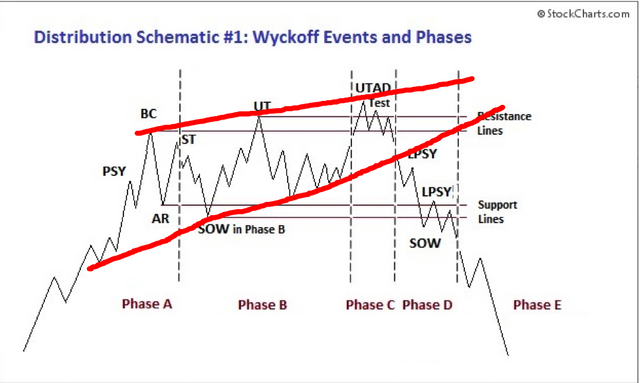

Wyckoff Model predicts Bitcoin Top.*4

Phase B

A secondary test (ST) is initiated to test the supply and demand of the upper price levels. The price can fall below the BC, or it can become an up thrust (UT) where the price makes a higher high than the BC but quickly falls back to the TR. After this move, the price often falls to the low (AR) or below it to test the lower boundary of the TR. If a new low is put in, it marks the first sign of weakness (SOW) which now becomes the new low of the TR.

Another up thrust test of the high (UT) is initiated but again, is quickly faded back into the TR. Market movers, and market makers will often stop out short traders with repeated UT's.