Bitcoin Cash Price Surpasses $1,800 — Eying the Second Largest Market Cap

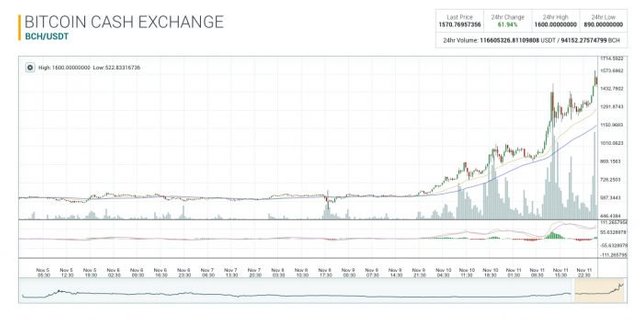

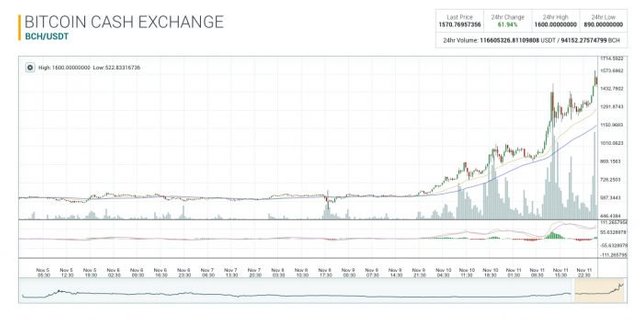

As news.Bitcoin.com reportedearlier this weekend, bitcoin cash (BCH) markets have been on a rampage following the canceled 2MB hard fork event. BCH prices have increased three-fold since then, reaching a high of $1810 across global exchanges and has since dropped to around $1400. Alongside this, the network hashrate has also met parity with the BTC chain.Also Read: Tezos Founders Enter Legal Battle for Control of $400m in Raised ICO Funds

Bitcoin Cash Reaches an All-Time High of $1,650 and $7B in Daily Trade Volume

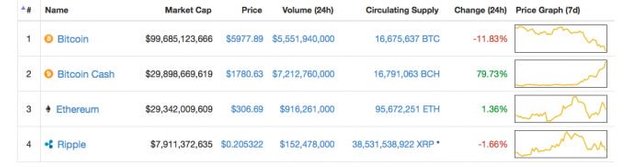

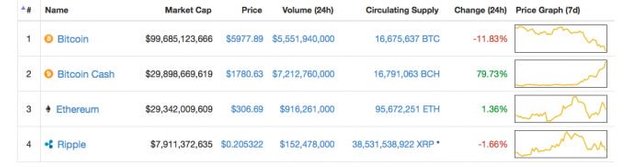

All eyes are on crypto-markets this week, and they’re looking at two markets in particular: bitcoin (BTC) and bitcoin cash (BCH). The two ecosystems have been sharing a strange correlation over the past 72 hours as BCH has reached new all-time highs and BTC has dropped over $1,300 in the last three days. Bitcoin cash markets are up over 70 percent over the course of the day.

Moreover, Bitcoin cash trade volumes have surpassed $7B in BCH swaps over the past 24-hours. The South Korean exchanges Bithumb, and Korbit are dominating BCH markets, as the won captures 47 percent of the market.

Further, the market capitalization of bitcoin cash reached over $29B, temporarily taking ethereum’s second place position.

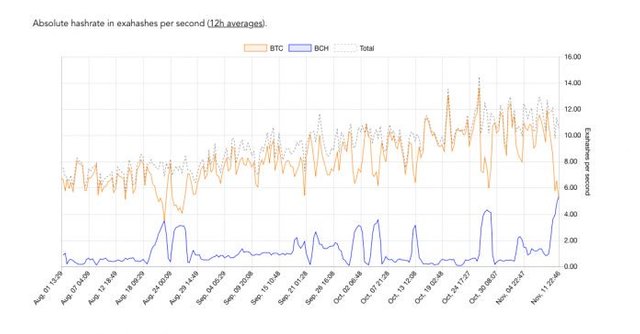

The Hashrate Parity

In addition to the market action, both BTC and BCH markets are seeing a strong correlation in the hashrate arena. At the time of writing, both networks have an equal share of roughly 5.4 exahash per second. BCH is operating at 10 percent of the BTC’s difficulty, and it’s 100.7% more profitable to mine BCH, according to Coin Dance statistics. There’s also a bunch of pools mining bitcoin cash including F2pool, Antpool, Viabtc, BTC.com, Bitcoin.com, BTC.top, Supernova, Bitclub, and some unknown pools.

Mempools and Fees

To add to all the market mayhem, the Bitcoin network’s mempool (transaction queue) is backed up by 139,000 transactions waiting to confirm. According to Johoe’s Mempool statistics, the backup has accumulated quite a bit over the past three days since the 2x cancellation. On November 11, using Earn’s fee calculator the average 226-byte transaction costs $9.64 or 155,940 satoshis. Some users are paying upwards of $15-20 per transaction just to get them confirmed quicker. The bitcoin cash mempool is also seeing some action but is clearing smoothly. The average fee for a bitcoin cash transaction is roughly $0.10-0.25.

The week going forward should be interesting, to say the least, watching both of these markets and ecosystems. Now, of course, the story could go on forever with the two community’s raging back and forth at each other in typical internet fashion. However, the statistics alone on November 11th are more fascinating, and the story will play itself out as time progresses.

https://news.bitcoin.com/bitcoin-cash-prices-surpass-1800-eying-the-second-largest-market-cap/

really helpful post for us 😊😊 @hamanda16

thanks for the post

The transaction fees in bitcoin are totally insane right now and you cannot even exchange any as the price is dropping!

Good post

guyzz a new challenger is in...BITCOIN GOLD...launched today..

https://steemit.com/bitcoin/@top5world/bitcoin-gold-launched-today

Very interesting. So, it seems that some SILENT fork actually happened, even though segwit2x was suspended; like a silent coup upon Bitcoin. Consequently the sudden price drop in BTC, and rise of BCH (the coup attacker) so to speak.

Most news in the world pales in comparison to what is happening in the cryptocurrency world; yet such a tiny percentage of populations even know about it. What happens with these dominant cryptocurrencies will set the direction of digital currency for the world, so that tiny percentage of people who do know are making history.

Very good info and charts, btw. Thanks.

dear fm @hamada16

Thank you Logical analysis Of course tomorrow is full of surprises

good topic

Bountiful post

Gotta keep an eye on this. Kinda snuck up on us out of nowhere... Anyone see this coming?

source