DAEX Blockchain: Decentralized and Centralized Exchange Combined

Hi guys, we meet again in a new article about cryptocurrency review. In this article, I'll talk about DAEX Blockchain. They've been in the industry for months, and right now their tokens are actually tradable at some exchanges including Indodax/Tokenomy and so on. However, they plan to launch an ICO this September, so that's why I guess you might take a look at this project once more if you don't know about it before.

# Decentralized and Centralized Exchange Combined

In a nutshell, I think DAEX looks like a combination of decentralized exchange (that is, their security and safety of assets) and centralized exchange (liquidity, volume, user experience). In short, DAEX will fix the inherent problems of centralized exchange where they store and manage user assets on their own without any possible audit from the public. Their solution is quite complex, including but not limited to built their own chains to process clearing (that is, withdrawal or deposit) of assets. I'll not go into detail about it because in this article I want to outline the problem that they wanted to solve.

So, what is the problem that they wanted to solve?

# Decentralized Exchanges Problems

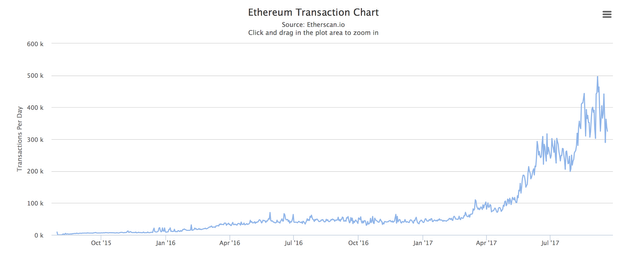

A decentralized exchange is great, in terms of security, but they are not perfect. As a trader myself, trading in decentralized exchanges is not easy and enjoyable compared to centralized exchange. Slow speed, error in smart contract, high fees, and so on. Even though our funds are technically safe because it was stored in a smart contract, but we have to spend a lot of fees when trading compared to using centralized exchange (imagine when the network is congested, you'll have to spend up to $10 per order). This happens because we have to trigger the smart contract function. It's probably fine for traders who have a lot of money, but it is certainly not alright for small-medium traders who don't want to lose money just to place their bid.

Not only that, decentralized exchange are usually slow in nature because they don't have a decent infrastructure to serve a lot of traders at the same time. Some of them are prone to distributed denial of services attacks as well as having high latency. This will make trading speed become much slower, you need a lot of patience to open the sites and makes orders.

Network congestion will cause higher fees. Image source: here

The next problems with the decentralized exchange are, you can't trade with different coins/tokens that are not using the same blockchain. Almost all decentralized exchanges are Ethereum-based or Waves-based. Eventually, you'll have to trade your crypto via centralized exchange if you want to trade from Ethereum blockchain to Doge or else. Considering some of these problems, a decentralized exchange is far from ideals. You can read more about the problem of decentralized exchange on the internet, such as this one.

# Centralized Exchanges Problems

Let's talk about centralized exchanges now. Centralized exchanges, especially those who ranked in the top 10, have a high liquidity, volume, great infrastructure to support fast trading and so on. So, what's their problem then?

The first and the most crucial problems might be the security of your assets. If you want to trade in centralized exchanges, you'll have to deposits your tokens to them and then do your trading. However, there is no guarantee that your tokens will be safe from security or safety problems. There is a lot of news about centralized exchanges being hacked, and probably, more will come later.

Hacking or cracking a centralized exchange, in my opinion, is understandable because they have a lot of money from their users' deposits. On the other hand, the exchange itself can scam their users, for example, freezing their account without any prior notice and unclear reason. In this way, a centralized exchange can take their user's money without nobody knowing about it.

Image source

Another problem is volume manipulation. Some exchanges are accused of doing wash-trading to increase their daily trading volume. Essentially, this means they're creating a fake liquidity to attract traders to use their platform. Of course, after some time, liquidity on their platform will decrease fundamentally when the wash trading activity is stopped. To understand this better, you can read this article.

# Bottom Line

So, what can we conclude from here? We certainly need a solution to separate trading and clearing (deposit & withdrawal), to ensure that we can have a great trading platform and protect our assets from hacking and etc. This is where DAEX comes in. We'll talk about DAEX, specifically the platform, to understand what solution they'll propose to solve the problems above.

Don't forget to check these important links below:

#DAEX Website: https://www.daex.io/

#DAEX Whitepaper: https://www.daex.io/daexPaper.do

This is a promotional article. I'm writing this article as part of my contribution for Bounty0x DAEX bounty. My Bounty0x username is joniboini16. Readers are suggested to read DAEX whitepaper by themselves to ensure the validity of data written here.