FUSION: The Future of Cryptofinance.

Introduction.

Money is an essential part of life. It is used for exchange of goods and services. At a time, the barter system was used but was found to be ineffective. The use of currency improved the financial world, giving rise to financial institutions like banks, insurance companies and others.

It was convenient to walk into a store, pick up items and pay with cash. Within your vicinity, payment for goods and services was so convenient. However, sending money across long distances is costly and takes time.

Then internet came and changed the face of the financial world. Now, sending cash across distances was convenient.

I can order for items from several countries and pay immediately via mobile banking. I can pay for my school fees from home without going through the stress of queuing at the bank. Banking just took a whole new turn with the advent of the internet.

However, there are still problems embedded in the system. I still have to go complete paperwork at the bank to validate my transactions.

Large scale transactions are a dream using mobile banking in my country as the bank has set limits. These online transactions are not so flexible.

Then the world of cryptofinance came and changed everything again. Large scale transactions can now be completed without the need for a third party agent in a secure atmosphere. Transactions carried out within the blockchain are secure. For the first time, traditional finance was threatened. Now, we have digital signature and smart contracts.

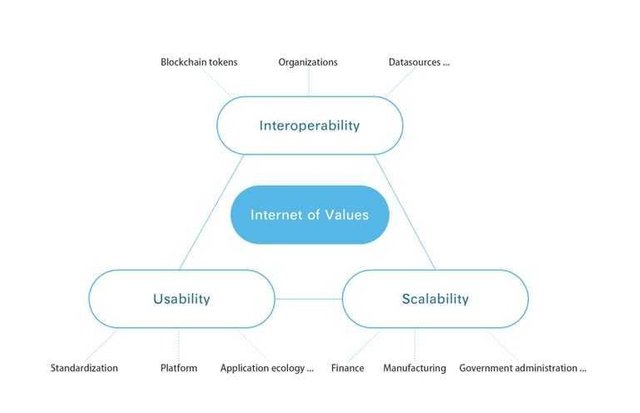

The blockchain has created a platform that ensures trust, security and speed of transactions ushering in the internet of value. Internet of value allows exchange of assets with little fee attached.

Bottlenecks of the internet of value.

Interoperability

While internet of information can send any kind of information, the same cannot be said about internet of value. Values exist in various blockchains, centralization organizations and different data centres. It is difficult to exchange values between different blockchain, each having their own ecosystem.

Also, interaction with external data or off-chain data is not allowed on the blockchain nor does it operate with external centralized organizations.Internet of value therefore requires a solution that can not only transfer value but also run smart contracts.

Scalability

Due to the problem of interoperability, scalability is really affected as each blockchain operates its own ecosystem, it hinders the migration of off chain values to internet of value.

it therefore limits its use in different scenarios like finance, manufacturing and government management.

Usability

Internet of value can hardly support heavy projects like internet of information which is able to fufil the demands of information management.

Through having a resourceful ecology, internet of value therefore, needs to make various applications run smoothly. As developers efficiently design applications, users equally easily use them.

These three, interoperability, scalability and usability are the bottlenecks of internet of value.

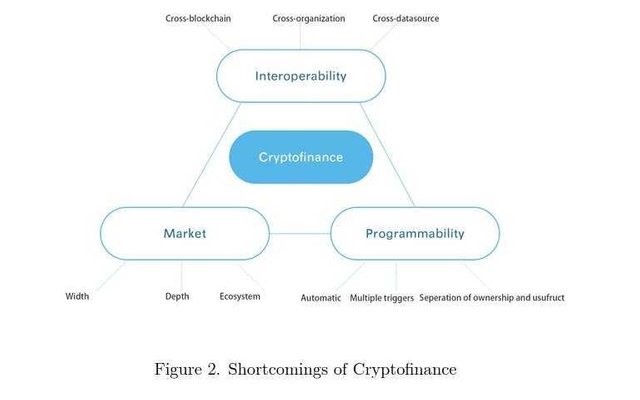

The concept of cryptofinance

Cryptofinance refers to on-chain financial activities on internet of values and the relationship it has with off-chain financial activities.

The word 'crypto' is used because the financial assets on internet of values are controlled by encryption technology. The tokens represented by the blockchain are the values in internet of value. Mapping of values to the internet of values is known as the process of tokenization of assets.

Assuming tokens on the chain represents the title, gain and control of underlying off chain assets, the linked assets would be expressed by on-chain and become part of the internet of values. This way, more values enter internet of values and prevents the 'double spending' phenomenon. Transferring value therefore becomes so easy without the need for intermediaries.

Securitization of assets maps off-chain values on-chain as cryptofinancial assets. This is also a process in tokenization of assets. Since tokens can now be transferred across time and space, they can be used in businesses such as mortgages, loans and insurance.

In addition, values would be diverse as long as tokenization is profitable.

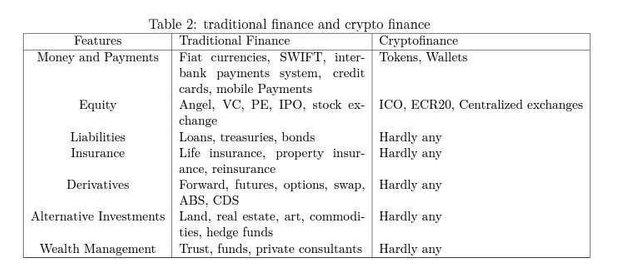

Traditional finance Vs Cryptofinance

Finance can only be defined by its functions. Monetary functions include payment, pricing, value storage among others. These can be covered by cryptocurrencies such as bitcoin and others but its use is not widespread as expected.Double spending problem is solved by distributed ledgers allowing transfer of funds without third party agencies and central organizations.

Other monetary functions such as debt, equity, insurance, trust have found no solution in the world of cryptofinance.

Other shortcomings of cryptofinance are;

Market

Interoperability

Programmability

What is therefore the solution to problems in cryptofinance? It is simple, FUSION.

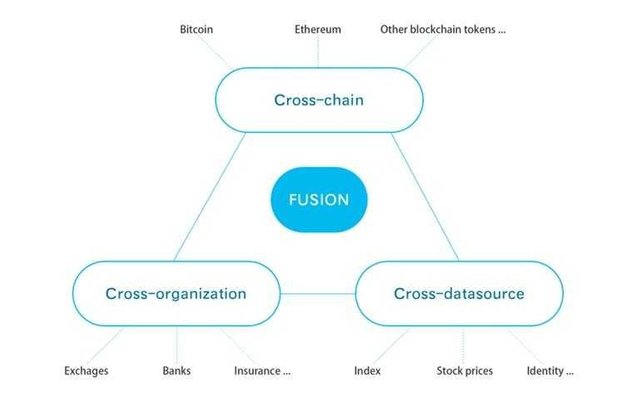

What is Fusion all about?

Fusion is the future of cryptofinance. Fusion will establish a blockchain based platform where all kinds of values could be exchanged connecting various communities and tokens. It would provide complete financial functions as well as bridge centralized and decentralized organizations.

How would Fusion change the world of cryptofinance?

Fusion aims to create a new system which is a value transfer system based on various tokens. It would fulfil all the functionalities of traditional finance in an efficient way with minimal costs. Fusion would be an inclusive platform that ushers us into a new era of cryptofinance by breaking the bottlenecks of interoperability, scalability and usability.

Fusion allows interoperability between different blockchain(cross chain), enabling exchange of tokens and the introduction of a smart contract solution. Fusion would act as a bridge between centralized organizations and off chain data sources.

Fusion is inclusive.

It brings all crytocurrencies under one umbrella, connecting centralized and decentralized organizations and uniting both on-chain and off-chain data.

Fusion is highly scalable

It creates the possibility that cryptofinance can be used across different blockchains and scenarios in the world.

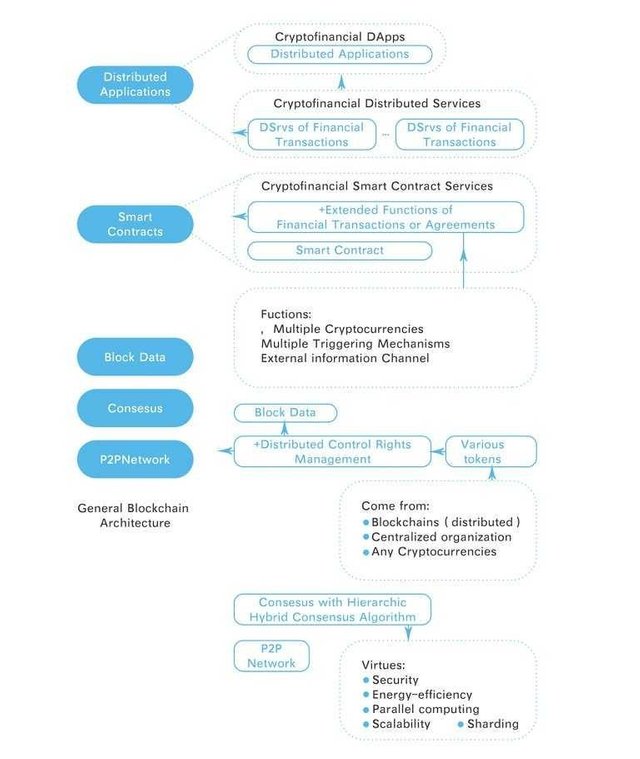

Fusion Architecture

Distributed Control Rights Management.

DCRM is a process where the controls of digital assets by individuals or centralized organizations are handed over to decentralized nodes' management. This method ensures no individual holds the complete private key meaning no single node can control digital assets under DCRM.

Cryptoasset Lock-in enables DCRM and asset mapping for all key managed tokens.

Crytoasset Lock-out is the reverse of Lock-in and involves distribution of control rights management and disassembly of asset mapping.

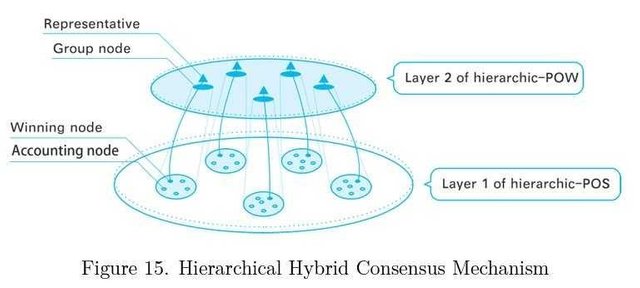

Hierarchical Hybrid Consensus Mechanism

HHCM in Fusion is used for stratifying computational all work of generating blocks and adopting a suitable consensus mechanism in different lauers. HHCM introduces the concept of grouping to achieve private keys' generation and management and parallel computing . HHCM combines the advantages of PoW and PoS to balance safety, efficiency, scale and other aspects.

Project implementation Plans

Fusion intends to achieve their goals through the following steps;

Distribution control rights management function which would enable the distribution of controls over tokens. A wallet is created which can be used to deposit or withdraw tokens. A user maps his/her tokens to the Fusion platform by transferring tokens to his/her Fusion address.

It would provide a Multi-token smart contract platform.

It would provide interfaces for various centralized organizations and external data sources.

It would also ensure continuous development to achieve its goal.

Fusion Use Cases

Use Case 1- Risk-Free Token Loan

Smart contracts serve as trust mechanisms that execute transactions. Smart contracts operate with different tokens of different blockchains(cross token contracts), meaning a person can ask for a loan with any type of tokens without any risks.

A Fusion based contract would be responsible for allocating the amount of the loan, the interest rate and the time frame as long as both parties agree.

Use-Case 2- Free Contract Market

Fusion smart contracts are similar to bank checks. They are risk free since the smart contract code creates a guarantee of future payment.

Considering this scenario, Alice wants to purchase an airline ticket from Bob, the travel agent worth 0.3bitcoin. However, they are not available but are invested elsewhere, let's say in a risk free token loan smart contract(C1) and would be returned in 10days plus 0.01interest.

To buy this ticket, Alice initiates a credit purchase smart contract(C2). She signs this, transferring control of her proceeds from C1 to C2. This means in 10 days, Bob would receive 0.3+0.01bitcoin because of this transaction.

However, if Bob needs the cash right away, he can initiate a discount sale smart contract (C3) with Carl.So if Carl sends 0.3bitcoin to C3, he would get it back in ten days from the transfer of tokens from C2. C3 is called a discount sale because it sells for less than its token flows.

Carl finds C3 risk free with an attractive interest rate. Everyone wins.

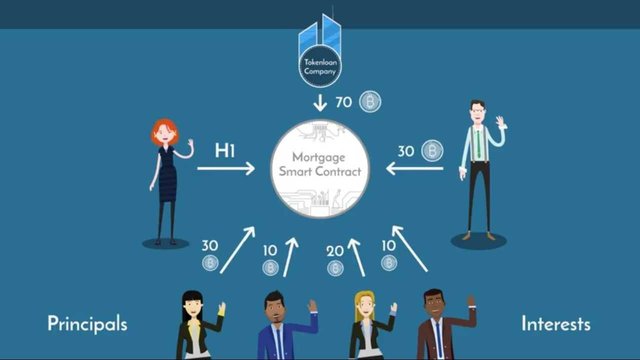

Use-Case 3- Mortgage Smart Contract.

Assuming Alice wants to sell her house for 100Bitcoins. She first needs to converts the house into a tokenized value. The House token Organization is a legal service provider will help Alice tokenize her house.

Bob wants to buy Alice's house but only has 30bitcoins. A mortgage smart contract is created by a Token Loan Company which in this case is the risk taker. This contract includes Bob, Alice and a series of other Risk-Free investors that make up the remaining 70bitcoins. The Token Loan Company invests the 70bitcoins as collateral for their investors.

Alice receives her 100bitcoins while Bob receives a mortgage of 70bitcoins and becomes the new owner of the house. Until he pays off the 70bitcoins, the house would remain a guarantee for the loan. If Bob cannot repay within a stipulated time, MSC has the right to resell the house.

Once the stipulated time has passed and the loan has been repaid, Bob legally owns the house while the Token Loan Company receives back their 70 bitcoins.

Mortgages are simpler, readily available and less expensive for everyone in this manner.

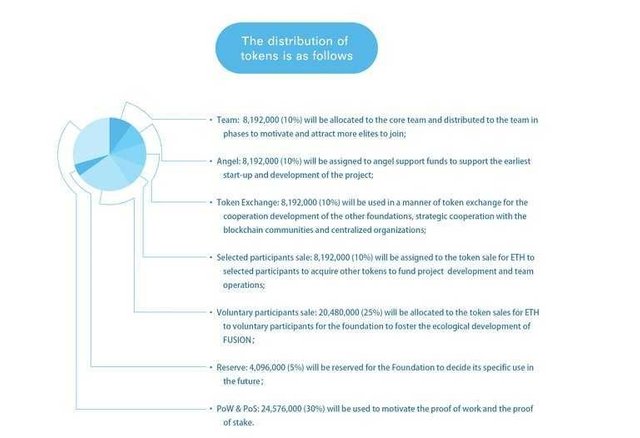

Token distribution

Fusion project has designed its token, FSN . The distribution is as follows;

Conclusion

Fusion is the future of cryptofinance. It would change the world of cryptofinance by offering solutions to problems within the system. Soon, the crytoworld would be able to replace the traditional finance system because of Fusion.

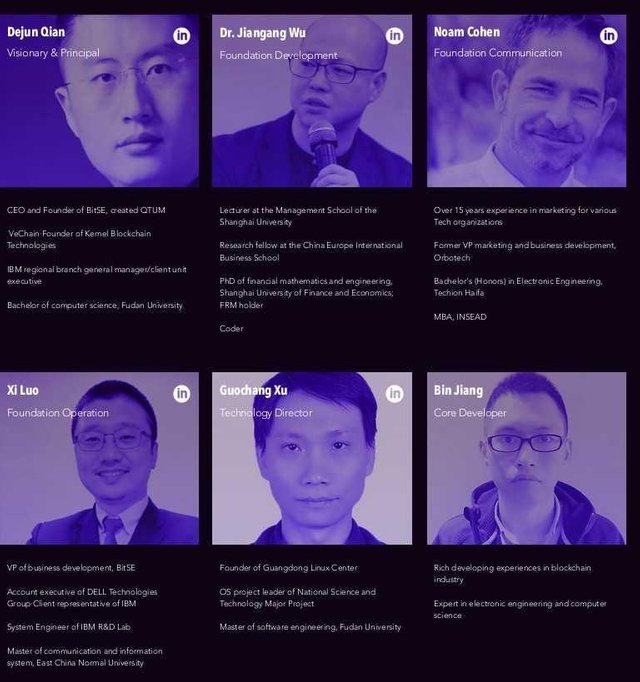

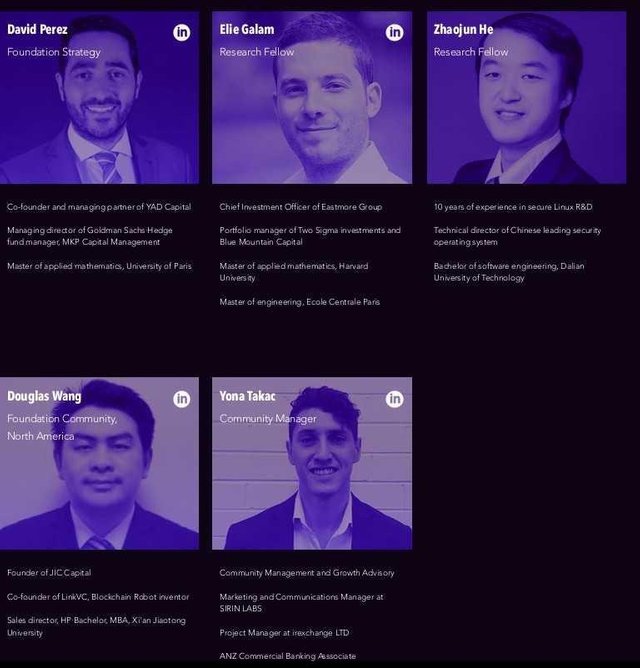

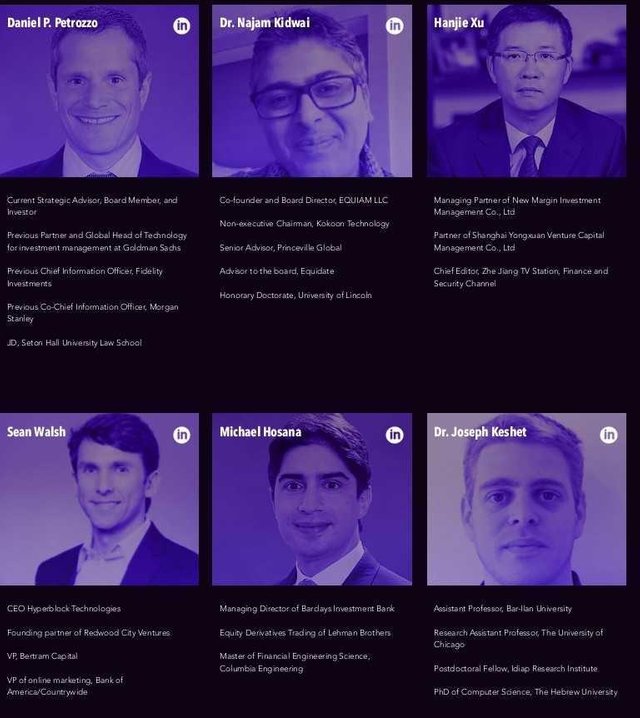

Meet the Awesome Fusion Team.

Management.

For more information,Check

Fusion Website

Fusion Summary

Fusion Whitepaper

Fusion Telegram

Fusion Twitter

Fusion Reddit

Fusion Bitcointalk

Fusion Medium

Fusion Videospage

Fusion LinkedIn

Fusion Facebook

Fusion Github

All images taken from Fusion Whitepaper and website

fusion2018

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations!,@cheekah Your post has been upvoted by @reachout

Our goal is to support Minnows on Steemit.

Join our discord group https://discord.gg/NWAkKfn

Major Upvote Sponsor : @bleepcoin

SP Donation by @rufans & @solomon507

Join Our Trail here: https://steemauto.com/dash.php?i=15&id=1&user=reachout