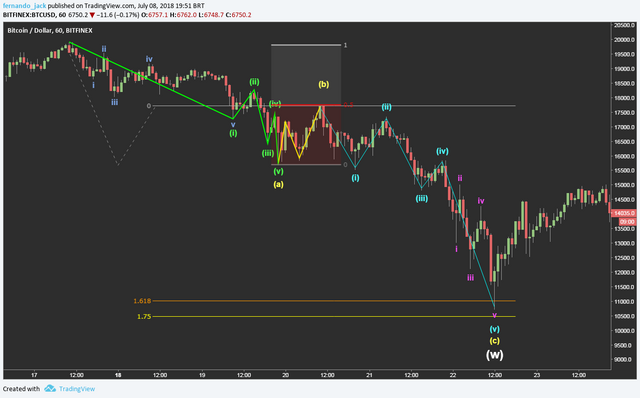

BTCUSD - Complex Correction - Part 1

So, after sketch the first motivo wave of the actual considered "grand supercycle" of Bitcoin, lets brainstorm the correction we are sitting on.

Overall analysis

First things first!

The overall analysis clearly give us two main possibilies of correction. A WXY wave and a WXYXZ wave.

The first consideration of a WXY wave doesn't please me so much because of the shallowness of "X" wave. As we see in Figure 1, the length of x wave is less than 0.5 times the length of w. From any reference in literature, it is too shallow for a corrective WXY. The spected ratio of lengths of x to w waves is above 0.5.

On the other hand, the second option fits perfectly with what is spected for a corrective WXWYZ wave. We have the ratio of (x) wave length to (w) wave length between the levels of 0.618 and 0.786. Also, (y) wave ticks right at the level of 1.236 times the length of w wave.

Figure 1 - Possible coutings for the corrective wave: WXY in yellow and WXYXZ in white

Figure 1 - Possible coutings for the corrective wave: WXY in yellow and WXYXZ in whiteAccording the second, and most probable, scenario, we draw areas of high probability for our (z). The recent pivot formed at the level of 0.618 ratio of (z) to (w) is a possible end for the correction. The areas around the levels of 1 and 1.236 are also possibilities to be considered. Lets continue the analysis...

Detailed view

Now we dive into each wave to see if there consistency to maintain our suggested scheme.

(w) wave

Figure 1 - Detailed (w) wave

Figure 1 - Detailed (w) waveOur (w) wave seems great. It is a 3 wave correction, abc.

(a) if a leading diagonal, in which the first motive wave (i) is also a leading diagonal.

(b) is a flat 3 waves correction, which reatraces 0.5 from (a).

(c) is almost at the tick of 1.618 the length of (a) and is a 5 wave ending diagonal which has its last motive wave, (v), an ending diagonal.

Next post I'll describe the other waves..

Thanks the support!