Technical Analysis on Bitcoin: Looking for the Bottom

Bitcoin has taken a very bearish turn. It penetrated the $6,500 support, but buyers quickly pushed it back up. If bitcoin does decisively drop below the $6,500 support, it'll most likely test the next support zone, between $6,000 and $5,800.

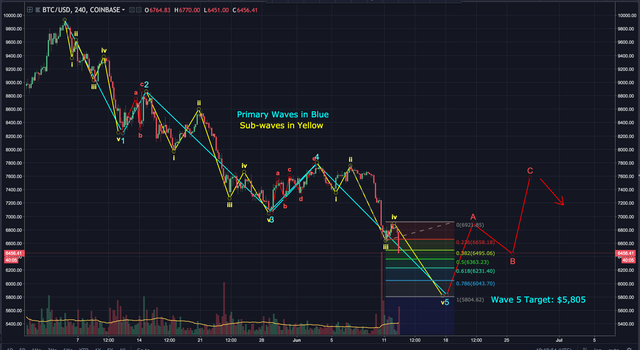

My primary count is still the bearish scenario I've been warning about for the last 2 weeks. It has bitcoin currently on wave 5 of 5 waves down. I've highlighted the sub-waves in yellow. The target for wave 5 is now slightly lower than previously stated. I'm targeting about $5,805 (1.0 fib level). Here's how it may play out:

Zooming in, if you look at the sub waves, wave 3 was greatly extended to almost the 2.618 fib level.

When wave 3 is extended, wave 5 is often times extended to at least the 1.618 fib. This means we MIGHT see bitcoin drop as low as $5,000. The reason I'm not targeting $5K is due to the strong support between $6,000 and $5,800. That said, if bitcoin does break below the $5,800 support, we'll likely see a drop to $5,000.

My alternate count is still a possibility. Bitcoin might be in a WXYXZ pattern. If accurate, it's currently on wave A of an ABC correction. This is not my primary, but it is still a possibility. Here's how this scenario might look:

The 1 day RSI just broke below the established support.

The 4 hour RSI is also looking very bearish. If/when bitcoin rises above the downtrend line, it might be an indication of a trend reversal. Until then, buying is a very risky play.

The 4 hour Stoch RSI looks oversold...which is not good. This means it's likely we haven't seen the bottom yet.

The 4 hour MACD, and 1 day MACD, has broken below the wedge I've been discussing. This gives more credibility to my initial bearish count.

If Bitcoin decisively drops (for longer than 2 hours) below $6,500, a short position targeting $6,000 might be attractive. I'd have a tight stop-loss set around $6,600. If it decisively drops below $5,800, a short targeting $5,000 would also be attractive in my opinion. My stop-loss would be set tightly around $5,900.

As of now, I'm not considering any buys until bitcoin breaks above the downtrend line we discussed on the 4 hour RSI. If bitcoin does drops to $5,000, I'll start to latter in my buys between $5,000 and $4,700.

Let's see how the next 24 hours play out. While this drop is painful for many in the short term, long term, it's very healthy for bitcoin, and the entire crypto market. We've needed closure on this downtrend for months. I believe we're finally getting it. Once the dust settles, I think it's going to usher in the bull run we've all been waiting for. It may not happen quick. In fact, once the market bottoms out, we'll most likely see a slow, steady uptrend until we break through $13K. From there, I think the bulls will start running. Until then, we need to be patient, manage risk and enjoy the show.

BIAS:

Short Term: Bearish

Longterm: Very Bullish

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Thanks for stopping by.

If you found this post informative, please:

If you don’t have an account on Binance, I STRONGLY recommend getting one. They’re usually the first to get reputable coins, have excellent security and second to none customer service. You can sign up here free of charge: https://www.binance.com/?ref=16878853

FYI…I just started a Facebook and twitter page where I’ll post analysis, along with other relevant crypto data from myself and others. If you’d like to be notified as soon as updates reach Steemit, the twitter handle is @Workin2005 and the Facebook page is https://www.facebook.com/Workin2005/

Published on

by Workin2005

Hi, @workin2005! Please take a minute and check out my new Steemit t-shirt design. I was working on it for a long time and hope that it is nice.

https://teespring.com/welcome-to-steemit-t-shirt

I think what we're seeing is a repeat of 2013 - 2014 mania blow off phase that will last more than a year. I think that an 87% correction from last December's high is possible sometime in 2019. This is similar to what Tone Vays has said, but I believe for different reasons. After the halving of 2020, bitcoin will moon again, this time much higher than $20K.

What we saw last December was an attempt at mass adoption, but the technology wasn't ready yet. This pattern will repeat until the technology can finally support the users who want to use the platform. This means that another bearish phase may return in 2022 if the technology isn't ready yet for mass adoption.

Once crypto (not necessarily bitcoin) replaces the banking system (hopefully not national centralized crypto), that's when mass adoption will render volatility practically nonexistent. At that point we won't be measuring the worth of crypto in dollars, but in the dominant crypto prevalent at the time.

You may be right, although I don’t believe it’ll take that long. The difference between 2013-2014 and today is, everyone is aware of crypto and we have endless competition within the crypto space. Everyone wants to become the go to crypto you’re referring to. Technology is moving exponentially faster than it was for many reasons. The obvious is, we just have better tech to create better tech. But that aside, we now have consumer awareness on top of countless cryptocurrencies competing with each other. This alone is driving innovation at a rate we’ve never seen before. Think about where we were 2 years ago and imagine where we’ll be next year. Bitcoin was the lone crypto in 2013-2014. Things have exploded in the last year.

The SEC is soon going to lay out regulatory guidelines that'll weed out many of the “scam coins” (to use Vay's words). This will leave only the real competitors left in the space. Once there are clear regulatory guidelines, I believe we’ll see a large amount of money enter the market. People want to know the rules before playing the game. Once they have those rules, I suspect those on the fence will make the jump. It’ll be slow at first, but at some point start to snowball.

So while a completely agree with your analysis, I don’t know if I agree with the timeline. I think the tech will be more than ready by next year, it’s just matter of the world being ready for the tech. At the current rate of govt spending, we’re going to see a major move away from fiat and into other assets...crypto being one of them. We’re already see that in many other countries like Venezuela. Time will tell. It’s certainly an interesting show to watch! ;-)