NYSE Owner Trying to Make Bitcoin the 'First Worldwide Currency'

The owner of the biggest stock exchange in the world -- the New Work Stock Exchange -- has high hopes for bitcoin. Bitcoin has unrivaled potential to overcome all boundaries and become the first-ever world currency, and he's trying to make it happen.

flickr/George Rex, CC BY-SA 2.0; pixabay

Jeffrey Sprecher is the founder, CEO and chairman of the Intercontinental Exchange (ICE) which owns the New York Stock Exchange (NYSE). He is also starting a new company called Bakkt with the goal to connect the worlds of crypto and mainstream Wall Street.

In an article speaking with Fortune, Sprecher thinks he can bring about bitcoin's greater potential to become the currency of choice throughout the planet. And Bakkt is his way of trying to make it a reality. Speaking about bitcoin being used for global payments, Sprecher says:

"Bitcoin would greatly simplify the movement of global money. It has the potential to become the first worldwide currency."

Many believe the lack of a respected regulated caretaker of the investing landscape as a reason for institutions staying away. Bakkt seeks to address this. Sprecher says his company will act to alleviate these concerns:

"In bringing regulated, connected infrastructure together with institutional and consumer applications for digital assets, we aim to build confidence in the asset class on a global scale, consistent with our track record of bringing transparency and trust to previously unregulated markets."

Kelly Loeffler, CEO of Bakkt details some more of the plan to take bitcoin mainstream:

"Bakkt is designed to serve as a scalable on-ramp for institutional, merchant and consumer participation in digital assets by promoting greater efficiency, security and utility. We are collaborating to build an open platform that helps unlock the transformative potential of digital assets across global markets and commerce."

ICE is already behind the NYSE, and now is position itself to be behind the shift in bringing bitcoin and crypto to the mainstream. It will launch physically-settled bitcoin futures and custody cryptoassets to assist in merchants being able to process bitcoin for everyday payments. It's an ambitious attempt, but could benefit the company greatly if it pans out, as well as the whole crypto sphere.

With a bridge between traditional financial products and crypto, this can attract the conventional investors who are skeptical of bitcoin, as well as younger investors who are skeptical of the traditional financial system.

"Millennials don’t trust traditional financial institutions. To gain their trust, banks, brokerages, and asset managers can use a currency that millennials believe in, like Bitcoin. Using digital currencies brings a lot of sizzle."

It's funny how many people have faith in a guy no one has ever met or knows to actually exist -- Satoshi Nakamoto -- while they highly distrust the US Fed. I think that speaks volumes about how much potential and much more reliable the blockchain crypto technology is, since it doesn't rely on trusting anyone, even a guy who may or may not exist. It's less about trusting a man no one has met, and more about a trusting a trustless ledger technology that surpasses the old-school US Federal Reserve system that's controlled by people we can't trust.

Thank you for your time and attention. Peace.

References:

- The NYSE's Owner Wants to Bring Bitcoin to Your 401(k). Are Crypto Credit Cards Next?

- Bitcoin Could be ‘First Worldwide Currency’: NYSE Owner

- Breaking: World’s Biggest Stock Exchange Operator is Launching a Bitcoin Market

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

It’s both great as well as scary. There are a lot of reasons people don’t trust the stock market. This doesn’t really do much to alleviate our gripes with that system.

Nice response. I'm on the fence with this news.

I couldn't agree more. There's a lot of fuckery to undo... Or at the very least to stop doing and never do again.

Thanks, agreed. They need it more than we need them.

Well it's going to integrate them further if he pulls it off. I guess then there is no trusting either of it when they merge :/ Shit... :P

I think just bitcoin, or at least I hope. I am hoping that we can still have alt coins and other new coins to be able to use and grow with.

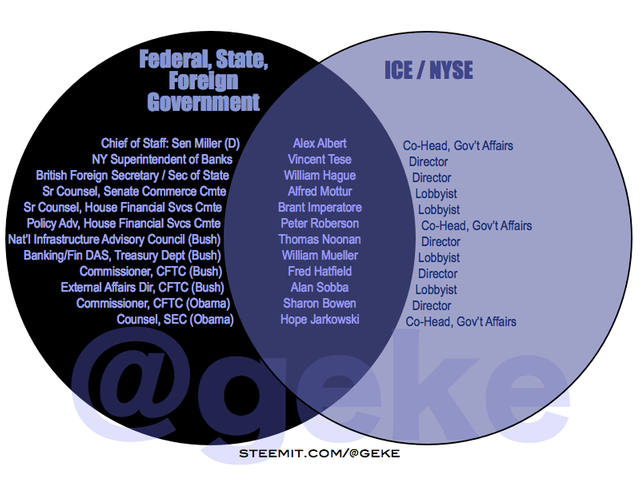

I did a venn on ICE a while back...

Yeah, no doubt there is an overlap, as in most cases the private and public work as two hands of the same body... :/ nice work ;)

I think people just want change,and this might be the chance the world is waiting for.

It could be a big step towards greater crypto acceptance...

You bet Jamie Dixon wants to enter. In this stage of the cryptosphere (just after the dotcom bubble), profits achievable with crypto are unheard of. Even for unicorn chasing VCs.

But could good old Jamie publicly admit such? What with fiduciary duties and so on.

While those 0.01%’ers constantly grow in wealth, they also put their head on the chopping block every day. A very comfortable chopping block though, one with more than a golden handshake when things go wrong.

He already has a blockchain department, until recently even led by a woman. So much for somebody “not believing in crypto”.

This announcement is great and its the third major one, after BTC futures and the Stuttgart stock exchange’s launch of its own app - coming later this year.

Regulations? We all know we won’t be able to avoid them. Those who want can always go Monero, ZCash, and the likes. Until those will be delisted from exchanges licensed to operate with fiat. Is that userbase large enough to bring the long overdue dEx consolidation and growth? Right now I doubt it is.

Let’s see what the Millennials actually bring to the table. Let’s see if they move their bottom cheeks to there where the evolution actually happens and where mobile wallets without interference (beyond AML/KYC) are actually becoming a reality. Coins.ph has 5 million verified accounts, in a population of less than 120 million people. The change is happening, but it will take a while before it happens in first world.

Addendum:

You overplay the common knowledge level here. People trust personal recommendations. Hopefully, those are based on the actual understanding - and trust in the new platform - of those who recommend. But as we go more mainstream such understanding will be like what we saw in Q3 and Q4 2017: FOMO.

My peers join because they trust me and my knowledge. They couldn’t care less about the decentralized system.

Perfect example: Millennials say they don’t trust Facebook yet all have Netflix (recommendation engine almost as good as Amazon back when it still sold books), use Uber, and they went from FB to Instagram. I still haven’t seen many in my Signal Messenger tho.

I meant trust in Satoshi that no one has ever, but I didn't reiterate it in the sentence ;) It's about the tech, not the man behind the tech to trust ;)

Regulation is coming indeed, will be a boom to the buy ins as I see it ;)

I keep saying that all of these crypto currencies are being beta tested for a final one world digital currency to use to control the world. If they do not like what you say they will turn off your currency chip or at least limit it and gone will be freedom of speech. Thanks @krnel

That’s my concern as well. We will see what happens; one thing I like is the creation of other coins not just bitcoin.

It could be. Digital path is the death of cash... I use cash everywhere except when buying online obviously...

I have no doubt that there will be mass adoption, as well as a bubble that will dwarf the pump seen last winter coming. The Robin Hood trading app has already jumped on this bandwagon.

I still suspect that this is all created and meant to funnel us all into a monetary system they can control through computers. Pretending they fear it as they laugh behind closed doors about how easy we are to trick.

Yeah, create fear to prevent early adoption as they adopt it instead, then bring it into the limelight and get everyone else on board after they already dominate it.

Great news, but no price movement.

I swear we will even get Bitcoin Etf approved and the price will go down even more.

Market Always does the opposite of what people think it will happen.

I think it does go up sometime son good news, but then some people might view it as bad news... lol

For the last 6 months i am expecting for the price to go up but nothing.

The biggest potential for freedom,, and the biggest threat of freedom -all at the same time....

...Interesting times.

Well said. It’s a very sharp double edged sword.

Its a race going on to enter big stock exchanges to crypto market because they know they have to enter it to rule the world as binance and coinbase did.

Binance and Coinbase are merely pocket change for the stock exchanges. They even don’t register on the radar yet.

But they proved that they can do much better for the future of blockchain. Thats y international stock markets are ready to move to crypto and test their platforms.

Do you have any validation of the second part of your claim? 🤔

Just have a look here: (https://www.ccn.com/binance-surpassed-germanys-biggest-bank-deutsche-in-profitability/)

Yeah, it's a step towards greater mainstream injection and possible control...

This is great news, I think the bitcoin is a currency for the future of nations, possibly the only world currency in the future according to the new world order that want to implant some political currents