Bridging The Gap Between Crypto and Traditional Financial Assets- eCOINOMIC.NET

The disruption of blockchain technology across so many sectors has led to the awareness and adoption of cryptocurrency. According to research, sectors such as finance, real estate, healthcare, voting, supply chain, cyber-security, are prime industries for blockchain disruption.

Pundits have predicted a massive disruption of blockchain in the financial services sector due to blockchain’s distributed and encrypted digital ledger ability to bring forth a decentralized and transparent means for transactions, whilst still keeping up with the top-notch security. Due to this, several digital currencies have emerged. For example, in 2017 alone, the number of cryptocurrencies and digital assets grew from 617 to 1,335 and a percentage increase of about 3,363% was recorded in market capitalization.

In spite of this, the cryptocurrency sphere is still believed to be in its infancy stage, gaining awareness, and still hasn't been adopted globally as several economies still have resentments about its use case. The latter has further created a harsh environment as crypto owners are not able to use their crypto asset as a collateral, which can be attributed to the fact that cryptocurrency is still not widely recognized.

Due to this, access to loans for crypto owners seems like a never achievable feat because traditional finance systems still do not recognize crypto assets as collaterals. Moreover, even if the crypto owner doesn't want to use his crypto asset as collaterals, the process for securing a loan in normal fiat currencies in traditional financial systems is very cumbersome, with lenders (large and small banks, credit unions) looking at credit history, business plan, and assets when assessing qualifications. Despite going through these processes, the probability of being given access to credit is still very low, most especially for large banks.

The aim of every crypto-investor is to make profits. They do this by either day trading or holding their crypto asset for such a long period so as to get massive returns on investment. However, in the situation whereby a crypto owner needs urgent cash for personal needs, he/she is often constrained to sell his or her asset due to the fear of missing out and losing on the investment. Also, due to the highly volatile nature of cryptocurrency, repurchasing crypto assets becomes quite risky.

It is however evident that there's a gap between cryptocurrency and traditional financing, and there's truly a need for an enabling environment to address these issues.

Having carried out due research and identified the issues, eCoinomic.net is proposing a fresh model to bridge the current gap between cryptocurrency and traditional financial assets. eCoinomic.net aims to leverage on blockchain technology to create a global network that will lend fiat currency to individuals and small-scale enterprises using digital assets as a means of collateral. It aims to provide a platform that will act as the intermediary services between financial institutions that intend to lend fiat currency and individuals who intend to borrow using their crypto asset as collateral.

This simply means as a crypto owner, you can easily secure a loan in fiat currency and then use your crypto assets as a collateral.

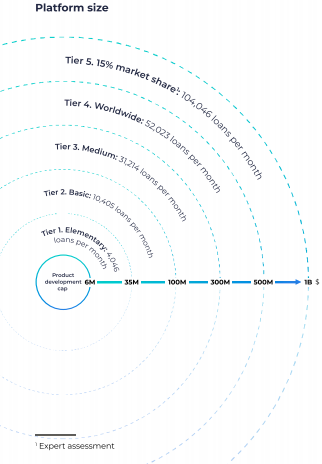

eCoinomic.net's platform will address the issue of low liquidity of cryptocurrencies by involving institutional investors and family offers to act as lenders on the platform.

eCOINOMIC.NET MODEL

eCoinomic.net will provide a range of services to crypto investors such as fiat loans back by cryptocurrencies as collaterals, investment and asset management, collateral management, transfers and mutual settlements between users and partner projects, and exchange.

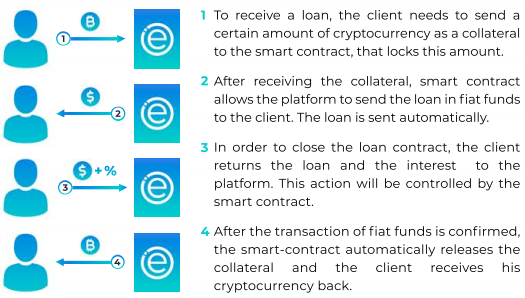

FIAT LOANS BACKED BY CRYPTOCURRENCIES AS COLLATERALS: This simply means as a crypto owner, you must not necessarily sell your crypto asset before you can secure a loan. You can easily get a loan by using your crypto asset as collaterals on the eCoinomic platform. This enables you as a crypto owner to hedge your risk and also manage your assets.

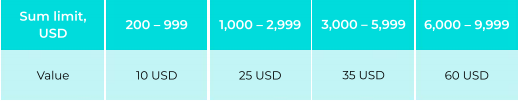

The minimum and maximum loan an individual can get is 200 and 10,000 USD respectively for a period of 30days. However, this is dependent on the asset type, the rating of the individual, and the amount of eCoinomic tokens holdings over a specific period. Also, individuals can single-handedly establish credit terms such as loan amount and interest rate. However, in order to provide transparency and assurance of collaterals, the asset deposited will be moved to the personal account of the user, and in the situation whereby the asset is not blocked by an ongoing loan contract, the user has the capacity to withdraw his asset from the platform.

The eCoinomic platform will accept BTC, ETH, XRP, LTC, BCH, EOS, NEO, ETC, ADA, TRX, DASH, and CNC as means of collaterals, and will also offer USD and EUR as loans. Other currencies such as GBP, JPY, CHF, CNY, and CHF will be offered as loans in the future.

COLLATERAL MANAGEMENT: This enables borrowers to manage their collateral by swapping the initial cryptocurrency used as collateral to another. E.g., if the user initially used BTC as collateral, collateral management enables him to swap it to ETH or other cryptocurrencies within the specified loan period.

INVESTMENT AND ASSET MANAGEMENT: Individuals will be able to make long and short-term investments in cryptocurrencies and fiat currencies. Also, eCoinomic.net provides the mechanisms to hedge the exchange rate risks for crypto assets.

THE eCOINOMIC ECOSYSTEM

The major participants in the eCoinomic platform are lenders and borrowers.

The lenders are financial institutions such as investment banks, family offices, funds. They will help supply the eCoinmic.net platform with the required funds in fiat currencies. The lenders are assured of the return of the loan and interest because eCoinomic has provisioned for this through its reserve.

The borrowers are individuals or small-scale enterprises that need a loan and intend to use their crypto asset as a means of collateral. However, borrowers require CNC tokens before they can make use of the platform. However, before a user can enjoy the benefits of the platform, he/she must register on the platform, perform KYC process and then add his CNC tokens to his balance on the platform.

The eCoinomic platform utilizes smart contracts to manage the operations of collateral blocking, returning or liquidating. Due to the immutable and secure nature of smart contracts, it will help to seal pre-set loan conditions and implement the actualization of loan obligations, thereby protecting the investments of both lenders and borrowers.

For example, if a user forgets to make the necessary payment, the smart contract will liquidate the collateral to return the loan and pay the interest rate. The remaining collateral will then be returned to the user.

Key distinctive features:

live pricing monitoring of collateral values

Fiat currency transactions will be processed within few minutes.

Use of smart contract to monitor current quotes on several exchanges

Clients are duly informed when the market rate of their crypto collateral drops by 20%

TOKEN

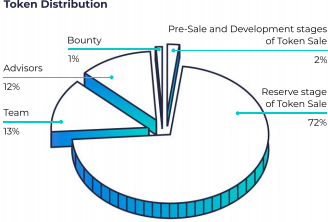

The eCoinomic.net token (CNC) will be issued in the form of an ERC20 token. The CNC will function as a utility token that will be used to fuel the eCoinomic.net platform. It will be used for commission fees including loan fees on the eCoinomic platform.

Total token supply: 2,100,000,000

Token symbol: CNC

Soft Cap: 6,000,000 USD (already reached)

Hard Cap: 106,000,000 USD

Token Price 1 CNC = 0.07 USD

Accepted currencies: ETH, BTC, XRP, BCH, LTC, NEO, XMR, ZEC.

81% of the total proceeds will be allocated for reserve only. The reserve funds will not be touched because it serves the purpose of ensuring that institutional investors and family offices participate as lenders on the platform. To simply put, the 'reserve' sort of guarantees them of their investment.

However, 10% will be channelled towards operational expenses, and remaining 9% for marketing.

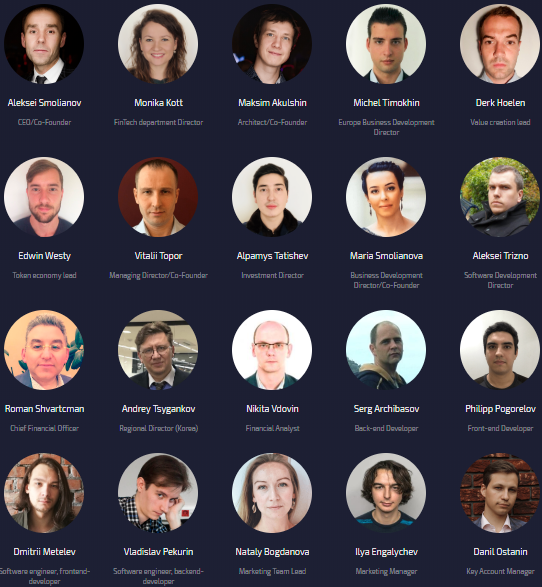

TEAM

The eCoinomic.net team is being run by a group of brilliant and versatile professionals with over a decade of experience in traditional finance and credits products.

CONCLUSION

The cryptocurrency market is already ripe for such advancement whereby crypto owners can easily get loans using their crypto assets and institutional investors and other private financial systems are also guaranteed of their investments for acting as lenders. This is indeed a revolution in the cryptocurrency sphere and eCoinomic has taken this giant step to provide the right ecosystem.

Kindly visit https://ecoinomic.net/ for more information.

Whitepaper: https://ecoinomic.net/docs/whitepapercachebust=56ce7d511bc65d0aee3d8ba2b2d5c876

ANN: https://bitcointalk.org/index.php?topic=2878954

Twitter: https://twitter.com/Ecoinomicnet

Telegram: https://t.me/ecoinomicchannel

Writer: Sucre123456

BTT profile link: https://bitcointalk.org/index.php?action=profile;u=1820055;sa=summary

This gave me a proper insight into the eCoinomic project. When is the public token sale?

Thank you. The public token Sale is currently on. You can visit https://ecoinomic.net/ to purchase the tokens.

Nice one