Money Management Strategy in cryptocurrency trading: how to calculate the risk/reward ratio and trading volume.best with 3commas

Not so long ago, we discussed the importance of personal strategy and learned how to manage risks. Don’t forget that the key to successful trading is money and risk management.

Today we will reveal the key points of risk and profit management in your transactions.

If you know the ways of managing your money, but don’t apply your knowledge in a real trade, you have a small chance to make money.

The main thing is that you don’t know how to make money, also, your success depends on luck. In addition, you cannot control your risks. It means that you may lose funds if mistakes or greed takes over you. Without an effective risk management strategy, your trading process turns into gambling.

Today you will learn how to calculate:

Risk/reward ratio,

Position size,

Risk ratio per trade.

Calculating Risk and Reward

You should know that it’s important to calculate potential profit and loss levels. The risk is determined using a stop-loss order, it the price difference between the entry point of the trade and the stop loss order.

A profit target is used to establish an exit point should the trade move favourably, it is planned in advance.

The potential profit for the trade is the price difference between the profit target and the entry price.

For example, if you buy a stock at $25, place a stop loss at $20 and a profit target at $30, then your potential profit on the trade is $30 - $25 = $5.

The risk is then compared to the profit to create the ratio:

С= A/B

where:

C — risk/reward;

А — the profit with a take-profit order (TP);

B — the loss with a stop-loss order (SL).

If the ratio (C) is less than 1.0, then the profit potential is greater than the risk.

If the ratio is greater than 1.0, that means that the risk is greater than the profit potential on the trade.

It is recommended to use trading strategies and entry points with a ratio from 2 to 3. It means that your profit potential should exceed by many times the possible loss.

Some traders decide not to set a stop-loss order, trying to avoid a drawdown. Alas, this strategy complicates the risk management, as the drawdown may deepen. Moreover, you shouldn’t follow this strategy at margin trading. All newbies should use a stop-loss order with leverage.

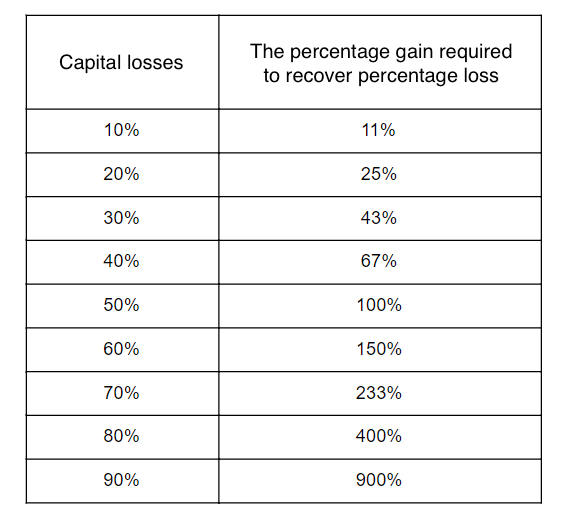

This table below shows the percentage of the profit needed to recover a loss:

As you may have noticed, the table depicts the sum you will need to recover if you lose your capital.

For example, a trader had a $1,000 deposit. As a result of losing trades, only had $100 left. The trader needs to increase the sum by 900% in order to recover the loss.

Calculating position size

Two options are available:

The first one is 2% Rule

(https://cdn.steemitimages.com/DQmcmknFvzxMMkLzVerDf7xVzy2HueGfp9eFXAizwSzmvFF/2%%20(3).png)

(https://cdn.steemitimages.com/DQmcmknFvzxMMkLzVerDf7xVzy2HueGfp9eFXAizwSzmvFF/2%%20(3).png)

Alexander Elder used this algorithm:

The 2% rule is a money management strategy where an investor risks no more than 2% of available capital on a single trade.

It will help you to avoid “the risk of being eaten by a shark”, meaning that a few large losses can reset your capital.

The second one is the Kelly criterion

Level up: this is a formula used to determine the optimal size of a series of bets in order to maximize the logarithm of wealth.

The Kelly bet is:

f = x/K

where:

x — trading value;

К — available capital.

The Kelly formula defines the limit value of f:

f.png

where:

А — the profit with a take-profit order (TP);

B — the loss with a stop-loss order (SL);

g — leverage (equal 1 if we have no leverage);

but we shouldn’t forget about p

p — is the probability of success

Attention, there is no need to use the limit — f max

It will be enough to use this range in order to lower the risk:

diapazon.png

It’s time to take a look at the risks of making a wrong decision

How to work out a probability

If you plan to determine the probability of success, everything depends on the source of your data:

External sources. You can use the average percentages of successful signals. It’s really important to know that groups, chats, and channels may publish misleading information and statistics.

Your own trading strategy. If you collect trade statistics, calculate and analyse your data, and ready to test your strategy, you should take a look at this:

veroyatnost.png

where:

p — is the probability of the trade being successful / conversion rates of positive transactions;

M — the number of profitable transactions;

N — the total number of deals in a strategy

Best tools for cryptocurrency trading.

Automate your crypto trading and learn from the best traders with 3commas