Pool of Stake

The first method adopted for transaction identification and verification by the first cryptocurrency bit coin was known as a proof of operation that required the computational ability (hash ratio) to be used to solve the math puzzle before the transaction block was added to the Blockchain. This process is called mining, and people mining is called mining. This process helps to create new coins.

The power consumed by the hash rate power is high and will continue to increase as the network's total hash rate continues to increase.

Pool of Stake is a first of its kind, decentralized pool for Proof of Stake, the future of blockchain. Qtum, Stratis, Universa and other PoS coin holders can unite in the Pool of Stake and start Mining 2.0, generating daily forging rewards by simply staking their PoS coins. PSK is a fully decentralized, self-regulated and completely trustless pool. This is made possible by powerful use of Smart Contracts and globally distributed nodes. Pool of Stake makes Mining 2.0 more secure and more profitable for individual PoS coin holders. The main goal of PSK is to increase profits for small miners who unite in the Pool of Stake. For this purpose, two tokens are used.

First, an ERC-20 PSK token and second, an IOU token are used. The IOU token ensures that PSK members are always in full control of their staked PoS coins. The PSK platform will provide an analytics tool via a smart i.o. database that will allow members to track, control and optimize their investments in a fully trustless way. In this white paper, we explain the implementation of Pool of Stake and its services. We elaborate the governance vision which will be developed in the coming months to ensure that the PSK community remains fair and agile. We then present detailed information relevant for the upcoming ICO starting 20 July 2018. We conclude the white paper with a review of our current accomplishments and an overview of projected milestones.

Moving into the Future - From PoW to PoS

Proof of Work has been the state of the art of consensus algorithms for first generation blockchains. Proof of Stake is the new kid on the block and 2018/2019 will be the years in which PoS will be fully adopted by major players in the blockchain field. When PoS becomes the new gold standard of blockchain, Pool of Stake will be ready to become the biggest forging pool for PoS. The core value of cryptocurrencies lies in fully trustless, permissionless protocols and decentralization.

PoW is not ecologically sustainable and exhibits fundamental problems that compromise decentralization. First-generation cryptocurrencies, e.g. Bitcoin, create new coins via mining, that is, by using computational power to solve mathematical puzzles based on blockchain rules. Due to significant growth rate of the network over time, Bitcoin’s PoW algorithm is facing fundamental problems. With the current block size, Bitcoin has a maximum transaction capacity of 7 transactions per second, with peak transaction costs of around $50 and an annual energy consumption of 42 TWh (the same amount as New Zealand).

These facts demonstrate that the first-generation digital cryptocurrency network Bitcoin has fundamental limits for scalability and problems with efficiency that cause it to that stray from its core philosophy. While the Bitcoin community was fighting and becoming divided over Bitcoin and Bitcoin Cash, in 2012 other parts of the community took a step into the future by inventing a new consensus algorithm: Proof of Stake (PoS). In 2018/2019 Ethereum will switch from PoW to PoS. PoS is the future of blockchain and Pool of Stake is already here to bring PoS coin together and make the greatest profit possible in Mining 2.0.

The current situation

At first all you need to mine bitcoin are computers and applications.

Then the market has developed the hardware so it is more difficult for people to mine.

This has, in turn, instigated communities to begin to form mining.

A mining pool allows its members to regain the edge and start mining again.

New development

The forging evidence of Stake seems to be the future of mining.

Solution

A pool for blockchains Proof Stake.

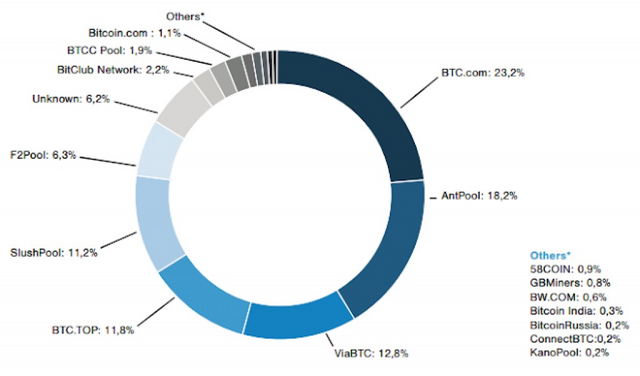

Hash Power Per Mining Pool in PoW

Pool of Stake allows small miners to build a mining pool. By joining together, they regain their lost edge. Now they can mine together and collect high forging rewards.

The future of blockchain is Proof of Stake

Pool of Stake Implementation

Token Sale

ICO

Pool of Stake AS will accept donations in €, $, CHF and ETH, in accordance to the Swiss regulations. In case a donation is equal or more than 50.000CHF, KYC process is obligatory. Pool of Stake ran a seed funding during which early adopters invested 750 000 €. This enabled the team to reach fundamental milestones andprepare for an ICO. There will be a prescription at a discounted price (less than ICO price) using reservation contracts. The official start of the ICO is 20 July 2018 and is scheduled to run for one month until 19 August 2018. Pool of Stake has established a hard cap of 8 Mio € and a soft cap of 2 Mio €.

In case the hard cap of 8 Mio € is reached prior to the official end, the ICO will be closed at that point in time. If the soft cap of 2 Mio is not reached, all invested ETH will be reallocated back to the investors. In order to protect the project from market fluctuations, once the ICO is closed the collected ETH will be reallocated to few and selected currencies. The tokens will be distributed 10 days after the end of the ICO. Strategy updates will be published on our blog, and any public key for the redistribution will be shared on our website. This allows every member of the community to verify the actions that are taking place. Citizens from the following countries may not partake in the ICO: USA, China, Canada, Israel, South Korea and Vietnam.

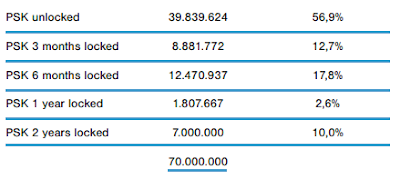

In the online procedure, investors themselves are responsible for determining their eligibility to invest. The ETH / PSK conversion will be announced 1 week prior the sale. After the end of the ICO the collected amount of donations will be distributed between CHF, €, BTC and ETH in order to guarantee the correct delivery of the project respecting the timeline. The total amount of tokens on the market will be 70 Million, the distribution will be the following:

Tokens will be distributed 10 days after the ICO closes in order to ensure correct distribution to our investors.

IMPORTANT:

If the hard stamp is not reached during the ICO, the amount of tokens (circulating and non-circulating) will be forged accordingly. The idea is to achieve a fair relationship between the donors, the developers, the advisors and the 3 founders. Hence the total amount will be divided according to the current%.

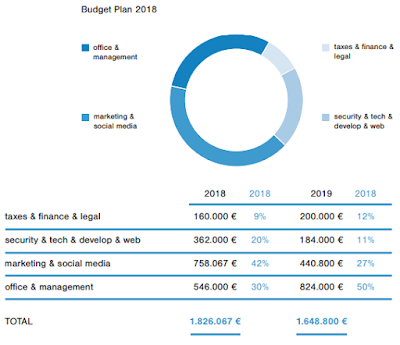

Budget Plan

In case the hard stamp of 8 ICO, the crowd sale distribution will look as follows.

Roadmap

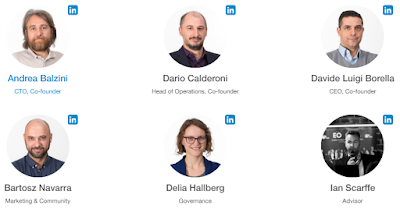

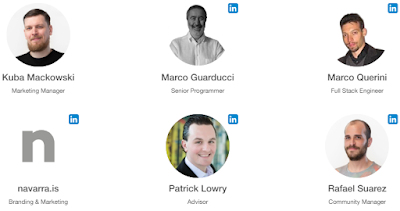

Pool Of Stake Team

For more information:

- Website: https://www.poolofstake.io/

- Thread: https://bitcointalk.org/index.php?topic=3283742.0

- Twitter: https://twitter.com/poolofstake

- Whitepaper: https://www.poolofstake.io/wp-content/uploads/2018/04/Pool_of_Stake_whitepaper.pdf

- Telegram: https://web.telegram.org/#/im?p=@poolofstake

- Facebook: https://www.facebook.com/poolofstake

BY : 5pandawa

LinkProfile : https://bitcointalk.org/index.php?action=profile;u=1868645

ERC-20 : 0x05Ef71Ec09744608b2Dfe816f4fceD559711411B

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

Coins mentioned in post: