The price of Bitcoin could reach $ 10,000 after Blockchain Week in New York

Blockchain Week New York begins today and the hype around the event could be enough to bring back the price of Bitcoin above the psychological threshold of $ 10,000 for the first time since early March.

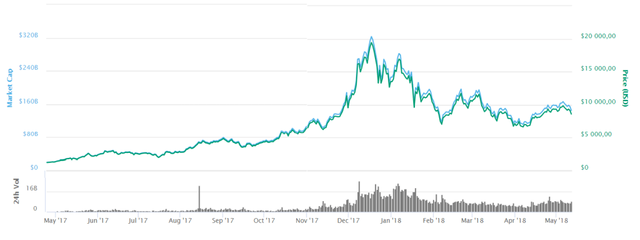

The price of Bitcoin - which has risen following the Consensus event for each of the last three years - has oscillated just under the $ 10,000 mark in recent weeks and almost exceeded it last weekend before to fall back. It is currently trading at about $ 9,000 per coin.

This is the first year that New York is organizing a Blockchain Week, which will take place from today to May 17th, and is organized in partnership with the research and media company Coindesk and the New York City Economic Development Corporation - a non-profit organization serving the creation of jobs in the city.

Last year, the Consensus, one of Blockchain Week's biggest events, launched the Bitcoin price boom that saw it climb during the summer and up to December, reaching $ 19,000 before falling back abruptly in early 2018.

Some 8,000 people are expected this week as part of Blockchain Week in New York, including Jack Dorsey, chief executive of Twitter, James Bullard, president of the St. Louis Federal Reserve, and Eva Kaili, a member of the European Parliament.

Bitcoin traders and investors will pay close attention to these and other leading technology and finance experts to gauge Bitcoin price sentiment and any plans to use cryptocurrency.

Robert Sluymer, managing director and technical strategist at investment research firm Fundstrat Global Advisors, told CNBC's Fast Money that the price of Bitcoin had risen every year after the Consensus.

The Consensus includes a hackathon job fair and about the Blockchain, starting on Monday, May 14th.

The 2018 Consensus will feature 250 speakers and 4,000 participants from start-ups, investors, financial institutions, and academic and political groups who will discuss the Blockchain and a future digital economy.

However, there has been a lot of good news for the price of Bitcoin in recent weeks, but that has not managed to raise it.

Last week, the New York Times reported that investment bank giant Goldman Sachs is studying ways to trade cryptocurrency chips and plans to release bids for Bitcoin futures.

By the way, it was also reported that the owner of the New York Stock Exchange, Intercontinental Exchange, is considering a type of Bitcoin swap for institutional investors.

Both are big news for Bitcoin and crypto-currencies in the established financial world and could mean that even the hype of Blockchain Week New York might not be enough to chase Bitcoin's bears.

Meanwhile, Fundstrat - who has long been optimistic about Bitcoin - predicted yesterday that the Bitcoin price could rise to $ 64,000 in the long run and $ 36,000 by the end of 2019 because of the growth of Bitcoin Mining. Bitcoins using computers to solve complex mathematical equations.

Sam Doctor, head of research in data science at Fundstrat, said: 'We believe that the current growth in hash power is supporting a Bitcoin price of around $ 36,000 by 2019, with a range of from $ 20,000 to $ 64,000.

As the power of hashing - also known as processing power - increases computers' ability to solve Bitcoin's creation equations, Fundstrat predicts that this will increase by 350% until 2019.

We think Bitcoin mining companies have fared well thanks to last year's price hike.

Bitmain, one of the largest Bitcoin mining equipment companies in the world, reported operating profit of about $ 4 billion last year.

Meanwhile, rival Canaan targets a $ 1 billion valuation of its planned initial public offering