What is the inflation rate of Bitcoin? How does it compare with gold?

The value of any currency is depreciated if it is printed. Ever since money was invented, the rulers have tried to spend more than they could collect in taxes. They only had two choices: borrow it, or print it. Sooner or later, the currency ends up getting printed.

Borrowing is just deferred printing. It's kicking the can down the road. Sooner or later you can't borrow any more, so you end up printing more to pay off your debts.

Very few currencies survive the long term. Most end up worthless.

In the long run the currency ends up worthless as it is replaced by a new one with the promise "We'll never let this happen again."

A currency reset is a great way of wiping the slate clean.

Bitcoin's "Halving*

Bitcoin is known for its "Halving". every four years the production of bitcoin will halve. Right now, the rate of production is 12.5 bitcoins approximately every 10 minutes. There are around 1800 new bitcoins every day.

In a year-and-a-half on approx 21st May 2020, the production will drop to 6.25 bitcoins every ten minutes. Will the bitcoin price increase when the production halves? It seems likely.

If you wonder why your house costs more than your parents would have paid 30 years ago, it's because the money is worth less. Same thing for just about anything you buy. It costs more because the money is worth less.

Gold and Swiss Francs

One currency which has withstood the test of time is gold. Gold is very hard to mine. It is outside the control of government. Another successful currency is the Swiss Franc. The tiny country has the second largest reserves in the world and almost no debt.

Hard to mine, impossible to print

Bitcoin is hard to mine. It's going to get harder and harder until is nearly impossible. The new supply will diminish in a way which ensures we will never have more than 21 million bitcoins. Put another way there will always be more millionaires than bitcoins. They can't all have one.

Bitcoin's inflation rate:

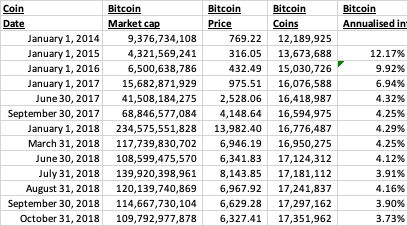

Like all currencies, bitcoin has an inflation rate. You can work it out very roughly. Currently it is just under 5% per annum. You can work it out like this. There are roughly 17.4 million bitcoins already mined. With 1800 mined per day, that's an annual rate of 657'000 new coins per year. 657'000/17.4 million = 3.8%. That's a low rate and one which is set to soon halve.

Here are the recent numbers:

How does bitcoin's 3.8% inflation rate compare with gold's?

According to the World Gold Council, there are approximately 190 tonnes of gold already mined. Around half of that is held in the form of Jewellery. Much of the rest is held as Central Bank reserves or Private investor hoarding and simple investment.

As for the annual production from mines, they say there are 2500 to 3000 tonnes produced each year. That gives us a roughly 1.5% inflation rate. For now gold beats bitcoin. That's because the gold inflation rate is lower.

The amount of gold mined each year is worth around $100 billion. The amount of bitcoin mined each year is worth about $4.2 billion.

How much gold could the average millionaire own?

If all the gold ever mined was to be shared equally between the world's 34 million millionaires, then each one would own 5.5 kilos, worth around $200'000.

How many bitcoin could the average millionaire own?

If all the bitcoin ever mined was to be shared equally between the world's 34 million millionaires, then each one of them would get about half a bitcoin worth around $3'500. Put another way, if bitcoin was as desirable as gold, then the price would be $400'000.

Conclusion

Whilst gold has a lower inflation rate - at least until May 2010, it is clearly bitcoin which is the rarer asset.

Other Bitcoin facts

Total Bitcoins in circulation: 17,359,725

Total Bitcoins to ever be produced: 21,000,000

Percentage of total Bitcoins mined: 82.67%

Total Bitcoins left to mine: 3,640,275

Total Bitcoins left to mine until next blockhalf: 1,015,275

Bitcoin price (USD): $6,478.00

Market capitalization (USD): $112,456,298,550.00

Bitcoins generated per day: 1,800

Bitcoin inflation rate per annum: 3.8%

Bitcoin inflation rate per annum at next block halving event: 1.80%

Bitcoin inflation per day (USD): $11,660,400

Do you need to know the inflation rate of another crypto?

Let me know. I may have the answer already.

Wow, what a great analysis!

This analysis further confirm the fact that bitcoin has a great potential.

Upvoted and Resteemed

That's a good topic.My opinion is many commentators have compared Bitcoin to gold as an investment asset. “Can Bitcoin Be Gold 2.0?,” asks a portfolio analyst. “Bitcoin is increasingly set to replace gold as a hedge against uncertainty,” suggests a Cointelegraph reporter.

Economists, by contrast, are more interested in considering how a monetary system based on Bitcoin compares to a gold-standard monetary system. In a noteworthy journal article published in 2015, George Selgin characterized Bitcoin as a “synthetic commodity money.” Monetary historian Warren Weber in 2016 released an interesting Bank of Canada working paper entitled “A Bitcoin Standard: Lessons from the Gold Standard,” which analyzes a hypothetical international Bitcoin-based monetary system on the supposition that “the Bitcoin standard would closely resemble the gold standard” of the pre-WWI era. More recently, University of Chicago economist John Cochrane in a blog post has characterized Bitcoin as “an electronic version of gold.”

In what important respects are the Bitcoin system and a gold standard similar? In what other important respects are they different?

Bitcoin is similar to a gold standard in at least two ways. (1) Both Bitcoin and gold are stateless, so either can provide an international base money that is not the creature of any national central bank or finance ministry. (2) Both provide a base money that is reliably limited in quantity (this is the grounding for Selgin’s characterization), unlike a fiat money that a central bank can create in any quantity it likes, “out of thin air.”

Bitcoin and the gold standard are obviously different in other ways. Gold is a tangible physical commodity; bitcoin is a purely digital asset. This difference is not important for the customer’s experience in paying them out, as ownership of (or a claim to) either asset can be transferred online, or in person by phone app or card. The “front ends” of payments are basically the same nowadays. The “back ends” can be different. Gold payments can go peer to peer without third-party involvement only when a physical coin or bar is handed over. Electronic gold payments require a trusted vault-keeping intermediary. Bitcoin payments operate on a distributed ledger and can go peer-to-peer electronically without the help of a financial institution. In practice, however, many Bitcoin transactions use the services of commercial storage and exchange providers like Coinbase.

The most important difference between Bitcoin and gold lies in their contrasting supply and demand mechanisms, which give them very different degrees of purchasing power stability. The stock of gold above ground is slowly augmented each year by gold mines around the world, at a rate that responds to, and stabilizes, the purchasing power of gold. Commodity (non-monetary) demands also respond to the price of gold and dampen movements in its value. The rate of Bitcoin creation, by contrast, is entirely programmed. It does not respond to its purchasing power, and there are no commodity demands.

Let’s consider supply in more detail. Secularly, annual production of gold has been a small percentage (typically 1% to 4%) of the existing stock but not zero. Because the absorption of gold by non-monetary uses from which it is not recoverable (like tooth fillings that will go into graves and stay there, but unlike jewelry) is small, the total stock of gold grows over time. Historically this has produced a near-zero secular rate of inflation in gold standard countries. The number of BTC in circulation was programmed to expand at 4.0 percent in 2017, but the expansion rate is programmed to fall progressively in the future and to reach zero in 2140. At that point, assuming that real demand to hold BTC grows merely at the same rate as real GDP, Bitcoin would exhibit mild secular growth in its purchasing power, or equivalently we would see mild deflation in BTC-denominated prices of goods and services. (Warren Weber’s paper similarly derives this result.)

This is a great commentary on some of the gold-bitcoin comparisons.

The most important difference is that the rate of creation of gold, (by mining), is driven by the economy, inflation rate, stock prices, and its own price. In other words, when the price of gold is higher than the cost of production, new mines open, and the amount of gold mined increases.

On the other hand the newly mined supply of bitcoin is hard programmed and can only go down. The bitcoin mining rate will never rise, even if the price goes to the moon.

Very long story here...

Great job i was actually doing a research on bitcoin on exchange rate not knowing you have already break it down for understanding thanks a lot

The difference between Bitcoin and Gold is that Gold has "intrinsic value". I hate that phrase, because it doesn't describe what it is - a better phrase would probably be "intrinsic demand". Gold can be used for things other than money, so it's not just a unit of account that people agree on for use as a currency. This is key, which is why I subscribe to the DAC philosophy. If we want a stable currency, it'd be better to put Gold on a blockchain for accountability purposes with cameras in the vault, because Bitcoin still has the possibility of being overtaken by a competitor. This is exactly why I support Quintric - Gold and blockchain are symbiotic, and we should be very careful to watch ourselves when we use Fiat arguments.

You are correct that gold has a "intrinsic demand" but not as much as we mine it. Imagine how many tons are stuck in the vaults with no use.

Also on the downside Gold has many. It is

So in my opinion (right or wrong) i still think BTC is much better moving into future of money/store of value. But who knows this is a "young" market and we never know what comes next.

I appreciate your opinion, but I'll offer some counterpoints:

I get the need for a trustless system, but I don't think we'll ever totally get that, even with Bitcoin. I think the ability for blockchain to provide transparency and accountability allows us to have an astronomically greater amount of trust in institutions that will have to actually prove their assets from now on. I like to think of it as a separate, but legitimate use-case. Plus, I'm just excited to trade Bitcoin with a proven non-fiat stablecoin.

Ok so my counterargument :)

I do hope we can get rid of all money but to be realistic i dont think we will ever get there totally but yes i agree that we will have a much better accountability and transparency thanks to Bitcoin. It might not even be Bitcoin that will be THE coin but something will come out of all this sooner or later.

ps. where is the video? i cant see it anymore.

Oh, @swissclive, thanks for such great analysis.

I look forward to your new blog about the steem and steem dollar inflation rates!

Exactly what i was looking for, thanks for the great summary!

What is the future of crypto?

I do not know if we could talk about inflation when the Bitcoin rises in value, Bitcoin is not itself a currency, but rather a digital asset that tries to represent a currency.

I will try to be more careful in my wording. Whilst in general conversation the word "inflation" refers to rising prices, I was using it in the traditional sense, which is the "inflation of the money supply".

As we know, in the fiat world, the symptom of inflating the money supply was higher prices. The higher prices are caused by the money being worth less. The money is worth less because there is more of it.

In any monetary system, savers want to see as little expansion of the money supply as possible.

The same is true of bitcoin. We want to see a shrinking supply, or at least a supply which does not increase too much.

Great analysis !!! I am very interested in what level of inflation and outlook for STEEM?

Yes, I have the steem and steem dollar inflation rates. The results are not what I expected. I will put them in a new blog.

I look forward to it.

Will BTC cross $20K mark by the end of Dec-2018

See complete analysis Here.

https://steemit.com/cryptocurrency/@shahhasan29/will-bitcoin-cross-usd20k-by-the-end-of-dec-2018

@shahhasan29. Welcome to steemit. I would very much enjoy your thoughts on my blog with some interesting ideas to engage in the discussion. However simply dropping a link to your blog is bad form.

Imagine you were having a discussion with your friends in a bar and I suddenly arrive inviting all your friends to leave you and join me in a different bar?

Good luck in your future blogging comments.

@swissclive. Thanks for the guidelines, will follow it.