Open your own insurance business with Black Insurance!

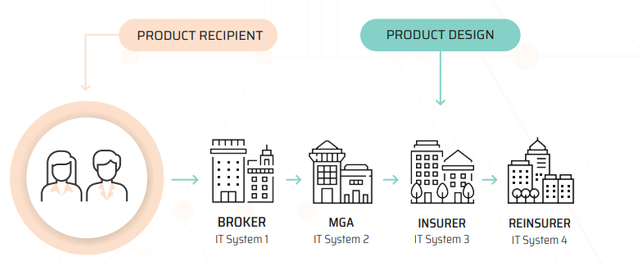

The market of insurance services is currently in an active stage of development. Modern people can insure absolutely everything, starting from own life and ending with real estate. The insurance process is executed by insurance companies that provide an insurance agent with a customer database, and a client is offered a brand with a good reputation and a wide range of possibilities. But the presence of the third party in the interaction of an insurance agent and a client significantly increases the cost of insurance services, at the same time significantly reducing the amount of profit for an insurance agent. Also, an insurance agent is severely limited by the internal standards of an insurance company and cannot realize his/her innovative ideas to increase own income. Starting a business from scratch in the insurance industry is hard enough because of a lack of reputation, and an individual insurance agent who starts working individually usually leaves the market quickly. Decentralized Black Insurance platform offers insurance agents to work independently to increase their income, and customers make insurance faster and cheaper.

Key Features of Black Insurance

Operating costs for running a business and the cost of starting capital will be reduced through the work of Black Insurance based on blockchain technology. The interaction of specialized service companies is managed through smart contracts, that will help to reduce the costs of operating the insurance business. By creating a market where insurance agents and customers can cooperate directly, the cost of capital necessary to fund the pool of insurance reserves will be minimized.

Advantages of Black Insurance

Black Insurance platform offers a wide range of insurance services, including car insurance, private property insurance, travel insurance, etc.

Insurance agents develop their own strategy. The platform will ask an insurance agent to provide business plan. Black Insurance specialists will analyze it and confirm the reliability of an agent. The project has an analytical function and is able to calculate the prices under which any insurance business can be effective. An insurance agent should begin to make a reserve of up to 25% of the working capital to cover losses in case of inefficient operation.

For insignificant insurance cases with a low level of risk, payments can be automated. Larger and more complicated insurance cases will include claims for reinsurance of a facility, use of reserve funds for payment of a sum insured. Automated workflows of smart contracts will notify the parties of the necessary follow-up actions to speed up the process. Insurance agents can use a user interface or API technology to store insurance policies and information about insurance claims.

A client, when registering an insurance policy, gets the opportunity to insure his/her objects cheaper and faster, and also receives a guarantee of payment of the insurance benefit in a short time. The blockchain-based platform will reliably protect the information being placed from unauthorized use.

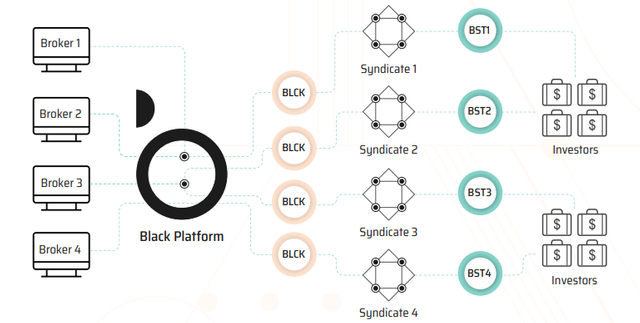

Black Insurance will issue two types of tokens: Black Insurance Platform Token (BLCK, utility token) and Black Insurance Syndicate Tokens (BST, security tokens). BLCK can be purchased and owned by any user account on the network, while BSTs are available only to accredited investors.

Black Insurance cryptocurrency

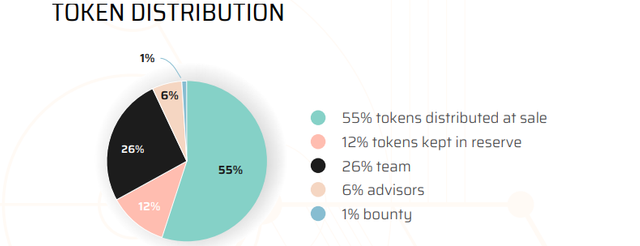

BLCK is used by users to pay for platform services. A total of 575 million BLCK tokens were issued, of which 55% were allocated for sale. One token can be purchased for $0.2. The minimum purchase amount is $100. The project’s softcap is $2 million, the hardcap is $45 million. The project’s crowdsale lasts until the end of August.

Summary

Thus, Black Insurance platform modernizes the insurance market, allowing insurance agents to create their own business and generate their own revenue independently. For customers, Black Insurance platform offers insurance design profitable and fast for proven insurance agents. Convenient interface, the possibility of constant communication with the insurance agent, work without intermediaries, quick payment of the insurance amount in the event of an insured event will allow considering the insurance process in a new way. By 2019, Black Insurance platform will release a beta version of its project, and by 2021 will provide its users with a full set of functions.

Ссылки:

Website: https://www.black.insure

WhitePaper: https://www.black.insure/whitepaper.pdf?pdf=whitepaper.pdf

Telegram: https://t.me/joinchat/Exji9RCKSs9Imxl_nDn6Ig/

Facebook: https://www.facebook.com/blackinsure/

Twitter: https://twitter.com/BlackInsure

Medium: https://medium.com/blackinsurance

ANN: https://bitcointalk.org/index.php?topic=3372186.420

Author: https://bitcointalk.org/index.php?action=profile;u=980049

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.