German Bank says BTC "should" be worth $90k in 2020

A German Bank says bitcoin is likely going to go a lot higher in the coming months

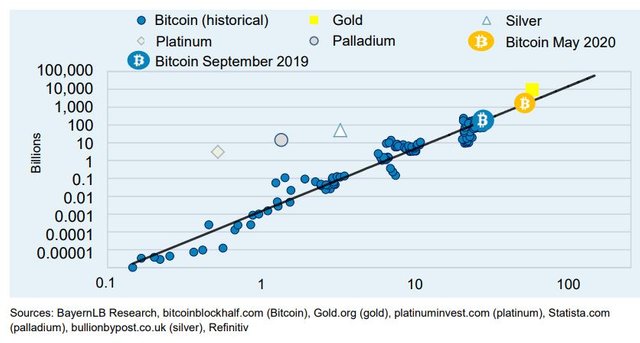

A bank out of Germany, BayernLB recently published a report about bitcoin and gold.

The report specifically talked about valuations for the precious metal and how those have also been applied to bitcoin prices with astonishing accuracy so far throughout its brief history, by comparison anyways.

Gold has been around, since, well, forever. Bitcoin has only been around for about a decade.

The report can be seen here:

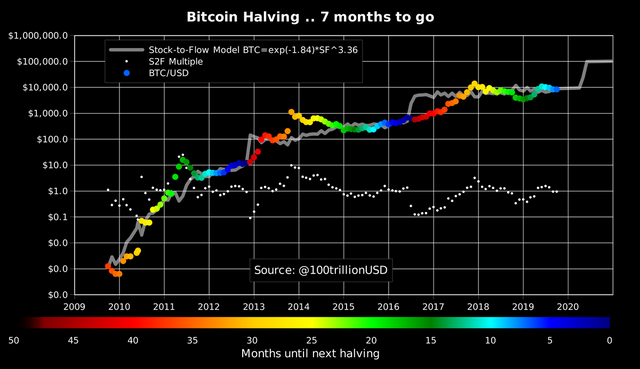

The Stock-to-Flow Model says bitcoin is going a lot higher

People may be wondering how they are coming up with such a wild price prediction for bitcoin in such a short time frame...

Let me first say that it isn't a prediction per say, but more of an "if-then" statement.

IF bitcoin continues to follow its stock-to-flow model/ratio, THEN the price will be $90k somewhere around its next halving, which takes place in May of 2020.

(Source: https://twitter.com/100trillionUSD/status/1178974437036740609)

Cool, what's a stock-to-flow model?

Stock-to-flow models are used to quantify the hardness of an asset. The harder the asset (in the model) the more likely it is to be used as money.

There are many reasons for this that I won't go into here, but they are listed in that report I linked above.

Bitcoin has already shown that it is very hard, very similar to that of gold, and likely to only get "harder".

It's interesting to note that gold and bitcoin appear to be very "hard" and work well as money partly because there is almost no (or very little) industrial use cases for either.

In very basic terms, the stock-to-flow model comes up with a ratio for a commodity (such as gold) by taking the amount of the asset that is held in reserves, and dividing it by the amount of the asset produced annually.

Interestingly enough in bitcoin's case, this model has been more than 90% accurate for all of bitcoin's move since it was created.

This model will really be put to the test during the next halving, because if bitcoin is not somewhere near $90k around the halving, it will be the first time ever that bitcoin failed to continue to move up in accordance with its stock-to-flow model.

We will find out either way in less than 8 months.

Stay informed my friends.

-Doc

Sorry, thought you are talking about the Germanbank (Deutsche Bank).

Posted using Partiko Android

Nope. They do have a lot of negative things attached to them though.

Definitely not buying this 🙁😒😒. No be only $90k🙄🙄.

Though it's good to buy Bitcoin now. But reaching $90k b4 the next 8months is a big joke😐😂😂

Posted using Partiko Android

Yep, I find it highly unlikely as well. Though, it doesn't specifically say by the halving, but somewhere around there. I think if it hit $90k at any point in 2020, it may qualify.

Lol. We shall see. I'll remind you by 31st December 2020 😂✌@jrcornel. $90k is way too high.

I don't see Bitcoin reaching that price until circulating supply reaches 21 million. And that won't happen anytime next year. Though we're around 18Million already. My opinion 👩👩👦👦👩👩👦👨👩👧👧

Posted using Partiko Android

Do you have any idea how long that will take to happen???

Perhaps 2 to 3 years😂😂 due to the mining speed these days

Posted using Partiko Android

Most estimates point to 2140 as the date when the last bitcoin will be mined and all coins will be in circulation. Safe to say, we won't be around to see it.

Lol. That's a century away!! 😵😵😵

Anyway. I don't see Bitcoin reaching $90k by next year. Really..

Posted using Partiko Android

I don't either personally, but I do think we break $20k next year. In fact, it might even happen by the halving in May.

These things are hard to predict, especially since every day is essentially uncharted waters when talking about crypto. When we talk about Bitcoin, the proverbial pioneer of this asset class, there are some very interesting things to consider. Like 85% of all the Bitcoin that can exist, already does exist. The remaining Bitcoin is a known quantity, with a known (or at least a reasonably known) "extraction" cost and time-frame, making the mining a comparatively easy cost-benefit calculation, if future value is stable.

Imagine if the same were all known knowns for gold: that we KNEW how much gold there was in the world, and that would ever exist in the world, knew when and where the remaining would be found and at what extraction cost. What would this knowlege do to the price of gold?

Then, we also have to consider "burn rate" for Bitcoin. I've read where it is estimated that anywhere from 5-10 million Bitcoin have been burned or lost, virtually cutting in half the available quantity, EVER available, almost in half. So, again, what does that do to the price of an asset's supply and demand calculations?

I dunno. But if I figure it out, I'll let you know...for a fee of a million bucks per!

There are estimates of how much gold is left to be mined. The thing with gold is that if demand increases, so does mining (which means more supply). Bitcoin's supply increases at a known fixed rate, irregardless of demand. Plus there is the issue of gold on asteroids and other planets etc that will likely come onto the market in the future. Bitcoin doesn't have that problem either. Which is why bitcoin is and will be harder money than gold in the near future.

My point exactly.

To my knowlege, there has never been a widely accepted currency that has an absolute fixed maximum supply. As the supply is a known, not just estimated, quantity, and the currency has no intrinsic or practical use (gold CAN be used for other things other than a currency) demand will largely be determined by acceptance. If it becomes widely accepted, as it seems to be more and more each day, then the network effect will kick in and make Bitcoin a very hard currency.

That's why I've never understood those who wish to "burn" crypto as a strategy to increase demand by decreasing supply. If it is harder for people to get into crypto, that is more expensive, then mass adoption will be harder to achieve. For a currency that has no practical or intrinsic value, like crypto, it seems to me that easy and cheap acquisition by the masses is a much better way to achieve mass adoption, and thus inducing the holy network effect. I think STEEM could use something like this where instead of burning STEEM by sending to "null" (I assume there are folks still doing this...I'm not as active here as I used to be), that the "null" account keep the STEEM in play, but just delegate it to new users for a certain time frame. Something like 100 STEEM for those who make one post a week for a year's time. Maybe a graduated program like 200 STEEM for those making 3 posts a week and 500 who make at least one post a day. Then you get people hooked on the site, on making STEEM and, after a year, their delegated STEEM goes to another newbie, but we've hooked the first one already so they continue on with their own account as a result of the network effect.

But, I digress. My point in all this is that I agree Bitcoin, as well as STEEM, can become hard currencies, if they can become the beneficiaries of the network effect of mass adoption and demand. However, "If" is a small word, with a big meaning.

I agree about the network effect and steem needing the masses to have value. However, steem will never be hard money with its current configuration, at least not as hard as bitcoin. Steem's supply increases indefinitely at .95% (once it gets there), there is no cap on supply, which means it also must have a steady stream of demand otherwise prices go down.

Wow this post is great and very informative. Really want to see a 90k Btc price .

Posted using Partiko Android

Yep, same here.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

German Bank? Known for the biggest scandals? Why should we trust them?

https://m.dw.com/en/deutsche-banks-5-biggest-scandals/a-46510219

Posted using Partiko Android

So every bank in Germany is the same? BayernLB is not Deutsche Bank last time I checked... Not saying they aren't possibly involved in their own shady dealings, but one has nothing to do with that link you just shared.