High Risk Of Double Spend Attacks Is A HUGE Vulnerability For Bitcoin Cash - Here A Full Explanation

Double spend attacks happen regularly on the Bitcoin Cash network, this means that the receiver thinks that he is paid already, but it turns out to be not the case. HERE you can find all the detected double spends, it is unknown in how many of these cases the product was already given out by the receiver. Probably many have lost money through this form of theft. Since it is relatively easy and profitable I suspect things will get worse. When BCH is shorted (leveraged) before the attack the profit can be even bigger.

In other words: A major security flaw for BCH

The big invention of Satoshi

The hilarious fact is that Bitcoin was the first successful attempt to create digital scarcity by solving the ‘double spend’ problem. Of course a double spend attack as described here will not lead to an increased maximum supply, but it enables theft. It is actually a security flaw that doesn’t belong to Bitcoin that is praised for it’s high security level.

What is a double spend?

A double spend happens when an attacker is broadcasting two different transactions to the network where the same funds are used. One transaction is to himself and the other one is to the merchant. The idea is that the attacker makes the merchant confident that he received the payment and ships the product, while ensuring that the transaction to himself will be included in the (longest) blockchain. Once the transaction to the attacker is permanently included, the other one to the merchant will be rejected or cancelled while the product is already shipped. The possibility or ease to double spend depends on the following factors:

0-confirmation transactions / amount of confirmations

In Bitcoin 0-confirmation transactions are not done. A transaction needs at least 1 confirmation to be counted as received, but 6+ confirmations is seen as safe. When you want to make onchain transactions you will always have to wait at least till the next block is created (every ten minutes), for instant payments the Lightning Network is developed.

Bitcoin Cash rejected Segwit and thus the Lightning Network, they use 0-confirmation transactions to enable instant payments. Also, Bitcoin Cash proponents are actively promoting the use of 0-conf transactions and claim that BCH is very useful for commerce because it is fast.

By the way: This is Satoshi’s vision about 0-conf transactions:

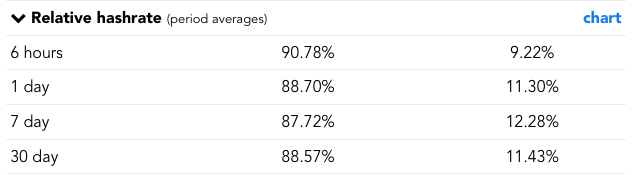

Hash rate

When two diverging blocks pop up the chain will split temporarily and the side of the split that forms the longest chain will be seen as the official blockchain and the other chain will be invalidated and disappear, so also it’s transactions. Also miners can decide about transactions that they want to include when they find a block. This means that hash rate gives power to write and rewrite blocks and enables big miners to execute certain double spending attacks.

Bitcoin Cash has only around 10% of the total hash rate, so a small group BTC miners can easily attack Bitcoin Cash, while BCH miners can hardly influence Bitcoin.

Left is BTC and right is BCH

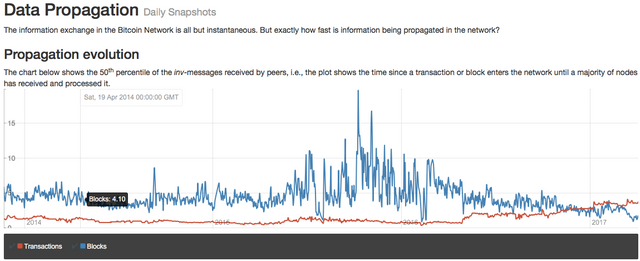

Block propagation time

When it takes longer to propagate blocks the miner that found the last block has a bigger advantage for the next block because he can start immediately while the others are still waiting for the block information. This leads to centralisation and makes certain (double spend) attacks easier. Also, sending a different block to different nodes will take longer to be detected.

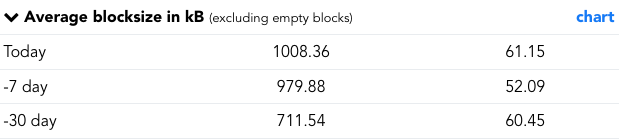

Actual block size is the most relevant influencer of propagation time, the bigger the blocks the slower the propagation. I can’t find comparison between the propagation time of BCH and BTC, but since BCH blocks are very small at the moment because nobody is using it and there are less nodes to propagate to it might be some faster at the moment. As soon as blocks start to fill up it will become much slower.

Nobody use BCH (yet), only 0.2% of the 32 MB block space is currently used

As you can see HERE, the Core devs managed to bring the time that 50% of the nodes receive the latest block back from around 5 seconds in the early years to 1.5 second now while the blocksize has grown bigger and the amount of nodes has increased. I couldn’t find any info about Bitcoin Cash, so can only speculate. In this post is the risk for BCH and BTC caused by propagation time considered even at the time, but in the future it will be much bigger for BCH when blocks get full.

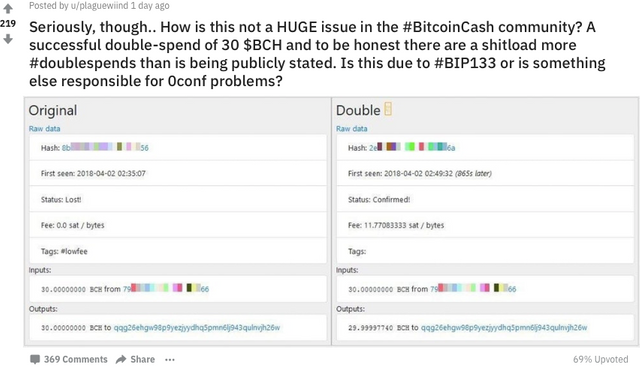

A successful double spend of 30 BCH took place recently

This is a HUGE deal, since this means that there is a huge hole in the security model of Bitcoin Cash that allowed a thief to steal 30 k USD from probably a merchant or exchange. This means that the use of Bitcoin Cash is not safe, you can lose money directly when you get attacked or indirectly when the price drops after a big attack. Since hash rate is one of the factors to allow a double spend, a price crash could increase the amount of successful attacks because the hash power will be lower (move to BTC) and crash the price again, this could become a real dead spiral.

Why is Bitcoin Cash much more vulnerable than Bitcoin

There are multiple ways to execute a double spend attack, and all of them are way easier on Bitcoin Cash. I will go through all the on Bitcoin Wiki described attacks and explain the difference between BTC and BCH.

Race Attack

This attack can only be executed when 0-conf transactions are accepted. In BTC 0-conf is not done and in BCH it is used and heavily promoted, so only BCH is vulnarable. When BCH finally get adopted by real users and blocks become filled up (or spam, can eventually be done by the attacker), this attack becomes even easier because slower block propagation will make it take longer to detect.

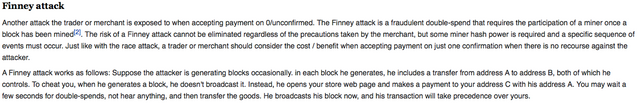

Finney attack

Also here only BCH is vulnerable because the use of 0-conf transactions. Furthermore, because BTC miners can shift temporary to BCH from BTC there are much more possible attackers (add up the hate against BCH). Also, when BCH blocks become full and thus propagation time is longer the attack becomes easier because the other miners are delayed more and this will give the attacker more time to execute his attack before other miners interrupts him by finding another block.

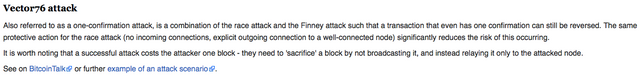

Vector76 attack

This attack is possible on BCH and BTC as well. However, on BCH it is way easier to execute because it cost way less to mine a block and the mining cost of one block have to be sacrificed for the attack. Furthermore, there is a way bigger pool of possible attackers because BTC miners can shift temporally to BCH to execute the attack.

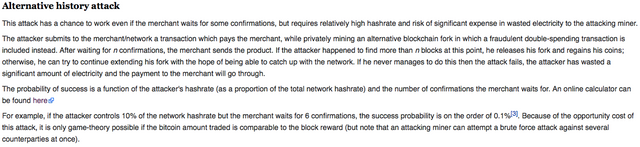

Alternative history attack

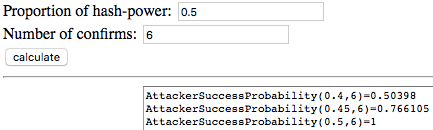

This attack requires a lot of hash power and in case of a failure the ‘work’ that is used will be lost with financial damage as result. As you can see here:

https://people.xiph.org/~greg/attack_success.html

When the attacker owns 0.4% of the hash power his chance to be successful is just over 50%. Between 0.4 and 0.5% of the hash power his chance will increase from 50 to 100%. It is very hard to take control over 40 to 50% of the BTC hash rate, but only 10% of the BTC miners will own 50% of the BCH hash power when they move over temporary for the attack. This makes BCH extremely vulnerable even with transactions with more than 6 confirmations!

Majority attack

This attack is really hard and expensive to execute on BTC and when individual miners see that a pool almost reach 50% they will leave this pool to avoid the possibility of an attack to maintain their future income. On BCH only 10% of the BTC miners have to move to BCH to execute the attack, when a part of the attackers is already on the BCH chain a way smaller part of the BTC network is needed. The existence of BCH is increasing the risk for BTC, because it is undermining the game theory as described on the Wiki, miners can move to BCH after attacking BTC so their hardware is not totally obsolete. Here more about a 51% attack:

Note that an attacker needs 10% of the BTC hash rate to shift over to BCH instantly to own 50% of the hash rate. When the miners shift slowly they will make other miners leave because the difficulty goes up and thus the profitability goes down. In that case they need way less than 10%, some more than 5%. The downside is that a big attack will lower the value of the already minted BCH and it cannot be sold immediately. This have to be figured out by the attackers what is more profitable in the end.

Conclusion:

It is very risky to use BCH, seen the profitability it is not the question if a huge attack will happen but when. I would advice all the merchants and exchanges to de-list BCH in order to avoid the attack to happen in your business. It will not only harm you, but the entire crypto ecosystem.

Imagine the mainstream media writing ‘Bitcoin security broken after major hack’.

It will be written like that because Roger spread the false narrative that it is Bitcoin

Bitcoin is a technological breakthrough because of the enormous security level, the knock off BCH is heavily flawed. Bigger blocks will give problems over time and multiple coins with the same mining algorithm is a bad idea anyway: It will destabilise both of the coins, add attack vectors to the majority coin by undermining game theory and make the minority coin extremely vulnerable.

So vulnerable that it shouldn’t even carry the name Bitcoin at all.

Thats why we better call it Bcash

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

You forget that Miners will choose the chain were they can make more profit. If Bitcoin Cash (BCH) Price is in relation higher than Bitcoin Core (BTC) Miners will move to BCH, doing more profit.

Miners can not really jump over to BCH and try the attacks you mentioned. Hashrate will be adjusted way faster in BCH than BTC, so it will be (if even) a very short time where they could try todo these attacks / doublespends.

About propagation time, in the end the (honest) majority will ignore the bad miner and his wrong block, he will loose money from his wrongly used hashpower.

0-conf does work and is fast(-instant), nobody will try to double spend your coffee when he needs to invest a lot more than he can win (your money from the coffee).

If you gonna sell a house with Bitcoin Cash, you can easily wait for 6 transactions to be sure.

0-conf works for micro transactions, nobody is going to pay 10 dollars for 0.00000001.

I prefer my Bitcoins in my own "private key" Wallet on the blockchain. I don't want them stored somewhere in another layer linked up to the blockchain.

Why should I want to leave my money at the supermarkets place for the next time I go shopping?

Why will a bigger car / plane / ship / harddrive... give more problems over time than a small car / plane / ship / harddrive?

Why is it a bad idea to use the same techniques as a competitor? Why is it bad to use the same wheels as another one?

Thanks for this valuable blog and complete knowledge of BCH loop hole. I also read about a case double spend with Cryptonize.it which is an online shopping website that sells gift cards via BCH payments.

In an attempt to execute a “double spend” attack using Bitcoin Cash (BCH), an unidentified individual purportedly lost $2,000 purchasing a gift card worth $1,000, as reflected on Cryptonize.it transaction data

Yes, I think it happens a lot, but a major attack didn't happen yet so nobody is talking about it. I think the community have to take action before it occurs, because it could crash the entire crypto market, people that don't understand crypto will think that it can happen to EVERY crypto.

Thanks for you sir

I have 1 BITCOIN but I can not sell it.because now bitcoin cost is very low.This post also say it about details.Thanks for this post bro.

And many people are saying that BCH is the real Bitcoin :o

Thanks for the clear explanation. That's why bch will never replace btc

great post thank you for all explication i vote and resteem ur post because is verry interesthing

nothing today is compared to Bitcoin robustness, compare the AltCoins hash rates, it's peanuts guys ;)

Bitcoin is the crypto-fortress

what do you think on this: https://steemit.com/bitcoin/@aro.steem/google-trends-crypto-market

For as much time and energy as I have put into cryptos, this is something that I've been needing to get educated on. Thank you for this very informative essay.

nice post..