Cryptos Crash After Nvidia Forecasts Big Drop In Mining Demand

Content adapted from this Zerohedge.com article : Source

Sales of mining equipment was down for the last quarter for Nvidia. This sent cryptocurrency into a tailspin. The day was also marred with the report that the Mt Gox trustee was selling bitcoin again.

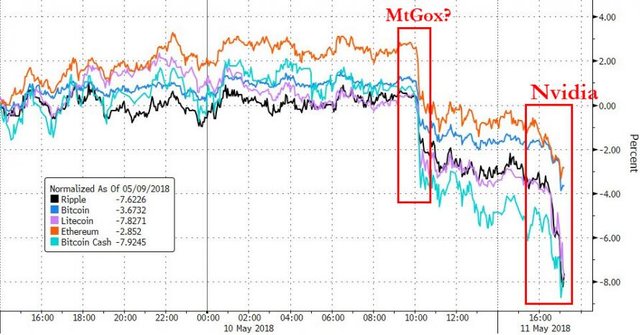

Cryptos have been hit with a double whammy today.

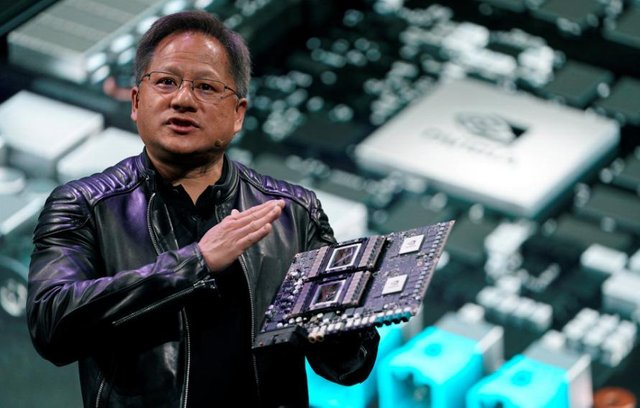

Around 1pmET, the entire space tumbled almost instantly as large blocks went through in Bitcoin, with chatter suggesting the MtGox custodian was unloading once again. Prices quickly stabilized once that selling pressure abated. However, shortly after the US market closed at 4pmET, Nvidia announced its results, posting quarterly sales that topped expectations.

However, NVDA shares fell as the company revealed for the first time that a bigger-than-anticipated portion of the demand for its powerful graphics processors came from the volatile cryptocurrency market.

And then the company said that while it generated $289 million in sales to cryptocurrency miners in the first quarter, Chief Financial Officer Colette Kress said that the company expects cryptocurrency-related revenue to fall 65% to about $100 million in the next quarter.

And that sparked a second leg of selling pressure across the crypto-space...

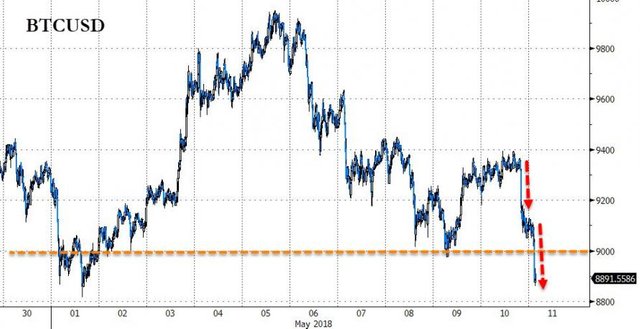

Sending Bitcoin back below $9000...

Non-adapted content found at zerohedge.com: Source

I wonder if BTC and Altcoins are going down further for the couple more days ahead.

Great

Is it time to panic and sell everything yet?

Just kidding

Let me explain this for those who need a bit more depth on why falling mining equipment sales could seem to cause the bitcoin price to fall. Then I will explain why that’s bollocks.

Here is what investors think:

They think that less sales of mining equipment somehow translates into fading investor interest, and thus a lower bitcoin price.

Here is why that is twoddle

The falling demand for rigs is merely a reaction to the already lower bitcoin price, and the reduced profitability for miners. In other words, it is not the production of rigs which determine the bitcoin price, but rather the opposite. The bitcoin price determines the demand for rigs.

The reality is that the prodution of bitcoin is constant irrespective of whether there are more or less miners. The cost of mining is not a factor that determines the price of bitcoin. However the number of rigs is affected by the profit. High bitcoin price=high profit=more rigs. That equation does not work in reverse. More rigs do not make more bitcoin, nor more profit. More profit from mining does not translate into a higher or lower bitcoin production, or price. The supply of bitcoin from mining is 100% inelastic.

With bitcoin, newly mined supply remains constant, irrespective of the price. It is not like gold, where the amount mined fluctuates with the price.

The only 2 things which change are the supply from existing holders and the demand from new investors. Neither of those is affected by either the number of rigs, nor by the cost of production.

If anything, one could argue that falling rig sales means less supply and higher bitcoin prices. However, that is also a fallacy, since bitcoin production is constant, no matter how many or how few rigs there are.