Peer to Peer bitcoin trading with cash is a critical part of the infrastructure - While regulators pressuring LBC and Paxful it is time to look for alternatives

Localbitcoins, the leading peer to peer marketplace that earned its reputation mostly through the ability to trade bitcoins for cash is slowly changing to a normal exchange due to regulatory pressure. Earlier this year KYC got implemented and last week even support for cash trades was dropped. Sadly enough, also Paxful, te 2nd by volume was subjected to KYC recently.

The exact thing that made these platforms very useful for millions was taken away by law makers overnight and destroyed the core of their business model. Even worse off are the people in countries with an unstable currency, who saw their ability to buy bitcoin freely and anonymously in order to preserve their wealth disappear.

Bitcoin is becoming relevant, thus the resistance from governments against free and private cryptocurrency trade is likely to increase. Crackdowns on non-KYC services will be seen more often and more countries will prohibit cryptocurrencies as a whole.

Alternative Peer to Peer cryptocurrency trading platforms without KYC like Localcoinswap, Hodlhodl and Bisq are critical to preserve free cryptocurrency trade in the years to come.

Because this is an extremely important issue, I want to urge @dollarvigilante, @joshsigurdson, @lukewearechange @skycorridors @marketingmonk @jeffberwick to bring this subject under attention!

Why is Peer to Peer trade so important?

Governments want to regulate every crypto transaction and forced KYC and AML on almost every bitcoin business over the previous years. If they succeed to regulate every fiat onramp, buying and selling bitcoins will not be permission less anymore and the ownership of every coin can be traced and identified. This would greatly impact our freedom. Peer to Peer marketplaces without KYC are our best chance to beat this.

Privacy and fungibility

When you send bitcoins from a KYC service to your own wallet your name will be linked to the wallet address and all your payments from this adres can be traced. There are ways to break the ability to trace funds like coinjoin, coin mixers or the use of anonymous coins. However, these measures are often not 100% reliable and can be complicated or costly to use.

This means that your privacy is in danger when you use KYC services. Furthermore, when a big part of the coins can be de-anonymised the fungibility of the entire currency will be at risk too. Peer to Peer exchange between bitcoins and cash is anonymous as long as the platform you use and the trading partner doesn’t leak your information.

The ability to buy bitcoin when it is illegal

India is planning to prohibit every involvement in cryptocurrencies and want to jail violators for ten years. Obviously, this will expose the government for being a power lusty selfish organisation that isn’t there for the people, but purely for their own interest. It will also enable them to misbehave even more and devalue the currency at an even greater pace. The escape hatch is closed, so the Indian people will be forced to go down with the sinking fiat ship.

This will cause an even higher demand for bitcoins, but they will not be easy to get. All the official services will be shut down. Peer to Peer trade will be the only way to get some coins and secure a living.

Peer to Peer exchanges are the only way to enable people in countries like India to escape the collapsing system and preserve some of their hard earned wealth!

The ability to buy bitcoin in countries with a weak banking infrastructure

KYC means that you have to fill out a lot of forms to be able to connect to the banking system. This is not only harmful for your privacy, it can also endanger you when your financial information get leaked. But, there is an even bigger problem with KYC / AML…………

Billions of people don’t have an official address or an ID, so they are simply not able to complete the KYC forms. This means that they are not able to enjoy financial services, while a loan, inflation protection or the ability to crowdsource would be an amazing tool to escape from poverty.

In other words: KYC is keeping people in poverty by eliminating their most important options!

Because of reckless money printing over the previous years, many fiat currencies are suffering from high inflation or even hyper inflation. Bitcoin is one of the best tools to preserve wealth, thus many try to escape through bitcoin. The effected countries are exactly the countries with a big unbanked or underbanked population. They are not able to buy bitcoin through KYC services. For most of them the only way to trade is with cash.

A peer to peer exchange without KYC is their only possibility!

What are the options outside of Localbitcoins?

LBC implemented KYC and dropped support for cash trades, thus is sadly enough not useful anymore for the biggest part of their customer base. Paxful, the 2nd biggest Peer to Peer marketplace implemented KYC recently too, and I think it is fair to expect them to drop cash trades soon too. This means that the two most relevant peer to peer marketplaces are being made worthless by regulatory pressure. This is a huge hit for the infrastructure. There are more resilient options, but the volume there is still low. This means that we need to grow them first!

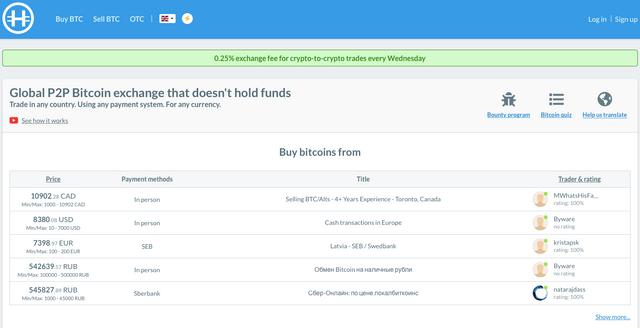

HodlHodl

Hodlhodl is a peer to peer exchange that uses multisignature contracts to do the escrow. This means that they don’t hold any funds and thus don’t have to comply to KYC / AML regulations. However, it is still a centralised company and they take part in the proces as co-signer to release the funds in case of problems between the trading peers. Because they realise that they are not immune to regulation they already block Americans on their platform.

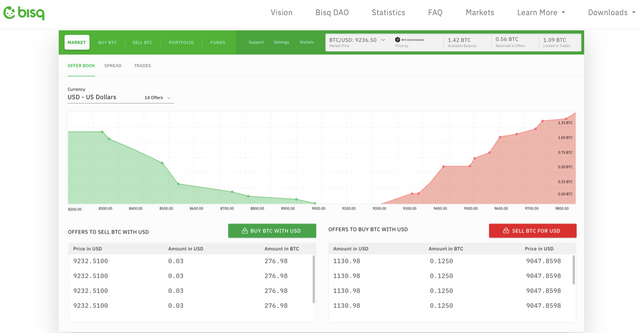

Bisq

Bisq is the most decentralised peer to peer exchange and thus the most resilient one. Even if governments collectively prohibit bitcoin, Bisq will still be useful because they can’t shut it down. The Bisq exchange doesn’t run on a website that can be confiscated or shut down, but uses software that every user must download to use the exchange. Recently, Bisq even decentralised decision making and development through the Bisq DAO, so even arrest of the Bisq devs will not stop the platform. Bisq is the last resort for Peer to Peer trading, but as long as shit doesn’t hit the fan it will probably not take off because of the extra effort that is needed to use it.

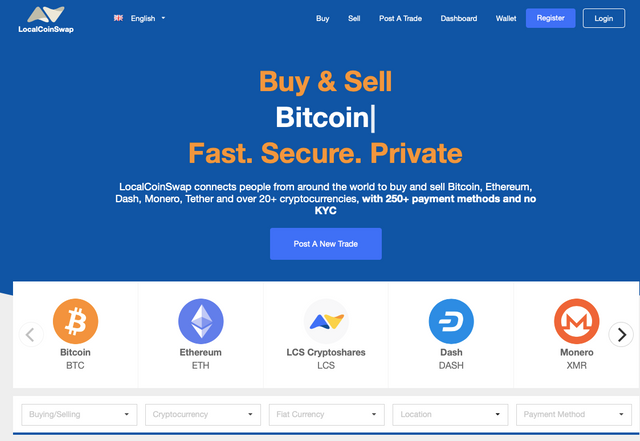

Localcoinswap

Localcoinswap is the only relevant Peer to Peer marketplace that feels the same as Localbitcoins and Paxful. The platform works similarly, but without KYC and with the possibility of the very important cash trades. The company is located in Hongkong, thus the relatively mild regulatory environment will probably enable them to stay with the same terms and conditions for a while. This marketplace supports many different payment options and beside bitcoins many altcoins can be traded too.

Localcoinswap did the hard launch last februari, so the platform is still very new and the volume is still low but steadily growing. When you are currently trading at LBC or Paxful it could be a good idea to start trading here too. Even if you don’t catch many trades, it is good to have some reputation already on an alternative platform in case regulators will hit again and you have to move. You will not only ensure your own business by diversifying to an alternative platform, but also make this very important part of the infrastructure more resilient!

What if the regulatory pressure increases even more?

This is very likely to happen, but it will be a cat and mouse game and the mouse will always just be faster. Every time that regulators strike, the industry will make a move. They can choose to move to an easier jurisdiction or increase the decentralisation of the platform to eliminate central points to attack.

Localcoinswap keeps everything user friendly by remaining centralised in a good jurisdiction, while Bisq has clearly chosen for decentralisation. Hodlhodl is somewhere in the middle and can move in both directions. For a resilient infrastructure we need a combination of these approaches to increase the chance of succes!

Conclusion:

Peer to Peer crypto exchanges without KYC are critical for the cryptocurrency ecosystem and enable the people who need it most to participate. I understand that people are hoping for a Bitcoin ETF to skyrocket the price, but a healthy Peer to Peer infrastructure is WAY more important. It will not directly skyrocket the price, but it will make the final effect of bitcoin adoption much bigger by serving the underserved first and the overserved at last.

To strengthen this part of the infrastructure we must #droplocalbitcoins and start trading on the smaller non-kyc alternatives like Hodlhodl, Bisq and Localcoinswap! Only then will Bitcoin really be for everybody and cause the biggest peaceful revolution in human history!

Do you think this subject is important? Please UPVOTE and RESTEEM!

Do you have something to add? Please LEAVE A COMMENT!!

You're back! I've missed your insights on crypto :)

Posted using Partiko Android

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.