Education Series: The History of Bitcoin

This is the second of a three part series focused on Bitcoin. In the first article, we dived into the shortcomings of our current money system. In countries suffering from currency devaluation, hyperinflation, and incompetent reserve banks Bitcoin serves as a hedge. By now, everyone has heard about Bitcoin but how did we arrive to this point. The future of this new invention is still working its way through our consciousness but it is also helpful to look back and reflect on how Bitcoin arrived on the scene.

Born from the fire of Mt. Doom

Not really, but it sounds cool. I'm reminded of the scene in Game of Thrones where one of the major characters, Daenerys Targaryan was put to the torch. Rather than dying in a flaming pyre, Daenerys emerged as "The Unburnt" and thus her legend was born. Bitcoin, like Daenerys, was born of the fiery mess of the Financial Crisis of 2008. Questionable lending standards and derivative financial instruments designed to share risk turned what seemed to be just a housing issue into a disastrous domino effect. Beyond the real estate sector, banks linked themselves to synthetic financial instruments such as Collateralized Debt Obligations (CDOs) that turned out to be a flimsy house of cards. Needless to say, the financial downturn led to a worldwide recession. Longstanding brand name financial institutions like Lehman Brothers went insolvent or like Bear Stearns were consolidated into the surviving banks.

Crises within financial sectors cause more widespread damage than recessions in other industries. Worse yet is that financially driven recessions take a considerable amount of time to recover from. During this painful period, Bitcoin was introduced in whitepaper authored under the pseudonym Satoshi Nakamoto. To this day, Satoshi Nakamoto is thought to be either one person or a group of people.

"I had to write all the code before I could convince myself that I could spice every problem, then I wrote the paper". Satoshi, ~2007

2007 - 2009: Birth of Bitcoin

Satoshi's infamous whitepaper Bitcoin: A Peer-to-Peer Electronic Cash System was published on October 31, 2008. The whitepaper is a short 9 page read. Compare that to the whitepapers of the projects out there today, Bitcoin's manifesto seems like a children's book. That's what makes Bitcoin so accessible - it's solution to the complex fiat currency problem with an elegant proposal. For those not technically inclined I suggest you read the introduction (section 1) and the conclusion (section 12). We'll take you to a distilled version of how Bitcoin works in part three of this series.

Between November 2008 to January 2009, Satoshi corresponded with his Cryptography Mailing List - an email distribution to cryptographers and others interested in digital currencies. On Friday, November 7, 2008, Satoshi wrote an email to his email followers,

"you will not find a solution to political problems in cryptography... But we can win a major battle in the arms race and gain a new territory of freedom for several years. Governments are good at cutting off the heads of centrally controlled networks like Napster, buy pure P2P networks like Gnutella and Tor seem to be holding their own."Based on the writing you can clearly see Satoshi's clear understanding of previous peer-to-peer (P2P) networks. Although Napster was a P2P network, it was easy to take down just by suing its owners Sean Parker and Shawn Fanning. Satoshi planned for Bitcoin to live beyond its creators, hence why Satoshi to this day is unknown. How can you catch the head of a network who is elusive.

Bitcoin Software hits the streets

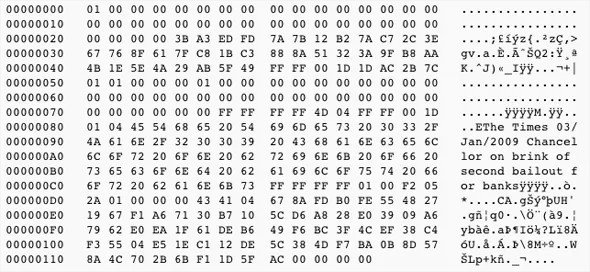

The first downloadable version of the Bitcoin software appeared on SourceForge.net on November 9, 2009. It took him some time to finally release the source code to the general public, but the first shot in decentralized digital currency was fired. The genie was never going back into the model. Satoshi, keenly aware of the failings of modern financial systems and their governments in preventing or reducing their damage, embedded a copy of the January 3rd issue of The Times article, Chancellor on brink of second bailout of Banks, into the genesis block. The image in the genesis block is in hex code, it looks like this:

Hex code is unreadable to the human eye. Here's what the image looks like when printed by a computer for human consumption.

Transaction #1 on Block 170

In the genesis block, created on January 12th, 2009, the first non-coinbase Bitcoin transaction between Satoshi and developer Hal Finney took place. We call this the first transaction even though it appeared on block 170. All other transactions prior were coinbase transactions. Do not confuse this with the company Coinbase. A coinbase transaction, with a lower case c, is a non-input based transaction that can only be created by a miner. These transactions are the block rewards for miners.

Silk Road Brings Bitcoin Into The Public Eye

New technologies are often vilified when they first appear. AOL supposedly had chatrooms full of child molestors and rapists. MySpace supposedly had chatrooms full of child molestors and rapists. For some reason, every technology is related to child molestors, rapists, and drugs. Ah yes, the drugs.

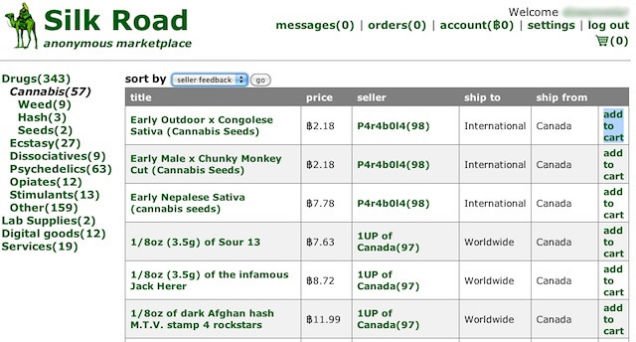

Enter the Silk Road, named after the historical route of old world merchants. The Silk Road was launched in February 2011. It served as a marketplace. Gawker's 2011 article "The Underground Website Where You Can Buy Any Drug Imaginable", seeded a media storm. What's more clickbait-ish and eyeball worth than technology and child molestors, rapists, and drugs. We've been down this road before.

The photo above shows marijuana and hash for sale priced in Bitcoin. Satoshi never supported Bitcoin as a medium of exchange, the media gave attention to Bitcoin's role in enabling illegal drug sales. In fact, he implored Wikileaks not to use Bitcoin as a means of accepting payment. Satoshi had a vision for the usage of Bitcoin and it probably wasn't to enable leaked state secret, child molestation, rape, and drug purchases.

Establishing Real Value

Just the year prior, the first Bitcoin exchanges started popping up. Bitcoin's trading values were nearly worthless. The first real life Bitcoin transaction (May 22nd 2010) was used to buy two pizzas. Laszlo Hanyecz's pizza slices cost him 5,000 BTC each. When interviewed, he said "I don't feel bad about it. The pizza was good".

Satoshi exits the online world as Satoshi Nakamoto. The last post from Bitcoin's founder was on Decenter 12th, 2010. Bitcoin lost its founder and its single point of failure. Bitcoin did not have significant economic value at that time, but now it could not be taken down like Napster.

It wasn't until February of 2011 that Bitcoin was worth over one US Dollar. Wikileaks, already in the global spotlight, started accepting Bitcoin in 2011. In the Fall, Vitalik Buterin co-founded Bitcoin Magazine in September 2011. When Gawker's article came out Bitcoin shot up to $27. Coinbase, the popular fiat gateway for American Bitcoin purchases, was founded in June 2011. Back then, it was a minor player compared to exchanges such as Mt. Gox.

Cyprus Bail Out

In March 2013, Bitcoin forked into version 0.18.1. The then popular exchange Mt. Gox temporarily suspended trading Bitcoin until the fork occurred. In the end of March, Cyprus' economy was in tatters and on the brink of a bailout. Wealthy patrons around the world used Cyprus as a tax haven. Seeking safer places for their wealth, many started to pour their wealth into Bitcoin. The price of Bitcoin spiked above $100 US Dollars for the first time during this period.

Legal Doubts

That same month of March 2013, Mt. Gox's trading volumes spiked to new highs. Shortly after, a Mt. Gox bank account had $2.9M worth of Bitcoin seized by the U.S. Department of Homeland Security. The seizure further raised the doubt of Bitcoin's legal status. In October, Ross "Dread Pirate Roberts" Ulbricht, founder of Silk Road, was arrested and a combined 44,000 BTC (30,000 Silk Road, 14,000 personal) were seized.

Bitcoin is not illegal, it may be innovation

On November 18, 2013, the U.S. Government held a panel discussion. During the proceedings a series of discussions started to indicate several Senators with a slightly positive tone towards Bitcoin. Jennifer Shasky Calvery, Director of the U.S. Government's Financial Crimes Enforcement Network (FinCEN) stated “[w] want to operate in a way that does not hinder innovation.” Bitcoin clearly had a future. On November 28th, Bitcoin finally crossed $1,000.

The Hacks

On February 24th, 2014 a meteor struck the ancient world of Bitcoin. The most popular exchange, Mt. Gox was hacked. After it was all over, 744,000 BTC had been stolen. The hack clearly showed that bigger was not always better when it came to centralized exchanges. Nearly a year later on January 4th, 2015 Bitstamp was hacked for 18,866 BTC were stolen. The two hacks reshaped thinking around security and protecting digital assets in cold storage. It also put all Bitcoin exchanges on high alert to defend against all threat vectors. Hacks not only lost customer funds, but could irreparably harm the reputations of the exchanges. Mt. Gox learned the lesson the hard way and closed for good.

Coinbase launches an exchange

Coinbase, a popular VC backed Bitcoin payment processor, announces it plans to launch an exchange in late January 2015. It worked to receive over two dozen state licenses to accept fiat deposits and the ability to buy and sell Bitcoin with a fiat pairing. Coinbase's approach to work with state laws gave Bitcoin a mass adoption boost. Today's Coinbase is still one of the primary places new cryptocurrency buyers use to enter the crypto asset market. Later in October 2015, the Winklevoss twins launch a Coinbase competitor called Gemini.

The Economist

Exactly 7 years after Satoshi's whitepaper was published, The Economist, published "The Trust Machine". It was the cover story of that's week's edition. Inside, the article brought to the public's opinion the potential utility of blockchain technology. Promoting the idea that financial institutions and governments would benefit from immutable databases further solidified Bitcoin's innovation and potential value it could bring.

Still a bright future ahead

I hope you enjoyed the read on the history of Bitcoin. We're still in early days on the technology. Bitcoin still faces mass adoption issues and detailed awareness in the public. Over the 8.5 years since Satoshi's original paper was published, Bitcoin has garnered worldwide media attention. Altcoins became popular and Ethereum grew to the #2 cryptoasset market. Bitcoin today is thought less as digital money but more as digital gold. In the last install of this series I will dive into how Bitcoin works. Thanks for reading.

Sources:

- https://news.bitcoin.com/bitcoins-quirky-genesis-block-turns-eight-years-old-today/

- Satoshi Nakamoto Institute

- Transaction #170

- Coinbase transactions

- https://en.wikipedia.org/wiki/History_of_bitcoin

- http://money.cnn.com/2013/03/28/investing/bitcoin-cyprus/

- http://onbitcoin.com/2013/11/18/senate-committee-listens-bitcoin-experts-expresses-open-mindedness/

- https://blog.coinbase.com/post/77766809700/joint-statement-regarding-mtgox

- https://www.coindesk.com/unconfirmed-report-5-million-bitstamp-bitcoin-exchange/

Thank you for coming to the site. Quantalysus publishes blockchain research and analysis for the crypto community. Please follow on Twitter, Steem (please follow and upvote if you can – thanks!), Telegram channel (New!), and Medium to stay up to date.

If you want to earn Aelf (ELF) tokens for just using Twitter and Reddit, sign up for their candy / bounty program.

If you learned something:

- Please consider donating to keep this website up and running

- Earn Aelf tokens by following them on Twitter (my referral link)

- Follow me on Steem (@quantalysus). I appreciate upvotes!

- Follow me on Twitter (@CryptoQuantalys)

- Education Series: Airdrops

- Education Series: Byzantine General’s Problem

- Education Series: Regulation A and D

- ICO Review: Hero Node

- ICO Review: Solana

- ICO Review: Phantasma

- ICO Review: Holochain

- ICO Review: Edenchain

- ICO Review: Quarkchain

- ICO Review: DAOStack

- ICO Review: Alchemint

- ICO Review: Loki Network

- Coin Review: Ontology

- Coin Review: Aelf

- Coin Review: Mithril: a social network app on the blockchain

- Coin Review: Qtum

- Coin Review: Waves

- Coin Review: Banyan Network (BBN)

- Opinion: Token economics

- Opinion: ICO paradox

- Opinion: Why we love Steem

- Analysis: If Steem were a country, it would be the most unequal society

this is the most comprehensive BTC history I have ever read

Thank you for reading :)

Very cool, love reading "the history of" posts

Thanks for reading! I may do a history of Ethereum or Monero since those two projects have huge bases as well.

It was easy to read! Thanks :)

I'm glad you enjoyed it!

Thank you so much for this :)

Thanks for reading!

This post has been shown by @tenorbalonzo to 9200+ followers. Please check the @tenorbalonzo page

Thank you for sharing!

Wow. This is truly knowledge.

I found this so fascinating and mind blowing.

Thanks for sharing.

You have My upvote

Glad you enjoyed it!

Quite educative and the simplicity is just ideal for newbies and crypto-aware masses. I think Bitcoin is the reason we met on Steemit; it has come a long way in changing how digital wealth is stored and shared and making banks cringe. It has given a new perspective to sending and receiving money across borders fast and cheaply. Thanks for your valued insights.

Thanks for reading. I just joined Steem earlier this year. There are some kinks to work out but overall it works quite well.

thank you so much for the history on bitcoin.

been looking to go into mining bitcoin here in nogeria.

but i coild not as i was being lazy to make my research.

thank you so much again for this.

it really means alot as it has added to my knowledge.

No problem. :) Best of luck to you. And wow, I have a reader from Nigeria. That's so cool.

Cool it is. You never had a reader from Nigeria?

Well I guess that's cool then. I just set my filter to all content that how I came across your work.

Almost wow! for the post.

Thanks for reading.

Congratulations @quantalysus! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP