Could bitcoin be a good long term store of value just because we say it is?

Absofreakinlutely!

The ones calling bitcoin a bubble are not understanding one very important thing.

Well actually, them calling it a speculative bubble is right on.

It is.

However, many that say bitcoin is in a bubble are really trying to say that they think it should be valued significantly less.

But who's to say if they are right or not?

You see, bitcoin is worth $0, or $1000, or $10,000, or $1,000,000.

Bitcoin is worth exactly what it's holders say it is worth.

Much like gold, there is very little intrinsic value of bitcoin. There is the cost of mining the coin much the same way there are input costs of mining gold, so theoretically one could say that price is the intrinsic value. Though many could easily make the argument that isn't even a good measure.

So, if bitcoin doesn't really have an intrinsic value, it's value becomes basically whatever market participants say it is worth.

Which means that if enough people think that bitcoin is a good long term store of value, it actually becomes just that.

The fact that bitcoin isn't controlled by governments, is much more portable than gold, is very difficult/costly to counterfeit, and is fairly secure gives it's holders strong incentive to hold it.

That doesn't even take into account what happens if use cases pick up.

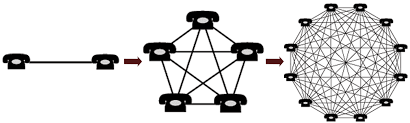

There is also the network affect.

Which says that as it's number of users increase, the value of the network increases exponentially.

Instead of a 1 to 1 relationship, there is an exponential relationship.

I actually did a post about this a while back in how this could pertain to Steem and Steemit and why it is important to get as many users on the site as we possibly can.

The post can be read here:

What this means:

Basically this all means that if we as collective holders of bitcoin decide that bitcoin is a good long term store of value we can essentially make that a self fulfilling prophesy by holding our coins.

If enough people do that, whala! We just spoke it into reality!

Futures launch in T-minus 25 hours, be ready for some extreme volatility folks.

Stay informed my friends.

Image Sources:

https://squawker.org/technology/bitcoin-gold-hard-fork-simplified/

http://www.mkbergman.com/837/the-law-of-linked-data/

Follow me: @jrcornel

Some people defend the high bitcoin fees with ... "well, gold is also not supereasy to move around" (actually, not that difficult to move around 1 btc worth of gold. It can be sent by mail as well, probably for a lower fee than the current average bitcoin fee).

One big difference though, there is no global capacity ceiling on gold transactions.

I am amazed we did not use blockchain deploying our troops. Maybe we could track THOSE TRANSACTIONS as well.

I've read about people arguing that it's important for bitcoin to evolve a fee market in order to include the storage and bandwidth resources it takes for nodes to maintain the network and validate transactions. I haven't read any comments saying categorically that the higher the fees the better. Could you please link the source? Who is defending high fees categorically?

I didn't say that a lot of people categorically thinks that high fees are good - but many people think "it's nothing to complain about". I quite much disagree with that.

The argument "we need a healthy fee level so we'll still have miners keeping the network going on when the block coinbase reward drops to 0" comes up every now and then; one thing is that miners still will enjoy coinbase rewards for an "eternity", another aspect is that to ensure a big fee income in the future, it's important to grow adoption and transaction volume today, rather than to just grow the fees. This ought to be quite obvious. I've touched on this in my bus analogy article.

lightning network almost ready, will solve that problem for bitcoin...go see my post.......thanks....https://steemit.com/bitcoin/@slygag/lightning-at-last-bitcoin-scaling-layer-almost-ready

I actually believe that when Bitcoin starts to reach its capacity and all most of the bitcoins are created, the price will stabilize pretty well. I dont the price can stabilize any other way. People say with more money the price will stabilize, but that will drive up the value and people will sell off, creating more volatility. I dont believe bitcoin will be a stable store of value for a while.

But i also believe it is the store of value against other cryptos and always will be

I thought so already previous year, when Bitcoin started reaching its capacity.

I believe the continued growth is due to new "investors", keeping their coins on the exchanges and having no idea about the capacity limit.

What will happen when Bitcoin starts to get mainstream adoption and it gets so much slower, showing that it's technically unable to handle such load?

Satoshi is glowing in the dark.

Thats why I also believe that one of these bitcoin hardforks will take over and improve this. But the problem now is that people dont want to abandon Bitcoin, but I think they should. The fees are way too high and it is slow. Things cant keep going in the direction they are.

Which coin(s) do you ultimately see ‘winning out’ over BTC long term?

I believe Litecoin is a possibility. Ethereum never will, but it will always be a good choice. I honestly believe IOTA is a game changer. I think i can become huge enough to rival bitcoin and possibly surpass bitcoin. But one of these Bitcoin forks will improve Bitcoin enough to win over most investors. Bitcoin Cash had potential, but it burned out because of security issues. There are many forks of bitcoin coming up. Like bitcoin lightning and super bitcoin and bitcoin platinum. There are many possibilities. But the strongest are IOTA Litecoin and a random bitcoin fork. Bitcoin will be around for probably a year or two more and then it will decline. This is my belief. Do you have an opinion?

Litecoin, I don't like it. It was a Bitcoin ripoff with no major value proposition, other than some people getting rich from the inflation of the crypto currency space. Charlie Lee is one of the big defenders of the current capacity limit in Bitcoin - probably because it makes his Litecoin more popular.

What's wrong with Ethereum?

IOTA, it's so far relatively unproven, they've made some weird technical design choices (like using trinary instead of binary, writing their own crypto algorithms from scratch, etc).

I haven't gotten through the whole whitepaper yet, but as far as I understand it every node needs to know the full history of all the coins they process, and every node needs to do proof-of-work, which I think doesn't sound much promising for a currency that's supposed to be used by embedded devices.

The concept doesn't sound much different from sharding, and sharding is on the roadmap both for BCH and ETH.

I haven't heard of the Bitcoin Cash security issue.

Many good points. So which crypto do you see overtaking Bitcoin? It has to happen at some point right?

And what do you believe will happen to the bitcoin price in an hour when the bitcoin futures open up and Wall Street investors enter bitcoin?

I ultimately think in 5-10 years from now, with the rise of insanely capable AI computer chips (http://fortune.com/2017/12/05/ibm-ai-chip-nvidia/) and/or quantum computing, we’ll be transacting using program(s) we don’t see today. In fact, I was always worried crypto would take too long to be adopted, and would become obsolete before adoption. However, now it’s apparent we’ve reached a critical enough of a mass to begin the s-curve of technology adoption, so in the coming years, I believe prices will rise exponentially, as we saw all of 2017. It’s for these reasons that I believe a “bitcoin/litecoin” partnership could lead the pack, simply because of name recognition, with dash and Monero close behind. In free markets like these, competition is near perfect, so I think the top coins we see right now will all be in play, especially if we develop systems for quick/easy/cheap currency conversions that occur seamlessly as a payment is made.

I think holding all the big fellas right now will get us to the promise land (at least, financially), and then eventually, we’ll move on from crypto (as we know it now) to the next best thing.

Yes. The small ones make quick profits though percentage wise. So I’m trying to get into the bigs and some small ones

ginquitti -You mention BCH had potential. What security issues did it have? BCH provided replay and wipeout protection. Are there new issues with BCH regarding vulnerabilities, or is this based on it's mining difficulty adjustment?

BTC is troubling from ridicules energy needs,

Because the speculators pushed the prices up, this problem is never resolved.

And thus now we are with a very slow and ineffective bock-chain.

Yes, I believe so too, it's quite scary when the market value rises so much as it has been doing for the last year, because the mining energy consumption (measured in fiat) will grow (slightly delayed) linearly with the bitcoin value - and that's not sustainable. Even if the market price stabilizes at the current level, bitcoin mining will drive up energy prices worldwide, possibly enough that ordinary folks may get upset from this.

This is why I believe Bitcoin will kill itself. Something needs to change within Bitcoin itself or one of these hard forks may be able to take over. It needs an improvement

Do you think that Bitcoin will be disbanded To other currencies ???

I believe Bitcoin will just lose its value. I suspect this will happen sometime in the future, hopefully not in 2018. But when this happens, I believe many people will lose their money and it will end very badly. Bitcoin can not last forever. That should be clear to everyone. It will simply lose value because another coin fixes the issues associated with Bitcoin.

Bitcoin is like the first pancake. It’s not the best and you mess up on it, but the next pancake is better. And the one after that is better. Basically you end up throwing the first pancake away and use the others instead because they are better.

How is that for technical vocabulary! LOL

I honestly think its jut a matter of time people stop riding the prices and start to look into the actual technology. We just need to get more accustomed to cryptos and the focus will shift to how cryptos can benefit and make our everyday life easier.

deligious sky 😍 good click

In the end, Bitcoin is worth what people are willing to pay for it.

Do you think if we work to educate people in a systematic way In order to use steemit to connect, blog and invest Thus increasing demand steam And it turns into an ideal way to store over the life ??

You know what...I don't care what it's worth! It is still freaking amazing that someone created this and that we can literally get money out of NOTHING. Here is South Africa you can literally buy a car with one bitcoin and currently you can put down a big deposit and pay off a big chunk of a home-loan if you wished. It is all just amazing. Steemit has changed my life forever and opened a whole new world to me. Even my parents that are in their late sixties are now involved... a bit difficult to explain to them but I cash out their steemit money and they are just glad about the money.

read that again, SLOWLY

Money out of nothing? LOL - that's what the Federal Reserve and the world's central bankers have been doing for decades....

I agree that bitcoin, like any other asset, is worth exactly what someone is prepared to pay for it. Much the same as property. It can’t be valued by how much it costs to mine as what will happen when all (or practically all) bitcoin is mined? You just can’t value it that way!

Right, some people have suggested that the bitcoin value should mirror the electricity costs that have gone into mining it. It's a bit the other way around I think, the electricity cost going into mining will eventually grow linearly with whatever the market is willing to pay for the bitcoin.

Although related it’s not directly related. For example, if price drops 50% difficulty won’t drop 50% as most miners have very cheap/ free electricity and have already bought hardware so it’s a sunk cost!

But I agree that if the price continues to grow, so will mining and hence difficult. And if the price drops miners may delay or cancel future investment but will not turn off existing miners!

Well, there are some "market inefficiencies":

With a growing market price, the electricity costs may fall way behind the market value due to a time lag - it takes time time to get new mining equipment online.

With a stable market price, the electricity costs will probably be some levels below the market value, mining equipment represents big investments, investors may shy away from risks and may require a decent return on the investment.

With a stable market price, mining cartels or big centralized mining pools may also decide not to invest too much into mining, as all new mining equipment put online hurts the profitability of existing mining equipment.

However, with a falling market price, we'll actually see equipment being turned off. There is equipment out there that is less efficient than others (i.e. old mining gear), and some miners are having higher electricity costs than others. If the price falls too much, some equipment will become unprofitable to run, and it will be put offline.

To an extent I agree. All the talk is now of a new massive figure that bitcoin will reach, which makes me rather nervous!

And what if the majority of the buyers, only want in because they expect an increase in price.

That has been the case for a long time now. The vast majority of people don’t buy bitcoin for its utility but because it has gone up so much and they want a part of the action. Current price is based on pure speculation!

Yeah. This has been the case for a long time. It’s personally what attracted me to bitcoin at first. I was talking to someone about how to get rich and some random stranger mentioned bitcoin. I looked up the prices and the increases and was impressed. That got me looking into what was behind bitcoin and the other coins. I have learned so much since that time and I believe that one of these coins has to technology to become THE crypto currency. But i dont believe it will be bitcoin in the end. This is why i am invested in other coins, while still riding the price of bitcoin.

Value is based on supply and demand.

The only difference between Gold and Bitcoin is that if people stop using them for monetary exchange Bitcoin will be worth 0 and Gold will be worth something greater than 0, but that amount would still be much lower than it is today.

Another way to think of it; It is personal fiat (I think it so) that gives anything value. It is government fiat (I declare it so) and force that gives the dollar value.

Nothing has intrinsic value, and in light of this everything is somehow a bubble. And it will burst the moment everybody starts to think it is near to burst.

Did you coin (pun intended) the word "Absofreakinlutely"? I really like it as I am a fan of the creative and novel.

You are 'AbsoFreakinglutely' correct with the intrinsic value which is what we agree it is becomes what it is. The truth is this: Money isn't the paper you tender as an exchange of value or service given. The money i transfer to you from my banking App is basically numbers just as the digits we transfer in crypto.

There is not intrinsic value in anything even Gold as we can decide that gold isn't worth a dime and it is so.

Those that are scared of cryptocurrency due to their assumption of it's value are actually deep in valueless transactions within the Fiat system.

Very true: "There is not intrinsic value in anything even Gold as we can decide that gold isn't worth a dime and it is so."

Haha I wish. I heard it somewhere, can't say exactly where it was though. Feel free to use it :)

Very informative post, thanks for sharing

Thank you. You are exactly right.

When people talk about BTC or crypto having no value that implies that the millions of holders have no use for it or desire to keep it... Of course we do have use for it and we do want it so it does have a value. And the more people who want it, the more its worth.

Supply and demand.

Great post. Up-voted and resteemed.

This is going to be Epic.

Confidence is what gives any currency value. If everyone suddenly stops desiring a certain yellow, shinny, rare metal, the value would plummet, because the commercial use of this metal has a lot less value than its desirability. If banks start to value packages of sub-prime mortgages, they gain value as a currency and can be traded and sold, but if confidence is suddenly lost....

The bitcoin price will readjust (possibly sharply) when more people decide to sell than hold or buy, and confidence will plummet from there as everyone tries to lock in their gains. Until, that is, enough people decide it again posses an opportunity. It is all about confidence. Nick.