Bitcoin: The World Can No longer Sustain Its Mining Costs

Bitcoin's price erodes due to rising operational mining costs

Image source: pixabay - TheDigitalArtist

We have had a long series of tax regulations, cryptocurrency bans by governments, price speculation as well as new technologies, hard forks and large companies joining the crypto market. As Bitcoin mining reaches its technical bottlenecks, ASICs mining could not resolve the scale of the current crypto market.

A commentary was made on the journal Joule addressing "Bitcoin's Growing Energy Problem" written by Alex de Vries, from the Experience Center of PwC, Amsterdam, the Netherlands. The Bitcoin network consumes at least 2.55 gigawatts of electricity and is estimated to consume 7.67 gigawatts in the future.

Mining costs are not limited to the electricity used to run the computational work for Bitcoin transactions. Cooling costs, mining facility rental, manpower, equipment cost and maintenance are just some of the auxiliary costs required to run a Bitcoin mining facility. With the difficulty of the algorithm and the hashrate of Bitcoin going upwards, the block rewards have been greatly reduced. It could be soon that Bitcoin will be no longer profitable to mine.

Image source: pixabay - Reisefreiheit_eu - Bitmain Antminer

ASIC mining industry in danger

ASIC miners often use Antminers or SHA256 based miners that are designed to mine a certain coin. ASIC farms cannot switch to mining another coin easily with their inflexible machines and will not be able to sell them off as they do not serve any other purpose, other than Bitcoin mining.

Falling Bitcoin prices and high operational cost could render the current Bitcoin mining facilities in the red zone, losing money as they have to resort to swtching off their miners and unable to recuperate operational costs. But this has been anticipated by cloud mining companies who sold mining contracts to customers for a more stable income, in case such events occur.

Ethereum Rising

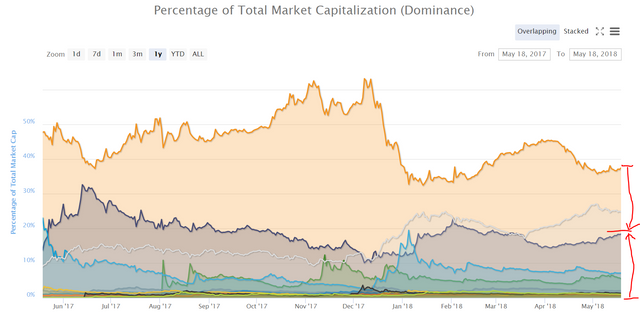

It is no joke that Ethereum is catching up on Bitcoin to become the No.1 cryptocurrency. Ethereum is reaching its 3rd peak soon, with the first peak that happened on June 2017 and the second in Feb 2018. We are talking about the ETH/BTC prices not ETH/USD prices. Within the cryptocurrency network of coins, Ethereum is definitely gaining much more value against Bitcoin the the past months. Ethereum's market cap was only one-third of Bitcoin's in Jan 2018. But today, Ethereum stands at 18 percent while Bitcoin hovers around 37 percent - Ethereum is currently at the halfway mark to surpass Bitcoin.

In addition, Bitcoin Cash [BCH] and EOS are doing quite well for Q2 2018. What will happen to Bitcoin when the mining stops? Will their Lightning Network be fast enough to mitigate the scalability issues?

-tysler

Image source: coinmarketcap - Ethereum's 3rd Peak

Image source: coinmarketcap - Total Market Dominance BTC vs. ETH

The one issue I have with these power consumption alarmist articles is their blatant disregard for the power consumption of the legacy financial system, which dwarfs bitcoin's power usage by order of magnitude.

Andreas dismantles these one-sided arguments quite well:

Hi the one issue I have with these Bitcoin spokespeople justified videos is their blatant disregard for the power consumption of Bitcoin mining itself, which grow as large as Austria's power usage: https://inhabitat.com/bitcoin-is-expected-to-consume-enough-energy-to-power-austria-by-the-end-of-2018/

Great post about the Bitcoin energy problem.

Energy demand is a very real problem that few discuss.

Canada's largest energy producer - Hydro Quebec - recently announced it can't handle increased energy demands caused by crypto mining.

Montreal is a leading area for crypto mining.

Is the answer Litecoin?

Thanks for the heads up about Montreal, Canada. That would be shocking as I would expect crypto mining's energy demands to be overwhelming. True, in colder regions mining costs are lower - which may lead to either governmental support for increased revenue or banning of mining operations to sustain the country's own energy consumption.

Not sure which is better.

I made bitcoin purchases yesterday i dont know what your talking about!

Ethereum and litecoin are great too, but this is serious FUD.

I don't think he gets it, his title makes no sense. Claiming that mining costs cause BTC price to drop, it's the opposite, mining price increases tend to cause prices to rise (just like in RL mining).

Also electric prices in the 3rd world or places like china, are still incredibly cheap.

Hi no one likes negative news, including myself. I still do buy Bitcoin, if that changes your opinion. From an economic pov, mining is never an economically sustainable activity due to its high energy consumption. Proof-of-Stake is. If not, why use Smart Media Tokens such as Steem and not Bitcoin?

Dont attack the flagship!

I understand many cryptos serve diff purposes...

Bitcoin is becoming bullion...

Decentralized

Good content, keep it up sir.

This post has received votes totaling more than $50.00 from the following pay for vote services:

smartsteem upvote in the amount of $38.47 STU, $53.86 USD.

buildawhale upvote in the amount of $36.39 STU, $51.06 USD.

For a total calculated value of $75 STU, $105 USD before curation, with a calculated curation of $19 USD.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

And.....that is why we are moving to Proof of Stake and Scalability...(EOS hint hint) :)

Interesting read, thanks for sharing. I've smashed the upvote button for you!

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

CryptoSuite (Special Discount): http://iwannasavemoney.com/oE5nh