📊 Oct 4, 2018: IMF thinks crypto will play an important role during the next financial crisis, Bitfinex adds fiat pairs for TRON (TRX), Bithumb launches DEX

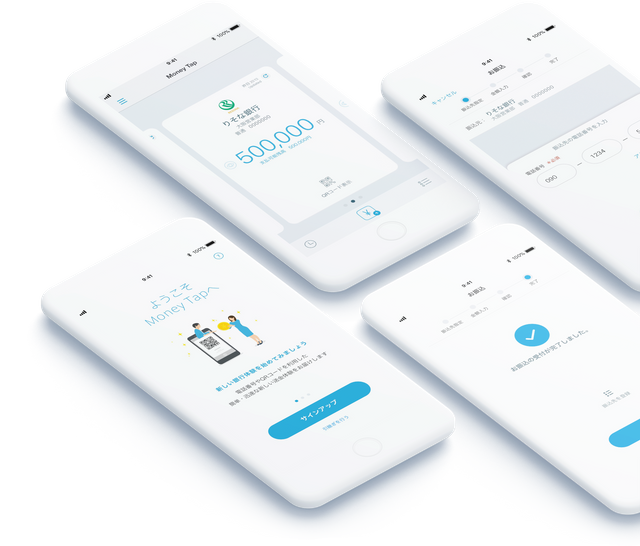

📌 SBI Ripple Asia's MoneyTap App Has Been Launched

SBI Holdings and Ripple Asia presents the new crypto product for banking payments based on xCurrent

The new product released by Ripple and the Japanese financial giant SBI Holdings has already been launched and is being used by organizations. Several Japanese banks began to use the MoneyTap mobile payment application - an application for domestic bank-to-bank real-time payments. Payment software is based on the existing Ripple's products — xCurrent.

The Japan Bank Consortium launched MoneyTap today, a Ripple-powered payments app to offer real time settlement for domestic payments in Japan! https://t.co/nNtkSfq2PN pic.twitter.com/oeg2XBZG66

— Ripple (@Ripple) 4 Oct. 2018 г.

The solution is now being used only by 3 local banks: SBI Sumishin Net Bank, Suruga Bank and Resona Bank. All of them can now make payments in yen or foreign currencies without fees. As for the MoneyTap technology, it is available for Android and iOS, and can be simply accessed with QR codes and mobile numbers.

XRP can't be used in xCurrent and this new application. At the same time, the realization of blockchain payments gives banks a solution for gradually improving their technologies in this area.

📌 Bitfinex Announced Maintenance, Causing "Prices Uncertainty"

(Upd.: Planned upgrade is complete) BTC short rise could be probably caused by the recent Bitfinex update (opinion)

Recently, Bitfinex, currently sharing a 4.04% ($228.51M) stake on the market, announced that the exchange will be undergoing infrastructure maintenance on 4th October 2018. As it happens with large markets, the announcement has generated a lot of theories around what lies behind this update (starting from liquidity problems up to significant changes). At now, the platform should be available to users:

Planned upgrade is complete and all trading and lending functions on Bitfinex are once again live. Thank you for your patience.

— Bitfinex (@bitfinex) 4 октября 2018 г.

Representatives also warned customers about the necessity of orders closing to avoid the consequences associated with price differences. As it became known, Bitfinex’s announcement about recent update provoked the "uncertainty" of the future price, which also made them switch on BitMEX.

A number of analysts confident that the BTC price has risen after Bitfinex announced its maintenance.

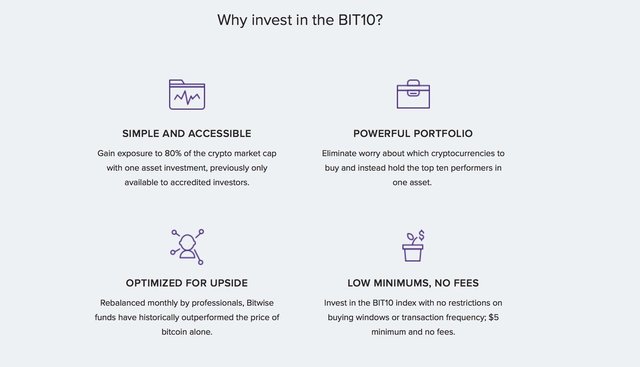

📌 Abra Launches New Token Based on the Top-10 Crypto Portfolio

Abra has launched its own token which price is based on the set of 10 cryptocurrencies. Startup refers to the traditional index model which also may attract crypto investors

Abra, the crypto wallet with a built-in exchange currently supporting 28 digital assets, announced the launch of "the world's first crypto index", which is actually a token based on the cryptocurrency portfolio. This portfolio is made up of 10 top digital assets: Bitcoin (61.19%) XRP 11.94%, Ethereum (11.47%), Bitcoin Cash (4.95%), EOS (2.84%), Stellar (2.49%), Litecoin (2.12%), Dash (1.07%), Monero (1.03%), Zcash (0.89%).

«Today, there are index funds tracking just about every sector of the economy and region of the globe. Mainly because of their low cost and diversification, index funds have become thought of as a foundational element to most investment portfolios.»

Abra — blog

Using the index model, investors now can not only buy assets separately but invest in a token linked to this set. Buying Bit10, the buyer gets a portfolio covering 85% of the market. The decision to launch "index" is quite new for the crypto market, but it also contains all the same, but complex risks. In addition to this, Abra's token is not a security, but is also not a fund, and belongs to a class of synthetic assets.

📌 Bithumb Plans to Release DEX Before the End of October

The largest SK cryptocurrency exchange Bithumb has joined a number of major exchanges, which promised to release decentralized platforms. Coming soon - not later than before the end of this October

According to Business Korea, the new Bithumb DEX platform will work outside the country also, which is a step towards the global expansion of the company. Now South Korea has a rather ambiguous regulation regarding cryptocurrency activity, the representative notes. Probably, this is also one of the reasons for the transition to a new platform, along with the scaling of the Bithumb's business. To make this real, Bithumb is working with global blockchain firm One Root Network (RNT), which already owns a decentralized exchange:

“Bithumb DEX will be operated by its overseas subsidiary. The company is working together with RNT only in the decentralized exchange sector.”

Earlier, cryptocurrency exchange Binance announced the release of its own decentralized platform in early 2019. As for the Korean market, one of the largest digital markets Upbit has already invested in the exchange of that type (Allbit).

📌 Head of IMF: Cryptocurrencies Poses Challenges to Financial System

Christine Lagarde ranked cryptocurrencies as one of the risky areas that could play a role in the future financial crisis. Head also notes that digital assets will significantly change people's lives

Christine Lagarde, head of the International Monetary Fund (IMF), also known as France ex-financial minister, stated that the world is one step away from the next financial crisis. Speaking at the IMF forthcoming annual meeting, opened her views on what exactly could be the causes of the “Second Great Depression”.

Now, most of the headlines connected with her statement, have picked the phrase that cryptocurrency is the problem for the modern financial system; but, actually, the crisis is described as systemic. The organization sees the concentration of banks, growth of shadow lending in China and insufficient regulation of insurance companies and funds that manage assets "worth trillions of dollars". All these markets, as we understand, are many times larger than crypto space.

However, digital assets are also on this list. Financial technologies and cybercrime were designated as risky areas, however, “potential benefits” are also mentioned. Earlier, Lagarde expressed an opinion that "the crypto-assets that survive could have a significant impact on how we save, invest and pay our bills".

📌 More updates

- Bitcoin Core 0.17.0 released. This version includes new features, bugfixes, performance improvements and updated translations.

- Poloniex exchange removes margin and lending products for US customers and delists 3 assets: AMP, EXP, GNO. Poloniex also reminds all users to close all trades prior to October 10th (margin).

- Bitfinex has announced the addition of $JPY, $GBP and $EUR pairs to TRON (TRX).

Great post!

Thanks for tasting the eden!