Beware Of Camouflaged Crypto-ETF’s

Do you know who gets the most earnings from shares on stock markets, compared with their own capital, or compared with their risks? Tech sector shareholders? Industrial stocks shareholders? Owner of small cap stocks? Owner of large caps?

(Pixabay.com)

Lambo without crypto

May be some investors who are holding simply NONE. Brokerage firms, banks, investment fund and trust managers, investing advisers. They have perhaps zero capital invested, are taking almost no risks (okay, they can be prosecuted in case of several type of errors). They don’t need to have shares to gain with shares, they are middlemen or high quality financial service providers.

They gain if stocks are going up and can also gain if the big bear is in town, may be less but they do. If some of the issuer companies become bankrupt, they can still earn their Lamborghini or Ferrari.

Buy the cow, not the milk

Nine of ten startups go bankrupt, and cryptocurrencies, ICO-s are similar to them. (Do you remember Namecoin, Feathercoin or Peercoin? Do you know how how many cryptos from 2013 are successful today?)

That’s because I’d rather possess a cryptocurrency-exchange than a cryptocurrency itself. Rather an ICO adviser than some ICO tokens. Better an established brokerage firm or fund management company than some startups or risky small cap stocks.

Cryptos can disappear

For example, internet shops like Amazon, eBay or Overstock could accept Bitcoin, Ether, Dogecoin or Steem, or any other crypto. Cryptos can come or go, the superstore stays. So I’m very interested in buying the shares of different tech-companies engaged in blockchain and cryptos.

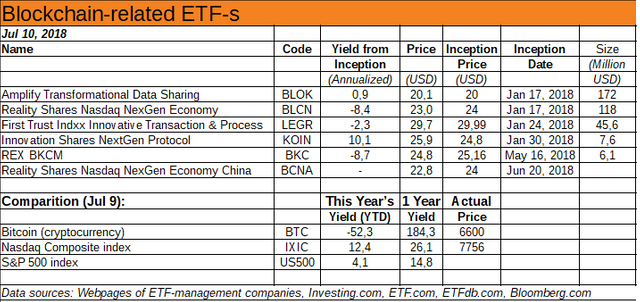

There is a wave of foundation of blockchain related ETF-s (Exchange Traded Funds) this year, ETFdb.com for example has six on its list, all started in 2018, some of them only weeks ago. Some have a considerable size of more than 100 million dollars, some others only a couple of millions. (See the table.)

Well known names

Whilst the price of Bitcoin is halved so far in 2018, this ETF’s price and yield stays relatively stable. They loose only some percent. Why? Which shares do have this funds in their portfolio? Let’s see a list of some of the greater holdings of this six funds (most of this stocks have 2-6 percent weight in at least one of them):

- Microsoft Corporation (NASDAQ: MSFT )

- Nvidia Corporation (NASDAQ: NVDA )

- Overstock.com Inc (NASDAQ: OSTK )

- Advanced Micro Devices Inc (AMD)

- International Business Machines Corp (IBM)

- Visa Inc (V)

- Amazon.com Inc (AMZN)

- Alphabet Inc (GOOGL)

- Intel Corp (INTC)

- Baidu Inc (BIDU)

- Taiwan Semiconductor Manufacturing Co Ltd (TSM)

- Fujitsu Ltd (6702:TYO)

- Cisco Systems Inc (CSCO)

- Digital Garage Inc (4819:TYO)

- GMO Internet Inc (9449:TYO)

- Square Inc (SQ)

- SAP SE (SAP:DAX)

- CME Group Inc (CME)

- Nasdaq Inc, etc. etc. etc.

Only the miners win?

So, that’s the reason because this ETF’s are behaving totaly different as cryptocurrencies: they have not very much to do with. May be Amazon, Microsoft, IBM and chip-makers, and the others are experimenting with blockchain-technology, may be they are investing a lot of money in this branch already. But I wouldn’t say they are blockchain companies. Their revenues are coming, may be, to 99,9 percent from other businesses. (Excepting, may be, the manufacturers of crypto-mining equipment.)

All mentioned funds are having this companies and other huge holding giants in their portfolio, only BCNA is a little different because it is specialized in Chinese companies, mostly also tech-titants.

Impossible ETF-mission

Many “real” crypto-companies aren’t listed in any exchange, they are private or made ICO-s, and are present only on the crypto-exchanges. Unless conventional ETF-s can’t buy ICO tokens, they may never get real blockchain ETF-s.

I’m very sad, but I can’t buy my desired crypto-companies ETF, because it doesn’t exist. I quite agree with this sentence:

Accordingly, its distance from cryptocurrencies themselves is both its greatest advantage and possibility its greatest weakness, depending on how you look at it.

– wrote Nasdaq.com in February about one of this kind of ETF-s.

Hype or not

Ultimately, it's possible that BLCN will become “just another tech ETF” or it could become something more - only time will tell as the hype behind cryptocurrencies dies down and the focus on the blockchain itself becomes stronger

– is their conclusion.

And if the hype comes back?

(I found some other ETF-s in Toronto, Canada, with the codes: BLCK, HBLK, LINK, BKCH. Next time I’d like to check this ones.)

Data sources: Webpages of ETF-management companies, Investing.com, ETF.com, ETFdb.com, Bloomberg.com.

Disclaimer:

I am not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think, entertain, increase testosterone and adrenaline level. Consult your advisers before making any decision.

Info:

You can message me in Discord.