Bearish Bitcoin to Continue Despite Good Weekend, Blockfolio Down Overall

Good Morning My Fellow SteemIt Patrons:

The following is not financial advice. Do not use it as a basis for your financial decisions. Do your own research. It is simply what I am doing with my own blockfolio and I haven’t been trading long. Advice is welcome, criticism will be considered if polite, rants in the comments will be ignored.

Bitcoin had a good run the last couple of days. Every other analyst I watch on YouTube is calling for the moon. They have been at this a lot longer than me, so you can’t discount them…except most of them have been calling for the moon for months.

We could absolutely be in the beginning of an uptrend due to the news on ETFs coming into the space. That said, I’m skeptical. I think it’s more likely we’re in a natural price cycle and we’ll hit resistance at the Kijun at $7,199 and fall back down to the Tenkan before bounce back and forth between the two for a few times.

The cloud, the Tenkan and Kijun, and the past price all scream bearish. Combine that with a lot of sideways price action and it screams consolidation.

That said I’m not committed to the bears for life. If you pull back at a wider view you can see the cloud is getting thinner. The spread of the cloud is significantly smaller than it was in April. I don’t do predictions more than those 26 days out, but if the cloud keeps getting thinner we may be looking at a kumo twist in the coming months that will signal a switch to the bullish cycle.

To add a bit of perspective, I won’t deny that the longer we hang out in the bearish cycle the better it is for me. Right now, I can only squeeze out tiny amounts of money to put into crypto—never more than $100 a month. I will have some things paid off later this year and will have a chance to add a little more. Right now, I’m just doing my best with trading and hoping and praying I can make it to one Bitcoin before everything shifts. I don’t know if the million-dollar Bitcoin predictions out there are legitimate or pure fantasy…either way I’d rather hedge my bets and have as much Bitcoin as I can in case they do happen. I can’t disagree with the people predicting it because ETFs are going to bring a significant amount of fiat into the space this year and there just won’t be enough supply to meet demand; or we could all be wrong and there just won’t be enough interest even when they enter the space to cause a big change.

News on Bitcoin today is that the Imperial College of London has endorsed the currency. That is a big step towards mass adoption. In a better market that news could have provided a bump in Bitcoin’s USD price, but for now everyone is still running scared. Read the story here: https://www.forbes.com/sites/billybambrough/2018/07/09/new-paper-reveals-massive-bitcoin-backing/#52c43d145ead .

On to my holdings. I’m down 1.1% this morning on the value of my holdings. It happens. I wish I only had 1% of my Bitcoin balance in any given alt, but Binance has this minimum trade you must meet. Most of my alts were bought at a value of 0.0015 BTC—that’s my personal safe minimum in case they drop so I can still get out.

I sold BAT this morning when I saw the Stoch RSI rose above 80. I ended up taking a loss on it, but with the thin kumo cloud being bearish it’s best I get out. I bought it on July 1st for 0.00004216 BTC and sold it today for 0.00004166 BTC. I took a 1.2% loss on the trade overall. You win some and lose some.

I had way too much in this crypto, so I’ll be able to make a couple buys today. Better to spread the risk than chance it all on one.

BNB looks like she’s done falling, but I don’t think she has any choice but to bounce today or tomorrow. Let me explain my reasoning on that. If BNB does not bounce soon it will hit a second resistance at the top of the cloud. I think it’s going to be hard to push past both the Kijun and the top of the cloud.

More than that, we’re nine days out from the next Binance coin burn. Supply will go down, but demand won’t. In fact, it’s safe to say that future demand can only increase as banks move into the cryptocurrency space. I am more than happy to hang on to this crypto until we see what the future holds for it.

Don’t get me wrong, if that RSI spikes above 80 I will sell the vast majority of it. I’m just being honest when I say it will greatly surprise me if that happens anytime soon.

You can find out more about the upcoming Binance coin burn here: https://oracletimes.com/binance-coin-burn-is-around-the-corner-how-the-coin-burn-works/ .

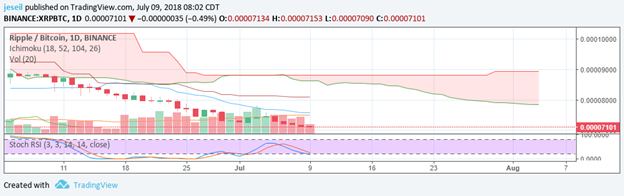

Ripple has dropped some more since I bought it. I am okay with that! I got it at a low. Despite positive news not helping the other alts or XRP, the negative is having an effect. The lawsuits claiming Ripple is a security is hurting the crypto.

Ripple has announced it’s joining three more exchanges. That is a big deal. The sad part is I don’t think that it’s going to cause a bump. Ripple is a solid project though with a ton of believers that act more like a cult than currency traders. I don’t say that as a bad thing—it is a good thing. I honestly think there are enough Ripple true believers to get us through this rough spot.

The RSI is low, so I’m hoping we’ll have only another day or two of falling before Ripple turns around. Who knows how long I’ll have to hold it to sell above a bullish cloud because the bears look like they’re planning to stay awhile.

Learn more about the exchanges Ripple is joining here: https://ethereumworldnews.com/xrp-xrp-to-further-increase-liquidity-through-3-more-listings/ .

Well, it’s pretty clear why my balance is down a bit this morning. EOS has also been falling since I bought it three days ago. That’s okay. There’s always a chance that will happen when you’re trying to buy the low. The indicators are split with the cloud being bullish and the Tenkan being bearish. I had hopes they would balance themselves out, but it looks like I’m in for some pain before that happens.

Looking at the RSI it wouldn’t even surprise me to see the price fall even more before we recover. It looks like we’ll be moving even closer to the bears at the end of the month so who knows how long I’ll have to hold EOS before I can sell above a bullish cloud.

After doing some research on EOS I’m more comfortable holding it. There are those who conclude it is in a deflationary period due to increased demand of EOS’s RAM. I kind of get the fundamentals of what they’re saying, but it’s hard for me to really understand it. I do get that when you have more demand of a commodity that commodity becomes more expense.

Maybe you can work through the technicals of the EOS RAM demand, read about it here: https://coingape.com/eos-ram-fees-account-reaches-1-28m-eos/ .

I get that not much has changed with Ethereum in the last 24 hours. Despite that, this morning I find the Stoch RSI concerning. I would like to see that at a low instead of a high. I really need that TK cross soon for the sake of my nerves.

I also don’t have a good reason as to why it’s staying down. Most of the news for Ethereum is just price analysis. The only thing out of the run of the mill was an article saying the co-founder of Google is mining Ethereum. To me, that’s encouraging.

Read about it here: https://www.newsbtc.com/2018/07/09/google-co-founder-sergey-brin-reveals-he-is-mining-ethereum/ .

NEO has also not really changed from yesterday. I guess I wasn’t even looking at the Stoch RSI yesterday. I should have been. I’ll own that I don’t fully understand the Stoch RSI, but I have seen a definite pattern in that it rises above 80 on a high and drops below 20 on a low.

The upside is that most of the news articles on NEO this morning are extremely bullish. I don’t think their overall premise is wrong, but I just don’t see a dramatic jump soon without an outside influence. Of course, there’s always the possibility they know what the outside influence will be, and I simply don’t. Check out the articles below:

https://globalcoinreport.com/neo-neo-wont-remain-this-cheap-for-much-longer/

https://globalcoinreport.com/heres-how-neo-will-reach-1000-and-establish-market-dominance/

To round out my down day Ontology has also continued to fall. It is in a distinct downward trend, so it’s not particularly surprising, but I was hoping it would start turning around. It may be below the cloud when it reaches it. I honestly thought it would be inside the cloud when it got there on the 16th.

Ontology announced that is has a ‘deep cooperation’ with a credit investigation firm on the fifth. To me, that provides a stability to the coin. If it is being used for real world applications, then the odds of it just dropping off of the exchange is lower. Keep in mind my logic on that could be faulty, but that is how my mind is working this. So…I hold.

Learn more about that partnership here:

https://coinfrenzy.io/chinese-credit-investigation-firm-ont-cooperation/

Now on to the new buys for today.

Tron is perfect for me right now. Its Stoch RSI is below 20 and it’s below every Ichimoku indicator. Could she keep falling? Absolutely, that’s always a risk. It’s a rick I try to manage with fundamentals though.

I don’t see how an unstable project could give out $2 million to projects. I’m not the only one thinking this way either—at least I don’t think so because some writers are saying this is absolutely the time to get into Tron.

https://globalcoinreport.com/best-time-to-buy-tron-trx-here-is-why/

VEN is also in my sweet spot. She’s below all the Ichimoku lines on the chart and her Stoch RSI has dipped below 20. VEN is going to try to get back to that Tenkan, so eventually it will turn around. I’m still unsure how the staking taking place on August 1st will affect the coin.

I know Binance is supposed to handle it, but I don’t understand if that means this coin disappears and the balance transferred to Thor or if it’s something that will go so smoothly that I wouldn’t notice it if I didn’t know about it.

The coin also launched a new wallet today. I’m nervous about the staking, but I went ahead and bought it. I’ll ride it out; if it fails I won’t be losing much. So…basically I’m gambling.

I won’t deny that it makes me happy whenever I log in and see a rise in the value of my blockfolio, but I understand the world doesn’t always work that way. Bad days happen and 1% down is not that bad of a day. Everything I’m in are things I will be holding for a while right now.

I think this month’s additional Bitcoin will drop tomorrow. Coinbase says Wednesday, but it almost always drops early. Knowing that I will wait later in the day to post.

What are your thoughts on what I’m doing? What can I do better?

If I’m interpreting anything wrong, please tell me. I’m new enough at this that I will think long and hard about anything you say. I’ll research it. In the end I may not end up agreeing with you, but I will think through your perspective.

Thanks for reading. Up votes are always appreciated and have a wonderful day.

Congratulations @jeseil! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - France vs Belgium

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes