The 2018 CryptoCurrency Market Correction has Shown Most of the Trading Analysis on Social Media Ineffective in a Bear Market - A Call to Watch the Fundamentals Instead

(To be clear, this piece was written mainly because of the several newbies to cryptographically-enabled digital currencies that have approached expressing disillusionment or even got discouraged from the technology due to some of the analysis they consumed and followed, rather than focusing on the fundamentals and what gives rise to value.)

During this cryptocurrency market correction that effectively began late December 2017 for bitcoins, the fundamental metrices was already showing the signs of a correction. In an invited expert blog on cointelegraph highlighting the fundamental drivers were indicating a coming correction:

Source: 2018 Blockchain and Cryptocurrency Outlook: Expert Blog.

Also recently, I wrote about a week ago that Bitcoin does not seem to have recovered fully yet (here and here).

However, on social media, the trading analysts kept predicting a bull market. Even after the first drop from $19K to $10.4K by December 24th, they simply predicted new highs to follow it right away. Then when it crashed in January to $9K they declared the bottom was in. And then when it got to $8K they called the bottom; but it just went down further still. Even on Friday as soon as it turned up again past $10K after dropping below $9k, they declared it would break out. This has caused a lot of people to lose cash that could have just held on to. Instead they bought Bitcoins at $17K or at some value higher than $6K when they could maybe have bought 2x to 3x as much of the same.

The problem is not that analysts do not mean well but that trading analysis tools are not equipped to discern the fundamentals currently driving bitcoins. And the fundamentals are what gives rise to the sentiment of investors. For instance if the transaction fee chart has a certain trend, or time for transaction to confirm, or more businesses begin to no longer use an asset - those are important variables. Those will determine how end users and ultimately investors feel about the asset, and those fundamental metrices can be mathematically modeled and result in more relevant long term results than chart analysis based solely on the asset's market price. In a bull market, since everything was rising, it was easy to appear correct by drawing lines (and more new lines when those old ones are not followed) and predicting new highs; especially without specifying a time frame. Because eventually everything was going up so every bullish analyst was bound to eventually prove correct.

This is not good for the blockchain space in general and has caused significant disillusionment from new entrants who got in following such bullish predictions rather than focusing on understanding the technology and what makes different assets of this space valuable. Essentially new entrants need to take heed to the fact that much of the analysis they are consuming lacks much basis and focus on fundamentals. What makes things valuable long term. Steem for instance is one blockchain asset that is now actually being used by millions of users who are on the platform each day and contributing to it. It has a real use case. Several use cases. Many listening to those pushing assets that have no utility, dubious potential utility, or whose fundamentals are pointing to declining utility could get hurt financially.

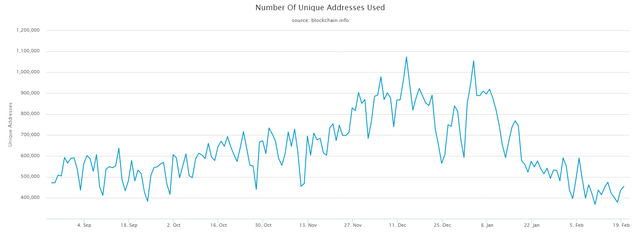

As for Bitcoins, keep an eye on this one fundamental long term - the daily unique address. It measures how many actual new users are joining the platform. Through its existence over 9 years it has been a growing metric. If that metric is declining, there is virtually no chance for the asset to sustain any long term recovery.

Source: Blockchain.info on Feb 21 2018

For those interested in a more deep dive into details of models based on this fundamental metric check the reference below, or other more user friendly articles in my profile.

On a final note, the daily unique address growth rate could turn around say in a few days or week and we could likely start to see return to normal growth again. This article is not to be interpreted as one disparaging bitcoins. It remains a revolutionary and leading asset that ushered in the entire blockchain technology space. And there is nothing wrong with taking calculated risks on some of the new assets where yes their promise may or may not pan out, but if they do could create significant rewards. This is not written to disparage analysts, but simply a call for renewed focus on fundamentals and the understanding that most analysis lack the basis for the bullish calls that is prevalent in this space.

Legal Disclaimer: I am not a financial advisor and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only.

It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Fundamental vs Technical? MAy be both...

Please explain more what you mean. Thanks.

100 percent correct. Lots of people got burnt listening to some analysts. You must do your homework and not just believe blindly. I have been working with 3 very closely and it's amazing how different their thought processes are. You know you are ok when they all come out with the same result. Bit like getting a second opinion from a doctor I suppose. Learnt to wait using their guidance and analysis to see what transpires. This way it is less risky.

Is number of unique addresses a leading or a lagging indicator?

Important distinction. Not clear you reported any data to clarify that question.

It is an input into the model. And the model outputs value.

TA is definitely not working in this market, dollar cost avg in and HODL ! that's really all you can do right now. Double down on the projects your really believe in, deals everywhere.

Double down approach is good approach when you expect a good future. With no proper insight, market not following any rules , I think Double down is double risk.

Yes it might be double the risk, That is why I stress make sure it the projects you believe and have faith in ( your long term hodls )

FREE COINS February, 26th #AIRDROP #Bounty #bitcoin#USD #ICO

https://steemit.com/free/@riann/free-coins-february-26th-airdrop-bounty-bitcoin-usd-ico

Thanks for this informative post. I prefer the long term hold approach for the projects I really believe in. Daily trading and all the chart analysis stuff is not gonna help a lot.

@kernaphael Thank you for your insights.

I would be very interested to hear any if you've done any analysis that incorporates a relationship between the rate of new unique users and the distribution of wealth on the rich list. I've wanted to explore that relationship myself, but have not as yet taken the time to figure out a good approach.

Have you done this kind of analysis, or seen anyone doing so? I feel like it could be very telling if done right. Let me know what you think!

No I have not done that yet. But I have tended to look at that distribution when considering the potential of the new alt coins. I agree this kind of analysis would be very useful for bitcoins as well, although my prior sentence implies that I believe bitcoins is now a bit more distributed such that the variable might not have as much effect as for the newer alt coins.

Additionally, I know you just finished explaining why you don't like technical analysis, but if you were to pick a set of three buy targets, what would they be, and how would you weight them? Don't worry, I will just take it into consideration, not blindly follow...

Here are mine.

https://steemit.com/bitcoin/@waygreenergrass/bitcoin-price-trend-analysis-possible-support-targets

I don't specify time frames very specifically, but my trend lines do inherently include them... I'd appreciate your thoughts!

I upvoted this but refuse to be drawn into making a price-chart analysis and recommending numbers ;) That was what this was trying to discourage. The disillusionment that comes from following chart analyst recommendations. No matter how I do it - let's say I opine that I prefer any of your lower entry points right now, someone reading this will want to take it and begin to make buying decisions on it. I suppose my posts of nearly 2 weeks ago that there was no recovery when many analysts were already calling 12K+ and other highs, kind of already made it clear I was expecting to see some lower numbers. And there's the article from Dec 2017 above stated that the retracement should not be as deep as 2014's, which was 80%, based on the model. But beyond that I don't want to replace following a bad habit of following someone else's numbers with another one of following mine.

But the answer is fundamental investing. Full understanding of what value you place on an asset. Take Steem for instance. Based on the fundamentals I bought in. I don't need an analyst to tell me an entry point.

But to be helpful if anyone is already bought best thing is to not panic and maybe wait out the downturn. But if they see more fundamentally valuable assets going by, then get into that instead. Just like if you were holding pets.com investments in the 90s and you see amazon.com going by. By all means move along with the more valuable fundamental asset with cheer and don't look back. If the fundamentals and the full understanding of the asset, the technology, and due diligence is done they would be better off in the long run and the space would benefit from more confident and informed investors supporting the tech they invested in.

Thanks for your measured input! I knew you'd be a good person to ask because you'd give me reasoning rather than specifics, which is exactly what I like, haha. You'll be seeing me around. :)

your post is good I wait for the next posting

informative post i belong to team HODL i dont pay any negative attention to social media i belive in crypto the technology and the future use of it.

thanks for sharing .

Great post my friend and appreciate you sharing the info with us! #teamhodl