A detailed overview of MOBU and why I think it is the solution we need for regulation within the blockchain space

Introduction

Hey guys, so the next exciting project on our quest to find all-star ICOs is called MOBU. This is different than most projects I write about, particularly because it involves security tokens. Basically, it is a decentralised, organised ICO platform for security tokens.

I must admit, I am usually very apprehensive about getting involved with security tokens, especially with regulatory uncertainty around them. So just to start, please tread carefully when considering security investments, as there may be many legal and security restrictions in the country you live in. I chose to talk about MOBU as I believe they are different, I believe this project offers something unique in this space. They aim to be at the forefront of “investment money” flooding into ICOs and will provide a regulatory secured ecosystem to realise this vision.

MOBU is all about disrupting the way we invest in ICOs. They see the advantages of ICOS over IPOS when raising capital and they want to open this to the multi-trillion dollar security market. This could be a very exciting project, as this “security token space” is filled with security and legal implications, which are difficult to work around. In their own words, MOBU will bring a consolidated and self-regulated platform for launching these security token ICOs, thus providing the means for investors and companies alike.

I really do feel this is the next level of cryptocurrency investment because this is what mainstream investors will want when they enter this market. They say that their platform is run by smart contracts and will bridge the gap between traditional security investment and blockchain, further exclaiming they offer a full KYC/AML and SEC approved platform. The MOBU platform will also have full banking support for the ICOs it launches and will allow for investor account portals. They also tell us that they will offer escrow accounts, legal support, and smart contract support, essentially providing a marketplace for fundraising. This, in short, is why I am speaking about MOBU today.

Points to note

For those of you not familiar with what a security is, they are essentially tradable financial assets. Most cryptocurrencies I write about are considered “utility tokens”, which have no financial value beyond what it is traded at on exchanges, it entitles the holder to nothing and are simple “vessels of value transfer on a platform “. Securities, on the other hand, can be broken into many types (stocks, equities, debt, bonds, derivatives, debentures etc...) and have finical value and may offer dividend rights.

It is MOBU’s vision that “tokenised securities “are the next revolution of this space. MOBU, (2018) claim fees will be lower because you can cut the middlemen (banks, lawyers, admin etc...) which are common-place with IPOs. Obviously, this will make fundraising faster and open up a free market (more open to investors) to a larger investor base. I fully believe smart contracts can automate a lot of the “middleman work”. As described above, this will make the process of raising capital fairer. Some other points to consider are:

- The MOBU token is a utility token itself, not a security; the MOBU platform allows security tokens to list on their ecosystem.

- MOBU chain code is the smart contract running the platform, which runs on Ethereum blockchain, MOBU is an ERC-20 token. However, there is also what is called a MOB-20 standard, which all ICOS need to conform to.

- MOBU.js is the JavaScript library which aids usability with the chain code and allows for encryption.

- All tokenised ICOs which are launched on MOBU will be securities, and as such will have restrictions, so only authorised investors can hold them.

Vision

MOBU, (2018) claim in their whitepaper that their vision is to cater to businesses who wish to run their own ICOs. This ICO model will be economically more efficient than its IPO counterpart, as some of you may know IPOS carry huge costs. MOBU want to capitalise on the multi-trillion dollar securities market, and who could blame them, in my opinion, more companies should be seeing this for what it is and targeting this, it is inevitable that this is going to happen. MOBU will facilitate this investment model by ensuring projects can confirm to regulations and procedures.

Pain point

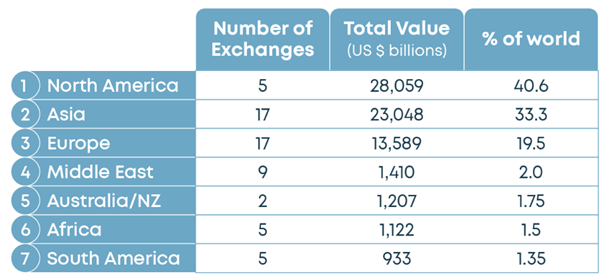

According to MOBU, (2018) this securities market is a multi-trillion dollar arena, the pain point being it remains untouched to date with this blockchain revolution. The chart below, taking from MOBUs bitcointalk ANN channel shows how big of a market the securities market is. This is an enormous sector.

Source: Bitcointalk.org, (2018)

The other pain points mentioned are that, to launch such a “security ICO” is filled with technical, legal and regulatory hoops to jump through. If these procedures are not followed then huge penalties are applied which could sink a project.

MOBU, (2018) also mention in their whitepaper that the difference in costs to run a successful IPO vs. an ICO can be substantial, claiming that an IPO can require upwards of 10% of the money raised. ICO’s are a fraction of this cost, due to the nature of blockchain.

MOBU further tell us of the confusion governments around the world have when it comes to discussing regulation in this space. MOBU suggest that all trends point towards government and regulatory recognition of security ICOs eventually. This is essentially what this project was created for, to cater for this eventuality.

Solution

The MOBU ecosystem is the solution. MOBU will bring the security marketplace to blockchain. This platform will restrict those who should not get their hands on security tokens also, effectively bringing regulation to the space.

MOBU will make the pain of partaking in ICOs easier to these “accredited investors” also by providing banking support, a much-needed requirement I might add. Most large investors I know don’t want to waste time transacting through various exchanges to make a purchase; they want a fiat gateway right where they can purchase.

MOBUs solution is an all-encompassing one in my view, they will allow “dividend paying tokens” at last for those who deal with these types of asset classes, and this is a platform with longevity in its mind. They are tapping into a huge market and driving blockchain mass adoption forward.

Technicalities of the Ecosystem

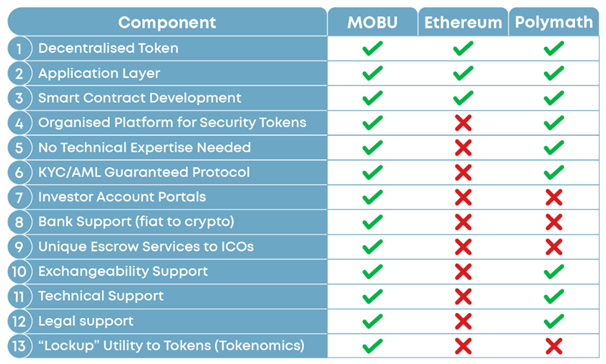

The way this will work is that MOBU will create “an abstract smart contract from which all security token ICOs will be extended”. This will be an ERC-20 platform but will be based on a “MOB-20 standard, from which all projects will have to conform to the MOBU smart contract. The chart below signifies what MOBU has to offer compared to Ethereum and Polymath (A potential competitor).

Source: MOBU, (2018)

MOBU will allow businesses to list their own “MOB-20 standard” security token and provide an escrow arrangement, allowing investors to exit after an ICO if the team does not reach their goals. This is fascinating and should really protect investors.

Lockups of tokens will ensure scarcity and stability of the MOBU token. They will ensure any security listed goes through a legal representative compliance process, to ensure all regulations are followed. This will be a lot more efficient for investors and businesses alike, a real push for worldwide adoption of blockchain technology. All such services/legalities will be paid in the form of MOBU tokens (discussed below) in the form of “bounties/bonds” in a staking mechanism. MOBU will charge 1% fees to all ICOs for use of this ecosystem and charge other small fees any trades within the platform.

MOBU will provide a KYC/AML procedure to stiffen off regulator concerns over security investments. Only “accredited investors” (region specific) can take part which takes away the risk to projects. Furthermore, the MOBU platform will be a self-regulated one to ensure they comply with varying laws around the world. Their platform will allow investors to enter this market easily via bank/fiat gateways, which will allow fiat-crypto conversions.

Their platform will be more cost effective for companies wishing to raise funds. They also see themselves appealing to non-tech companies, to provide an easy avenue for these companies to participate. Trades of tokens after ICOS will only be capable between verified/authorised parties, which will aid in the regulatory approval for this platform.

MOBU, (2018) suggest that the securities market is quite complex because of these legal restrictions, and they aim to fundamentally change this. MOBU will also hold a percentage of the tokens from ICOs on its platform, to ensure success. MOBU will also ensure there are lockups within the ecosystem, to ensure scarcity of MOBU tokens to raise prices.

I have to admit, it is a very well thought out platform. They believe the ICO boom is fundamentally changing the way projects raise capital and they aim to be at the forefront of this revolution.

Token Economics

As always, token economics is the most important element to any project. What MOBU are selling here, is that their token is a utility token, which will be required to use its ecosystem. This is the transfer of value within the MOBU platform. There is always the argument to “why not use an established cryptocurrency on these platforms”, such as Ethereum, after all, MOBU runs on the ETH network. MOBU, (2018) argue such platforms lack incentivisation, and state that without a unique token have struggled to develop. A native token allows for liquidity also, which puts a personal value on a project.

The MOBU platform will be fully secure, as they “isolate the storage of each security token ICO” (MOBU, 2018). MOBU state that the following users will use MOBU tokens on the platform:

- Issuers- Essentially sellers of security tokens. Interestingly they can offer “bounties” in MOBU tokens for legal representation and services.

- Developers- These create or review the contracts, for which they receive MOBU tokens as payment. MOBU adds these will be locked up for 3 months after ICOs end to ensure fair play.

- KYC Providers- MOBU will require ETH addresses to be matched with investors. These providers pay fees in MOBU to join the platform; they then in turn charge MOBU for their services. Apparently, they are partnered with Civic for this KYC platform, (MOBU, 2018).

- Investors- These are the people paying for KYC services, with MOBU tokens.

- Legal Representatives- These take control of “token issuances” via a tender process, and receive the bounty mentioned above, in MOBU tokens.

- Escrow providers- This makes the platform secure. These providers will earn MOBU tokens to provide escrow services. MOBU will require all Issuers to lock funds in escrows over a few years to protect investors, essentially allowing investors to pull out if the team is not delivering. I love this feature.

- Bank Partnerships- MOBU will drive these fiat gateways for investors, they state they are already “regulatory friendly”, which one could take as a positive sign this will be realised.

What I love about this ecosystem is that MOBU is already thinking about how to stabilise the platform, in a very turbulent market. They will do this by ensuring MOBU tokens are subject to “lockups” for all services on the platform. This should give MOBU a very stable price. As described above, service providers need to “stake/lock” tokens for the right to work on the platform. MOBU will provide premium features, which can be accessed via “staking”. They will also have referral systems, with 3-year lockups to reward participants.

The MOBU ecosystem is a platform which will provide a huge amount of benefits to projects. The MOBU token has real intrinsic value within the operation of this platform.

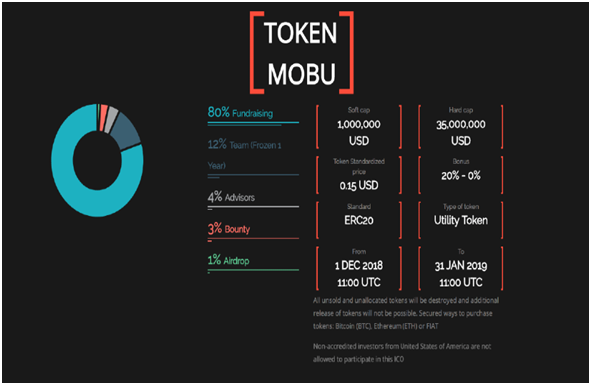

Source: Bitcointalk, (2018)

Key dates

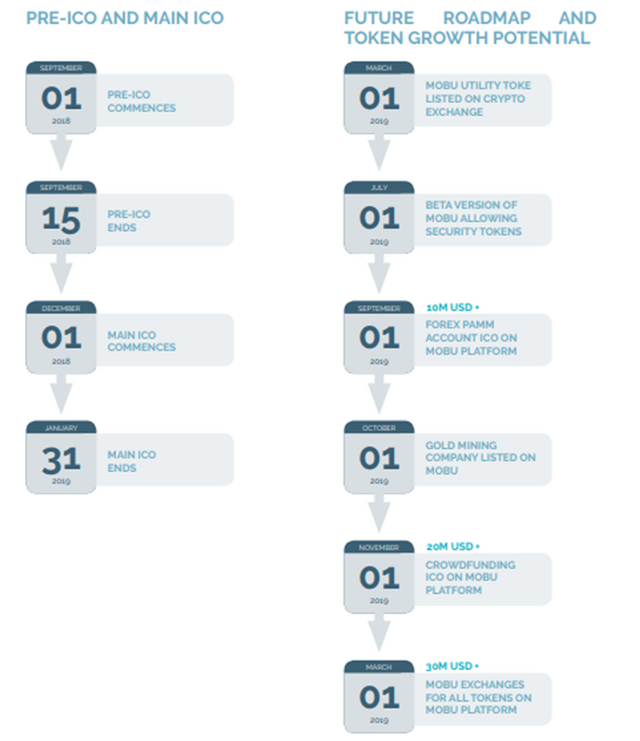

- Pre Sale is 1st Sept 2018 to 15th Sept 2018 with a zero dollar soft cap and a hard cap of 20 million dollars.

- Main ICO is 1st Dec 2018 to 31st Jan 2019 with a soft cap of 1 million dollars and a hard cap of 35 million dollars.

Roadmap

Source: MOBU, (2018)

This Roadmap is very exciting, beginning in September 2018 and running through March 2019. Yet again this is a project with great value recognition dates for investors. I also like that even if the hard cap is not met, MOBU still anticipates developing this platform:

- If a minimum of 10 million is raised then a “forex/crypto % allocation money management system” will be established (MOBU, 2018).

- If a minimum of 20 million is raised then a “crowd farming ICO” will be developed (MOBU, 2018).

- If a minimum of 30 million is raised then we get a “full regulatory approved security token platform”, as discussed in this article.

I might add, however, that if the first 2 occurrences materialise, then the team will hold some proceeds to ensure one day they can develop MOBU to its fullest potential. This should instill a lot of confidence in potential investors.

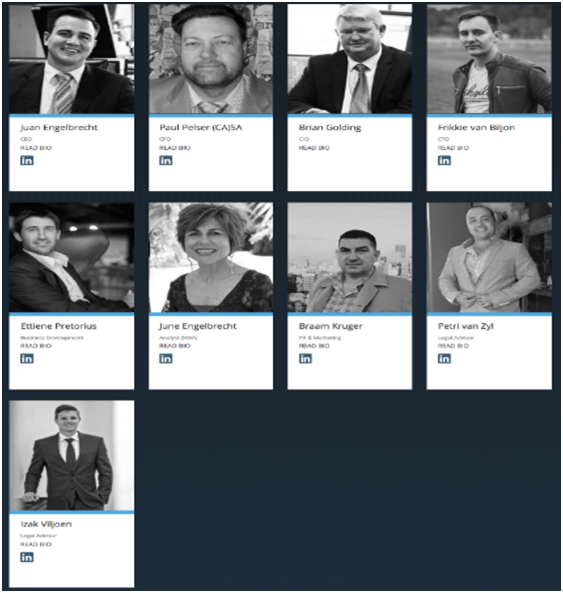

My opinion of the Team

Source: Bitcointalk, (2018)

I think this team is well capable of pulling this off; it is, without doubt, a very ambitious project to pull off. Usually, I steer clear of speaking about teams, as I am a believer that if the vision is great enough, then any driven team can make it happen. This 9 person team has strong ties across the IT, economics, law and blockchain industries. They are being advised by a very impressive 10 person board of advisors, who are equally as impressive.

We need to be sure as investors that these people can make this project a reality because dealing with securities is a high risk, but one which provides an equally high return, if it can be pulled off. From reading their whitepaper I get the impression that the team has the experience to make this a reality.

Juan (Founder & CEO) is the one person who caught my attention, he has a wealth of experience in equity markets and business, he is a man who shares my vision, that “blockchain will revolutionise business and re-define companies and economies in the world”. (MOBU, 2018). He was an early adopter of blockchain, even acting as CEO of a company (Zaber Import Export PTY) which had the largest crypto miners in the southern hemisphere. He now owns 4 large mining farms; Juan in my view is an all-star.

All the other members are equally as impressive with a wealth of experience, Please check out a link to the whitepaper below, where you can read the introductions of the team. It is my opinion that this team has an all-star status, and they will make this vision a reality for us.

Conclusion

This is a very ambitious project, one which I had to think strong and hard about before I wrote about. This is due to the lack of regulations we currently have around cryptocurrencies. However, my mind was swayed when I read the whitepaper and saw firsthand how ambitious and revolutionary this project would be.

MOBU would be a true first mover in the tokenisation of securities in the blockchain sphere. The securities market is too large to ignore. This is a market in which mass investors/traders want their hands on. You can see by now from my work, that I am a true believer in the use case of blockchain, the team in MOBU have captured this vision, and proved to me they are serious about making it a reality; they will achieve it by opening a gateway into one of the largest markets on earth. I don’t know how far we are off mainstream adoption, but one thing is for sure, MOBU will be there at the tip of the sword when it does come, allowing a huge influx of investors and providing a platform for regulation. I believe they will solve all the pain points in the space.

The MOBU token will allow the ecosystem to operate, an ecosystem which will be first to cater for security tokens. The MOBU ecosystem provides KYC/AML, links to banks/exchanges, escrow services, account portals and technical/legal support to users. The tokenomics and their lockup procedures have installed a faith in me of this project. Another element which sold me on this project is that, through the MOBU escrow service, investors will be able to exit ICOS when teams are not fulfilling promises; this is revolutionary in a space littered with dishonesty and fraud.

I really do feel this amazing team can pull this off. I feel MOBU, will open the door for businesses to enter the blockchain arena and drastically lower barriers to entry. MOBU will be a regulatory ecosystem for these businesses, so they don’t have to worry about what most of us investors do today in the space.

Overall, my opinion is that most “projects” we are all “investing “in today are just hopes or dreams for most of us. What really is the value of “x utility token” over “y utility token” other than what it says on the exchanges? At least with stocks/shares, the value is based on the worth of the said company. Are most of these “projects” just using the “ICO system” to propel their company into the mainstream and raise easy money? We really need to open our eyes, yes most of these “ICO tokens “are nothing more than speculative worth and may never be anything else. Maybe they will fail or maybe they will simply do a burn of tokens for shares in the future, once they are successful, or maybe they will flourish into successful companies, and never worry about their “speculative ICO utility token”, this is all quite possible.

MOBU are different; they are opening a new stream to all of this, providing an ecosystem for real, secured and most importantly legal security tokens, with real conceivable value. We all know regulation is coming, so let’s not bury our heads in the sand, platforms like MOBU will be the platforms operating when real money enters this market, count my words.

Final word

Lastly guys, I just want to stipulate to you that you should not take any of this as investment advice. I am not a financial advisor and urge you all to do your own research when considering any investment, this space can be very unforgiving and is very speculative in nature. Never follow somebody blindly; my job is to showcase projects I see with real potential that is all. I hope you enjoyed this article and I will aim to find the next amazing project in due course. I thank you all for your support and ask for you to share my work. I would be more than happy to discuss any questions you may have in the comments section.

Further Reading

- MOBU Website: https://mobu.io

- MOBU Telegram: https://t.me/mobuCHAT

- MOBU Twitter: https://twitter.com/MobuICO

- MOBU Facebook: https://www.facebook.com/MobuICO

- MOBU Instagram: https://www.instagram.com/MobuICO/

- MOBU Reditt: https://www.reddit.com/r/Mobu/

- MOBU Medium: https://medium.com/mobu-io

- MOBU Bitcointalk (ANN): https://bitcointalk.org/index.php?topic=4726508.0

- MOBU Bitcointalk (Bounty): https://bitcointalk.org/index.php?topic=4795544

- MOBU YouTube: httpss://www.youtube.com/watch?v=OEkbAX_hu_4

- MOBU Github: https://github.com/mobuadmin

- MOBU: Bitcoinwiki: https://en.bitcoinwiki.org/wiki/MOBU

References

- Bitcointalk.org. (2018). [ANN] MOBU - The Future of Security Tokens. [online] Available at: https://bitcointalk.org/index.php?topic=4726508.0 [Accessed 9 Aug. 2018].

- En.bitcoinwiki.org. (2018). MOBU – Future of Security Tokens. [online] Available at: https://en.bitcoinwiki.org/wiki/MOBU [Accessed 9 Aug. 2018].

- ICObench. (2018). MOBU (MOBU) - ICO rating and details. [online] Available at: https://icobench.com/ico/mobu [Accessed 9 Aug. 2018].

- Mobu.io. (2018). [online] Available at: https://mobu.io/assets/documents/mobu_whitepaper_english.pdf?80172489074 [Accessed 5 Aug. 2018].

- MOBU (2018). [online] Steemit.com. Available at: https://steemit.com/ico/@mobu/solving-the-blockchain-regulatory-crisis-with-mobu [Accessed 9 Aug. 2018].

Great article! Mobu sounds like it has potential. Following.

Yes it really could, this could be huge. Thanks for the comment

Great article!

Thanks for taking the time to read

A well detailed article. This is definitely a brilliant idea on the blockchain. Would also be looking into the whitepaper

Thanks Karl , yes definitely, if you need anything clarified while your reading the white paper just give me a shout!

Another interesting comparsion which was shared on their telegram channel, showing the real competitive advanatge MOBU has: