A Look Back at BTC Price Manipulation Before and After the VanEck ETF Delay

FOMO price manipulation, OTC sell-off afterwards, but a super-exciting future still awaits us.

As the learned Steemit community already knew, the SEC’s delay of the VanEck ETF until September 30th was expected, but the FOMO market psychology generated by the narrative of its possible approval was an opportunity that couldn't be missed by the big players to manipulate the market.

Here's a walk-through of how their cunning plan unfolded, so, first of all, let’s look back at the monthly Bitcoin chart, below, showing 2 prior tests of the 6k support line, which held-up.

As the long-term 6k support-line had held-up twice before, many traders would have considered a 3rd retest buy order in this area of support to be a low risk, high reward trade, but enter the stop-hunters, who manipulate the market, creating false break-outs and the type of price activity around support-lines we see below.

The 3rd retest of the 6k support line held-up at first, but was breached with a decline to 5.8k levels (see chart below.) Here, ordinary crypto-traders are in the process of being tricked and used by big players, so that they can transact efficiently off the back of ordinary traders' money: they know that the VanEck narrative is coming and they want to trade in large quantities, but, as the ordinary trader knows, the 6k support-line is a good area to buy, so there aren’t enough sellers out there, especially as the ordinary trader also starts trading at 6k, which means the price will accelerate away from the support-line before they are able to get their large order filled at the support entry-point.

However, it’s very obvious to the big players that because the ordinary trader buys arround the 6k level, there will be a clustering of stop-loss orders just below the 6k support-line, rather than well below it, since the ordinary trader, with a small account, wants to manage their capital risk, so the big players manipulate the price below 6k, into this sweet zone, where there will be a huge amount of liquidity waiting as a result of the forced selling.

Unfortunately, with the breach of 6k support the ordinary trader now sees an opportunity to trade the break-out, placing sell orders and, as they believe the 6k support has now become resistance, the ordinary trader now places a tight stop-loss above 6k. The price manipulation continues and the breach of 6k support proves to be a false break-out as the price retraces back up to 6k, triggering stop-losses again, leading to more net selling and more liquidity for the big players, who are now finally able to get all of their large order filled efficiently.

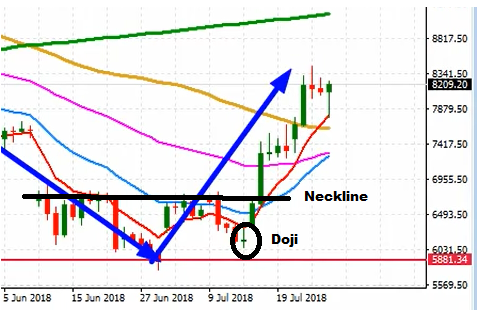

This manipulation caused a decline to 5.8k, forming the head of what would become an inverse head and shoulders pattern and with the completion of the price manipulation there was a rally on heavier volume back above 6k from the head to the neckline (black line), without many of the ordinary traders onboard, followed by a burst of activity from the right shoulder (Doji candlestick circled) to the breaking of the neckline.

We can expect to see a repeat of this kind of thing around September 30th, with the accompanying narrative that the SEC may be more amenable to the approval of the VanEck ETF. But will the VanEck ETF be approved on the 30th? I doubt it very much. Whilst I think the VanEck ETF will be approved by the SEC, September will be too soon.

There are suggestions that after the SEC delay the Bitcoin price has been manipulated lower by a large OTC sell-off, breaking trend-lines and support levels and, looking at the charts, some of the daily declines appear to be rather sinister.

However, we shouldn't let all this dampen our spirits, because the future of crypto will still be super exciting with more recent announcements adding to the bigger picture of a maturing market: NYSE owners, ICE, to launch Bakkt Platform in Q4; Coinbase will introduce custody plans for 40 digital assets (including Steem); Germany's second largest stock exchange aims to compete with the Robinhood trading app by launching its own cryptocurrency trading infrastructure.

At the moment, the market does what the market does and it's more suited to traders, trading volatility, but in the long-term the good, low hanging fruit will become more difficult to reach (opinion.)

Starting next weekend, 18/8/18, I'll begin a series of Steem Basic Income giveaways for newbies, who post me a link to a good quality article they have posted, which got buried on this site, without receiving the recognition it deserved. The top ten selected from each giveaway will each receive 1 share of Steem Basic Income, in order to support this noble endeavour. (don't send any articles yet, please)

In the meantime, to support this project, you can send 1 STEEM to @steembasicincome. Include the name of a Steemian you wish to sponsor in the transaction memo (preceded by @). You and the person you sponsor will each receive 1 share in the program. You can sponsor any active Steemian, it does not have to be a current member.

For more information on Steem Basic Income, follow the link below;

https://steemit.com/steembasicincome/@steembasicincome/steem-basic-income-frequently-asked-questions

I'm also not sure that what we are seeing is linked to the the ETF. However my opinion is based on a simpler notion. Recently when Bitcoin went up OR down in value it sucked in market value from ALL the altcoins. Bitcoin market value domination is now at 51% up from 50% two days ago and up from 39% a month ago. The speed of vaccuuming is increasing.

This is all despite altchain projects actually coming to fruition, goals being realised and increasing presence of mainstreet in cryptospace. Similar shakedowns occurred in internet 1.0 and 2.0.

Fully agree with you @sugarfix. I also find the BTC dominance growth very noteworthy and also somewhat surprising given that some altcoin projects are showing progress.

Regarding Bitcoin: I am very bullish on Bitcoin in the long-term and also wrote a longer research post about it a few days ago. Have a look if you are interested: Bitcoin Research

Thanks, interesting.

Everyone was so bullish with the ETF, rumours of massive OTC buys. Sad that the market decide to go the other direction.

The market does what the market does, but Bitcoin’s fundamentals are good, so the market isn’t reflecting its value. Things will change, when we have regulations in place.

Open to everyone, free frm inflation and Government interference.

$6,420.88 USD (2.33%)

1.00000000 BTC (0.00%)

Market Cap

$120,465,743,594 USD

17,234,137 BTC

Volume (24h)

$4,447,475,467 USD

692,286 BTC

Circulating Supply

17,234,137 BTC

Max Supply

22,000,000 BTC

I am very optimistic on ETF approval in Sep.18

Etfs, institutional money, lightning network, mainstream adoption etc etc! Not to mention all the exciting stuff happening with some of the alt coins. The future is bright, don't be scared by all the noise!

Meanwhile, let's buy crypto while it's on sale.

Appreciate it sir

Is Sep.18 the new date?

The decision has to be taken until (not on) September 30, or the deadline can be pushed back an additional 240 days.

Maybe he is predicting that a positive decision for the VanEck-SolidX’s Bitcoin ETF will be announced on that particular date (it happens to fall on a Tuesday just like with the August 7 publication), or maybe he is talking about any Bitcoin-related fund application having in mind that The SEC Will Decide on 9 Bitcoin ETFs in the Next 2 Months.

ETF will be approved soon,, until then market takes deep dive

Absolutely right sir appreciate it

Opening open even better buying oppurtunities!

Yes, get them while they are on sale.

What if, it has to take till next year, will the market be waiting for it?

That was a good and succinct explanation of the manipulation by big players.

We have 8 more months until we see the next bull run if you ask me. That is when the final deadlines for the ETF decisions will be and I think they will push it back as much as possible until then.

I feel that we could see big upward movement before then as well. Bull run confirmation is probably 8 months like you said, but prices will start increasing in prepration in the next month or two. We need to break some key points before anyone can say bull run!

Hope it will go possibly

This market is still so young. The technology alone is only 10 years old! lots of time for the early crypto participants.

Are you serious? 10+ yrs is a very long time in this tech space, the "early" crypto participants purchased at far far lower levels and have made % gains that will never be seen again even in the best case scenarios if crypto becomes widely successful and mainstream. It's too late, not early, hence the huge bubble bursting. IF it was "early" then my portfolio would not be down 75% while there have been more good news this year than all of crypto's history combined. The amount of selling heading back towards ATHs will be huge, I'm looking to break even someday if there is a huge rally.

I don't think you realize that these are global markets. There is so much money that has even been introduced to money! Yes, I say the technology is still very very new! Think about how long computers and the internet took to go mainstream! We will see new ATH in next 5 years, with a massive bull run to follow!

Yes, I think you’re right and in the meantime the big players are going to keep shaking the tree to get the ordinary investors out.

Optimism now will pay off for those of us who are surviving this market! HODL strong and fingers crossed for the ETF.

Interesting

personally I don't see Bitcoin to touch even 12000 by the end of this year but I I hope that it would work and we can see Bitcoin at around $50, 000 by the end of the 2018