📰 Weekly Crypto Meta: QuadrigaCX/MtGox Stories Continue, Bitcoin Is Seems To Be Bullish in February, Russia Will Be Disconnected From The Global Web and more

SEC provokes competition between crypto-oriented companies, Quadriga and MtGox stories continue as new details become known, analysts' forecasts regarding crypto vary from bullish to extremely negative and other news

SEC Commissioner: Fund Based On Bitcoin Will Eventually Be Approved

The topic of Bitcoin ETF is still in the field of public discussions on cryptocurrencies. While big crypto media figures claim that crypto ETFs are not necessary for the industry, some investors are still interested in the subject (according to general impressions). At the same time, the details of the upcoming interview of one of the four SEC commissioners, Robert Jackson, became known. And this is probably of some significance, besides a decline in sentiment associated with crypto ETF fever.

So, Jackson noted that the Bitcoin-ETF application filled by VanEck and SolidX is probably more promising (and, therefore, has a better chance of approval, as we can think), unlike the Gemini's application. It can be assumed that this also reflects the general mood around Gemini today, given that Winklevoss are at the center of a legal process against Charlie Shrem because of a dispute over cryptocurrency assets. Recently, it also became known that Gemini is subject to complaints due to unexpectedly closed trading accounts and so on. This generally does not strengthen Gemini’s position in the cryptocurrency market.

But, back to the details of future interview with SEC Commissioner, the following can be noted:

"The case that we had last year involving the Winklevoss trust, in my view, was not a difficult case. So there you had a situation where the risk for manipulation and for people getting hurt was enormous. The liquidity issues in the market were very serious".

The Commissioner also said that the SEC requirements for Bitcoin ETFs can be met by any of the market players, taking into account all the risks:

"Eventually, do I think someone will satisfy the standards that we’ve laid out there? I hope so, yes, and I think so. Getting the stamp of approval from the deepest and most liquid capital markets in the world is hard, and it should be. Once we make it available to everyday mom and pop investors, we are taking risks that Americans can get"

In general, of course, little is clear from this interview, so the old predictions about Bitcoin ETF remain valid. But, SEC’s preferences for certain applications have probably changed.

SFOX Research: Crypto Market Recovers "From Highly Bearish to Highly Bullish"

SFOX researchers claim that the crypto market as a whole is moving towards recovery. This statement is based on its own SFOX index, which shows "mildly bullish" in February 2019. (Of course, the first thing to point out is that the concept of recovery is relative. Objectively, no one knows whether today's Bitcoin price is the lowest possible under these conditions or not; so the market is always in "its place".)

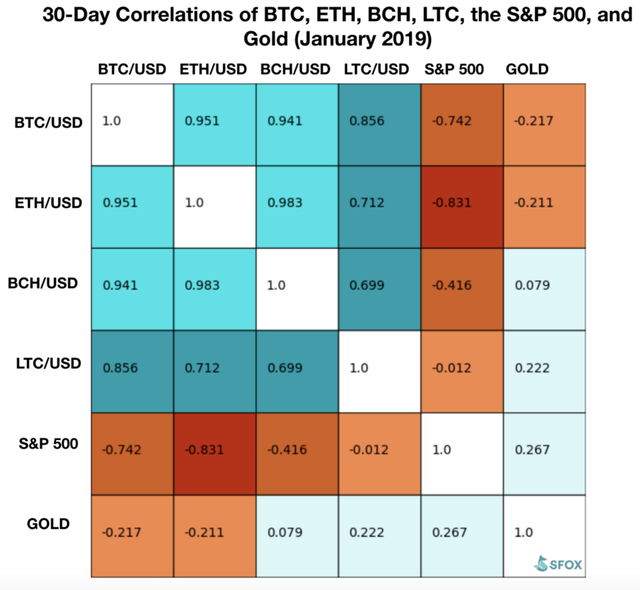

According to the report, if in January the market sentiment was middle bearish, now they have changed to middle bullish. On the one hand, SFOX notes decreasing of cryptocurrency hype, on the other hand, analysts see the overall active development stage as one of the reasons for a gradual decrease in market“s volatility. While the technology got rid of unnatural hype and excessive noise, it has become more common and stable, according to researchers. Meanwhile, cryptocurrency assets are of independent value for investors. SFOX also claims that the correlation between Bitcoin, Ether, Bitcoin Cash and Litecoin is very close:

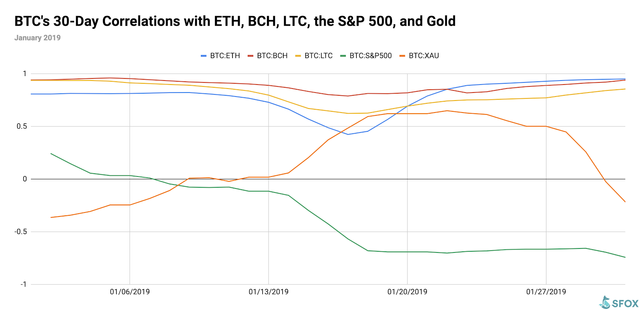

Another interesting fact is the inverse interdependence of crypto prices with the S&P 500 index and gold:

"A graph of those 30-day correlations over the past month shows that there has been a significant amount of fluctuation in BTC’s correlations to the S&P 500 and gold over the last month"

Researches and forecasts appear one by one. And while most analysts agree that cryptocurrencies are in an extremely negative position relative to previous price and volatility values, long-term forecasts are different: from very negative to very positive.

CRYPTO: we see 9 incremental improvements in the landscape that ultimately support higher prices.

Thomas Lee (@fundstrat) February 8, 2019

See below... pic.twitter.com/7DSrfVjkoi

Hester Peirce (SEC) Promises More Regulation In Crypto

The last speech by the US Securities Commissioner Hester Peirce may indicate further action or attitude of SEC regarding cryptocurrency. This time, the Commissioner told about the accusations of investors and regulation of trading platforms.

As we know, the Commission is now rather restrained with respect to new cryptocurrency initiatives. So, in fact, Peirce is the one stands for the protection of moderately regulated digital assets. Besides, Pierce probably enjoys the collective support of cryptoinvestors and is largely focused on demand:

“There is also great interest in exchange-traded products based on bitcoin or other cryptocurrencies. As I have mentioned in the past, I am concerned that our approach with respect to such products borders on merit-based regulation, which means that we are substituting our own judgment for that of potential investors in these products. We rightfully fault investors for jumping blindly at anything labeled crypto, but at times we seem to be equally impulsive in running away from anything labeled crypto. We owe it to investors to be careful, but we also owe it to them not to define their investment universe with our preferences.”

Speaking about regulation of cryptocurrency trading platforms:

"Our interactions with cryptocurrencies are not limited to questions about the regulation of token sales and disclosures. Closely linked to the question of whether tokens are securities is the question of how the platforms on which tokens trade should be regulated. Some of these platforms want to register with us, and I am eager to make progress on this front".

Earlier, Peirce disagreed with the regulatory body that she represents. The SEC repeatedly refused to launch Winklevoss Bitcoin Trust fund associated with the first cryptocurrency, having met the disapproval of the current Commissioner.

QuadrigaCX Scandal Continues, Exchange's Creditors Are Preparing For Trial

The scandal around the Canadian cryptocurrency exchange Quadriga takes place not for the first week. The exchange has been operating since 2013, and over the past five years has attracted 360 thousand people. At the same time, the exchange was individually managed by its founder, Gerald Cotten. The founder of the exchange died in India, as stated by official documents. As a result of this story, the total amount of unpaid funds is estimated at $53 million (Fiat) and $137 million (cryptocurrency).

Many who have studied this story or being users of Quadriga, also could not avoid suspicion and theories regarding the fate of the exchange's founder. Some analysts now believe that the funds may be missing, and not just "stuck" according to the "official" explanation. And, while someone is thinking about the prerequisites for a situation, some users are wondering if this problem can be solved earlier. So, users are also asking the crypto exchange Kraken to redeem QuadrigaCX.

In many aspects, now this situation depends on creditors and their conflict. Claims regarding the procedure for making payments among interested parties have already been made to the court. Many holders of fiat deposits consider that they have a priority in the return of funds, but not all parties agree with them. Now the court of the Canadian province has established a temporary ban on legal actions against the exchange, while Quadriga users are preparing a collective appeal. Probably, this story will not last for one week or even a month.

Jeff Sprecher (ICE): You'll See Bakkt Launch Later This Year

Intercontinental Exchange, Inc. (ICE) CEO Jeff Sprecher said that the launch of crypto platform Bakkt will be implemented later this year. At the moment, it is known that the ICE has spent $1 billion on cryptocurrency initiatives, which also includes financing of Bakkt, and this is quite a significant investment in the market. In general, financing is an important issue for launching the platform:

"our investment in Bakkt will generate $20 million to $25 million of expense based upon the run rate in the first quarter. We will update you on progress at Bakkt and the level of investment as we move through the year. We delivered another record year in 2018 and we have momentum entering 2019".

Hill noted that he sees Bakkt as an investment in many ways. At the same time, which may not be a completely positive sign, the launch of the platform may be moved beyond 2019, as far as we can understand from the interview.

Alfa-Bank Launches Utility Payments Platform Based On R3 Corda Blockchain

One of the largest Russian banks, Alfa-Bank, in partnership with utility cloud services provider Kvartplata 24, presented the digital settlement platform for the housing and utilities sector. This platform is based on R3 Corda blockchain and is designed to bring some positive things in exchange between energy companies, utilities and users.

All users of the platform now can receive reliable and unchangeable information from the distributed registry about which payer, when and for what made the payment. This mechanism emphasizes the platform as the basis for a distributed system.

Meanwhile, the head of one of the largest Russian banks, VTB, compared the cryptocurrency mining to counterfeiting.

What else is going on here? Recently, it also became known that local telecom operators will hold "exercises" to disconnect Russia from the Internet. Probably, Russian lawmakers want to build the same Internet borders as in China, that is, based on local databases and working as an eastern firewall. Few experts come to say how expensive and real this idea is.

Users Can Now Buy Crypto Directly In Opera Browser

Now users of one of the popular browsers Opera for Android will be able to buy cryptocurrencies right in the mobile window:

However, Opera now provides the opportunity to purchase Ethereum only for users from Sweden, Norway and Denmark. This service also has quite high commissions and it is not known whether the purchase option will become available for other cryptocurrencies and countries. Maybe it is still in experiment phase. Users can purchase cryptocurrency using credit, debit cards and payment systems.

GoxDox: MtGox Trustee Nobuaki Kobayashi Used Japanese Platform BitPoint To Secretly Sell Exchange's' Assets

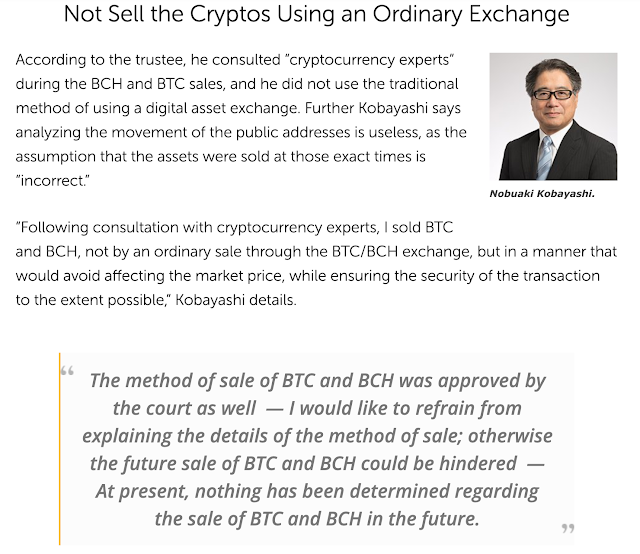

The GoxDox, website dedicated to the support of MtGox creditors, published previously hidden banking documents, according to which the exchange's trustee Nobuaki Kobayashi received payments from the BitPoint exchange. Presumably, this exchange created specially to withdraw Bitcoins and Bitcoin Cash to Kobayashi’s account, which violates the conditions for managing the assets of the bankrupt exchange.

"Instead of taking Kraken’s advice, the trustee decided to (1) sell, (2) not tell us how he sold, and (3) hire a different so-called “cryptocurrency expert” to sell the BTC/BCH".

The total amount of payments received by Kobayashi is estimated at $34.3 billion yen (about $312.5 million at the current exchange rate). Many analysts have suggested that big sales of cryptocurrency could affect the Bitcoin price last year. However, this story still remains a blind spot in the MtGox case.

💸 Axoni, Bitfury, Coinbase, Circle, Gemini and Ripple in Forbes Fintech 50 list | Litecoin becomes the 4th currency in terms of market cap | Binance Coin (BNB) becomes the 10th currency by marketcap, hitting $9,30

💱 Bithumb launched the OTC platform | CZ (Binance): With xRapid, there’s nothing going on right now | Huobi US started Fiat Launch Promotion until Feb.19, USD support added | Kraken acquired Crypto Facilities

👁 Investors report: TON project is now 90% ready | Beware of phishing attacks on MyEtherWallet | 2 OTC desks report their accounts at Gemini closed without explanation | Research: Ethereum suffers from JSONRPC vulnerability issue

Congratulations @icotelegraph! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!