VIAZ:First major decentralized shared subsidizing platform on Tezos.

Contrary to popular opinion, digital currency trends are not alternatives to banks or their statutory functions, but they are geared towards improving the ease of doing business especially as the 21st century grinds to a halt.

Words on the crypto space show there’s not much effort towards including banks in the scheme of things. Yes, there have been rumors about some crypto-giants partnering with banks, but much of that smoke has turned out to be mere dust with no flame.

In the budgetary space, we are today, numerous people and corporate bodies over the globe are unmindful about cryptographic money and its inventive innovation, subsequently, neglected to receive its unparalleled developments. You might need to inquire as to why? There are such a large number of reasons brought about by various people and corporate bodies. Be that as it may, with respect to me, one of the real reasons is on the grounds that the advantages and preferences of cryptographic money and its creative innovation are obscure to them and they neglect to comprehend its significance in the budgetary business – credit and loaning space.

Blockchain innovation close by with digital money has very lifted those people and corporate bodies that embrace its advancement. In the present customary loaning and getting biological community, such a large number of are looked with bunches of difficulties running from powerlessness to give guarantee, loss of insurance in light of high-financing cost, failure for most people to approach advance, delays in advance procedures, extortion, absence of information security and straightforwardness, local confinements thus numerous others. These securities could be landed properties, land deeds, and other physical properties however in the decentralized acquiring and loaning stage, the individual uses digital money as methods for guarantee.

Blockchain innovation has made it clearly evident that anybody can approach cross-fringe acquiring and loaning with no confinements and putting of physical properties as guarantee which is an additional interesting favorable position to the individuals who receive the utilization of cryptographic money as a methods for getting and loaning. Getting and loaning on the blockchain innovation have a cleared route with loads of advantages to corporate bodies and to the individuals who don't approach bank or any loaning administrations.

The decentralized acquiring and loaning framework have incredible points of interest over the customary loaning framework regarding straightforwardness and effectiveness because of brilliant contracts use on the stage. It likewise wipes out middle people, giving space for distributed obtaining in a tranquil and secure condition at the comfort of your home. The decentralized obtaining and loaning stage are not inclined to hacks.

How about we perceive how this customary creating economy framework has showered open door for a blockchain innovation like VIAZ platform.

MODUS OPERANDI OF THE VIAZ

While it’s easy to fantasize about the impact of the banking sector on cryptocurrency, there has to be a strategy towards making the involvement hitch-free. VIAZ uses an app in making this possible. It’s not only trendy and catchy as with all innovative, but esteemed business values like transparency and ease of operation are not left out of the picture.

VIAZ is a decentralized application ("DAPP") running on the Tezos blockchain. It looks to dispense with the hole between the banks and borrowers of cryptographic forms of money and fiat and in doing as such, make the digital currency showcase helpful for both digital money and fiat.

VIAZ is the first of its sort of platform to connect moneylenders and borrowers in a verified decentralized space, the center motivation behind this creation is to annihilate difficulties and misrepresentation cases endured by those needing credits and those ready to give out an advance. With VIAZ the scaffold between middle men will be shut while permitting the stream of computerized resources and FIAT (Government issued money.), VIAZ offers a vivacious system that acknowledges statement of advanced resources.

How VIAZ Tezos Peer To Peer Blockchain Funding Platform Works

Viaz looks to urge its record holders to get fiat or crypto through utilizing their tokens as guarantee. At first, Viaz tokens and Tezzies ("XTZ"), the local token of Tezos, will be the main acknowledged guarantee. Later on, Bitcoin and different altcoins will be added to the stage.

When a borrower posts an advance, a keen contract is made by the stage and the credit is recorded on the Tezos blockchain record. Banks will at that point get the opportunity to offer on the distinctive financing openings relying upon the loan costs. In situations where the bank needs to support the credit at higher loan fees, they can do as such and gain higher financing costs. The credit reimbursement by the borrower will be through the Tokens of the Viaz stage.

Viaz consequently issues clients with a fiat and crypto wallet once they join on the stage. Through the wallet, clients could deal with their portfolio and exchange assets on or off the Viaz decentralized stage.

VIAZ Benefits

Transparency

The every day activities of the Viaz stage are increasingly available contrasted with the conventional loaning frameworks, as its highlights are good with IOS and Android working frameworks. Subsequently, clients can utilize the Viaz versatile application from their gadgets for nothing out of pocket.

Secure

The Viaz stage works on the Tezos blockchain organize that is monetarily secure, as it records every one of the exchanges on its record that isn't alterable or open by outsiders. So also, Viaz gives clients a digital money and fiat wallet that makes it workable for them to safely store their assets, deal with their portfolios, and exchange reserves.

No Taxes

Contrasted with the present loaning frameworks and organizations, Viaz will be less expensive as borrowers won't need to make good on regulatory obligations on the acquired cash.

Hazard Free

For borrowers to post advance demand on Viaz, they should vow a specific measure of security. This shields the loan specialists from the danger of losing their cash on the off chance that they default.

No Fees

Clients are not required to pay any join, month to month or upkeep expenses to Viaz. The stage will produce salary for itself by deducting a little rate from the enthusiasm on all credit reimbursements.

It is the world's absolute first multi-stage arrange that empowers loan specialists (shared) to loan in commercial centers, banks and other credit establishments. They mean to contact the world by creating multi-stage arrange worldwide and to achieve a tipping point for mass reception utilizing blockchain resources (tolerating advanced resources as insurance) than the customary loaning technique. They will likewise give a protected decentralized cryptographic money resource security framework which can manufacture many guarantee safe stage.

VIAZ is based over Tezos, and will give the

Crypto-upheld credits. at first VIAZ will concentrate on crypto-upheld advances, enabling borrowers to stake their crypto as security and get a fiat credit (from one of our loan specialists).

Home-sponsored credits: we will progress in the direction of giving an answer where clients can buy homes utilizing VIAZ, with titles being overseen on-chain. The home hence turns into the insurance.

Unbound credits – at long last, we intend to give controlled unbound advances.

The VIAZ token will be utilized as the main impetus of the stage, it was made on TEZOS blockchain in light of the fact that it conveys a protected and increasingly strong calculation. With TEZOS there is a usage of assigned verification of stake agreement conventions for consistent exchanges which has turned out to be progressively effective to existing blockchain innovation conventions.

Loan lenders dismiss cryptographic money offers from borrowers.

Borrowers should join all their crypto resource for one when they meet a loan specialist willing to acknowledge digital money as insurance.

Low liquidity.

Borrowers can't store or sell their crypto property.

Loan specialists will acknowledge computerized resources as guarantee from borrowers.

Advances will be accessible in any benefit of decision by loan specialists.

Resources can be saved by borrowers and they will, thusly, get a credit from banks.

Arrangements are made unmistakable to borrowers, banks and viaz to eliminate misrepresentation from any gathering.

Easy to use and simple to explore the stage.

Decreased administration charges contrasted with customary keeping money techniques.

Disposal of charge back extortion.

Clients have complete control of their assets.

Arrangement of full help and request execution.

The utilization of VIAZ tokens pulls in rewards and limits.

Cutting edge framework.

day in and day out client care bolster administration.

Decentralized, straightforward, consistent, quick and verified arrangements accessibility.

Shared exchanges.

As an advanced cash wallet, VIAZ seems to accomplish something other than be another money related storage room. It's giving an immediate connection between the entirety of your computerized resources and the decency run of the mill of the customary saving money area. With VIAZ, you gain admittance to applications (Android and iOS) which put important resources (both advanced and fiat) readily available. Financial specialists, old or new, would love the inventiveness of the applications.

TOKEN DETAILS

TOKEN NAME: VIAZ

TICKER: VIAZ

PRICE: $0.0652c

NETWORK: TEZOS COMPLIANT

TYPE: UTILITY TOKEN

TOTAL SUPPLY: 1.5 BILLION VIAZ

SOFT CAP: $5,000,000

HARD CAP: $30,000,000

KYC: MANDATORY

ACCEPTED CRYPTOCURRENCY: BITCOIN, TEZOS & ETHEREUM

TOKEN DISTRIBUTION

FOUNDERS: 5%

BOUNTY/MARKETING: 5%

TEAM: 15%

PRIVATE SALE: 15%

EARLY CONTRIBUTORS: 25%

PUBLIC SALE: 35%

FUNDS DISTRIBUTION

MISCELLANEOUS EXPENSES

LEGAL EXPENSES

MARKETING/GLOBAL EXPANSION

EMPLOYMENT

INFRASTRUCTURE DEVELOPMENT

SOFTWARE DEVELOPMENT

BUSINESS DEVELOPMENT

CONCLUSION

You don't host to experience third-gathering stages and untrusted people with the wellbeing concerns they harbor before making an exchange. Nothing beats contributing whenever the timing is ideal particularly when there are no security dangers to stress over.

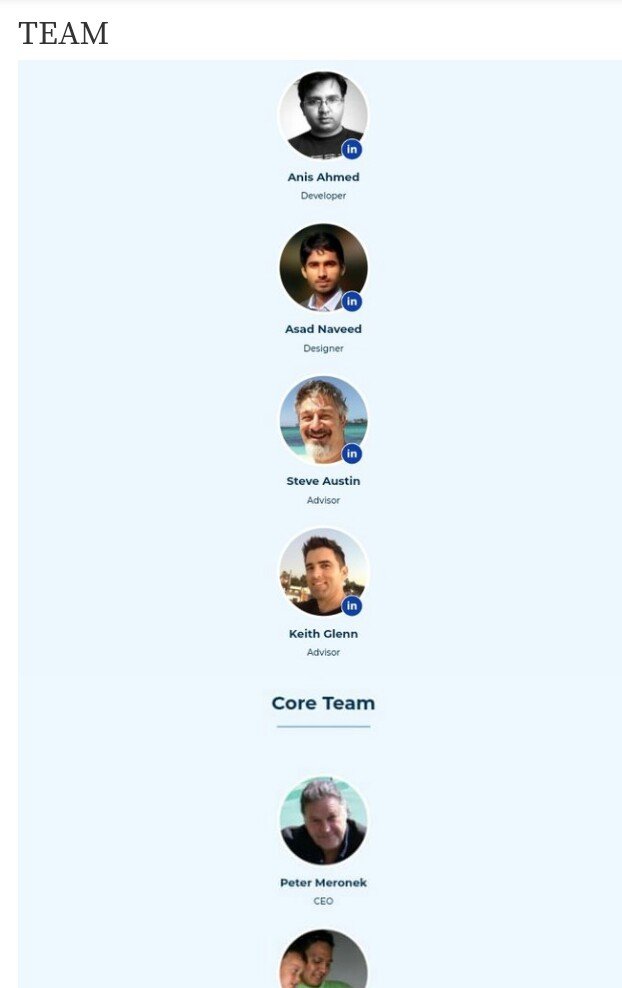

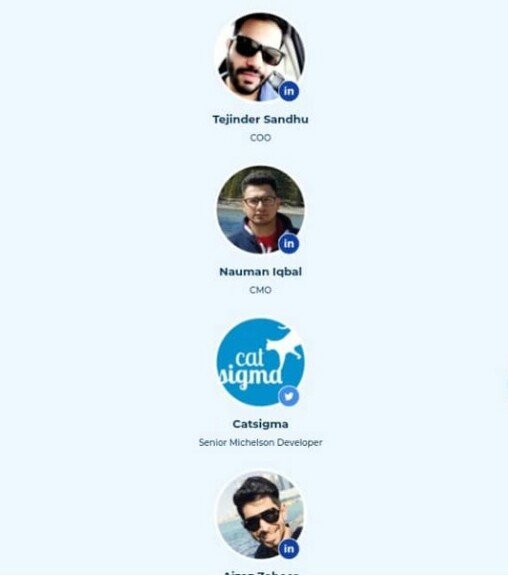

TEAM

USEFUL LINKS

Site: https://viaz.io/#documents

Archive: https://viaz.io/#documents

Whitepaper: https://viaz.io/archives/Viaz-Whitepaper_EN.pdf

Facebook: https://www.facebook.com/viazofficial

Wire: https://t.me/ViazOfficial

Twitter: https://twitter.com/ViazOfficial

BountyOx username: confii555

Congratulations @makdon! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!