Le plus grand PDG de l'incubateur de start-up indien [faussement] déclare que Bitcoin a échoué en raison des frais de 20 $

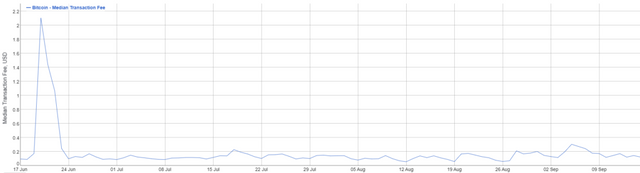

According to Jay Krishnan, CEO of T-Hub, SRI Capital's largest incubator and venture capital advisor in India, Bitcoin has failed because of a $ 20 transaction fee. Except that since December, for more than nine months, Bitcoin's median transaction fees have remained below $ 0.2.

In December 2017, demand for Bitcoin and other major cryptocurrencies such as Ethereum, Ripple and Bitcoin Cash reached a record high. The price of bitcoin, which has hovered around $ 19,500 on the world market, has exceeded $ 24,000 in South Korea, with premiums driving up the price of BTC.

False argument about scalability

Bitcoin and blockchain based systems, in general, are decentralized networks that exist on peer-to-peer protocols. As such, scalability via cryptographic engineering and development is required. Since the end of 2017, Bitcoin, Ethereum and many other blockchain networks have seen dramatic improvements in scalability.

Bitcoin has integrated SegWit and Lightning, while Ethereum is implementing Sharding and Plasma to potentially increase the transaction capacity of the blockchain to one million transactions.

Yet Krishnan, who is responsible for overseeing innovative developments in one of the world's largest markets in terms of population and market size, concluded that Bitcoin was unable to respond to unprecedented levels of transaction and demand. .

"Bitcoin's mistake as a currency is its transaction costs, usually over $ 20. Transaction fees are paid to ensure the convenience and security of the exchange. This is not only higher than the transaction fees paid for the regulated currencies, but is also an indication of the security risk involved, "he said.

The difference in position vis-à-vis Krishnan's crypto-currencies and world-renowned venture capitalists like Andreessen Horowitz is quite obvious. This week, at the TechCrunch Disrupt conference, the legendary investor and one of the most successful venture capitalists, Ben Horowitz, said that crypto represents the birth of a new computer system.

At first, cryptography may seem more inefficient and impractical than legacy systems. But its decentralized nature leads to develop applications impossible to build before. He added that the misleading nature of the new computer systems is that in the beginning they seem in most cases worse than the old ones.

Horowitz said:

"I think there is probably more development activity in cryptography than anything we've seen from the Internet, and the right way to think about it is a new computing platform. Once a decade, a new computer platform is available. What is misleading is that when the new platform at the time is generally worse than the old platform but has new features. "

Bitcoin has succeeded

It is easy to find arguments to rule out the emergence of disruptive technologies. Analysts condemned smartphones in 2007 because they seemed lower than computers at the time.

However, it is important to recognize the potential of new systems and the ability of disruptive technologies to create applications that did not exist before, such as consensus currencies such as Bitcoin.

The transaction fees associated with the use of Bitcoin could be considered high for most people, even if they are currently less than $ 0.1. But compare it to the fees associated with using offshore bank accounts to store money and $ 0.1 seems well below the tens of thousands of dollars needed to transfer millions of dollars.

With the adoption of financial institutions and investment companies such as Citigroup, Goldman Sachs, Andreessen Horowitz, Morgan Stanley and the recognition of government agencies, it can be argued with ample evidence that Bitcoin has succeeded.