Everything You Need To Know About The Cryptocurrency Market Cap

‘Market Cap’ is another way of saying Market Capitalization. It is one of the most critical concepts that investors have to understand and is a technical indicator derived from the traditional stock market, we can use a similar approach to show us the estimated net-worth of a specific digital asset.

Not knowing or understanding the Market Cap is a sure way to lose money and miss opportunities in the cryptocurrency markets.

Yet, many new investors overlook it, or just don’t properly seem to grasp what it means and how it is calculated.

Therefore, this article will iron out those creases so that you can feel confident you fully understand everything you need to know about market capitalization.

The topics that will be covered include:

- Why are digital assets market caps so important?

- How to calculate the cryptocurrency market cap

- Calculating the price

- Circulating supply vs. distributed supply

- Online platforms which show you the already calculated market capitalization

- How to use market capitalization to make better investment decisions

- Disclaimer: factors to be aware of

- Investing in low cap cryptocurrency is a high risk investment

- A high market cap doesn’t necessarily signify a stable investment either

- Additional factors to take into consideration when choosing your investments

- What will be the market cap cryptocurrency value of Arbitrade & Cryptobontix‘ gold backed token: Dignity ($DIG)?

- Final words

- Further research

- Why Are Cryptocurrency Market Cap’s So Important?

- Investors should be able to easily monitor, or at least recognize opportunities, based on the market cap of a potential investment.

“Every investor should learn as much about altcoin Market Cap, or market capitalization, as possible for a very basic reason: the market capitalization may tell you how much money you might be able to make from a cryptocurrency.” – cryptoincome.io

Cryptocurrency Market Cap 1

It is also important to understand that the market capitalization does not actually represent the true value of a cryptocurrency project.

More often than not, the true value of a cryptocurrency token or coin is falsely undervalued or overvalued as the price can often be easily inflated or manipulated. This is due to both ‘pump and dump’ scams, which directly affects the ranking of a cryptocurrency asset, as well as the following common misconception:

New investors blindly base their trades on the price of a coin or token, rather than the market cap.

However, the price is speculative and does not equal value. Therefore, market cap definitely doesn’t equal true market value, which is why it is important to recognize potential opportunities – I will discuss this further in the next section.

It is easy to understand why new investors would fall into the trap of believing that they have found a bargain based on purely the price of a coin; They hope for the price to skyrocket in a similar style to the likes of Ripple. However, this theory is unrealistic and is therefore very unlikely to ever happen.

Taking Ripple as an example, the following quote explains this further:

“Ripple (XRP) is trading at around 1$ right now. You might think this is cheap but if you look closely, you will see that there are over 39 Billion Ripple coins in circulation.

Therefore Ripple already sits on a market cap of over 43 billion $ which is a huge number.

To put this into perspective, Bitcoin currently has a circulating coin supply of under 17 Million with a market cap of around 200 billion $.

So in order for Ripple to reach Bitcoins price, their market cap would have to grow to approximately 464 Trillion $. And that’s just not going to happen.” – J.Smith, Henry Lax Ltd

Cryptocurrency Market Cap 2

How To Calculate The Cryptocurrency Market Cap

The market capitalization of a cryptocurrency stands for the current dollar market value of the currencies circulating coin supply.

It is based on two factors:

The current price per coin

The total quantity of the specific cryptocurrency coins that are circulating in the market.

Therefore, to calculate the market capitalization, also referred to as ‘relative size,’ of a token or a coin within the cryptocurrency market, the following formula is used:

Market Cap = Price X Circulating Supply

As you can see, you simply multiply the Price by the Circulating Supply.

Calculating The Price

Some of you may also be wondering how to calculate the price:

Price = The average of all prices reported at each market*

*Sources for the prices can be found on the markets section on each cryptocurrency page.

Circulating Supply vs. Total Distributed Supply

It is important to note the differences between the circulating supply and the total distributed supply:

The circulating supply includes only the coins or tokens that are being actively traded and held by external investors.

The total distributed supply includes the company’s share of coins, extra coins from mining, and other coins not released into the supply.

It is, therefore, more accurate to estimate the value of a cryptocurrency based on the following calculation:

Cryptocurrency Value = Total Distributed Supply X Coin Price

Online Platforms Which Show You The Already Calculated Market Capitalization

Fortunately, there is an online calculator which can calculate the market cap for you: marketcapcalculator.com

We also recommend the following websites to find out the current market cap cryptocurrency value of a coin or token:

coinmarkets.net

coinmarketcap.com

cryptocompare.com

livecoinwatch.com

Market Cap Cryptocurrency 1

How To Use Market Capitalization To Make Better Investment Decisions

Let’s face it, we all strive to find THE cryptocurrency coin or token that will give us a significant return on investment (ROI).

Before we continue, and just to reiterate my point from earlier, it is so important that you stop looking at the price of coins or tokens!

Instead, to be a good investor, you must always make sure that you gather sufficient information about a project before investing in their coin or token. Not only will this save you time, but potentially a lot of money too!

put simply, we tend to research coins and tokens which show:

A low market cap

Opportunities for potential market cap growth

Use some of course, this is easier said than done.

However, there are a few additional factors that will help you complete thorough investigative research in order to figure out whether there are clear opportunities for growth or not. These include:

The size of the branch that the project is operating in and its future potential

How innovative and unique the technology and idea really is

The number of tokens or coins that the development team owns – if they hold a significant amount, they will be able to retain control over the direction of the token

The capability of the team behind the project – level of expertise? Age? Experience? – keep in mind: a billion dollar idea is worthless without the right people working on it.

Press coverage, government regulation, politics, rumors, the behavior of individual investors, and more!

If you take all of these factors into account, you can certainly find cryptocurrencies that are truly undervalued. If you find the gems and invest in these early on, you will see some significant gains over time and you will not need to be checking the price every minute because you know you’ve got in early and you believe in the vision of the company. You must be aware and not succumb to confirmation bias, you can keep an eye on key global events surrounding blockchain and cryptocurrency affairs, by simply subscribing to a reputable newsletter such as Blockchain Bullion.

Use some simple websites, app, and subscriptions to keep current on market news and portfolio performance. We have listed useful tools and resources.

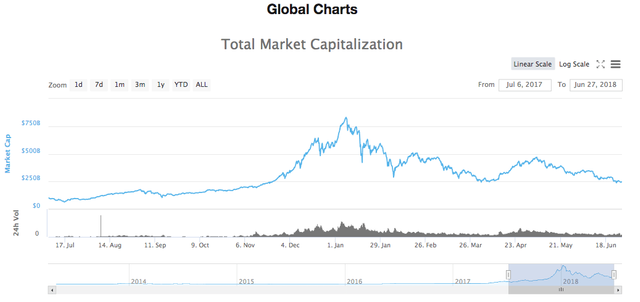

Please also rest assured during times of ‘dumping’ (also known as the price suddenly decreasing). If you are actively investing do not be discouraged by a small pullback. Instead, zoom out on the graph to display the bigger picture and remain patient. The best investment gains are never made by chasing coins, it is the waiting that is rewarded the most.

Disclaimer: Factors To Be Aware Of

Investing in low cap cryptocurrency is a high-risk investment

We should all be aware that investing in low market cap coins and tokens comes with high risks. This is because:

The projects may still be in their infancy with a lot of potential roadblocks ahead.

Holders of tokens with small market caps are at risk of being crushed by larger traders. If several whales conspire to sell at the same time, the price of a token can crash to zero instantly.

The lower the market cap, the more volatile the coin, but then the more lucrative the ROI opportunities with ICO’s providing by far the biggest ROI for investors with an appetite for risk.

A high market cap doesn’t necessarily signify a stable investment either

Don’t be fooled into thinking ‘stable’ coins with large cryptocurrency market caps are a safe investment either. This is because they can still be volatile. Take Bitcoin for example. Since June 2017, it has had many price swings between 30-50%. Prior to this, it encountered several rises and falls between 30 and 2.

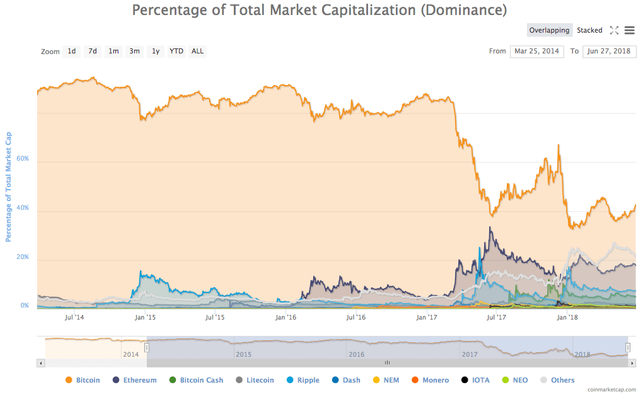

Most people have heard of Bitcoin but have probably never heard of a lot coin or token, like Dignity. This is one of the primary reasons many alt-coins are not getting the attention they deserve yet from the wider public. I conclude that there is a strong possibility that Bitcoin’s Coin Price and Market Cap will start to decrease as more people become aware of the alternatives.

Market Cap Cryptocurrency 2

Additional factors to take into consideration when choosing your investments

As an investor, you must get into the habit of routinely keeping up-to-date with industry changes, whether that is by carefully checking reputable news platforms, subscribing to news websites (like Blockchain Bullion) and by following key analysts and influencers.

We have already witnessed the extent to which news has such a huge impact on the cryptocurrency market fluctuations.

A most noteworthy example was when the price of Bitcoin dropped in mid-2017 after the news reported that the Chinese government was shutting many cryptocurrency exchanges. If you had been following the industry, you will have known that China is the world’s largest market for Bitcoin. Those who failed to keep updated with industry news would have lost out.

Keeping an eye on the news will also mean that if a huge corporation or government announces that they will be accepting cryptocurrency payments, you will want to be one of the first to know so that you can jump on the investment, before it goes globally viral.

What Will Be The Market Cap Cryptocurrency Value Of Arbitrade & Cryptobontix‘ Gold Backed Token: Dignity ($DIG)?

Nobody knows this yet, but the forecast from our own personal research on Arbitrade and Cryptobontix looks extremely promising.

Keep up-to-date with the progress of this revolutionary project by regularly checking the Timeline.

Final Words

Overall, understanding the Cryptocurrency Market Cap and its limitations can help you make profitable investment decisions in alt-coins.

Yet as we have discussed in the article, when it comes down to choosing where you want to invest your money, there are a lot of other factors to account for during your research.

As an investor, you should make sure that you examine the Market Caps of all cryptocurrencies and estimate what the reasonable growth potential might be for each coin or token you consider investing in.

On a final note, it is always important that you have completed your own thorough due diligence when investigating a project.

Further Research

As we have already mentioned earlier in the article, we recommend the following websites to help you research and monitor cryptocurrency tokens and coins:

coinmarkets.net

cryptocompare.com

coinmarketcap.com

livecoinwatch.com

Please refer to the knowledge base to discover more useful online tools and websites, which will help to deepen your knowledge about cryptocurrency and blockchain technology.

WWW.BLOCKCHAINBULLION.IO