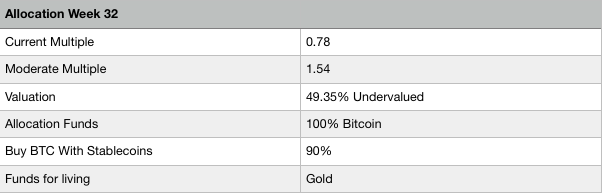

Weekly Update Diversification Protocol Week 32 - Multiple 0.78 - 49.35% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living On Gold

Today is the 20th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

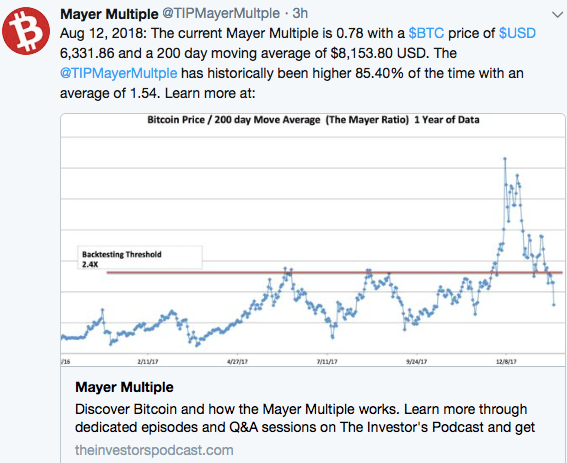

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 13,046 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

Bitcoin dominance over 50%

Bitcoin held strong during the huge altcoin selloff this week and reached 51% market dominance. It looks like the market is finally waking up and the air is flowing out of the alt bubble. Segwit is implemented in Bitcoin just over a year now and the results are great. Onchain efficiency is improving every day and 2nd layers that can replace many features of alt coins and will greatly scale the network are being rolled out. Also financial products will bring Bitcoin to the institutional investors and Bitcoin will receive the first flood of new money. This makes the outlook for Bitcoin extremely bullish and for altcoins quite bearish.

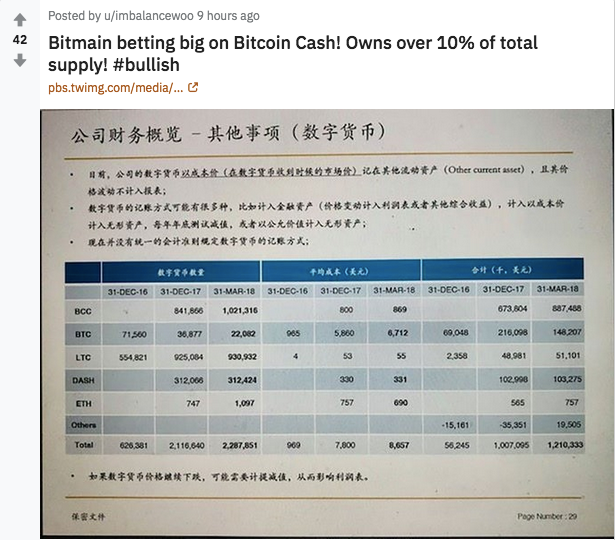

Bitmain opens the books for the IPO

Bitmain will do a huge IPO to raise billions of dollars and have to be transparent to investors and is opening their books. The results are shocking: Bitmain sold almost all it’s bitcoins and bought a lot of Bcash back for it. At the moment they own more than one million Bcash, this is even more than the enormous stack of Satoshi himself! In the Bcash community on r/btc this news is celebrated:

On r/btc (Reddit sub about Bcash under the BTC name where the best comments are on the bottom of the page because of the downvote censorship) they see it as a bullish fact, but it actually means that Bcash is extremely centralised and that there is a huge risk of a price crash when coins on one of Bitmains wallets start moving. On top of that: Bcash is heavily pumped over the last year by Bitmain (sold a lot of BTC and bought a lot of BCH) while the price didn’t appreciate. This means that the Bcash price would certainly slide down without this extremely expensive support of Bitmain. Since the bitcoins of Bitmain are almost finished, the future of Bcash doesn’t look bright.

OOHHHH, thats why they do an IPO, they need new cash because they spilled everything on manipulation of the Bcash price……………

Serious bug in Bcash found by Core dev

A few months ago one of the Core developers found a bug in Bcash that could split the network and make the entire network unusable instantly. He reported it anonymously and the Bcash devs fixed it silently. He reported anonymously because he was afraid someone would exploit the bug before it was fixed and destroy the Bcash network and seriously damage the reputation of cryptocurrency overall.

Imagine that the flippening attempt of Bcash (driven on manipulation) was successful and someone exploited this bug, then the Bitcoin experiment that otherwise would free humanity would have failed. NEVER EVER TRUST THE BCASH DEVS WITH YOUR CRYPTO! THIS IS THE 3RD BUG THAT THEY CREATED!

https://bitcoinist.com/bitcoin-core-dev-critical-bug-bitcoin-cash/

The Bitcoin price tanked again

The Bitcoin price sunk from 7074 to 6355 this week, the sentiment was extremely depressed despite the good news of the last few weeks. The market reached a low of 6140, this might be the 4th bottom in a row and it is to be seen whether a bullish trend of a bearish trend will be next. The 5800 level looks like a strong support, but the absence of reaction after good news is worrying. 9 ETF’s are being reviewed in the 2 months to come, this could be a catalyst for a new direction.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 14.60% of the time. Since the multiple today is 0.78 while the moderate is 1.54, there is 49.35 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table, Bitmain can’t dump much more bitcoins and an ETF is coming closer. Short term sentiment is bearish to neutral, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Now nothing Update Just one Not invest at a time

I also love this news: remember that Bakkt app?

Blockstream is it technical arm. I think bc how inexperience wall street is with bitcoin they just hired blockstream which means that liquid network and the Lightning network could be used in the app one day 😀

You got a 53.45% upvote from @emperorofnaps courtesy of @michiel!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

You have recieved a free upvote from minnowpond, Send 0.1 -> 10 SBD with your post url as the memo to recieve an upvote from up to 100 accounts!