BTC:USD 4 hour chart DAILY UPDATE (day 133)

Disclaimer: This is not meant as financial advice and is for entertainment purposes only.

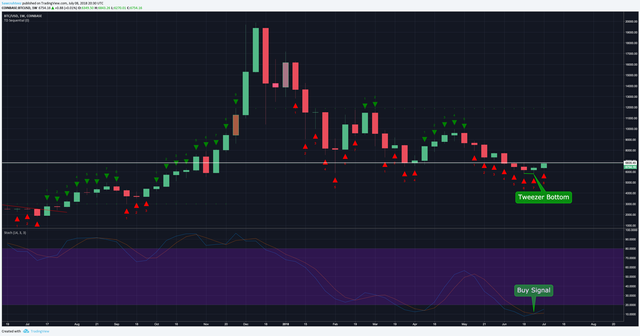

Yesterday we looked at the reasons why I am expecting a $750 - $1,000 pump from the current price level. Today we will look at the mounting bullish indicators and ask ourselves if they are enough to bet against the bear trend.

It is Sunday and we only have a few hours left before the weekly candle closes.

We are on a red 8 out of 9 on the TD Sequential and I would really like to see the the countdown complete before this pump continues. If we rally through $6,886 too soon then we will get a price flip before the red 9. If the countdown doesn't complete this time then it is very likely to complete in the future before this bear markets comes to an end.

We are bouncing strong off the Stochastic buy signal and the Tweezer bottom. I do think there is plenty of room for this dead cat to bounce, however I am hoping that it doesn’t happen too fast such that it ruins the countdown to a 9.

The RSI is back above 50 on the daily chart for the first time in two months.

I view this like the 50 yard line of a football field. The bulls are now on offense and getting close to scoring position. This is an important confirmation for me when considering a long.

There are currently multiple divergences in the On Balance Volume. One in the daily chart and one in the weekly.

This is indicative of bigger players building a long position. The price has stayed level and the buying volume has spiked. That tells me that the proverbial smart money is accumulating at these levels and that is a very good sign for the bulls.

The 12 and 26 period EMA’s on the daily chart are posturing for a bullish crossover as well as the 50 and 200 period MA’s on the 4 hour chart. Longing one or both of those buy signals is becoming more and more attractive. If you elect to do so then I would suggest using ½ of your normal position size due to betting against the trend.

A profit target of $7,500 - $8,000 is reasonable and a 5% stop loss provides a favorable risk:reward.

I am going to remain on the sidelines for the time being and will be strongly considering buying each of the moving average crossovers. The main reason I am being cautious is because of the visible range volume profile. It is showing resistance stacked up from here to $9,000 with a big gap at $5,000 that is begging to be filled. Shorting this bounce and longing $5,000 are my priorities and it will not be a cause for much concern if I miss a move in between.

Thank you for reading! Have something to say? Leave a comment! Smash the follow so that you don’t miss out on future updates and remember that clicking the like is good karma!

After content like that you know you want more!

Yesterday's Post - Day 132

Trading Challenge - Day 117

Weekly Gold Update - Week 15

School - Options 101: Limited Risk with Unlimited Reward | Intermediate Trading Strategy | White Paper Cliff Notes: AION | Intro to Indicators: Stochastic | Bitcoin Market Cycle

Need a break? Read some Poetry! - I Believe | Aliens | The Universe is a Hologram | Sunset

Congratulations @sawcruhteez! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The semi-finals are coming. Be ready!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes