This Is What Bitcoin Futures Have Told Me Today

Two big, established, official exchanges launched Bitcoin futures trading in December 2017. Some people was blaming them earlier for the quick price falls from end of December and January. Can this futures markets, in their actual state, really influence Bitcoin price?

Two big, established, official exchanges launched Bitcoin futures trading in December 2017. Some people was blaming them earlier for the quick price falls from end of December and January. Can this futures markets, in their actual state, really influence Bitcoin price?

Millions or billions?

First let’s see the trading volumes. Daily turnover on Chicago Mercantile Exchange (CME) was 2683 contracts today, and here one contract equals 5 bitcoins. So, 13 415 bitcoins in total, that means 84 916 950 dollars, about 85 millions by the actual price (6330 USD). Meanwhile, by Coinmarketcap.com, the 24 hours turnover of bitcoin is 3.715 billion dollar now.

The difference is huge: that means, all this volume is representing today only 2.3 percent of the daily turnover of Bitcoin. So this futures are not very important and influential, actually. (This doesn’t mean that future players or a future hype can’t elevate considerably the turnover and the importance of this market.)

Some percent, no more

Let’s see the other. The daily turnover on the Chicago Board Options Exchange (Cboe) was 1829 contracts, but here one contract equals only one bitcoin (11.578 million dollars). The volume here was only 0.3 percent of the volume by Coinmarketcap. The two exchanges have a weight of 2.6 percent in this market.

Other important data is the open interest, that means, all live contracts investors don’t liquidate until the end of the day. Cboe has 5225 open contracts today (=5225 BTC), CME only 2092, but this means 10 460 bitcoins. Total: 15 685 BTC, worth 99.3 million USD. This means also only 2.7 percent of the mentioned 3.7 billion daily turnover.

Drop in the bucket

But let’s compare holdings with holdings (stock), and not holdings with turnover. This 99 million dollars of open interest are only 0.09 percent of the 109.54 billion dollar total bitcoin market capitalization. Funny. If most investors would liquidate their futures quickly, very probably that woudn’t cause any mayor price movement. (If this capitalization is real, and how many bitcoins are lost forever, is an other issue.)

I found historical open interest charts here: Bitgur.com Short and long positions seem to be increasing in number in last months. May be if real bitcoin ETF can finally start, the futures volume will also increase.

The Cboe Bitcoin Futures Contract uses the ticker XBT and equals one bitcoin. The CME Bitcoin Futures Contract will use the ticker BTC and will equal five bitcoins. (Reuters)

Day trader’s ground?

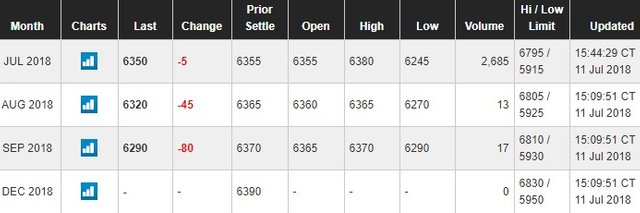

Volume issues, second part. Trading is possible on both exchanges for the three near-term serial months (July, August, September now), but real trading volume can be observed only by the nearest one, July. The volume by the other months contracts is only a fraction of the front-end month, almost nothing. And daily volume also exceeds open interest – that means for me, this markets are the playground of short term speculators, day-traders. Not realy for HOLDers. (With the high margin requirements, not a surprise.)

(Source: CME)

Prices. August futures price is lower than July, September lower as August – see the pictures. (That is called backwardation.) That means, investors are pessimistic, very likely awaiting further price falls. But the difference is small, only 0.2-0.5 percent.

Sell and buy back?

In theory, in case of this backwardation, when futures are cheaper as spot price, investors can arbitrate, sell their bitcoins and buy them back at the lower price. But with this small difference – and the high costs of the margin requirements – I don’t think this is worth the effort.

(Source: Cboe)

The margin requirement on CME is 13 920 USD, on Cboe, 2893 USD – that means, you must have at least so much security puffer in cash to buy or sell a single contract. This is actually 44-46 percent of the market price, much-much more than by any other futures product.

Conclusion?

The futures are not really influential on bitcoin market this time, but can gain in importance in succeeding times. After more than a half year, the crucial part of trading volume stays on cryptocurrency exchanges.

Data sources:

Barchart.com

Reuters

Cboe

Coinmarketcap.com

CME

Disclaimer:

I am not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think, entertain, increase testosterone and adrenaline level. Consult your advisers before making any decision.

Info:

You can message me in Discord.

@deathcross good information and good job. I really like your article

Free Upvotes

ENJOY !

You got a 3.30% upvote from @postpromoter courtesy of @bidbot.credits!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!