrency and enjoy the benefit of price fluctuations, basically, trade. Three, spend it to buy good(s) and service(s) both online and offline.

What is Blockchain technology?

Blockchain technology is the brain of cryptocurrency. It is the public ledger system that contains a list of transactions and is globally accessible by anyone. Think of blockchain as a database, which does not have any administrator, is not editable and does not reveal any other detail other than the transaction amount & other system-specific information.

Let us literally explain the term to you.

Blockchain is a chain of blocks, blocks that contain raw information of transaction happened in a particular application, in this case, cryptocurrency. Now a certain number of transaction of fund transfers will be recorded to form a single block and will be out for approval. This where cryptocurrency mining begins.

Let us take an example. A send 1 BTC to B and this record of the transaction is in the queue for approval, just like in case of the bank. A group of volunteers called the ‘miners’ take this transaction, use their hash power and run algorithm to verify the transaction. At the end of this run, there are two outcomes.

- The transaction is verified and added to the blockchain

- A certain number of new cryptocurrency coins are generated and miners get a portion of it as a reward

This is the whole process in a nutshell. Now that you know the process, let us explain this in super detail.

Read Also: Bitcoin Vending Machine/ Bitcoin ATM launched in India

What is cryptocurrency mining and how does it work?

Cryptocurrency mining is one of the two possible outcomes of ‘verifying a cryptocurrency transaction’ in a blockchain. Furthermore, there are two things mining cryptocurrency does to the whole cryptocurrency network.

- Add new cryptocurrency units to the market for circulation

- Strengthens the network by adding a verified transaction to the blockchain and hence increasing the overall value of the cryptocurrency.

By the second point what we mean is more transactions are verified more people are gonna use it and more the people use it more valuable the network becomes. Depending on the cryptocurrency in use, the algorithm would vary. For the sake of this articles, we will take Bitcoin as an example.

So the task of mining begins soon after a transaction is triggered and is in a queue for verification. The process of mining is a subset of the verification process. The miner needs to solve the cryptographic algorithm, in this case, it’s SHA256, the cryptographic algorithm along with Proof of work of Bitcoin. This process involves a lot of computational energy and hence it costs a lot of money, literally a lot. That is why Bitcoin mining is kind of centralized now and is dominated by only a handful number of big players. The algorithm, SHA256 consumes a lot of energy, which small mining pools or individuals do not find lucrative as what they make nullifies in paying for energy consumption. Also, thanks to the densely populated bitcoin network, the process is getting slower and slower and more competitive by each passing day. Also, it works this way, more power the network consumes, more the network is safer and secure. This is the only reason Bitcoin(and Ethereum) is still the king of the cryptoverse and unmoved from the top of the table and its price is going to rise again.

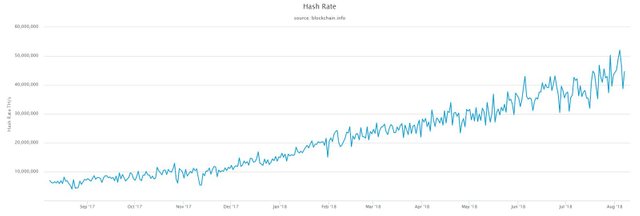

Look at the Bitcoin hash rate chart from Blockchain.com, it clearly shows that the hash rate (amount of computational power required to solve a block) has gone up gradually which means that the network is getting more and more secure. Checkout Ethereum’s hashrate here, you’ll see that even that is ever increasing.

The system was designed so, that by using computational power not only will make money for miners but it will also make the network more secure.

Now there’s a problem here,

If miners continuously keep mining all the cryptocurrency units would be mined before time and the value of the Bitcoin would fall due to this. So to avoid this from happening, Satoshi Nakamoto came up with something called mining difficulty. Mining difficulty is nothing but a simple protocol that makes mining more and more difficult after a certain period of time. Apart from making mining difficult, even the reward reduces. There was a time when mining a single bitcoin block would result in 25 bitcoins as a reward. This will be halved after 210,000 blocks are mined, and it takes four years for the network to cross this milestone. Currently, the bounty is 12.5 so next and third halving happens in 2020 which will make the bounty to 6.25 BTC per block.

Each block take 10 minutes to be mined so this makes 1800 blocks a day and as per the Bitcoin Whitepaper, the network was powerful enough for mining 6400 blocks per day and then the first halving occurred in late 2012. This process will go on until all the 21 million units of Bitcoin are mined and sent in the market for circulation, this is estimated to happen in 2140.

The bitcoin community ensures that the average time taken to mine a block remains around 10 minutes and this time is adjusted every 2016 blocks which roughly happens every fortnight.

Profitability in mining cryptocurrencies

On one hand, the network becomes more and more secure which increases the prices of cryptocurrencies and makes the network denser. And on the other hand, more secure & denser network needs costlier equipment to support the cryptographic computing. Initially, an i7 CPU was enough to mine Bitcoins which soon required ASIC chips specially designed for bitcoin. These chips are damn expensive for individuals and this is why Bitcoin mining pools are becoming more and more famous. Technically, mining bitcoin makes more sense only when in a pool. Individually, the profit margin is too thin to call it a lucrative income source.

The equipment is becoming so essential that the leading mining equipment manufacturer, Bitmain, launched a new series of ASICsfor different algorithms and cryptocurrencies like Ethereum and monero. These equipment are obviously costing a bomb of money which is why individuals do not get into Bitcoin mining.

The biggest differentiator in mining cryptocurrency is the price of cryptocurrency. Speaking of price, we all know Bitcoin price has gone upside down since Jan’18. To make it worse, the price of hardware needed for bitcoin mining has gone high, the cost of energy consumption is also going high. So overall, the money miners make and the expenses in making that money are nick to nick. Not to forget the ever-increasing difficulty level of Bitcoin mining. The difficulty level has increased in 82% in 2018 and prices have continuously kept falling. See the graph that states the miner revenue.

Few considerations that will affect the revenue miners will make:

All these factors along with the poor performance of Bitcoin’s price is an alarming reason for miners.

Frequently asked questions

What is proof of work?

Proof of work is the way mining algorithm(verification algorithm) reaches the consensus for the transaction to be added to the public ledger that is the blockchain. Proof of work is the how the network decides whether or not a particular transaction deserves to be added to the blockchain. This happens behind the scene while miners run pending transactions to achieve a hash.

What is the mining difficulty?

Mining difficulty is the level of difficulty the network will be at on any given time. It is how difficult the mining is going to be for miners to perform. As many miners joins the network, the difficulty rate inevitably goes up.

What is hash and hash rate?

Hash is a randomly generated alphanumeric series. The cryptographic algorithm used by the blockchain network produces a hash for every transaction it verifies. Once the hash is produced, it is irreversible. Hash is unique for every transaction and does not have any meaning. Hash rate is the speed at which the computer is performing the calculation or solving the algorithmic problem.

What is the mining pool?

Mining pool is a group of miners collectively involved in mining cryptocurrencies. This helps to reduce the cost of energy consumption as the more systems are involved. Also productivity, profit and number of cryptocurrencies mined increases.

What is Mining algorithm?

A mining algorithm is the logic solving program used by the cryptocurrency network to solve cryptographic problem involved and creating a hash on the successful solution of that problem.

How to get started with mining cryptocurrency?

Mining is a tedious task to begin with. It would take a good amount of money that would go in as an investment in mining cryptocurrency. If you don’t want to spend much on buying hardware for mining, you can join mining pools like MinerGate. It is a great place tobegin with, you just need to download a GUI available on the website and start running the unverified transactions to generate hashes.

Final thoughts on Mining Cryptocurrency

Mining cryptocurrency needs a huge investment no matter which cryptocurrency you choose to mine. Even the most lightest cryptocurrency needs a decent powered CPU+GPU combination that would cost anywhere between $600 to $1000 so that is a lot of money for beginners.

Also, considering the massive number of miners populating the cryptoverse is also a major factor that will rule the miners revenue in coming time.

Over to you. What was your experience going through this guide? Have you been doing mining? If yes which cryptocurrency was it? Let us know in the comment section below.

Did you find this guide informative? Show us by sharing it on social media and helping those interested.

Originally published at http://bitfolio.org/mining-cryptocurrency.