Is Bitcoin Moving Together With The Stock Market, Or On The Contrary?

The US stock market is falling like a stone since the negotiations between the US and Chinese governments failed, and Bitcoin is skyrocketing in the last couple of days. Reached 7,900 8,084 USD some minutes ago. In moments like this many people are asking themselves: Are Bitcoin and other cryptocurrencies a good hedge, an alternative to conventional, traditional assets?

Gold or Bitcoin?

Can the capital leaving, escaping the stock market, enter in the crypto space and raise the prices, may be direct to the Moon? Can cryptocurrencies be a safe harbor for the capital seeking alternative investments? Gold, for example is surging today again, reached 1300 USD, and gold mines’ shares are skyrocketing.

But, last December, Bitcoin, and stocks were at local lows almost the same time. The main cryptocurrency was “hitting a 2018 price low of $3,112 on December 15, 2018” by Coindesk.com, and the S&P 500, the leading stock market index bottomed December the 26th. The two assets seemed to move more together, at least not in opposite directions.

Please, be independent

Are they correlated (moving together) or is there a negative correlation (moving in the opposite directions)? Or is there no remarkable connection to observe? If you search on the internet, you find mostly opinions saying there is no correlation. Like Bitcoinist, Bitcoin Market Journal, Cryptoslate, and CCN.com. The latter wrote:

A negative correlation suggests that investors have a shot at generating returns with bitcoin even when the S&P 500 is in the doldrums.

Crypto experts, in my opinion, basically want you to think there is no correlation. Because if there isn’t any, Bitcoin can be a good alternative investment, a portfolio diversification tool. “The stock market hedge investors crave.” You can’t protect yourself against stock market losses with an asset which is moving together with the stock market.

Every year was different

But I think the truth is more complicated. Most opinions about the un-correlated Bitcoin-Stocks movements were born after the volatile year 2018. And in that year, the correlation was indeed non-existent.

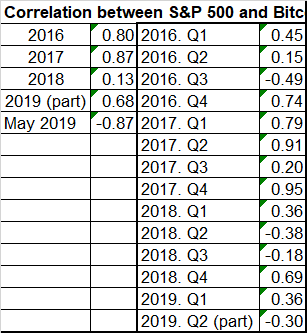

I calculated a simple correlation in Excel (Correl function), and it showed in 2018 there was no correlation (value 0.13, means nothing at all). But in 2017 (0.87) and 2016 (0.80), the correlation seems to be significant. In 2019, the coefficient of 0.68 indicates that in most cases Bitcoin and US stocks were moving together, despite the events of the last few days.

Are there more and less correlated time frames? Yes. If we calculate correlation for every quarter, some seem to be very correlated, and some, not. And some have a negative correlation, like May 2019 so far. In 2018, as I mentioned, there was no real correlation in the whole year, but in the last quarter, yes.

Conclusion

Is all this a little chaotic? Yes, but I wouldn’t say Bitcoin has no correlation with the stock market. It seems to have one in many quarters. On the long term I agree with Cryptoslate which wrote in January:

the beta of bitcoin relative to the S&P 500 fluctuates wildly… Currently, there is not a sufficient amount of data to conclude whether bitcoin responds positively to a bearish stock market.

We will see if May 2019 changes this conclusion.

(Photo: Own work, download here)

Спасибо, что определенно помогает прояснить некоторые вещи.

Пожалуйста.

Great article, enjoyed reading it. Good analysys and good topic too and well presented and it was easy to head not atall heavy as you can generally expect with these financial detail and analysys articles.

I don't know BTC's correlation with stocks, but it certainly gives move returns then stocks and so is a attactive form of investment.

One can make 60% profits easily, if done properly but it has to be done properly not hastily. At the right cryptos , entering, holding and selling all done in a way that would give profits anyway.

Nothing is certain if we talk about cryptos, or stocks...

And also 96 percent loss, easily.

Actually if you sell it and buy it at the right time, it would be fine. Now bull market i broken and price correction is happening, people if they would have brought BTC and cryptos when they were low, at the bottom, waited till it reached a level would have made profits. it m=takes some time to understand, learn and control ourselves actually.

Over 8,000 USD! Time to release some btc 😀

Posted using Partiko Android

You brought its price down now then, ha, its 7940 something.

😩

Posted using Partiko Android

You got a 60.68% upvote from @spydo courtesy of @deathcross! We offer 100% Payout and Curation.

You got a 62.66% upvote from @brupvoter courtesy of @deathcross!